Digital is the new normal. This mantra of B2B payment automation has been ingrained in our post-pandemic world which is a big change in terms of how we used to function. The pandemic played an important role in familiarizing us with the world of digitalization and how dependency on manual or traditional processes is not an ideal way to survive in this evolved economy. Technology is slowly but surely changing the world as we know it and its Midas touch has been felt by businesses, big and small, worldwide.

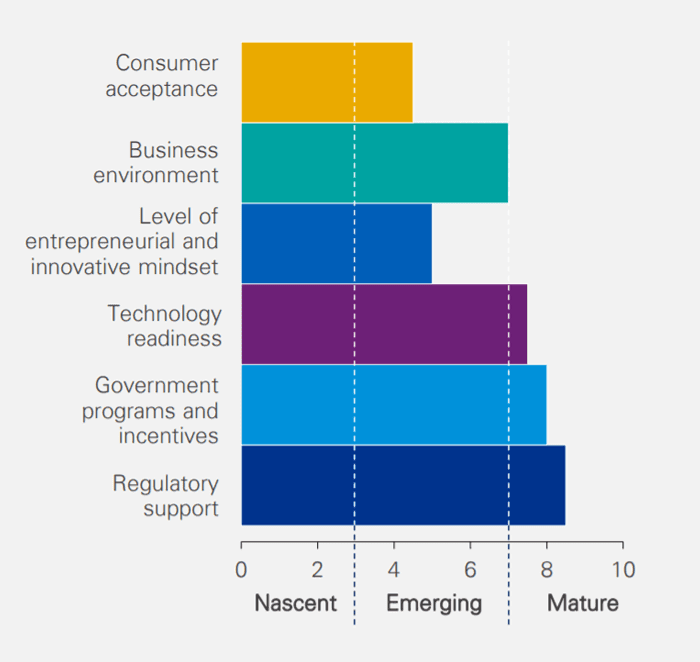

The digital payment revolution has been on the top of the list of key FinTech players in the country who are rapidly evolving with the changing consumer demands. The sociocultural landscape in India has changed drastically over the past few decades and consumers are now hungry for newness. Gone are the days when people used to stick to the old ways of doing things purely out of comfort. Comfort zones are being escaped, barriers are being crossed and the appetite for innovation has increased substantially.

A snapshot of the digital payments ecosystem in India

Automation has now diversified the B2B payment automation and payments infrastructure in India. Digital payments transaction value in India between 2019 and 2023 is expected to grow at a CAGR of 20.2 percent. By 2025, it is forecasted that the volume and value of digital transactions in India will reach INR 167 billion and INR 238 trillion respectively.

New technologies are simplifying the way we look at finance. FinTech is making things simpler to understand and easier to execute. B2B payments remain a market with a huge untapped potential for growth.

Why is Automation Required in B2B Payments?

| Lower Risk Digital transactions happen in a secure environment through proper gateways. These gateways have multiple layers of security checks which almost nullify the chance of any fraud. |

Faster TAT Digital payments are processed and disbursed faster than non-digital modes of payments because they bypass human interference and paper checkpoints. |

Convenient & Accessible

Transacting huge amounts of money from anywhere in the world is the biggest plus that digital payments can provide to any user. The payment platforms can be made accessible to anyone with proper authorization which makes a business scalable and flexible.

Traceable Transactions

Maintaining a trail of digital transactions is much easier when you have B2B payment automation, as compared to traditional bookkeeping methods. This helps in easily accessing a specific transaction in real-time and tracing the payment status.

Saves Processing Costs

The traditional non-digital payment methods are laden with soft costs and processing fees of paper checks. A digital platform can help eliminate these costs and can be customized according to the business needs. EnKash is an all-in-one payment processing platform that can cut your business expenses by 60%.

While these are routine advantages that any business can enjoy upon adapting a digital payments platform, there are added advantages of involving FinTech as a backbone of finance in your business. FinTech offers SaaS-based payment solutions that work on a microscopic level to elevate your payment experience fundamentally.

5 reasons why FinTech is a must for B2B businesses

1. Blockchain Payments

Blockchain is a relatively new technology that is used for secure storage of data. Blockchain-enabled payments are highly secure and have inbuilt features like transparency, immutability, traceability, and auditability. Blockchain provides superlative security in exchange for money and sensitive information to thwart attacks and threats. Blockchain payments allow real-time verification of transactions while superseding the need for intermediaries like banks.

2. Commercial and Virtual Cards

Improved cash flow management, enhanced visibility, increased efficiency, and enhanced security are just a few of the benefits that businesses can enjoy by leveraging the power of commercial and virtual cards. These digital payment solutions offer centralized management, expense tracking, fraud protection, and customizable features, making them essential tools for streamlining operations, reducing costs, and improving overall financial performance.

3. Automation

FinTech is essentially the automation of payments. The amount of time that is wasted on issuing checks, PO, invoices, bank guarantees, and other documentation mounts up to a big number. This can be made time and cost-effective with the help of an automated payments platform that houses the digital onboarding of clients and suppliers, salary and reimbursement deductions, tax filings and rebates, and much more. Digitizing and automating your business’ Accounts Payables and Receivables can make your business a truly futuristic business.

4. Cloud Banking

Cloud computing has time and again proven why it is one of the best technologies to emerge in this decade. Cloud banking will drastically reduce the costs of transactions as it does not need any dedicated hardware to function. The cloud banking resources are scalable and integrate easily with existing platforms to work seamlessly.

5. Customizable Payment Platforms

Not all businesses are the same. A payment platform that provides the best results for one business might be totally wrong for you. This is where FinTech steps in with its diverse portfolio of feature-rich payment platforms and modes of payments that can be customized to craft a tailor-made solution for your business’ pain points. An intuitive and responsive platform for processing payments is much better than old-school methods that hinder the growth of your business.

As it is evident from this list of benefits, it comes as no surprise that more and more businesses are hopping on the FinTech trend to enable better B2B payments. EnKash aims to be a one-stop solution for all your business commerce needs so you don’t have to look any further.

From commercial cards to an all-inclusive payment platform, EnKash has all your business needs covered. With EnKash, you don’t have to work hard. Our payments platform will do it all for you! To find out if EnKash is what your business needs, book a free demo with us and we promise to deliver!