Businesses- big or small, need a steady account receivable and payable flow to function. A business’ bottom line may be green at the end of the quarter, but if the cash flow is not maintained meticulously, a lot of decisions might get affected. Sooner or later, these will trickle down to the revenue statements of the company.

Maintaining an efficient cash flow is no piece of cake. It requires a strong strategy, planned accounts payable, and collections decisions. And most importantly, a robust commercial expenses platform that can provide visibility into the financial structure. These kinds of business accounting requirements cannot be met by traditional banks or legacy financial management systems.

To save the day, FinTech emerged from the digitization wave. FinTech enables payment gateways to work in tandem with banks to provide more sophisticated and intuitive account receivable and payable solutions.

With FinTech, the digitization and finance industry came together to completely revolutionize the face of the business accounting and payments industry in India. Now even start-ups, small and medium-sized businesses, vendors, and small brick-and-mortar retail establishments have embraced FinTech in some form.

What’s The Key Innovation Of Fintech Towards Balancing Of Accounts?

One helpful product of the FinTech revolution is automation in payment processing. From B2C to B2B and even P2P payments, people are now getting comfortable with online payments.

Automation has truly leveled up the commercial finances industry. Businesses earlier used to make payments in cash or cheques, although now they are almost obsolete.

Most of the businesses have turned to one of the following digital payment methods:

- Bank Transfers (NEFT/IMPS/RTGS)

- Payment Gateways

- Corporate Cards

These payment methods increase transaction throughput in multitudes. While bank transfers have been around for quite some time, payment gateways are relatively new in the market. Payment gateway providers partner with business accounting and payment aggregators to allow B2B and B2C payments.

Corporate cards are the newest kids on the block with their flashy new functionalities that have made them the most popular choice. With their convenience, ease of use, and accessibility, corporate cards have been climbing the charts for being the most favoured tool for commercial expenses.

The shift in B2B payments towards accounts receivable process and automated payment facilities is due to a variety of benefits. Let’s take a closer look at these benefits that make business owners seriously consider switching to an automated corporate payments platform.

Have a look at the future of EnKash account receivable and payable tools for your business.

5 Quick Benefits Of Corporate Cards And An Automated Business Accounting Tool

Collect Payments Faster

With an automated payment platform, you can generate purchase orders and invoices with a touch of a button. Automated payment platforms have easy-to-use templates for POs and invoices, thus making it quicker to generate them. The faster you invoice your clients, the more your chances of receiving payments.

Traditional methods of invoicing took days to generate and send to the clients, who took their own sweet time to process these invoices. With an automated platform, you can also send timely reminders to clear payments. Faster payments mean an increased cash flow and accounts receivable process, which in turn can be used to purchase supplies for business.

Extend Payment Credit

With the EnKash automated payment system, you can have a higher level of visibility of your accounts payable. Many times, it happens that businesses make their payments much before the due date. While this is a good practice, it can harm your balancing of accounts.

Making payments well in advance can reduce your business’ cash flow without it being necessary. This cash could’ve been used for some emergency purpose or to buy some other office supplies on the fly. When payments are made before the due date, the credit period available for payments is not used wisely to increase the revenue.

This scenario is handled well by an automated payment platform to monitor business accounting. EnKash has an in-built functionality of generating payment reminders a day or two before the due date.

This way, you do not miss any payment nor do you pay before the deadline; in turn, increasing your cash flow movement towards revenue-generating streams.

Convenience For Customers

When you provide your consumers with an automated platform, you are not only providing them with a tool but also with a bonus of convenience.

Digital payment platforms offer ease of payment by providing a bird’s eye view of the entire biosphere of your business’s finances. You can send e-invoices to your consumers with a digital payment link that directs to a digital payment method to pay the bills. This streamlined way of accounts receivable process can boost your consumers’ faith in you while also making you look like a futuristic business that’s here to stay.

Increased Security

Automation prevents expense fraud in the best manner possible. Employees need to be empowered to make decisions related to balancing of accounts and purchases so that they can make expenses on the fly but do not have to spend from their own pockets.

Corporate expense cards come to your rescue in this scenario as they provide flexibility and efficiency in corporate purchases. Corporate cards can be controlled centrally by pre-deciding their parameters. They can be customized as per authorized vendors, types of purchases, and the maximum number of swipes.

Businesses can also generate virtual cards on the fly, which can be only used for digital payments. These cards are usually employed for one-off purchases with a maximum cap of expense. Thus, corporate expense cards are one of the most powerful tools in your account receivable and payable process, along with the business finance arsenal.

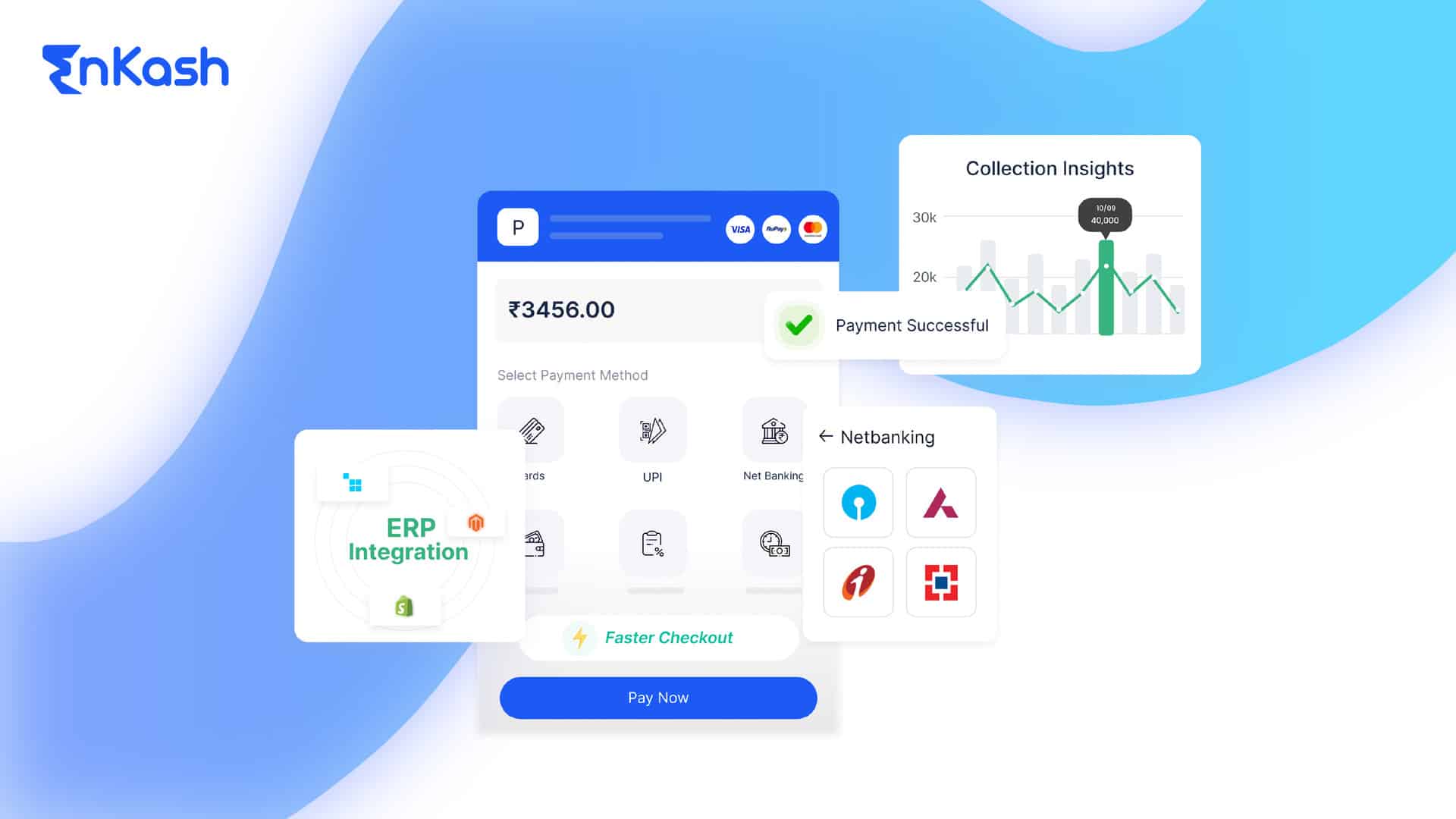

Enhanced Visibility

With a digital B2B payments platform, you can have centralized control yet decentralized spending ability. The platform offers a clear picture of your business finances- your Accounts Payable, Accounts Receivable, Cashflow, Working Capital, and many more business payment features.

This bird’s eye view of your business finances can help you make informed decisions regarding upcoming purchases and payments.

The kind of advantages that a digital automated platform offers for SMBs are massive. Especially, a platform like EnKash can truly enrich your B2B payments experience with its host of functionalities. EnKash also offers a huge variety of corporate cards that can empower you to make purchases on the go so that you never think twice before making payments. Experience true financial freedom with EnKash!