Virtual banking has penetrated the large-scale sector, and every small-scale and medium-scale business is also moving towards virtual banking. Virtual bank accounts are trending because of features such as an extra layer of security, real-time transaction monitoring, and virtual cards to streamline transactions. For the B2B sector, virtual bank accounts are a boon. But many businesses are still apprehensive about using these services, and we are here to help them realize the benefits of doing so.

So, if you are also wondering what is a virtual account number or what is a virtual bank account, how it is different from a traditional account, its benefits, and how you can open one, keep on reading!

Understanding the intricacies of what is a virtual accounts

As the name suggests, virtual bank accounts operate entirely online and can be accessed through mobile or desktop. The virtual account is linked to a primary bank account, and a system-generated account number is provided, masking the key account number. These virtual accounts cannot be traced to the primary bank account by people other than the account holders, which offers the company an extra security layer from online fraud or theft.

Meaning of what is a virtual account is really easy. Virtual bank accounts are easy to set up and can be used for various purposes, such as paying vendors, receiving funds, making online purchases, and paying bills. Some virtual bank accounts may also offer features such as virtual debit cards, which can be used to make purchases at merchants that accept card payments, pay employees, and more.

Now that you know what a virtual account is, learn how it differs from traditional bank accounts. One of the key reasons businesses use virtual accounts is that they charge zero processing fees, helping companies save costs on bulk financial transactions. In case your business is also looking forward to expanding and exploring overseas markets, virtual accounts can be beneficial as they can be used as an alternative payment method.

Types of Virtual Bank Accounts

Virtual bank accounts have become increasingly popular due to their convenience, security, and cost-effectiveness. They are designed to cater to a variety of business needs, and each type serves a specific purpose. Here are the main types of virtual bank accounts:

Single-Use Virtual Accounts

These are set up to handle a one-time transaction, and therefore they are perfect for companies that have a sporadic need to pay for the occasional vendor or contractor’s work done for a client. For example, if a company pays a particular vendor or contractor for a specific project, it can easily create a one-time virtual account for the single payment. Once the transaction is done, the account can be deactivated. Single-use accounts are great for companies that want to treat specific payments as separate from other transactions, which offer a very secure and easy way to do it without having to maintain multiple accounts.

Multiple-Use Virtual Accounts

Multiple-use are these unlike single-use virtual accounts, which are designed to be recurring. This kind of account would suit businesses that would like to track regular transactions in terms of payments to suppliers, contractors, or service providers in order to conduct a repetitive financial flow. The great flexibility of having to make such regular payments by making use of the account without having to create a new one, makes it quite convenient to operate with. Using multiple-use virtual accounts makes everyday balancing of accounts simple, while at the same time it’s quite safe and legal when many payments are taken care of individually.

Escrow Virtual Accounts

An escrow virtual account is an intermediary where two parties deposit funds before completion of a transaction under agreement until fulfillment of certain terms. It is ideal for lofty business transactions, particularly when the transfer of payment is made contingent upon some service or contract completion. In a real estate transaction or a business acquisition, an escrow account ensures that one party does not run the risk of being defrauded or that the service is not completed satisfactorily. It further assures buyer and seller protection, since disbursement is only possible once specific per-determined criteria have been fulfilled.

Cross-Border Virtual Accounts

Cross-border virtual accounts, by offering a simple way to make payments and receive money from a different country for businesses operating internationally, do away with the difficulties and much higher costs associated with conventional banking channels. This is especially beneficial for organizations that require doing payments or may be receiving them in several currencies, making cross-border transactions simple and inexpensive. Virtual cross-border accounts provide a better platform for businesses in efforts to stretch worldwide.

Virtual Savings Accounts

There are virtual accounts that allow a business to earn a return on idle funds without doing straightforward transactions. Virtual savings accounts offer all the advantages of online banking coupled with the upside of passive income. Businesses can save their surplus cash in such accounts so that they are not pressed to come up with money whenever they need it, but they have the power to keep withdrawing and accessing the money whenever they want. Such virtual accounts ensure that businesses can maximize their finances by providing interest free from traditional savings accounts.

Features of Virtual Bank Accounts

Virtual bank accounts come with a wide range of features that make them highly attractive for businesses:

No Transaction Fees:

Unlike the traditional accounts, where there is a fee transaction for every payment or transfer, virtual bank accounts do free transactions and all the business activities will be economical with this facility.

Paperless Setup:

Virtual accounts can be opened online and paperless, and customers do not have to visit any branch at all to have an account set up within minutes.

Security Features:

Advanced security features such as two-factor authentication (2FA), encryption, and secure password policies are often included in virtual accounts to provide security against cyber threats.

Virtual Debit and Credit Cards:

Most virtual bank accounts give businesses virtual debit or credit cards for online purchases or payments without needing a physical card.

Transactions Monitoring in Real Time:

Companies will be able to monitor online in a secure place their transactions in real time, thus assisting them in managing cash flow and avoiding discrepancies.

Customizable Alerts:

Virtual accounts can have custom alerts set for certain actions when it comes to alerting, such as low balance or huge transactions. Therefore, businesses will always know their financial position.

No Minimum Balance Requirement:

Today, very few virtual bank accounts have a minimum balance requirement like traditional bank accounts; thus, these accounts can be used flexibly to manage business funds.

Difference between a virtual account and traditional bank account

Listed below are the key differences between virtual and traditional bank accounts:

No physical branches

Unlike traditional bank accounts, virtual accounts exist only online and do not have any physical branches to carry out operations.

Easy account setup

While setting up a traditional bank account, you may have to visit a bank branch, fill out a form, and submit it to the bank official, whereas when we think of what is a virtual account can be created online with paperless KYC.

Accessibility

Traditional bank accounts can be accessed through multiple channels, such as bank branches, ATMs, bank applications, and net banking, whereas virtual accounts can be accessed through mobile or desktop.

Transaction fees

Traditional bank accounts charge transaction fees for making payments through UPI or NEFT, whereas virtual bank accounts do not charge fees.

Security

Both traditional and virtual bank accounts are subject to federal regulations and are required to have specific security measures in place to protect customer information and funds. Whereas, virtual bank accounts may have additional security measures, such as two-factor authentication, to protect against online threats.

Benefits of Virtual Bank Account Number

Virtual bank account numbers bring multiple advantages to businesses in terms of security, cost-cutting, and efficient financial management. The following are the main advantages:

Increased Security

One of the biggest advantages of having virtual bank accounts is increased security. A virtual account number is not directly related to the primary bank account; hence, it provides an added layer of security. This reduces fraud and online robbery since cyber thieves cannot access the main account through the virtual account.

Economically Beneficial

Virtual accounts tend to be free of processing fees; this is beneficial compared to traditional bank accounts that charge transaction fees during payments. For business entities that regularly engage in high volume transactions, this would translate into massive savings, reducing the overall cost of operations.

Effortless Cash Management

With the virtual bank accounts, it is possible for businesses to open as many bank accounts as they want for payments to vendors, employees, or even subscriptions. This will greatly help in organizing the revenue and making tracking the movement of cash easier, and help avoid confusion concerning where the fund allocations are directed.

Easy-to-use

Virtual account access can be gained via desktop or mobile devices so that business can have the flexibility to manage their finances anytime and anywhere. This is particularly useful for multinational companies or businesses requiring constant access to financial information.

International Expansion

Yet another benefit is for those considering international expansion for their business. The virtual accounts will allow easy transacting across borders without the need to maintain several local bank accounts. This becomes a lot easier and more efficient in operations and costs.

Real-time monitoring

Instead, it gives such companies a window of real-time transaction monitoring. Henceforth, the company can effectively keep track of incoming payments, ensuring they are processed when due. In this way, it hosts reduced errors associated with processing and clear operational flow in finances.

Advantages of virtual bank accounts for businesses

Moreover, to help you understand what is a virtual account number in detail, let’s learn about its advantages. A virtual bank account helps businesses simplify their cash management and offers several other benefits, as mentioned below:

- Businesses can allot different virtual accounts for vendors, freelancers, utility bills, and subscriptions to streamline transactions

- Facility to accept payment via various modes such as UPI, NEFT, RTGS, IMPS, and QR

- With the proper documentation of each transaction, there are zero chances of manual error

- Ability to build a separate wallet for consumers to receive, send, or even request funds

- Can use the virtual account as an escrow account to protect the business from online fraud

- Significant savings on maintenance charges, transaction fees, and minimum balance fees

- Quick transactions and confirmation to ensure timely payments to service providers to maintain healthy business relations

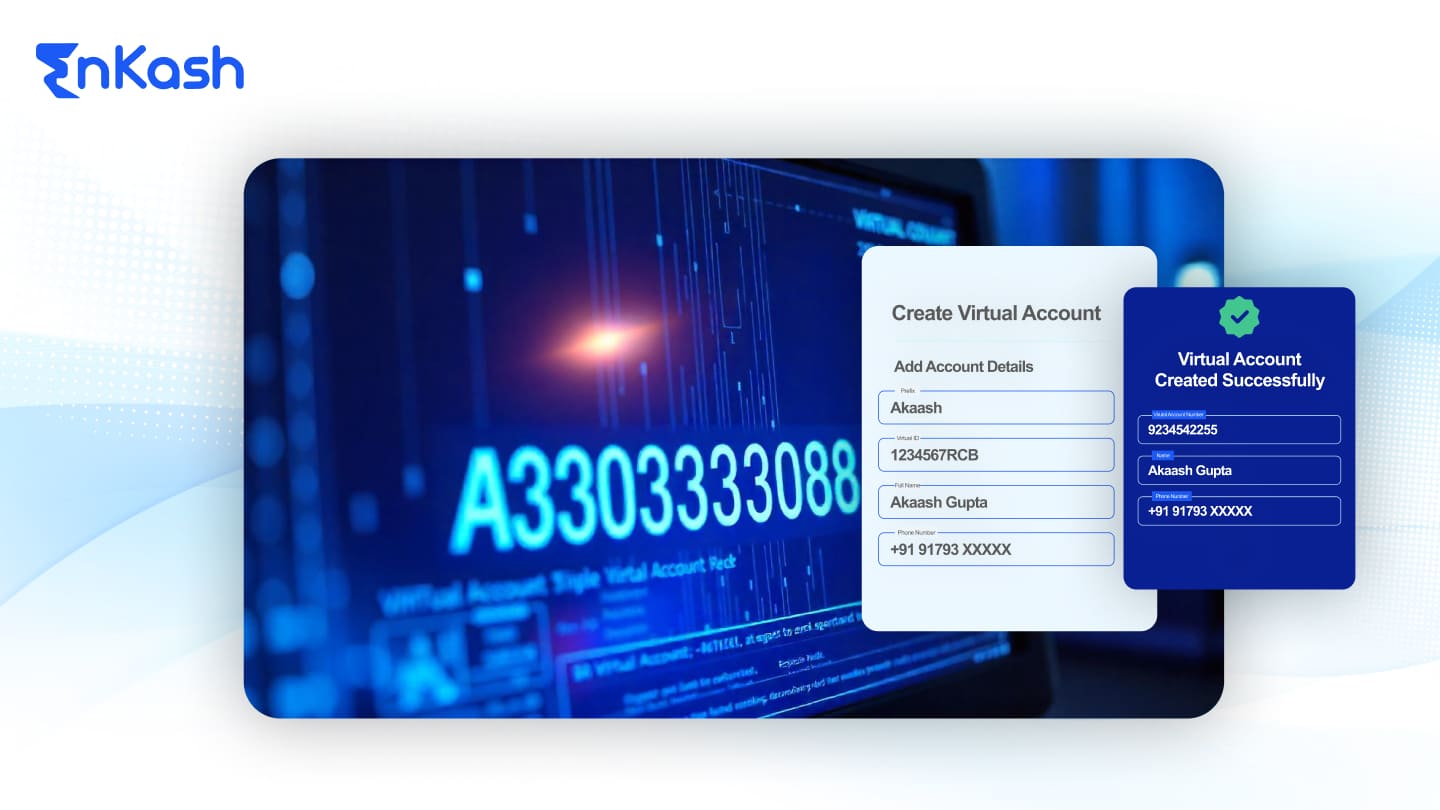

How can you open a virtual bank account?

Knowing what a virtual account is is not enough. You should also know how to open a virtual bank account and enjoy its benefits thereafter. Below are six easy steps to open a virtual account:

- Open the website and log in with all your information

- Fill in the personal information and submit the identity proof, including PAN card, voter ID, Aadhaar card, and other details

- Sign the disclosure agreement after reading the terms and conditions

- Upon completing the procedure, you will get a virtual account number

- Transfer the amount to the account from your existing account and link the cards

- Now start the transaction as required

Here, you can monitor all the data from the dashboard from their online platform. You can limit and monitor transactions, get certain rewards, and even block the account as per your will. Furthermore, you can also access archived data at any time and anywhere.

In case your company is planning to launch any credit card or prepaid card programs and needs a virtual account to transfer funds to other accounts, let EnKash assist you. We offer virtual bank accounts powered by reputed banks. Having a virtual bank account will take away most of your worries related to bills and invoices, and every payment will be automated.

Now you know what is a virtual account and opening a virtual bank account is easy and hassle-free as the entire process is paperless. Once you log in to your account and complete all the procedures, including verification, you will instantly get your virtual account number and access. With EnKash, all your data is protected and secured. So, what are you waiting for?