Over the last ten years, digital payments in India have experienced rapid expansion, which has resulted in fundamental changes to daily transaction methods. Online payments have taken over as the preferred transaction method, and UPI (Unified Payments Interface) has been the leading force in the digital payment revolution since its launch in 2016. With UPI usage reaching unprecedented levels, you will repeatedly encounter the term UPI ID. What does UPI ID stand for, and how does it function as an essential component in our current cashless economic system?

The UPI ID functions as the essential access point for both sending and receiving money within the UPI payment system. UPI ID serves as a distinct identification code that functions similarly to an email address for your bank account and enables instant fund transfers between banks through your smartphone. The UPI ID functions as your financial address within the UPI network. Users can transact by sharing a basic ID instead of memorizing lengthy account numbers and IFSC codes. This convenience has made UPI immensely popular: UPI IDs have become as widespread as mobile numbers for making payments.

The adoption of UPI by India has reached phenomenal levels. Over just a few years, UPI transformed from a new concept into a system handling billions of monthly transactions. UPI reached a milestone of processing over 16 billion transactions each month by late 2024, demonstrating its widespread use in daily activities. Millions of users across both large urban areas and small rural locations have adopted digital payments because of the simple process of creating and using a UPI ID. In this comprehensive guide, we will explore everything about UPI IDs. This complete guide will cover the UPI ID full form and its working principle, along with steps on creating it, using it securely, and recognizing its advantages. After this guide, readers will gain a thorough understanding of what UPI ID means and how to maximize its use in daily transactions.

We will explore UPI IDs meaning to understand their role as the core component of India’s real-time payment system.

Understanding UPI ID

The UPI ID stands for Unified Payments Interface Identifier and functions as your unique address within the UPI network. The acronym UPI within UPI ID represents the Unified Payments Interface, while ID signifies an identifier. Your bank account is assigned a UPI ID, which serves as a unique virtual identifier for UPI transactions. The proper term for a UPI ID is Virtual Payment Address (VPA). The term VPA stands for Virtual Payment Address, which functions as a UPI ID in the Unified Payments Interface system. UPI ID and VPA represent the same entity.

A UPI ID serves as a payment address akin to how an email address directs messages to your inbox. Like an email address routes messages to your inbox, your UPI ID channels funds to your bank account. Through the UPI system, your bank account becomes connected to a memorable ID. A UPI ID usually appears in the format <identifier>@<bank> or <identifier>@<paymentapp>. A UPI ID example can appear as alice@upi or 81******80@paytm. The UPI ID’s first portion is a unique identifier chosen by you or provided to you, whereas the second portion represents the bank or payment app that issued the UPI ID.

Now we will analyze how a UPI ID is structured:

- Your phone number or any selected username or alphanumeric string can serve as the initial section of a UPI ID before the @ symbol. The default setting in numerous applications uses your mobile number as the leading component of your UPI ID.

- The component following the @ symbol represents the financial institution or service provider. The most frequently seen examples are @upi for BHIM app users, @okaxis is used by certain Axis Bank apps @oksbi for SBI accounts on Google Pay @ybl designated for Yes Bank accounts on PhonePe @paytm employed by Paytm @icici belonging to ICICI Bank accounts @hdfcbank for HDFC Bank customers, @kotak for Kotak Bank services, and others. Your UPI ID handle depends upon the bank or application used for its creation.

SBI UPI ID example: A State Bank of India account holder will see a UPI ID like yournumber@SBI when they use either the YONO app or the BHIM SBI app. When you connect your SBI account to Google Pay, your UPI ID will follow the format yourname@oksbi because Google Pay uses the “oksbi” handle for SBI accounts. Kotak customers who create a Kotak UPI ID through the Kotak app will receive an ID in the format of yourname@kotak. Google Pay assigns UPI IDs like john.doe@okhdfcbank for HDFC Bank accounts and 81******80@okicici for ICICI accounts. Most Paytm UPI IDs default to your phone number followed by @paytm, for example, 8123956180@paytm. These examples illustrate that UPI ID formats use a basic structure with minor variations between different service providers.

UPI ID ensures your sensitive bank information remains protected from view. To complete a transaction using a UPI ID, you don’t need the recipient’s bank account number or IFSC code, and the recipient doesn’t need your bank account number or IFSC code. Payment routing requires only the UPI ID. Your UPI ID and your UPI PIN serve different functions and are not interchangeable. New UPI users frequently question whether there exists a UPI ID number and mix up the ID with their PIN or transaction ID. Let’s clarify:

- UPI ID: Your payment address works like an email ID for money transactions and looks like name@bank.

- UPI PIN: To send money through UPI, you need to use a 4 or 6-digit secret code that you create for this purpose. The UPI PIN functions as the security password needed to complete your UPI transactions. You should never share your PIN.

- UPI transaction ID: Each transaction you perform generates a unique reference number. The transaction ID serves to monitor payment progress unlike UPI ID, which users select and share.

Your UPI ID functions as your unique payment address for transactions. The UPI ID is user-friendly to remember while being shareable without concerns and enables seamless transaction processing. For those curious about the terminology in other languages: UPI ID ka matlab (Hindi for “UPI ID meaning”) stands for बस आपके बैंक खाते का वर्चुअल पता, which translates to “the virtual address of your bank account.” Your UPI ID functions as the identifier you provide or type whenever you wish to transfer or receive funds through UPI. Now that we’ve learned about the structure and purpose of a UPI ID, we can move on to creating your own UPI ID.

Read more: UPI Payments

How to Create a UPI ID

The procedure for obtaining a UPI ID involves simple steps. To start, you need a bank account and its linked mobile number. You can build a UPI ID using any app that supports UPI services. This section will guide you through the detailed steps needed to set up UPI IDs on various popular platforms. If you want to learn how to generate a UPI ID, it’s much simpler than you expect.

Using Google Pay (GPay)

Google Pay remains among the leading UPI applications available. The initial registration process on Google Pay creates your UPI ID in just a few moments. This section will inform you how to create a Gpay UPI ID.

- Download & Install Google Pay: Download and launch the Google Pay (GPay) app through the Play Store/App Store.

- Register with Mobile Number: Provide the mobile number connected to your bank account. Google Pay will confirm this process using an SMS OTP.

- Sign in with Google (if prompted): Google Pay may request you to select a Google account to store backup information and manage receipts.

- Link Your Bank Account: Google Pay displays a selection of banks for users to choose from. Choose your bank from the available options such as SBI, HDFC, and ICICI. The application will access your bank account information through your mobile phone number.

- Create a UPI ID and UPI PIN: After linking your bank account with Google Pay an automatic UPI ID creation process is initiated. The system will request you to establish a UPI PIN for the account by entering your debit card’s last 6 digits plus the expiry date to create a new PIN if you haven’t set one yet. Payments cannot be authorized without the UPI PIN.

- You’re All Set: Your GPay UPI ID becomes available once your bank account link and PIN setup are complete. Your app contains your UPI ID displayed under your name when you tap your profile picture; this ID appears as yourname@okbank. Google Pay shows your UPI ID on this screen for easy access.

How to change UPI ID in Google Pay: Google Pay lets users generate new UPI IDs and select alternative handles. For users who want to obtain a different UPI ID because they desire a more customized option or another handle:

- Access your profile page, then select a Bank account to reach the Manage UPI IDs section.

- Google Pay lets users create additional UPI IDs, which include handles from partner banks, such as @okaxis and @oksbi. ).

- The process of creating a new UPI ID reveals how to update your UPI ID within Google Pay. It is not possible to modify the text of an existing UPI ID yet you can create a new one and designate it as primary.

- You can designate the newly created UPI ID as your default option for money transfers once it is added.

Google Pay allows users to manage multiple UPI IDs within a single account. If your primary Google Pay UPI ID reads 81******80@okhdfcbank you have the option to establish an alternate identifier such as yourname@okhdfcbank whenever possible. Google Pay UPI ID example: The Google Pay interface displays user IDs like alex@okicici or alex@okaxis, while phone number-based IDs such as 81******80@oksbi appear depending on the user’s bank connection.

Using PhonePe, Paytm, and Other Platforms

The standard procedure for setting up a UPI ID across different apps begins with mobile number verification, followed by bank account linking and UPI PIN configuration. Below is an overview of three popular approaches: PhonePe, Paytm, and other platforms.

PhonePe

The leading UPI-based application, PhonePe, generates a unique handle ending in “@ybl” for users who download the app from their app store and register using their bank-connected mobile number. After inputting the OTP you receive, you can proceed to log in if you have an existing account or register by entering your name and email information.

Select the My Money or Bank Accounts section to add your bank account. Once you verify your phone number with PhonePe, it automatically detects your bank and creates a PhonePe UPI ID like 81******80@ybl. When using UPI for the first time, you need to create a UPI PIN by confirming your debit card details. That’s it—your PhonePe UPI ID is live. Users can link multiple bank accounts to PhonePe, but the platform does not yet support changing the “@ybl” suffix or creating personalized handles.

Paytm

Paytm expanded its services from wallets to include UPI functionality. Launch the Paytm application and verify your login status before proceeding. The BHIM UPI or Bank Transfer section displays prompts for adding a bank account. Paytm confirms the legitimacy of your account by sending you an SMS to match your registered phone number.

After linking your account, Paytm generates a handle for you, which typically takes the form mobilenumber@paytm. To set a new UPI PIN, Paytm provides instructions for a swift debit card verification process. The PIN you created in another UPI app for your bank remains valid for use. The Paytm UPI menu contains a Show UPI ID option that displays your exact handle. Paytm typically restricts users from modifying their UPI ID handle but allows each bank account to generate a separate Paytm UPI ID through its platform.

Other Platforms

The majority of banking apps and services provide users with similar functionality to create UPI IDs. After SMS verification, WhatsApp Pay generates a handle from your phone’s contact list that looks like 81******80@icici or @sbi. The Payments tab on the app shows your designated ID. After you connect to Amazon Pay UPI, you will see a handle that looks like 81******80@apl. Several banking-specific applications including SBI YONO, HDFC MobileBanking, ICICI iMobile, and Kotak Mobile, generate unique email-like addresses such as number@SBI or name@kotak for users.

The Flipkart UPI payment system depends on PhonePe technology, which means shoppers will need to create or access their PhonePe account during checkout. Regardless of which platform you prefer, the underlying steps are consistent: The system creates your UPI handle after you verify your phone number and connect your bank account.

Whether you choose PhonePe, Paytm, or any other application, users can send and receive money easily with their UPI ID. Several apps allow users to customize prefixes as well as create multiple handles, whereas other apps maintain default formats. Every platform offers a seamless digital payment solution, so you can choose the one that best matches your personal preferences and banking connections.

Read more: UPI Transaction Status Check: Verify Your Payments

Benefits of Using a UPI ID

The UPI ID serves as the fundamental component of every UPI transaction. Here are the special benefits you gain when you own and operate with your own UPI ID:

Instant Transactions via Your Personalized Address

You don’t need to remember long account numbers and IFSC codes because you use your own UPI ID, which works like an email address for payments. You can quickly send or receive payments anytime by either entering your short UPI ID or sharing UPI ID with others. The direct connection between your UPI ID and bank account enables immediate transfers of funds without any batch processing delays.

Greater Privacy for Senders and Receivers

UPI ID transactions keep your bank account information hidden from others. Others see your public identifier, such as yourname@bank, without access to your real account number. The additional privacy protection proves beneficial in transactions with unknown vendors, new service providers, and unfamiliar online contacts.

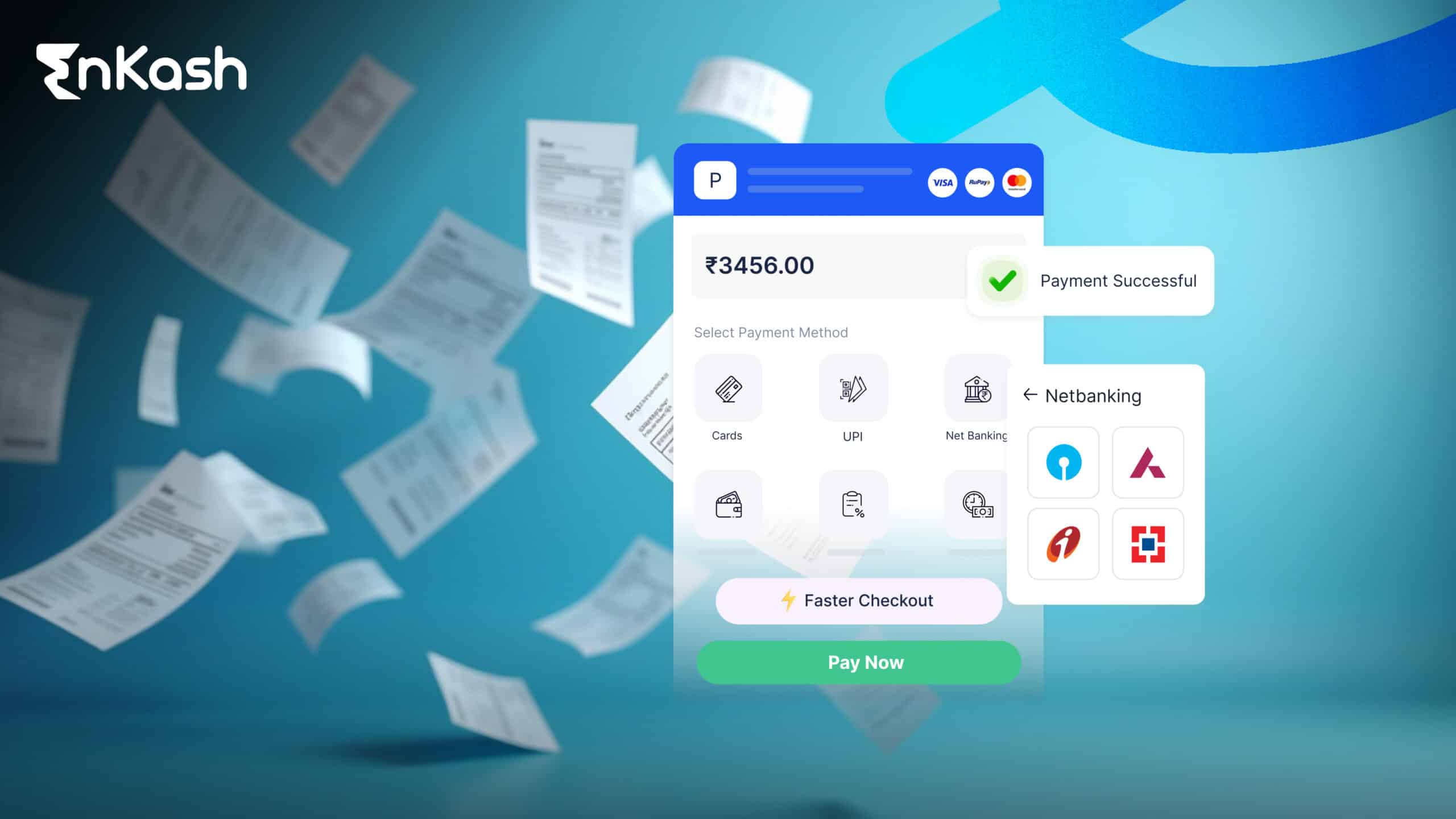

Avoiding Extra Steps in Transactions

UPI payment transactions require only your UPI ID and PIN instead of entering bank details for every transaction. The checkout process becomes quick and efficient when you use the merchant’s UPI ID or QR code for shopping. Net banking and card-based payment methods require users to enter extensive details, such as card numbers or IFSC codes and often involve additional OTP verification steps.

Minimal or Zero Fees, Endorsing Even Small Payments

Personal transaction fees do not apply to several UPI applications. Your UPI ID enables effortless handling of small payments. Other payment methods require additional top-up costs or transaction fees, which can deter people from making smaller digital payments.

Seamless Use Across Multiple Apps and Banks

You can use your UPI ID in any UPI-enabled app, no matter the original bank or application that created it. A user with an SBI UPI ID can make payments to merchants who have an HDFC UPI ID because all UPI IDs function across platforms regardless of bank association. Standardization eliminates the compatibility barriers between different apps, which guarantees mutual interoperability for everyone’s UPI ID.

Control Over Multiple Bank Accounts

Users can create multiple UPI IDs through different applications to handle various bank accounts and financial tasks. You could keep one UPI ID for business expenses and another UPI ID for personal expenses. Users can switch between bank accounts directly from their UPI ID, which connects to the specific account, and this action can be completed through a single tap.

Strong Security Measures Backed by UPI ID

Your UPI ID alone cannot operate independently because each outgoing transaction requires your private UPI PIN for authorization. Anyone who knows your ID cannot process payments without your PIN. Regulatory authorities such as NPCI and RBI work to strengthen security measures for UPI IDs to prevent unauthorized transaction debits.

Read more: UPI Transaction Limit: SBI, HDFC, ICICI, & PhonePe

How to Use a UPI ID

After creating your UPI ID you can start financial transactions immediately without having to provide any bank details. These methods demonstrate how to maximize your UPI ID usage:

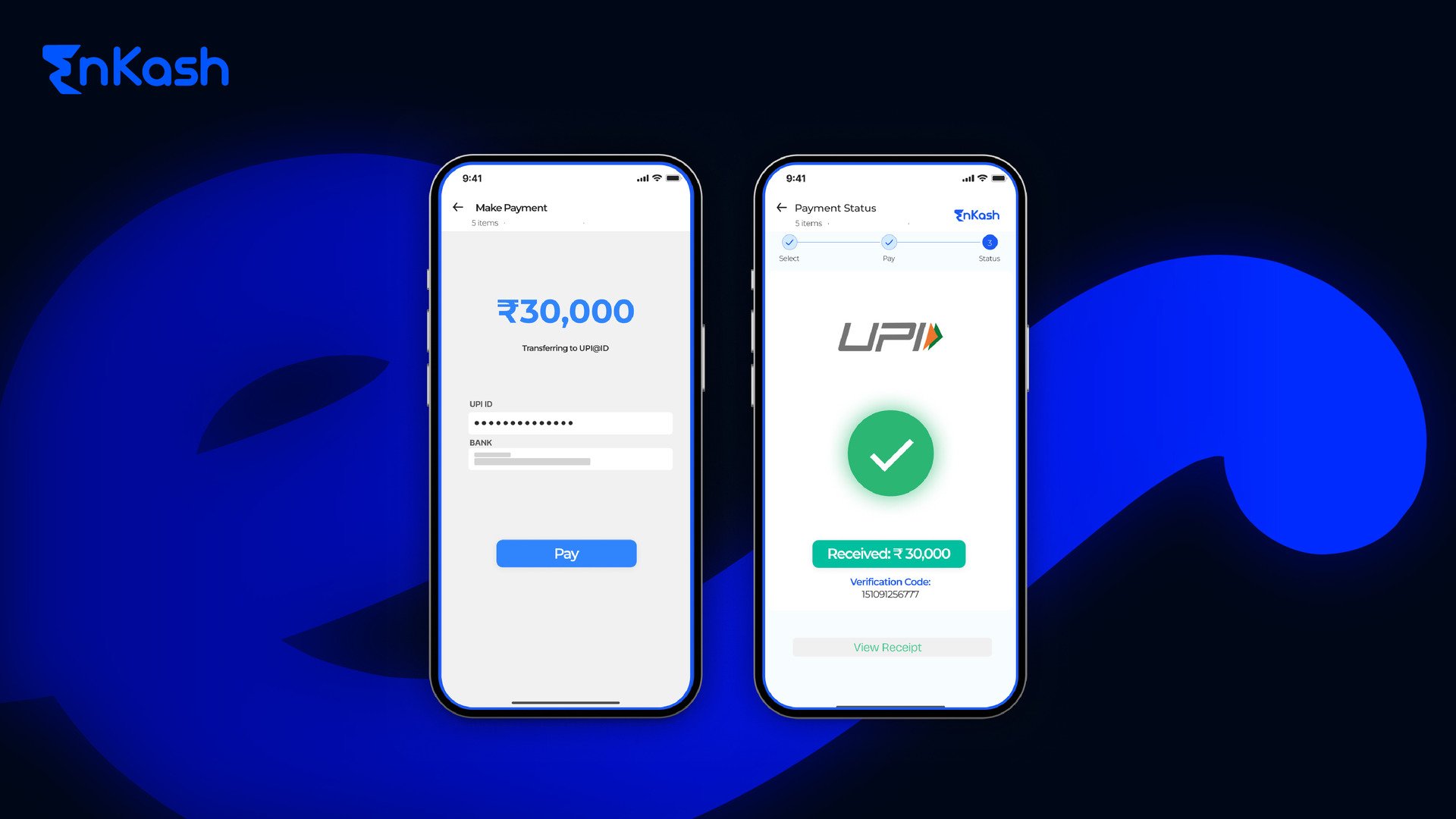

1. Sending Money with a UPI ID

Enter the Recipient’s UPI ID

Open your UPI app and select either “Pay by UPI ID” or “Pay to VPA,” then enter the recipient’s UPI ID, such as friendname@bank or 81******80@upi, and complete verification. The application routinely pulls up the receiver’s registered name to enable user verification. Errors can be prevented by verifying both the name and UPI ID before proceeding. Next, input the transfer amount, then add an optional note before selecting continue. To approve the transaction, you must enter your UPI PIN. A successful transaction will generate a UPI transaction ID for your records.

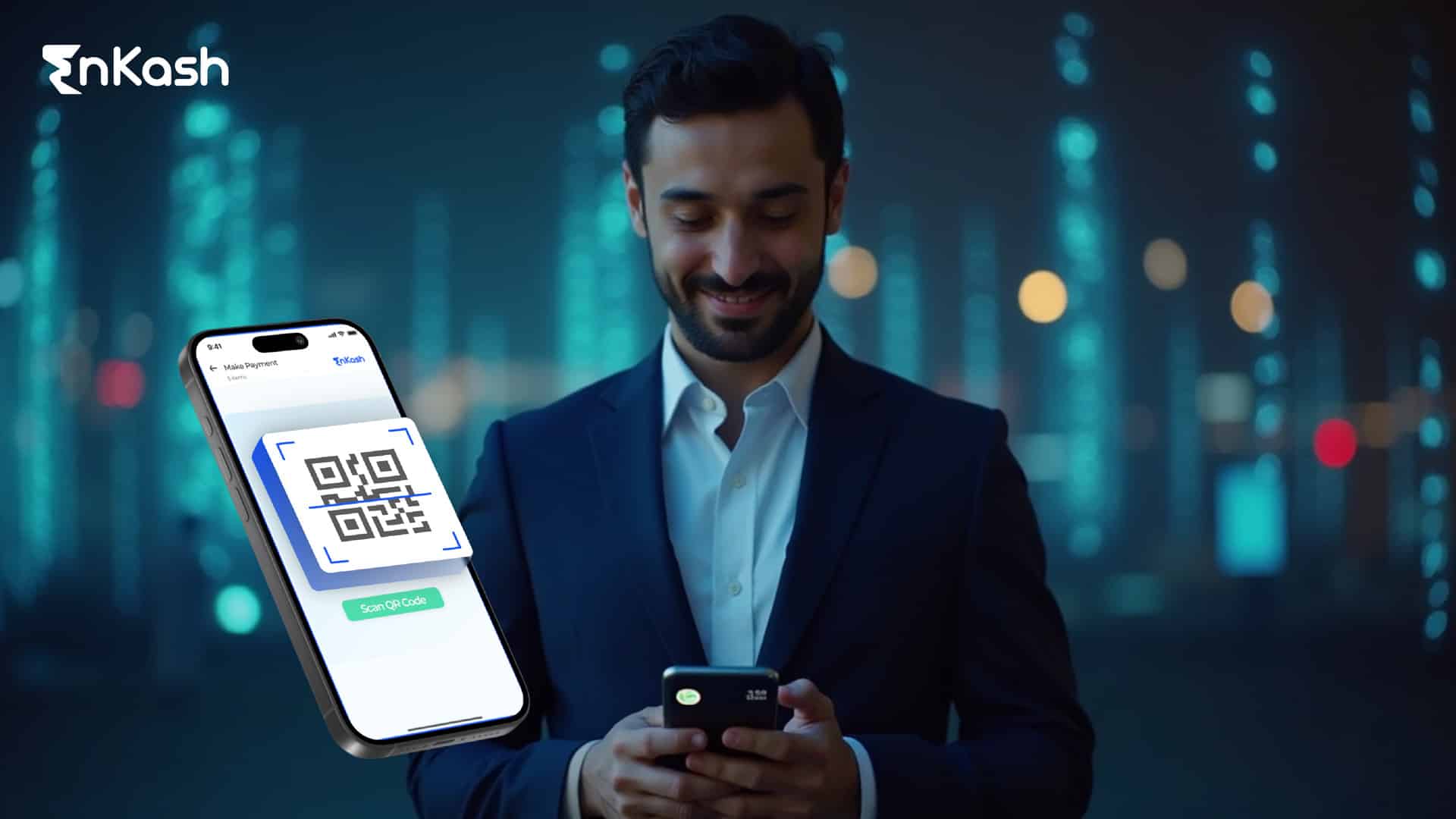

Select from Contacts or Scan QR

When using UPI apps, you can select a saved contact who uses UPI and the app will match their UPI ID without requiring manual input. You can use your scanner to scan the QR code of the person or merchant you want to pay. Scanning a QR code functions as an alternative method to retrieve someone’s UPI ID. Shops frequently place QR codes that display the payee’s information in your app upon scanning. Type in the transaction amount and confirm your selection before entering your PIN. The transaction is instant.

Send via Phone Number

You can transfer money using multiple applications when a phone number has an established UPI ID connection. While you view the phone number contact in your app, it works internally to find the linked UPI ID. Many platforms like Google Pay, PhonePe, etc, use a system where phone numbers from your contacts frequently link directly to UPI profiles.

Before completing any transaction, take the time to check the recipient’s name or UPI ID for accuracy. When necessary, provide the receiver with the generated UPI transaction ID to serve as proof of the transaction.

2. Receiving Money via Your UPI ID

Receiving funds is even simpler. To receive money from others, you just need to give them your UPI ID. Make sure to give the UPI ID verbally or copy and paste it through the app’s “Share UPI ID” function into a message. After the sender types your UPI ID and confirms the transaction, the funds are immediately deposited into your bank account. You’ll typically get an instant notification.

You can present your UPI QR code, which acts as a unique identifier connected to your ID. The payer scans your UPI QR code and finishes the payment transaction. To find your address when you’re uncertain about it, you need to tap on either your profile or the QR section inside your UPI app. Sharing your UPI ID does not pose a security risk because your ID alone cannot initiate a transaction without your PIN or OTP.

3. Linking Multiple Bank Accounts & Managing UPI IDs

UPI applications provide an easy method to connect multiple bank accounts. Users can either assign a unique UPI ID to each account or connect multiple accounts under a primary ID by adding a suffix. You have the option to set one bank account as your primary payment destination. Your main UPI account could use myname@upi, while a secondary account might use myname@okbank. The adaptable system simplifies financial management for both private and commercial accounts.

4. Setting & Using Your UPI PIN

During setup, you created a UPI PIN. The secret code protects each transaction you initiate by blocking unauthorized payments. Do not share your PIN with bank officials or technical support agents under any circumstances. Most applications allow you to reset your forgotten PIN by confirming your debit card information through your bank. Keep your UPI PIN private because writing it down or sharing it compromises your security.

5. Troubleshooting & Unblocking

Entering an incorrect PIN multiple times often results in a temporary UPI ID lock that typically lasts 24 hours. You have the option to let the cooldown period expire or reset your PIN after successful account verification. Your bank might restrict your UPI access when fraud is suspected until you verify your information through their customer service.

Once you master these fundamentals, you’ll effortlessly send, receive, and handle money through your UPI ID, which, without a doubt, offers quick and secure transactions better than conventional methods.

Read more: What is MPIN? Full Form, Meaning, and How to Generate and Use MPIN in UPI

Security and Fraud Prevention

UPI transactions possess strong core security features, but users need to watch out for social engineering attacks and scams targeting naive customers. Following some basic safety measures lets you enjoy UPI benefits without having to worry about fraud.

Never Share Your UPI PIN or OTP

Your UPI PIN functions as the primary protective measure for your account. A bank employee who is legitimate or any UPI app representative will not ask for your UPI PIN. Any communication requesting your PIN or OTP through calls, messages, or emails should be treated as a warning sign. Never reveal OTPs generated for registration or PIN reset processes.

Watch Out for Phishing Collect Requests

Scammers trick people by claiming they will transfer money to them and then ask them to approve a request through their UPI app. The true purpose behind their actions is to set up a collect request that needs you to input your PIN so they can withdraw funds from your account. A PIN is never required when you receive money. The statement “Approve money request of ₹X” signals that you will be sending money instead of receiving it.

Avoid Strange Payment Links

Scammers frequently send you unexpected links that falsely state that you have received money or need account verification. These links can redirect users to fraudulent UPI sites that steal personal information and execute unauthorized payments. If you receive suspicious links, ignore them. Always confirm or decline payment requests through your official UPI application.

Use Built-In Security Tools

The in-app contact search feature or the QR scanner option provides precise accuracy for money transfers. The chance of entering either an incorrect or fake UPI ID decreases when using these methods. A multitude of UPI apps utilize special icons or badges to identify verified merchants, so users should carefully monitor these indicators.

Check Transaction Alerts

Banks send notification messages through SMS or mobile applications whenever they process transactions, and this practice is especially common with debit transactions. An OTP notification or unauthorized deduction signal could indicate your account has been compromised. Access your UPI app right away to check for pending requests and reject any activities that seem suspicious. Update your PIN and notify your bank to implement additional safety measures.

Enable App Lock

Users have the option to configure a PIN, fingerprint lock or face unlock to access each major UPI application. Activate this additional security measure so unauthorized users can’t access the UPI app even if they physically get hold of your phone.

Review Statements Regularly

It’s important to frequently check your bank statements together with transaction histories inside your apps. Confirm that every listed payment is familiar. The appearance of unfamiliar UPI transaction IDs might indicate fraudulent activity. Detecting problems early offers you the greatest opportunity to solve them quickly.

Keep Apps Updated

The latest version of your UPI app provides new security features, so make sure you update it regularly. Use official platforms, such as the Google Play Store or Apple App Store to download UPI apps instead of third-party websites. Security patches are regularly issued by developers to improve defenses against new threats.

Report Suspicious Activity

Contact your bank immediately to report any unauthorized transactions by providing them with the UPI transaction ID as soon as you detect fraudulent activity. NPCI, together with government support lines, including 14440, exists to help consumers. The chance of stopping unauthorized transactions or getting money back increases when you act quickly.

Staying informed is your best defense. Responsible usage combined with UPI’s security features allows you to make fast payments without hassle while keeping the risk minimal.

Read more: Payment Gateway Security Features: Safeguarding Online Transactions

UPI ID vs. Other Payment Methods

UPI established itself quickly as India’s preferred digital payment method, yet it remains one of many available payment solutions. This analysis details the differences between UPI payments through a UPI ID and other well-known digital payment options.

UPI vs. NEFT

UPI followed NEFT as a digital payment option for several years. NEFT transactions were historically processed in scheduled batches, resulting in transfer delays. NEFT now operates 24×7 through half-hourly cycles yet remains slower than UPI, which offers real-time transactions. NEFT payments require you to input a beneficiary’s account number and IFSC code, while UPI transactions only need a UPI ID or QR code scanning. Even though NEFT fees are now minimal, everyday payments favor UPI because of its quick processing time and user-friendly operation.

UPI vs. IMPS

IMPS (Immediate Payment Service) functions as an additional bank transfer service that operates non-stop throughout the day. The IMPS system requires users to input account information alongside either an IFSC code or MMID for mobile transfers. IMPS operates 24×7 like UPI but charges small fees and requires multiple account details instead of a single UPI ID. UPI enables users to make immediate payments using only a contact number or an ID without any charges for person-to-person transactions.

UPI vs. RTGS

The RTGS system facilitates real-time high-value transactions that usually exceed ₹2 lakhs. RTGS processes transactions instantly, but its primary usage remains within banking business hours. Large financial transfers done by companies and individuals depend on RTGS, while UPI, with its ₹1 lakh transaction limit, serves smaller daily payments. The presence of transaction fees makes UPI a cheaper alternative for common payment activities compared to RTGS.

UPI vs. Mobile Wallets

Digital payment platforms like Paytm Wallet and Mobikwik gained widespread popularity during the initial stages of digital payment adoption. Users transfer funds into their wallet accounts to make purchases inside the same payment system. The main disadvantage lies in limited interoperability, which requires additional steps to transfer money from one wallet brand to another. Wallet services usually apply KYC restrictions and fees when users transfer funds to their bank accounts. UPI removes these barriers by interfacing directly with any bank account, which removes the need for wallets and enables smooth payments between all UPI account holders.

UPI vs. Credit/Debit Cards

The dominant method for cashless payments over the past decades has been card-based systems, which involve either swiping or tapping cards at terminals or entering card information during online purchases. Cards enable credit periods and rewards but obligate merchants to operate POS machines and usually charge transaction fees. The QR code system from UPI allows merchants to avoid fees on small payments while offering a setup process that requires only printing a QR code. When making fast online purchases, UPI eliminates the need to input card information, which speeds up checkout time. UPI debits your bank account right away, unlike credit cards, which provide a billing cycle, thus making it easier to avoid debt.

UPI vs. Cash

UPI’s adoption by small vendors and transportation services demonstrates its strong capability to substitute physical money even as cash remains important. Skip the hassle of searching for change because a QR scan or entering UPI ID transfers money instantly.

Read more: Get paid faster and boost cash flow with auto collect

UPI and Digital Payments: Future Prospects in India

The ongoing evolution of India’s UPI success story creates fresh opportunities in digital transactions. The upcoming period will witness the development of innovative capabilities while achieving broader implementation across multiple applications.

UPI Lite for Small Payments

The UPI Lite system facilitates effortless payments for transactions below ₹200 each. Customers can deposit a minimal amount into their UPI Lite balance to perform multiple quick payments without needing to enter a PIN. The feature relieves core banking networks from pressure while providing solutions for common everyday payment needs such as coffee or bus ticket purchases.

UPI 123PAY for Feature Phones

For inclusive access, RBI and NPCI introduced UPI 123PAY to support those who do not own smartphones. Feature phone users can now perform UPI transactions by using IVR calls, missed calls, or simple menu navigation systems. The initiative expands UPI’s accessibility to semi-urban and rural regions where smartphone ownership remains limited.

Global Expansion

UPI’s growth isn’t confined to India. The collaboration between UPI and Singapore’s PayNow demonstrates existing cross-border connections for efficient money transfers. The upcoming pilot projects will enable UPI payment systems to function in nations such as Nepal, UAE, and Bhutan. Travelers can avoid currency management issues by scanning a QR code to make payments in local stores through their UPI ID with automatic currency conversion.

Credit on UPI

UPI started as a service connected to bank accounts but now extends its services to credit payment methods. RuPay credit card linkage to UPI combines phone transfer simplicity with credit line flexibility. The expansion of credit card network participation could transform credit card usage through UPI serving as a single unified gateway.

Recurring Transactions and Automation

UPI AutoPay provides a streamlined way to handle subscription payments, insurance premiums, and SIP transactions. Setting a recurring payment schedule enables automatic transactions, which transform UPI into a comprehensive payment system. UPI is quickly evolving into a comprehensive payment solution that accommodates both routine transfers and substantial scheduled payments.

Rising Limits and New Use Cases

Users can expect UPI transaction limits to respond and adjust according to their unique requirements. For major transactions like IPO applications and bulk payments, existing caps might increase. UPI’s adaptable system enables continuous integration into various financial operations, such as government bond transactions and philanthropic contributions.

Innovations from Banks and Fintechs

Financial institutions and technology firms enhance UPI’s open architecture by adding features like personalized expense tracking systems, voice payment options, and comprehensive financial management solutions. The cooperative nature of UPI’s platform generates continuous innovation that maintains its relevance and ease of use.

Enhanced Security

As UPIs become more widely used, security continues to be the most important concern. The combination of biometric authentication and AI-driven fraud detection with optional time or location-based restrictions aims to enhance the security of users’ digital transactions.

Digital Rupee and UPI

The digital rupee from RBI may join forces with UPI to enable digital transactions through familiar QR code interfaces. This integration merges cryptocurrency payment features with the streamlined functionality of UPI.

Read more: Make secure contactless payments using QR codes

Conclusion

UPI’s expansion alongside the easy-to-use UPI ID has brought about fundamental changes to India’s payment system. The feature introduced in 2016 has grown into an essential element of daily existence for hundreds of millions of users. UPI has made bill-splitting with friends and quick payments to vendors second nature to us. This guide explained what UPI ID represents and demonstrated its operational mechanics and powerful attributes. The UPI ID or VPA represents your personal payment address, which allows you to send and receive money with the simplicity of sending a message. By now, the UPI ID meaning should be crystal clear: UPI ID acts as a condensed representation of your financial information to facilitate effortless payments. We demonstrated the process of creating your UPI ID on multiple platforms, including Google Pay and PhonePe. This section explains effective UPI ID usage and outlines its multiple advantages compared to traditional payment methods. We reviewed security measures to protect your transactions while exploring UPI’s future developments, including UPI Lite and international connections.

UPI has made digital payments accessible to all citizens by providing secure banking services to smartphone users and those without smartphones through 123PAY. The basic UPI ID, composed of the name@bank stands as the entry point to this financial revolution. As UPI continues its expansion, it is beneficial to develop familiarity with its operations while tapping into its convenient features. If you haven’t used UPI before, now is the ideal moment to start using it. The setup process is straightforward, while usage remains free and acceptance widespread. Existing UPI users should now find this complete guide useful for resolving any doubts about UPI IDs while gaining fresh perspectives.

UPI represents more than a payment mechanism because it demonstrates how technology creates simplicity in our everyday lives. The UPI ID stands as a critical yet compact element in the digital transaction narrative because it enables users to conduct business without interruption in today’s online world. Dive into the cashless convenience by using your UPI ID with confidence and responsibility as you join India’s digital payment revolution.