Introduction

Managing any business requires considerable effort. From procurement to vendor selection to payments, generating revenue, and gaining profit, it’s a period of rapid fluctuations. As a business owner, you would want to simplify certain areas of your business. Collections or receivables in one such crucial area that requires simplification. eNACH is one such payment mandate that helps businesses in collections from their customers.

What is eNACH?

National Payments Corporation of India (NPCI) introduced the eNACH or electronic National Automated Clearing House (NACH) to simplify electronic payments and collections. An electronic mode of payment, eNACH allows businesses to automate their recurring payments such as SIPs, EMIs, insurance premiums, utility bills, and more.

eNACH example for business collections

A company known as X enterprises sells subscription-based diet plans to their customers. They depend on manual bank transfers or credit card payments from their customers.

Sometimes this leads to missed or delayed payments by customers. The subscriptions get canceled if the card applied is expired resulting in losing customers.

X enterprises integrate eNACH for recurring subscription payments. eNACH allows them to collect recurring payments from their subscriber’s bank accounts digitally on the designated date each month. This way they do not lose their customers and they don’t have to follow up with their customers for monthly payments.

Benefits of eNACH for businesses in collections

eNach helps streamline business collections in the following ways:

Automation At Work: Businesses can easily ditch manual payment collection and choose automation with eNACH. This will allow them to focus on other tasks like customer service or growth initiatives.

Quick Collections: eNach payments are settled within a few business days when compared to cheques or credit card processing. This allows businesses to receive their funds faster, improving their cash flow.

Less Failed Payments: eNACH debits the amount due directly from the customer’s account on a scheduled date. This reduces the risk of failed payments and overdue accounts.

Enhanced Customer Experience: Businesses can integrate eNACH into their websites and be rest assured about customer convenience. The user-friendly mode of payment leads to higher customer satisfaction and retention.

Reduced Operational Costs: eNACH helps businesses save money on administrative costs and collection efforts.

Competitive Edge: Businesses using eNACH for payment collection have a competitive edge over their competitors. Integrating eNACH can help them attract and retain customers while building a build a positive reputation in the marketplace.

Flexibility: eNACH facilitates flexibility as it can be customized to meet the unique demands of different businesses depending on their industry type, size, and payment requirements.

Security: A secure and reliable payment solution, eNACH reduces the risk of fraud and errors associated with manual payment processing. Electronic transactions processed via eNACH are accurate and secure.

eNACH for Recurring Payments

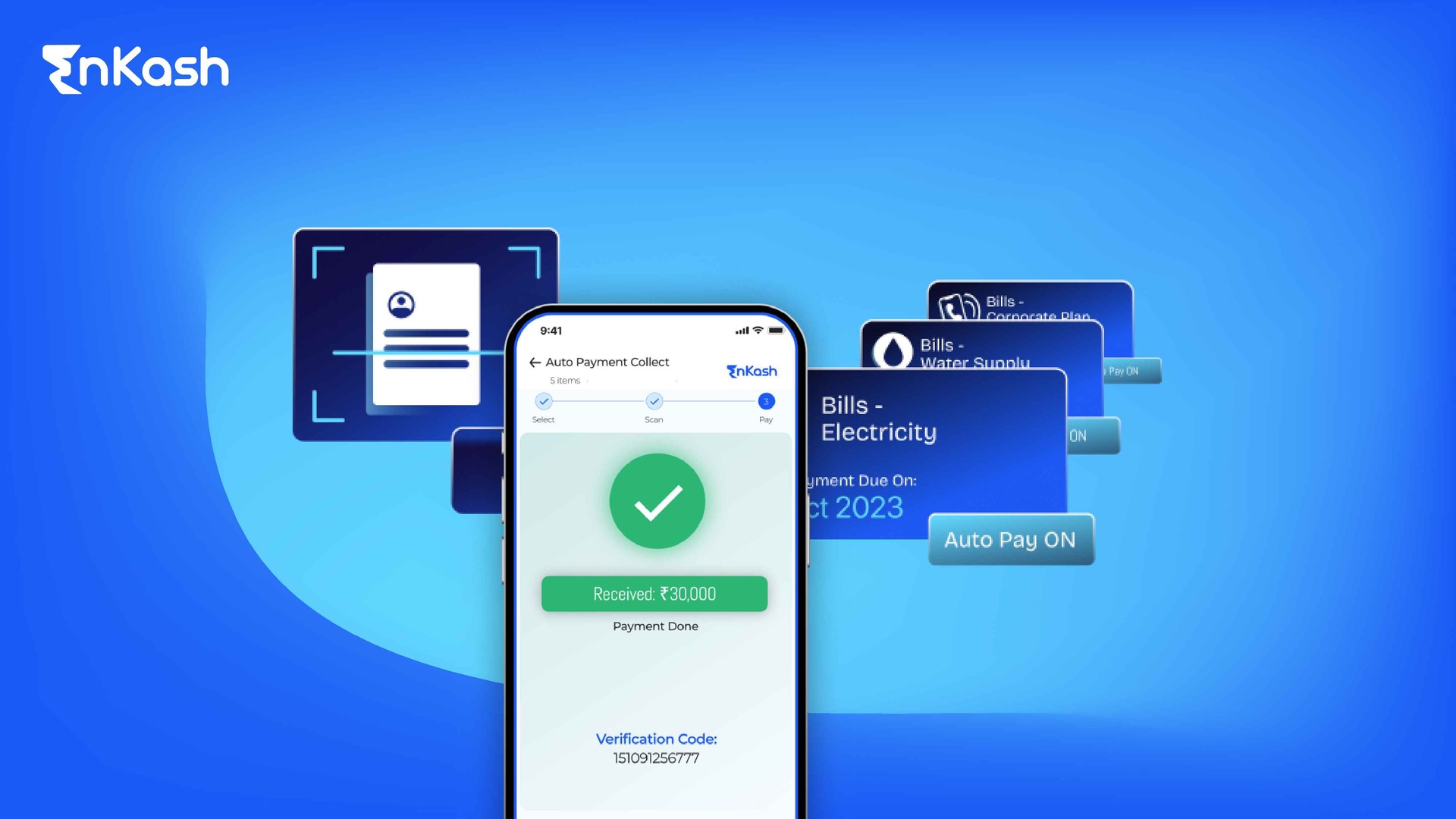

Businesses can easily integrate eNACH into their website and start collecting recurring payments from their customers. Customers have to authorize eNACH to deduct their monthly fee or payment directly from their bank on a specified date. This helps businesses save time in chasing payments and reduces processing costs compared to credit cards. With eNACH, businesses have predictable cash flow allowing customers to pay in a convenient, automated manner.

How to integrate eNACH into my business?

Follow these steps to integrate eNACH into your business:

Find an eNACH Service Provider: You need a partner that facilitates eNACH transactions. EnKash is one such provider with a user-friendly platform.

Account Setup: The service provider will help establish an eNACH account for your business. This involves document verification and approvals.

API Integration: eNACH providers offer APIs to connect their platform with your existing billing or Customer Relationship Management (CRM) system. This enables automated data exchange simplifying the process.

Customer Onboarding: During sign-up, customers provide their bank account details and authorize recurring eNACH debits for their monthly fee.

Payment Processing: After a customer authorizes eNACH, the system handles automatic deductions on the designated dates. EnKash provides a single dashboard for monitoring transactions and managing exceptions.

Technical Support: EnKash provides reliable technical support to assist you with any integration or transaction issues.

Conclusion

By using eNACH for payment collections, businesses can stay ahead of the curve and facilitate their cash inflow. Businesses can easily automate their manual collection process with seamless integration and complete security while increasing their customer retention.