Days Sales Outstanding (DSO) in accountancy refers to calculations a company or an organization uses to estimate the size of outstanding accounts receivable. It helps businesses to measure the size of average sales days.

Days sales outstanding are calculated with the help of the following formula:

Accounts receivable/ net credit sales multiplied by the number of days

DSO (Days sales outstanding) is a parameter that helps to measure the average number of days a company or an organization takes to collect the payment for a sale. Since it is evident that cash flow in a company or a business is given top priority, it is in the company’s best interest to collect its outstanding debt as soon as possible. Hence, collection is important to be done on time.

One can analyze days sales outstanding in numerous ways. Some of them are:

Good and bad DSO numbers in finance and calculation

When a company’s days sales outstanding is increasing rapidly, it is a warning sign that something is wrong. There can be multiple reasons for this. For instance, customer satisfaction might be declining, or the salesperson might be offering longer payment terms to increase sales. One of the major reasons for this warning sign can also be that the company is allowing people with poor credit scores to make purchases on credit. Therefore, a rapid increase in a company’s DSO (Days Sales Outstanding) leads to serious cash flow problems. If a company’s ability to make payments promptly is disturbed, the company might be forced to make drastic changes.

However, days sales outstanding vary consistently monthly, specifically if the company’s product is seasonal. And in the case where a company’s days sales outstanding consistently dip during a particular season every year, then there is no reason to worry. Therefore, it is advisable to maintain the e-collect account.

Limitations of days sales outstanding as a measurement criterion

The days sales outstanding is backed by certain limitations that are important for all investors to consider before making any decision. First, while using days sales outstanding in finance and calculation to compare a company’s cash flow, it is imperative to compare companies within the same industry along with similar business models and revenue numbers. If you compare different companies of different sizes, the results might need to be more accurate because of different DSO benchmarks and targets. Therefore, make sure to set a specific target and the same parameters.

How to reduce the days sales outstanding

Reducing a company’s DSO days sales outstanding is partially in the hands of a company’s finance and accounts department. In addition, other departments of the company have an impact on this metric. Thus, reducing DSO is not only a focused effort of the finance and accounting departments but a collective effort of all other departments including sales, after-sales service, and post-sales customer care. Below mentioned are some of the steps that you must consider to reduce days sales outstanding.

Collect data about the current DSO status

The first step to take when you plan to reduce your company’s DSO is to collect the DSO data and carry out a benchmarking analysis that shows where your business stands in comparison to peers and competitors. In short, a company must focus on both attainable and suitable DSO reduction based on a company’s realistic situation.

Focus on customer credit

Days sales outstanding is determined by a customer’s ability to pay their invoices on time. Thus, all efforts to reduce DSO days sales outstanding must focus on customer credit risk. The first step is to determine appropriate parameters for acceptable credit risk. This helps the company ensure that all new customers do not represent slow and unaccountable payments. Companies can also extend this criterion to existing customers, starting with those slow to pay.

Define customer payment terms

Days sales outstanding is highly influenced by the terms a company extends to its customers. Those payment terms should be defined in a way that balances the company’s days sales outstanding. Ensuring that the invoices clearly and visibly state payment terms and conditions would reduce the chances of confusion over receiving payments.

Keep up the momentum

Companies must work to reduce the days sales outstanding and maintain this effort for the long term. In addition, the companies must ensure that they stick to the new terms of reducing DSO and should not return to the old ways of payments and credit risk. Loop in your marketing and sales team as they are the main touchpoints for customers before and during the sales process.

Reducing the days sales outstanding is one of the best ways to improve a company’s cash flow. All you require is a focused and sustainable effort to realize the metrics of increasing DSO. The accounting and finance department members should take the required steps into account to ensure that the days sales outstanding is reduced and taken care of.

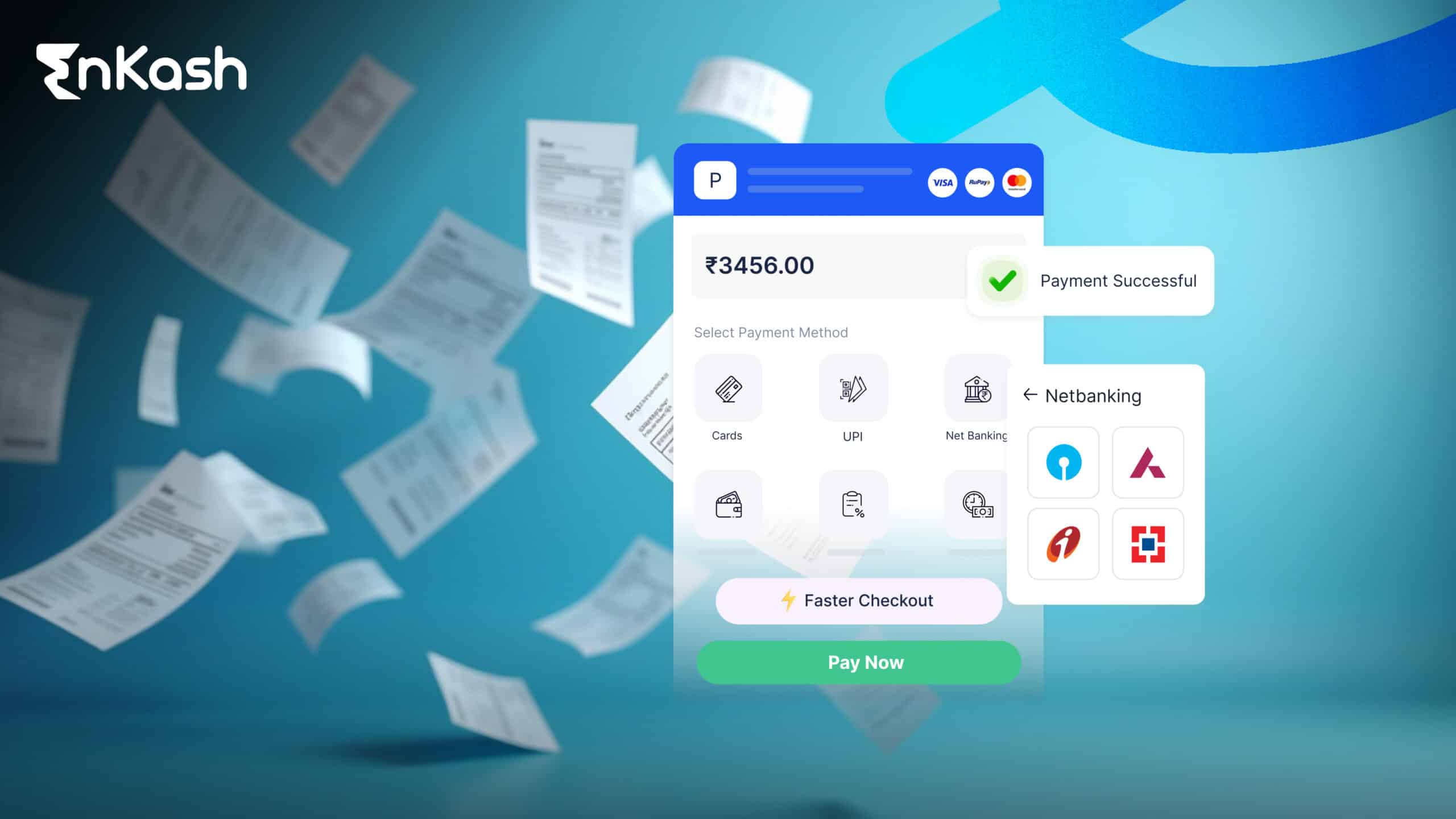

EnKash offers the best spend management solutions that help you get a holistic view of your cash flow, automate invoice sending, enable various payment modes, and thereby improve your cash flow and help your business grow.. With our solutions, you can increase your organization’s earnings and multiply savings. Get an EnKash consultation online and easily understand the essentials about your company’s days sales outstanding. Therefore, it is time to lead with change, cutting-edge innovation, and industry-first solutions with EnKash.