A cash budget is a critical tool that enables firms to estimate the amount of cash available for financial activities, giving them a chance to make informed financial decisions. By calculating expected cash inflows and outflows, firms can avoid shortages of cash, make sound financial decisions, and contribute to the long-term sustainability of their operations. Sound cash budget management helps the company run more smoothly, better manage liquidity and free up cash to better support its day-to-day activities.

Introduction

A cash budget is an important financial tool companies can use to ensure smooth business functioning. It helps companies determine whether it has sufficient funds to pay their short-term liabilities such as salary payments, rental payments or utility costs. It enables businesses to budget how much cash they expect to receive and pay out over a given period so that they can make decisions on timing their investment, holding back, or bridging cash shortfalls.

Cash budget helps businesses to remain one step ahead of the curve when it comes to planning for future growth, avoiding debt, and avoiding overdrafts by maintaining the right balance between income and expenditure.

Regardless of the size of the businesses, cash budgets can help them have a healthy financial future. Learning the cash budget definition, its methods and common problems and solutions can help businesses hold their own in changing financial and market conditions.

Also Read: What is Capital Budgeting

What is a Cash Budget?

One of the key features of a cash budget is its focus on cash liquidity. In contrast to many other financial budgets, which typically focus on profitability, a cash budget tracks real cash movements. By estimating inflows and outflows, the cash budget can enable the business to keep its operations running by ensuring sufficient cash for its expenses.

For example, a company might anticipate receiving revenue from sales made two months ahead but will need to pay salaries and other expenses before that revenue comes in. The cash budget will assist the company in planning for these gaps and seeing what kind of financial action might be required, such as holding off on capital expenditure or taking a short-term loan.

Purpose of a Cash Budget

A cash budget enables not only the short-term survival of businesses but also their long-term expansion by assisting managers in making decisions about the future in a more informed fashion. Here is how a cash budget helps with financial planning:

Maintains Liquidity

The primary purpose of a cash budget is to ensure that a business has enough cash to pay its immediate and short-term obligations: payroll, rent, utilities, etc, and to suppliers. A profitable business can also run out of cash. A lack of liquidity can grind business activity to a halt.

Also Read: Payroll Process

Helps to Plan for Growth

Forecasting how much cash a company will take in and payout can help them plan for growth. If a company knows its future cash position, it can plan for investments like purchasing machinery or hiring personnel.

Prevents Overspending or Risky Borrowing

If the cash budget indicates a possible cash shortfall, the business can plan corrective action well in advance, such as delaying expenditures or procuring funds before the cash becomes scarce, rather than resorting to high-interest, emergency loans.

Monitors Cash Efficiency

By showing how efficiently a business is using its cash, a cash budget allows management to reinvest surplus cash into the business or perhaps save it for some future expenditure. And in cash-deficit periods, knowledge of inefficiency can bring about better cash management.

Key Components of a Cash Budget

A cash budget consists of three essential elements – cash inflows, cash outflows, and net cash flow. Let’s look at these elements in detail.

Cash Inflows

Sales Revenue: For most businesses, sales revenue is by far the most important cash inflow. Cash or credit sales are at the heart of the business’s liquidity position. Precise prediction of sales is vital as it directly influences the dependability of the cash budget. Overestimating sales can result in cash shortages.

Accounts Receivable: For businesses that extend credit to their customers, a large portion of the cash inflow is through the collection of accounts receivable. When receivables are collected becomes extremely critical because cash that can’t be put to work immediately can result in the business’s inability to meet short-term obligations. Proper estimates and collection processes must be implemented for better cash flow.

Other Income: Companies can have other income sources like return on investments or proceeds from selling assets. All of these inflows must be considered since they can make a huge difference in the company’s cash position.

Cash Outflows

Operating Expenses: These are all the daily costs for the business like salaries, electricity, rent, etc. Since they are repeating costs, these amounts make up an ongoing cash flow and have to be managed closely to avoid cash shortfall.

Capital Expenditures: Cash spent to purchase fixed assets such as equipment, machinery, or a building. These expenses are often one-off outflows and can be substantial, so it is important that they are budgeted for to ensure there is no negative impact on short-term liquidity.

Debt Repayments: Companies borrow money to fund their operations, and repaying that debt is another vital part of cash outflows. Not paying or delaying these payments both accrues interest (and the associated credibility issues) and may add unfavorable terms to future debts.

Also Read: What is Cost of Debt

Net Cash Flow: Net cash flow is the amount of cash flowing into the business (cash inflows) minus the amount flowing out of the business (cash outflows). When inflows exceed outflows, the business has positive cash flow, so it has an excess of cash that can be reinvested, used to reduce debt, or held as a reserve. On the other hand, if outflows exceed inflows, the business has negative cash flow and a cause for potential liquidity concern. A positive net cash flow will ensure that the business is able to fulfill its obligations and pursue growth opportunities.

Managing the above components well should make the business run smoother and help achieve long-term financial survival.

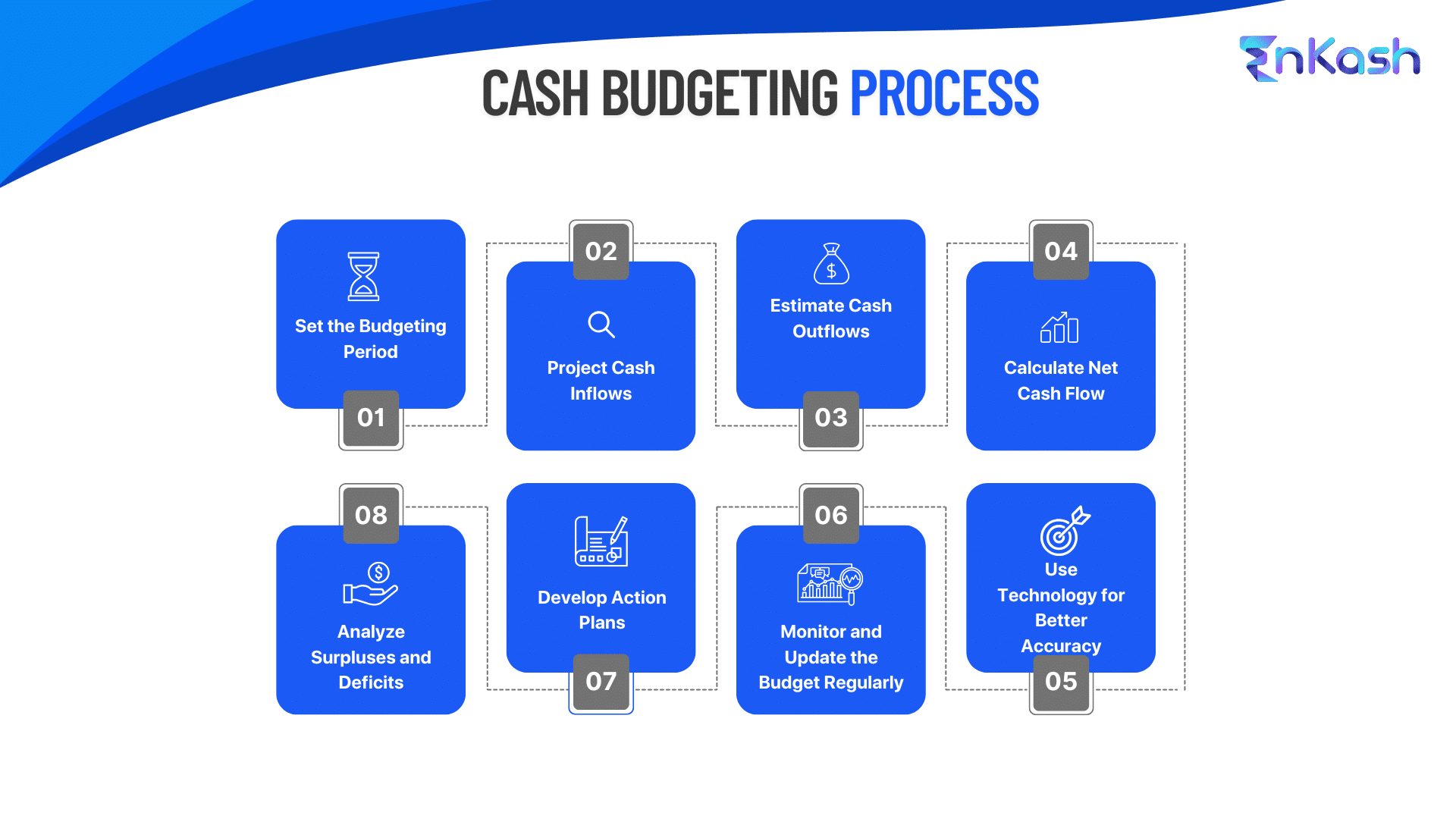

How to Prepare a Cash Budget?

The creation of an effective cash budget requires a systematic approach to control the flow of cash in and out of an organization and help to avoid any financial deficits.

The below steps can help prepare a cash budget.

Gather Historical Information

The starting point for preparing a cash budget is to examine historical financial data. This involves collecting information about past cash inflows (cash from sales, loans, and receivables), as well as cash outflows (rent, payroll processing, inventory purchases). Historical data is important in forecasting future cash flows because it provides a point of reference and shows patterns, seasonal trends, and potential cash shortfalls. Without this baseline, projecting cash needs into the future becomes quite speculative.

Forecast Cash Inflows

The next step is to forecast cash inflows. This can come from different sources, including sales of products or services, customer payments, or outside financing such as loans or investments. It’s wise to be conservative when forecasting cash flows, especially when dealing with market volatility. Overestimating the amount of income could result in financial distress when revenues fall below forecasts.

Estimate Cash Outflows

The next step is to estimate cash outflows. Some costs will be fixed, like rent, salaries, and loan repayments, while others will be variable costs, such as utilities, raw materials, or marketing. It’s important to itemize all possible spending, making sure to have enough money on hand to meet these expenses. Variable expenses deserve special attention because they are more likely to fluctuate.

Find Net Cash Flow

Net cash flow value can be determined as – total inflows minus total outflows. A positive net cash flow means that the business is generating more cash than it is using and, therefore, may be able to reuse it by reinvesting it into the business or paying down debt. A negative net cash flow means that this business made less cash than it spent – and needs to make up the difference by cutting costs, finding additional investments, or increasing revenue.

Review and Adjust

Cash budgets should be adjusted periodically based on real-time financial information and changing circumstances. This constant monitoring enables a business to absorb new costs, react to changing market conditions, or make the most of new opportunities. The more consistently the cash budget is updated, the more proactive a business can be in coping with day-to-day cash demands and planning for future growth.

Different Methods of Cash Budgeting Explained

Depending on the size, complexity, and requirements, a business can adopt different cash budget preparation methods. Let’s explore some of these cash budget methods below.

Traditional Method

This is the approach taken mostly by companies with more stable and predictable cash inflows and outflows. It uses past historical data to estimate future cash flow patterns. However, if a company operates in a highly dynamic market or is facing economic stress, the traditional method could be ill-advised, as it assumes that the future cash flow pattern is similar to past trajectory.

Zero-Based Budgeting

Rather than analyzing historical data, zero-based budgeting focuses on evaluating every expense and determining if it is necessary. This method is detailed and has the potential to prevent unnecessary spending. For example, the company has to justify every expense, salary, or bonus. However, it can be time-consuming, so the method is suited to large organizations with resources or companies wanting to optimize their expenses.

Rolling Budgets

Continuous budgeting or rolling budgets are a popular approach that updates the cash budget frequently – generally monthly or quarterly. This method works best when the business is in an industry where cash flow is susceptible to changing external events like market conditions. Adjusting their financial plans based on current financial conditions gives businesses a level of flexibility and enables them to keep their cash-flow forecasts fresh and reliable over time.

Activity-Based Budgeting

This budgeting approach ties cash inflows and outflows to specific operational areas in business. It helps businesses see the costs and revenues associated with each activity. For example, a company could define budgets for marketing, IT, and customer service. It helps businesses conduct in-depth financial analysis and understand the profitability of each business operation. The cash budget method works best for businesses with diverse revenue streams.

Common Cash Budget Problems and Solutions

Businesses can experience issues when preparing and updating a cash budget. Knowing about these potential issues can help them plan for their financial accounting needs better.

Inaccurate Forecasting

Overestimating inflows or underestimating outflows is a common issue that can lead to cash shortages or inability to take on growth opportunities. It’s, therefore, important to use conservative estimates when predicting revenue and expenses to prevent such financial problems. Constant revisions of the budget with actual financial results help improve the projections and alert organizations in case the market or costs change.

Mismatch in Cash Flow Timing

A company might encounter liquidity problems if customers fail to make timely payments, but expenses such as salaries and rent are due immediately. The timing mismatch problem can be solved by using a rolling cash budget, where the cash budget is updated routinely based on actual inflows and outflows. This way, a company can see ahead of time if it will have shortfalls or have too much cash and take action to address the situation.

Unforeseen Costs

Unanticipated costs like machine repair or changes in rules might create a sudden need for cash, and can turn the budget upside-down. To be ready for these unexpected expenses, businesses should have a cash reserve or emergency fund to help level out any surprises.

Over-reliance on Credit

The more a business uses borrowed money, the harder it will be for that business to pay back those debts, especially when cash flow begins to slow down. In the long run, the continuous use of debt can wear away at the business’s financial stability. Lowering debt dependency is the way forward here. Surpluses should be used to pay down loans, and the business should try to develop multiple revenue streams to ensure they remain financially viable without overleveraging their debt capacity.

Tools and Resources for Cash Budgeting

Businesses can employ technology for effective cash flow management. It can help them save time while improving the quality of estimates. Let’s explore some cash budgeting tools below.

Spreadsheets

Businesses can build custom cash budgets at a relatively low cost with programs like Microsoft Excel and Google Sheets. Businesses have to manually input cash inflows and outflows, sort them and write formulas to get the value of net cash flow. Spreadsheets can work well for smaller enterprises or those with consistently predictable cash flows, but they have to be closely monitored and regularly updated – errors in input can lead to erroneous forecasting.

Budgeting Software

Budgeting software offers organizations an advantage over the manual way of doing a cash budget. It automates much of the cash-flow tracking, giving you the ability to import transaction data from your bank accounts, see real-time cash-flow information, and use tools that predict cash usage and requirements in the future. Other features, such as accounts payable and receivable, record who you owe and who owes you, helping stay top on cash flow issues.

Also Read: What is Expense Management Software

Financial Advisors

A financial advisor is essential for companies with more complicated cash flow or those involving large-scale investments. Advisors provide the expertise needed for businesses to build more precise cash budgets that meet their needs. They can provide strategies for cash flow management when the business is growing, struggling, or transitioning, ensuring that the company is liquid and does not run into financial problems.

Cash Flow Forecasting Apps

For instant access to cash flows, businesses can leverage cash flow forecasting apps. These apps link up to accounting applications and automate cash flow reporting, allowing companies to view their current cash balance in real-time. Apps send alerts when possible cash flow deficiencies are found so that enterprises can respond in time. They work well for dynamic companies with fluctuating cash flows.

Conclusion

A cash budget is an important financial tool for a company to regulate their liquidity, prepare for growth, and stay away from debt. Whether the business uses a conventional or a more sophisticated approach, such as zero-based or rolling budgets, the ultimate objective is to make sure the company has enough cash and can cover its bills.

Now, spreadsheets, budgeting software, and real-time cash flow monitoring apps make much of this work automatic and allow companies to focus on growth and sustainability. Having regular updates, conservative forecasts, and an emergency cash reserve can be effective in keeping a company solvent.

Once businesses know the cash budget definition, apply the right method, and familiarize with common cash budget problems and solutions, they will be ready for opportunities and be better prepared during financially difficult periods.

Frequently Asked Questions (FAQs)

What is the primary purpose of a cash budget?

The main purpose of a cash budget is to provide an estimate of the expected cash inflows and cash outflows during a given time period. They help ensure there are adequate funds to meet the short-term obligations such as bill payments or financing day-to-day operations, thus enabling the business to avoid liquidity issues.

What are the main components of a cash budget?

Cash inflow and outflow are key components. Income from sales of merchandise or assets are examples of cash inflows. Rent and utility bills are examples of cash outflow. The difference between these amounts will get you the net cash flow.

How does a cash budget help businesses avoid financial trouble?

A cash budget enables a business to get an idea of its future cash needs. It can use the estimation data about cash inflows and outflows to manage liquidity proactively in a bid to maintain or safeguard its financial well-being.

What is the difference between a short-term and long-term cash budget?

Short-term cash budgets tend to last between a few weeks to up to several months; they are typically prepared to highlight businesses’ immediate cash needs. On the other hand, long-term cash budgets tend to span a period of one year or more and are more aligned with strategic planning. Long-term budgets often include capital investment, large monetary projects, and major operational plans.

How can businesses manage unanticipated expenses?

To deal with sudden and unexpected expenditures, businesses keep cash reserves or an emergency fund. This is an amount of cash available to fund any ad hoc expenses as they occur, which can include equipment breakdowns, lawsuit costs, emergency sewer repairs, and so on. The purpose of such funds is to provide the means to pay for unanticipated costs without affecting the business’s normal operations or having to resort to expensive loans.

What benefits do budgeting software offer?

Budgeting software not only automates the tracking, projections and management of cash flow, it reduces the incidence of human error. It can, in many cases, provide real-time data for a company to monitor its financial health. Budgeting software can also integrate other financial processes, such as accounts payable and receivable, to create an accurate financial state for the company.

Why is conservative forecasting important in cash budgeting?

Conservative forecasting is necessary for businesses to avoid overestimating the amount of cash they generate and underestimating the amount they disburse. By being cautious in their budget management, they’ll be prepared for bad news – such as disappointing sales or higher-than-expected cost burdens. They’ll minimize their liquidity risk and maintain a healthy cash flow.

How frequently should cash budgets be updated?

For the majority of businesses, cash budgets should be updated at least once a month or even once every quarter. However, companies experiencing fast growth, or those that operate in highly volatile industries, might need to update their cash budgets even more frequently in order to reflect the financial reality of the business. Continuous updates help companies to tweak their budgets and make better decisions.