In every scenario, if you want to grow something, you have to invest in it be it time or money. Consistent growth is only possible with the help of effort, time, and money. So, even in every business be it big or small investing in new and existing assets is essential to stay ahead in the market. Capital expenditure, commonly referred to as CapEx, is a crucial aspect of money management for businesses of all sizes. It involves the funds any company utilizes to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment.

But despite its importance, many people still need to learn about what it is and how it can help their business. So, in this blog, we will learn everything about capital expenditure, from its meaning to its types, examples, and the formula used to calculate it, providing you with a comprehensive understanding of its importance in business.

What is Capital Expenditure (CapEx)?

Capital expenditure (CapEx) refers to the money a company uses to purchase, improve, or extend the life of long-term assets. These long-term assets are also called PP&E assets i.e., property, plant, and equipment, such as buildings, machinery, and equipment, and they are typically used for more than one accounting period. CapEx is an investment that’s done keeping in mind the future of the company, aimed at enhancing its production capacity, efficiency, and overall profitability.

But don’t confuse CapEx (Capital Expenditure) with OpEx (Operating Expenditure) as both of these expenditures are completely different. Operating expenses or OpEx cover expenses like rent, utilities, and wages, required for the day-to-day functioning of a business. CapEx on the other hand as mentioned above is focused on acquiring and maintaining long-term assets that will benefit the business over multiple years.

Now that the meaning is clear, let’s move on to the importance of CapEx for your business.

Types of Capital Expenditure

Capital expenditures can be classified into several types, each serving a distinct purpose within the business. The main types of CapEx include:

Growth CapEx: These are investments made to expand the company’s operations. This includes building new facilities, acquiring new equipment, or entering new markets. Growth CapEx is aimed at increasing the company’s revenue-generating capacity.

Maintenance CapEx: This type of CapEx is used to maintain or repair existing assets to keep them in good working condition. Maintenance CapEx is crucial for ensuring that the company’s assets continue to operate efficiently and safely.

Strategic CapEx: These are investments made to achieve long-term strategic objectives. This can include investments in research and development (R&D), acquisitions of other companies, or significant upgrades to technology and infrastructure.

Regulatory CapEx: Sometimes, companies need to make capital expenditures to comply with regulatory requirements. This can include investments in environmental controls, safety equipment, or other regulatory compliance measures.

Replacement CapEx: This involves replacing old or obsolete assets with new ones. Replacement CapEx ensures that the company’s assets remain modern and efficient, reducing the risk of breakdowns and inefficiencies.

If you want to learn more about the different types of business expenses, you can also read this blog

Want To Invest In Your Business Growth

Examples of Capital Expenditure

To better understand CapEx, let’s look at some real-world examples from different industries:

- Manufacturing: A manufacturing company might invest in new machinery to increase production capacity, replace outdated equipment, or build a new factory to meet growing demand.

- Technology: A tech company might invest in data centers, servers, or new software development tools. These investments are crucial for maintaining the company’s technological edge and supporting its product development efforts.

- Retail: A retail chain might open new stores, renovate existing locations, or invest in a new point-of-sale system. These expenditures help the company expand its market presence and improve customer experience.

- Energy: An energy company might invest in new power plants, upgrade existing facilities, or invest in renewable energy projects. These investments are essential for meeting energy demand and transitioning to more sustainable energy sources.

- Transportation: An airline might purchase new aircraft, upgrade its fleet, or invest in new maintenance facilities. These expenditures ensure that the airline can meet passenger demand and operate efficiently.

The formula for Calculating CapEx

Calculating CapEx involves understanding the changes in a company’s fixed assets over a period. The formula for CapEx is:

CapEx = Ending PP&E – Beginning PP&E + Depreciation

Where:

- Ending PP&E: The value of property, plant, and equipment at the end of the period

- Beginning PP&E: The value of property, plant, and equipment at the beginning of the period

- Depreciation: The total depreciation expense for the period

This formula provides a clear picture of how much a company has invested in its fixed assets over a specific period. Let’s break down each component:

- Ending PP&E: This is the value of the company’s fixed assets at the end of the period. It includes the cost of any new assets acquired during the period.

- Beginning PP&E: This is the value of the company’s fixed assets at the beginning of the period. It reflects the cost of the assets that the company started with.

- Depreciation: This is the allocation of the cost of an asset over its useful life. Depreciation expense reflects the wear and tear on the company’s assets over the period.

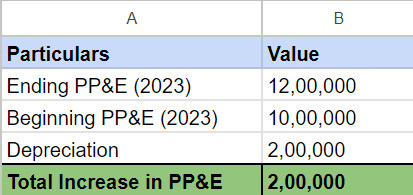

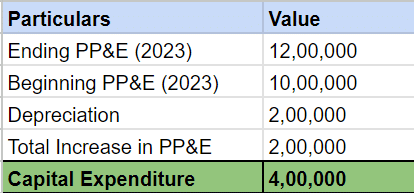

How To Calculate: Example

Let’s assume we have the following information for Company XYZ:

Beginning PP&E (2023): 10,00,000

Ending PP&E (2024): 12,00,000

Depreciation (2024): 2,00,000

So, by subtracting the PP&E value at the end of the year from the PP&E value at the beginning of the year, we will get the total value of the increase in PP&E.

Now, to get the capital expenditure all we have to do is add the increase in PP&E with the depreciation expense.

Factors Influencing Capital Expenditure Decisions

Several factors influence a company’s capital expenditure decisions. Understanding these factors can help businesses make informed investment choices:

- Financial Health: The company’s financial condition plays a significant role in CapEx decisions. Companies with strong cash flows and access to financing are better positioned to make substantial capital investments.

- Market Conditions: Economic and market conditions impact CapEx decisions. During periods of economic growth, companies are more likely to invest in expansion projects. Conversely, during economic downturns, companies may scale back their capital spending.

- Technological Advancements: Rapid technological changes can drive CapEx. Companies need to invest in new technology to stay competitive and meet changing customer demands.

- Regulatory Environment: Regulatory requirements can necessitate capital investments. Compliance with safety, environmental, and industry-specific regulations often requires significant CapEx.

- Strategic Goals: A company’s long-term strategic objectives influence its CapEx decisions. Investments in new markets, products, or capabilities are aligned with the company’s strategic vision.

- Competitive Landscape: The actions of competitors can also impact CapEx decisions. Companies may invest in new assets to match or surpass their competitors’ capabilities.

- Cost of Capital: The cost of financing CapEx projects affects decision-making. Higher interest rates or unfavorable financing terms can deter companies from making significant capital investments.

Capital Expenditure Planning and Budgeting

Effective capital expenditure planning and budgeting are crucial for the success of any business. Here are some key steps in the CapEx planning process:

- Identify Needs: The first step is to identify the company’s capital expenditure needs. This involves assessing the condition of existing assets, forecasting future demand, and identifying growth opportunities.

- Prioritize Projects: Once the needs are identified, the next step is to prioritize the projects. Companies must evaluate the potential return on investment (ROI) for each project and prioritize those that offer the highest returns.

- Develop a Budget: After prioritizing the projects, the company needs to develop a CapEx budget. This involves estimating the costs of each project and determining the total capital required.

- Secure Financing: Securing financing is a critical step in the CapEx planning process. Companies need to explore various financing options, such as internal funds, debt financing, or equity financing.

- Implement Projects: Once the financing is secured, the company can proceed with implementing the projects. This involves acquiring the necessary assets, managing the construction or installation process, and ensuring timely completion.

- Monitor and Review: Monitoring and reviewing the progress of CapEx projects is essential. Companies need to track the actual costs and benefits of the projects and compare them to the initial estimates.

Challenges in Capital Expenditure Management

Managing capital expenditures comes with several challenges. Here are some common challenges faced by companies:

- Accurate Forecasting: Predicting future needs and costs accurately is challenging. Inaccurate forecasts can lead to over- or under-investment in capital assets.

- Budget Constraints: Limited financial resources can restrict a company’s ability to make necessary capital investments. Companies need to balance their CapEx needs with available funding.

- Project Management: Managing CapEx projects effectively requires strong project management skills. Delays, cost overruns, and project scope changes can impact the success of CapEx projects.

- Regulatory Compliance: Ensuring compliance with regulatory requirements can be complex and costly. Companies need to stay updated on regulations and make necessary investments to comply.

- Economic Uncertainty: Economic fluctuations and market volatility can impact CapEx decisions. Companies need to be flexible and adapt their CapEx plans to changing economic conditions.

- Technological Obsolescence: Rapid technological advancements can render existing assets obsolete. Companies need to invest in new technology while managing the risk of obsolescence.

The Impact of CapEx on Financial Ratios

Capital expenditures have a significant influence on various financial ratios that provide insights into a company’s financial health and performance. Let’s explore some key ratios and their relationship with CapEx:

1. Return on Investment (ROI)

- Direct impact: CapEx is a crucial component of ROI, as it represents the initial investment in assets. A high ROI indicates that the capital invested has generated substantial returns

- Calculation: ROI = (Net Profit / Total Investment) * 100

- Implications:

- A high ROI suggests efficient use of capital and successful CapEx decisions

- A low ROI might indicate overinvestment in assets or underperformance of those assets

2. Return on Assets (ROA)

- Indirect impact: While CapEx directly affects assets, its impact on ROA is more nuanced

- Calculation: ROA = (Net Income / Total Assets) * 100

- Implications:

- Increased CapEx can lead to higher asset values, potentially lowering ROA in the short term

- However, if the CapEx leads to increased revenue or reduced operating expenses, it can improve ROA over time

3. Debt-to-Equity Ratio

- Indirect impact: CapEx can influence the debt-to-equity ratio if it is financed through debt

- Calculation: Debt-to-Equity Ratio = Total Debt / Total Equity

- Implications:

- Heavy CapEx financed by debt can increase the debt-to-equity ratio, potentially raising financial risk

- A well-managed CapEx strategy with appropriate financing can maintain a healthy debt-to-equity ratio

4. Cash Flow to Capital Expenditures (CF/CapEx) Ratio

- Direct impact: This ratio specifically measures a company’s ability to fund CapEx with its operating cash flow

- Calculation: CF/CapEx Ratio = Cash Flow from Operations / Capital Expenditures

- Implications:

- A ratio greater than 1 indicates the company generates sufficient cash to fund its CapEx

- A ratio less than 1 suggests reliance on external financing for CapEx

5. Fixed Asset Turnover Ratio

- Direct impact: This ratio measures how efficiently a company utilizes its fixed assets to generate revenue

- Calculation: Fixed Asset Turnover Ratio = Net Sales / Average Fixed Assets

- Implications:

- A higher ratio signifies the correct use of fixed assets

- CapEx investments can improve this ratio if they lead to increased revenue without proportionally increasing fixed assets

The Role of CapEx in Valuation

Capital expenditures play a crucial role in business valuation, as they represent investments in the company’s future growth and profitability. Here’s how CapEx is incorporated into valuation:

1. Discounted Cash Flow (DCF) Analysis

- Direct impact: CapEx is a significant cash outflow and directly affects free cash flow (FCFF), a key component of DCF valuation

- Process:

- Forecast future CapEx to estimate future FCFF

- Discount future FCFF to present value using the weighted average cost of capital (WACC)

- Sum the present values of FCFF to determine the company’s enterprise value

2. Comparable Company Analysis (CCA)

- Indirect impact: While not directly used in CCA calculations, CapEx can influence the selection of comparable companies and valuation multiples

- Process:

- Identify companies with similar business models, growth prospects, and CapEx profiles

- Apply valuation multiples (e.g., EV/EBITDA, P/E) from comparable companies to the target company

3. Asset-Based Valuation

- Direct impact: CapEx directly contributes to the value of fixed assets, which are a key component of asset-based valuation

- Process:

- Determine the fair value of the company’s assets, including property, plant, and equipment acquired through CapEx

Difference Between Capital Expenditure and Revenue Expenditure

Capital and revenue expenditure are two fundamental terms in finance and accounting that categorize business expenses. In the below-given table, you’ll be able to understand the key differences between the two terms:

Feature |

Capital Expenditure (CapEx) |

Revenue Expenditure (OpEx) |

Definition |

Money spent to acquire or improve long-term assets (property, plants, equipment) |

Money spent on the day-to-day operations of a business |

Impact on Balance Sheet |

Increases asset value |

No direct impact on asset value |

Impact on Income Statement |

Depreciation expense over asset’s life |

Expensed immediately in the period incurred |

Expense Recognition |

Spread over multiple accounting periods |

Recognized in the current accounting period |

Examples |

Purchasing new machinery, building a new factory, land acquisition |

Rent, utilities, salaries, marketing expenses |

Timeframe |

Long-term |

Short-term |

Goal |

Increase or maintain operating capacity |

Maintain ongoing business operations |

Financial Impact |

Typically higher upfront costs, but potential for future returns |

Lower upfront costs, but ongoing expenses |

Conclusion

Understanding Capital Expenditure (CapEx) is very important for business growth and sustainability. By strategically investing in long-term assets, companies can enhance productivity, expand operations, and improve their competitive edge. While many challenges also exist, careful planning and execution can optimize CapEx returns and contribute to overall financial health.