Businesses are continuously seeking innovative solutions to streamline operations and enhance financial efficiency. Virtual bank accounts have emerged as a powerful tool in this quest, offering significant advantages over traditional banking methods, particularly in the business-to-business (B2B) sector. These digital-only accounts facilitate the seamless management of large-scale transactions and financial operations, enabling companies to maximize their operational agility and financial oversight. As these accounts become more prevalent, understanding their strategic benefits is crucial for any business aiming to leverage technology for competitive advantage. This article delves into the multifaceted benefits of virtual bank accounts, underscoring their transformative potential in the corporate world.

Understanding Virtual Bank Accounts

Virtual bank accounts represent a significant evolution in modern banking enabling businesses to handle extensive transaction volumes seamlessly, without relying on traditional physical banking infrastructure. Each virtual account is linked to a central master account yet functions independently, offering the detailed tracking and management capabilities of separate accounts. This structure is particularly advantageous in the B2B sector, where companies frequently manage complex financial transactions. By streamlining these processes, virtual bank accounts not only simplify financial operations but also enhance the overall efficiency and responsiveness of businesses navigating the dynamic commercial landscape.

Benefits of Virtual Bank Accounts

Virtual bank accounts offer several key advantages that are especially significant in the context of business-to-business transactions.

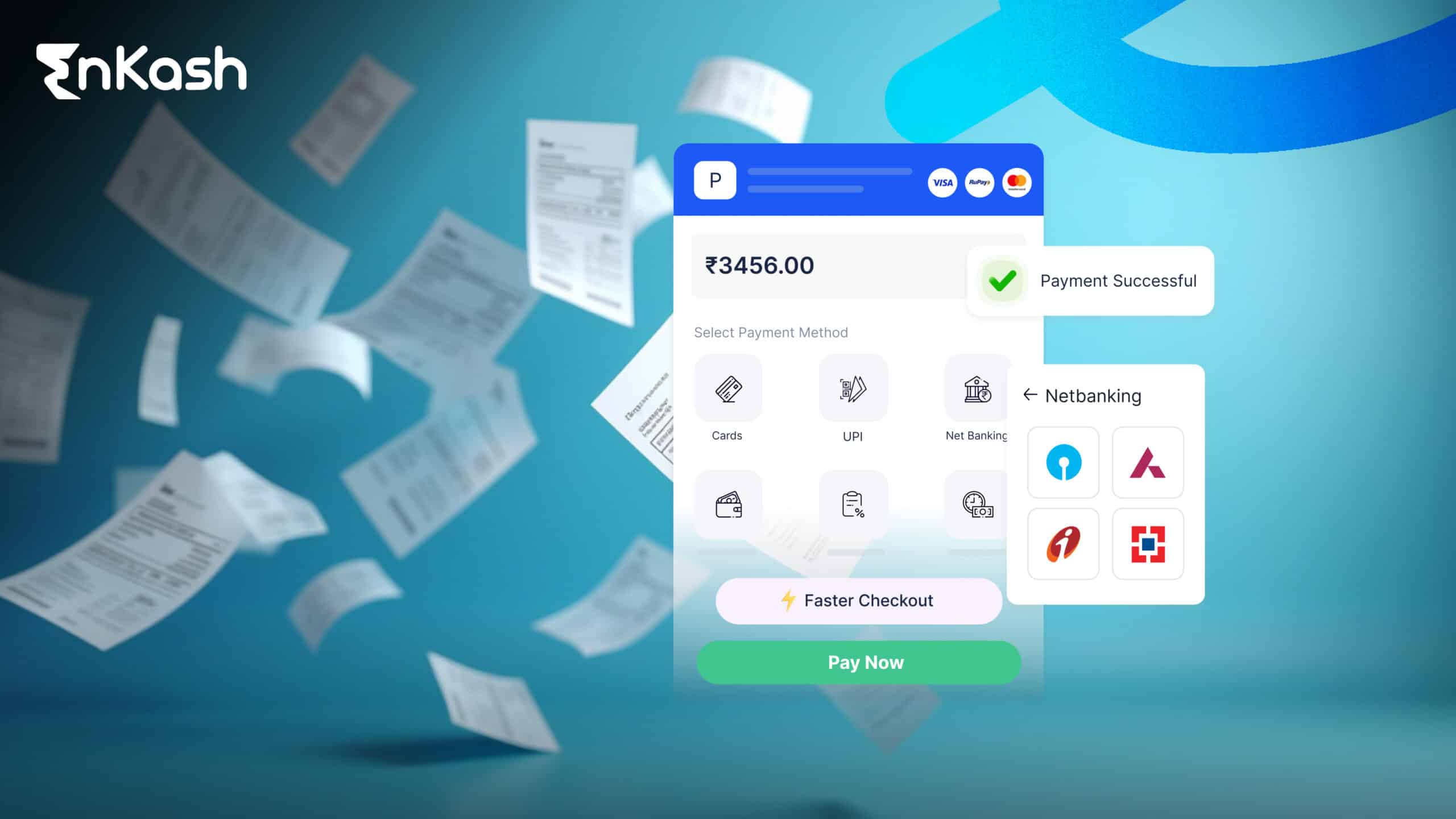

Enhanced Transaction Speed and Efficiency: Virtual accounts are engineered to streamline financial processes dramatically. By facilitating quicker transaction times and enabling immediate financial reconciliation, they address one of the primary challenges faced by businesses today—efficient cash flow management. This speed and efficiency are crucial for businesses that operate on tight schedules and need to maintain a steady flow of income and payments to sustain operations and grow.

Cost-Effectiveness and Reduced Operational Costs: One of the most tangible benefits of virtual bank accounts is their ability to reduce overhead costs associated with financial transactions. By automating the bulk of payment and receipt processes, these accounts minimize the need for manual handling, thereby cutting down on labor costs and the potential for human error. Furthermore, transaction fees are typically lower with virtual accounts compared to traditional banking methods, which can accumulate significant savings over time for businesses dealing with large volumes of transactions.

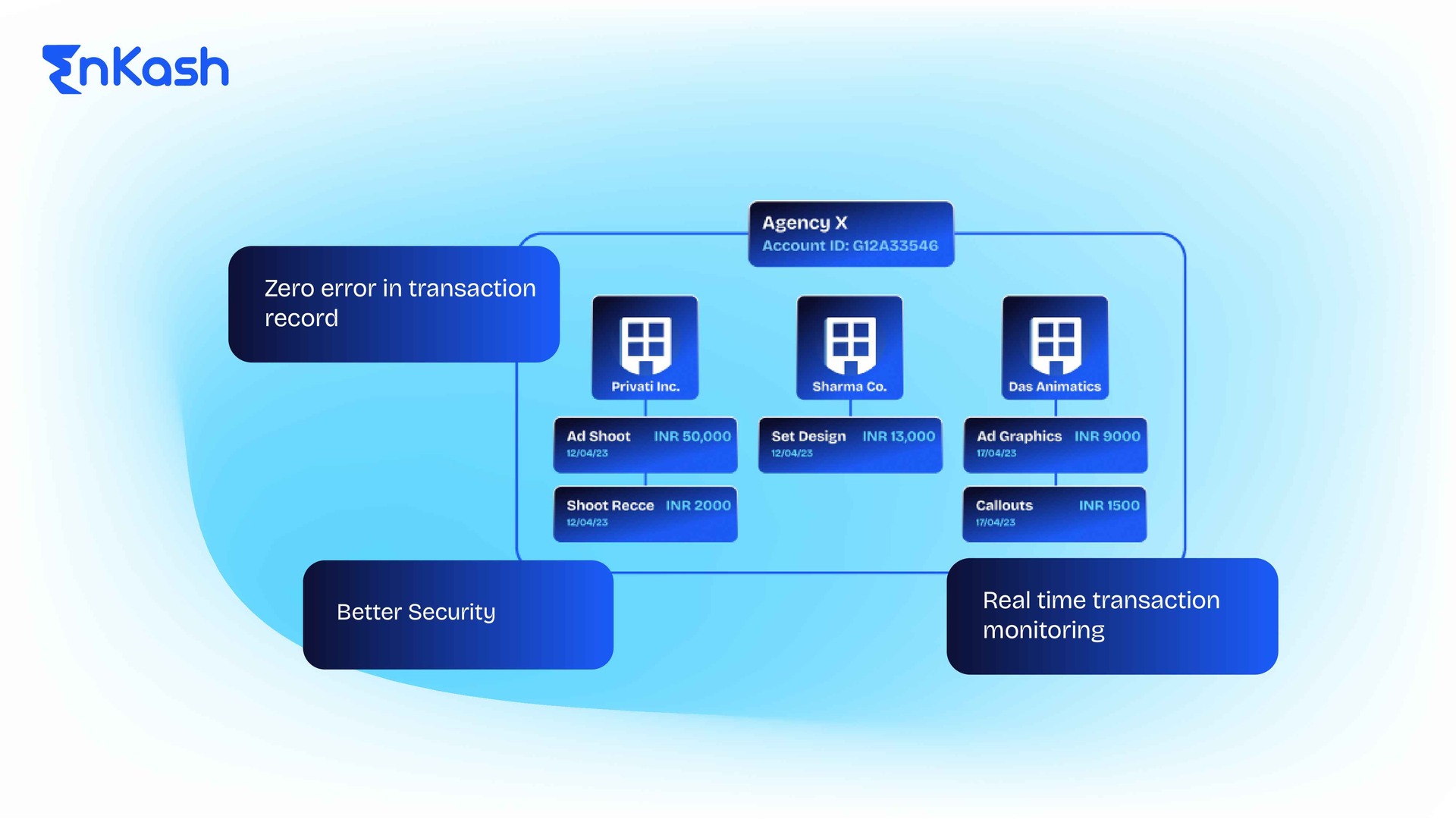

Improved Financial Control and Visibility: Virtual accounts provide businesses with a powerful tool for financial management—real-time monitoring and detailed reporting. This level of visibility is unparalleled in traditional banking setups and allows company managers and financial officers to keep a close watch on all transactions as they occur. Such immediacy and clarity in financial reporting are vital for effective risk management and strategic financial planning, enabling businesses to make informed decisions quickly.

Scalability and Flexibility for Growing Businesses: As businesses expand, their financial needs become more complex and demanding. Virtual bank accounts are uniquely equipped to handle this growth. They can be scaled up or adapted with minimal effort, allowing businesses to add more accounts or adjust their financial infrastructure as needed without the cumbersome procedures typical of traditional banks. This scalability and flexibility make virtual accounts an ideal choice for growing businesses that anticipate changes in the scale and scope of operations.

Virtual Accounts in the B2B Sector

Virtual bank accounts have become a critical component in the financial toolkit of many B2B companies, providing substantial support for sophisticated financial operations and improving interactions with both clients and suppliers.

Facilitating Tailored Financial Operations: In the B2B realm, each client or project may require a unique approach to billing and payments. Virtual bank accounts offer the flexibility needed to tailor financial operations to these specific requirements. Companies can create and manage multiple sub-accounts under a single main account, each designated for different projects or clients. This capability allows for customized billing cycles, payment terms, and handling fees that suit the demands of various business relationships.

Enhancing Client Relationships: By using virtual bank accounts, businesses can offer their clients more personalized and efficient service. For instance, the ability to manage payments on a per-project basis allows for clearer financial communication, reducing the chances of errors and delays. Moreover, the enhanced financial transparency and reporting provided by virtual accounts reassure clients about the security and proper management of their funds, which is pivotal in maintaining trust and satisfaction.

Streamlining Supplier Payments: When it comes to managing supplier relationships, virtual bank accounts simplify the process by enabling automated and scheduled payments. This efficiency not only ensures timely financial exchanges but also helps in negotiating better terms with suppliers due to reliable and predictable payment practices. Additionally, the precise tracking and reporting features of virtual accounts allow for better dispute resolution and financial auditing, which are crucial for maintaining smooth supply chain operations.

Corporate Banking through EnKash’s Virtual Accounts

EnKash stands out in the fintech landscape with its virtual account solutions tailored to meet the complex demands of modern corporate banking.

Customized Financial Solutions: EnKash offers unique virtual account numbers for each customer, a feature that greatly simplifies the financial reconciliation process. This customization allows businesses to assign specific accounts to clients or projects, making it easier to track and manage multiple income streams accurately and efficiently. The ability to instantly recognize the source of funds and allocate them appropriately reduces administrative overhead and enhances financial clarity.

Facilitating Large-Scale Operations: EnKash’s virtual accounts are particularly advantageous for large enterprises that manage numerous transactions across various sectors. The platform’s robust infrastructure supports high-volume transactions without compromising speed or security, enabling businesses to scale operations smoothly as they grow.

Enhanced Financial Management: With EnKash, businesses gain access to tools that offer real-time data on financial activities. This immediate insight into cash flows and financial statuses empowers companies to make informed decisions quickly, respond to market changes more effectively, and maintain a solid financial footing.

Strengthening Financial Security with Virtual Bank Accounts

Virtual bank accounts incorporate advanced security measures to ensure the safety and integrity of business transactions.

Advanced Security Protocols: Virtual bank accounts are equipped with state-of-the-art security features, including robust encryption and multi-factor authentication. These measures protect against unauthorized access and ensure that all transaction data remains secure. By using these sophisticated technologies, virtual accounts safeguard sensitive financial information from the increasing threat of cyberattacks and fraud.

Regulatory Compliance: Besides their advanced security features, virtual bank accounts adhere to stringent regulatory standards. This compliance is crucial for maintaining the legality of financial operations and upholding trust with clients and partners. Businesses can rely on these accounts to manage their finances in a manner that meets all required legal frameworks, which is especially important in industries facing tight regulatory scrutiny.

Providing Peace of Mind: The combination of cutting-edge security technologies and strict compliance with financial regulations gives businesses peace of mind. Knowing that their transactions are secure and legally compliant allows companies to focus more on growth and operational strategies rather than on managing potential security risks.

Conclusion

Virtual bank accounts stand as a pivotal innovation in the realm of corporate banking, especially within the B2B sector. They provide businesses with the tools necessary to streamline financial operations, enhance transaction efficiency, and foster stronger relationships with both clients and suppliers through tailored financial operations and improved financial visibility. Furthermore, with advanced security protocols and compliance with regulatory standards, virtual bank accounts offer a secure and scalable solution that supports the dynamic needs of growing businesses. By integrating these digital accounts, companies can achieve a higher degree of financial agility and security, positioning themselves for success in a competitive and rapidly evolving marketplace.