Accounts receivable is a critical component of every business’s financial operations. It refers to the money owed by customers for goods or services that have been provided on credit. Managing accounts receivable effectively is essential for maintaining a healthy cash flow and ensuring the financial stability of the business. However, the accounts receivable process can be complex and challenging, with various hurdles that businesses need to overcome. In this comprehensive guide, we will explore the accounts receivable process, common challenges businesses face, and strategies to overcome them.

What is Accounts Receivable?

Accounts Receivable (AR) is a term used to describe the money owed to a business by its customers or clients for goods or services provided on credit. When a business sells products or services on credit, it creates an account receivable, which represents the amount the customer owes to the business. Accounts receivable is considered an asset on the balance sheet, as it represents the funds the business is expected to receive in the future.

Managing accounts receivable effectively is crucial for maintaining a healthy cash flow and ensuring the financial stability of the business. It includes processes like generating invoices, sending them to customers, collecting payments, and reconciling accounts. However, businesses often face challenges in each step of the accounts receivable process, which can impact their cash flow and overall financial performance.

Steps in the Accounts Receivable Process

The accounts receivable process consists of several key steps that businesses need to follow to ensure timely payment collection and efficient management of receivables.

Establish Credit Policy

The first and foremost step for a business in the Accounts Receivable (AR) process is to establish the correct credit policy. This should be based on the customer’s ability to repay, with clear credit terms outlining the credit limit, payment timelines, penalties, and early payment rebates. Having a concise credit policy allows businesses to function smoothly in case of payment delays and outstanding invoices.

The credit policy also needs to state the clear process of evaluating debtors through credit checks and credit application processes.

Invoice Generation

The next step in the accounts receivable process is the generation of invoices. When a business provides goods or services on credit, it needs to create an invoice detailing the products or services provided, the quantity or duration, the agreed-upon price, and any applicable taxes or discounts. The invoice should also include the payment terms, such as the due date and accepted payment methods.

Businesses can digitize their invoices by uploading them on EnKash and bulk dispatching them to customers. This streamlines the invoice process by providing real-time tracking and notifications. It reduces manual discrepancies and brings efficiency into the system.

Effective Monitoring of Payment

Effective monitoring of payment is very important to avoid any payment being lost. Corporations have accounting packages to watch out for any balances that are still owed. Such systems prepare aging schedules that classify pending bills into different age ranges e.g. 30, 60, or 90 days overdue. This helps the organizations know what accounts to focus on first in terms of collections.

Sending Payment Reminders

Sending payment reminders is probably one of the best techniques for encouraging the timely settlement of customer debts. Businesses automate this process by sending reminders via emails or texts, or they may use personal follow-ups for big accounts. It is also imperative to send communication after a defined period, such as a week before the due date or a week after the lapse of that date.

Payment Collection

After the invoices are sent, the next step is to collect payments from customers. Payment collection methods can vary depending on the business’s industry, customer preferences, and available payment options. Common payment methods include cash, checks, credit or debit cards, electronic fund transfers, and online payment platforms.

Efficient payment collection requires clear communication and prompt follow-up with customers. Businesses should have well-defined payment terms and policies, including due dates, late payment penalties, and accepted payment methods. Regular reminders and notifications should be sent to customers as the payment due date approaches to ensure timely payments.

Reconciliation

The next step in the accounts receivable process is the reconciliation of payments received with the corresponding invoices. Reconciliation involves matching the payments received from customers with the outstanding invoices and updating the accounts receivable records accordingly. This ensures that the business’s financial records accurately reflect the payments received and the remaining outstanding balances.

Reconciliation can be a time-consuming process, particularly for businesses with a large customer base and a high volume of transactions. It requires careful attention to detail and the ability to identify and resolve any discrepancies or errors in the payment records. Automated accounting systems or dedicated accounts receivable software can streamline the reconciliation process, reducing the risk of errors and improving efficiency.

Handling Disputes or Adjustments

Sometimes, the customers may have issues with a certain bill and refuse to pay because they claim there was a mistake. Organizations must make sure they have a well-defined way to look into these matters and deal with them. If there is a mistake, there can be changes made to help retain the customer and even grow the business.

We have now learned about what is accounts receivable process. Let us now examine traditional vs modern accounts receivable.

How Does Accounts Receivable Process Cycle Work?

Accounts receivable is one of the essential financial components of the organization which deals mainly with the proper control, tracking, and collection of all sales made on credit. This is how the accounts receivable process cycle functions:

1. Credit Sales

Firms allow individuals to buy products and services and pay for them at a later date. The later date is defined as the credit Sale period. This encourages the customer to buy the product and also helps in establishing respect and goodwill between the firm and the customer and therefore more sales in the future.

2. Recording Transactions

Every credit purchase is noted in the respective credit customer’s accounts receivable, in order to have an up-to-date record of all uncollected sales. These expected inflows of cash are normally reported as current assets at the given period balance sheet since they are expected to be realized in a short period.

3. Monitoring Outstanding Balances

Companies also keep track of accounts receivable to monitor the amounts due and those overdue regularly.

Typically, an aging report is used to classify accounts that are becoming overdue, so it aids in spotting patterns such as instances of chronic non-payment.

4. Collections

Payments received are allocated against the respective invoices thereby decreasing the outstanding receivable balance.

These sums collected assist in boosting the cash flow of the business thus facilitating its liquidity and solvency.

5. Reconciliation

Practical reconciliation means cross-checking allowance for doubtful accounts with business records of accounts receivable and financial statements. The banking records are also helpful in justifying such records. Such discrepancies are resolved at the onset hence contributing to the precision of the figures presented in the accounting records.

Other Elements of the Payment Process

To successfully manage accounts receivable, one should understand various elements in the context of how payments work, for instance:

1. Payment Terms and Conditions

Clear payment terms, such as “Net 30” (payment due in 30 days), define expectations for customers. Cash discount for early payment or interest charged on late payments is employed to encourage prompt payment.

2. Payment Methods

For enhanced customer service, a business provides several payment methods such as check, EFT, and credit card or wallets like PayPal or Stripe among others.

3. Customer Communication

Active interaction with customers makes them conscious of when they ought to pay.

Effectively managed and simple billing reduces reconciliations and fosters trust hence conducive to timely payment.

4. Dispute Resolution

Where there are disagreements concerning a bill or charges, interruptions to billing and payment are avoided through processes that facilitate resolution.

5. Reporting and Analysis

Detailed reports can be prepared to show how customers make payments and the frequency of their payments. Such data is used to straighten credit control measures to minimize credit clean up and also collection of debts.

By managing accounts receivable effectively, businesses can maintain a healthy cash flow and enhance financial performance.

Common Accounts Receivable Challenges

Managing accounts receivable effectively can be challenging for businesses, as they often face various hurdles that can impact their cash flow and overall financial performance. Let us explore some of the common challenges businesses encounter in the accounts receivable process:

Late Payments

One of the most common challenges in accounts receivable management is late payments from customers. Late payments can disrupt the business’s cash flow and create difficulties in meeting financial obligations, such as paying suppliers or employees. Late payments can be caused by various factors, including customer financial difficulties, disputes over invoice accuracy, or simply a lack of attention or prioritization by customers.

To overcome the challenge of late payments, businesses need to establish clear payment terms and policies. This includes setting realistic payment due dates, offering incentives for early payments, and enforcing late payment penalties. Regular follow-up and reminders to customers can also help encourage timely payments. Additionally, businesses can consider offering flexible payment options, such as instalment plans or automated recurring payments, to make it easier for customers to meet their payment obligations.

Disputed Invoices

Another common challenge in accounts receivable management is dealing with disputed or contested invoices. Disputes can arise due to various reasons, such as incorrect pricing, damaged or defective products, or disagreements over the quality of services provided. Resolving invoice disputes can be time-consuming and may require communication and negotiation with the customer.

To overcome the challenge of disputed invoices, businesses should have a well-defined process in place for handling customer complaints and disputes. This includes promptly addressing customer concerns, investigating the issues raised, and providing timely resolutions or compensations when necessary. Clear communication channels and documentation of all interactions with customers can help in resolving disputes more effectively.

Inaccurate or Missing Information

Inaccurate or missing information in invoices and payment records can create significant challenges in accounts receivable management. Incorrect or incomplete invoices can lead to delays in payment processing and reconciliation, as well as confusion or disputes with customers. It is crucial to ensure that all invoices are accurate, contain all necessary information, and are properly documented.

To address the challenge of inaccurate or missing information, businesses should implement robust systems and processes for generating and managing invoices. This includes using automated invoicing software or accounting systems that can automatically populate invoice templates with accurate customer and product information. Regular audits and reviews of invoice records can help identify and rectify any inaccuracies or missing information promptly.

Manual and Time-Consuming Processes

Manual and time-consuming processes can significantly impact the efficiency and effectiveness of accounts receivable management. Manual processes, such as manual data entry, paper-based invoicing, and manual reconciliation, are prone to errors, delays, and inefficiencies. They require significant time and effort from the accounts receivable team, limiting their capacity to focus on more strategic tasks.

To overcome the challenge of manual and time-consuming processes, businesses should consider automating their accounts receivable processes. This includes implementing accounting software or dedicated accounts receivable management systems that can automate invoice generation, payment collection, and reconciliation. Automation can streamline processes, reduce errors, and free up valuable time for accounts receivable teams to focus on customer relationships and strategic financial management.

Inefficient Communication

Inefficient communication with customers can create challenges in accounts receivable management. Lack of clear and timely communication can lead to misunderstandings, missed payment due dates, and delayed resolutions of invoice disputes. Poor communication can strain customer relationships and impact the overall collection process.

To address the challenge of inefficient communication, businesses should prioritize effective and proactive communication with customers throughout the accounts receivable process. This includes clear and concise invoice instructions, timely payment reminders, and regular updates on outstanding balances. Utilizing technology, such as automated email or messaging systems, can help streamline communication and ensure consistent and timely interactions with customers.

Overcoming Accounts Receivable Challenges

While accounts receivable challenges can be daunting, businesses can implement strategies and best practices to overcome them effectively. Let us explore some strategies to address common accounts receivable challenges:

Implementing Clear Payment Terms and Policies

Setting clear payment terms and policies is essential to ensure prompt and consistent payment collection. Businesses should establish realistic payment due dates, clearly communicate them to customers, and provide detailed instructions on accepted payment methods. Clear payment terms and policies help manage customer expectations, minimize disputes, and encourage timely payments.

Automating Invoicing and Payment Collection

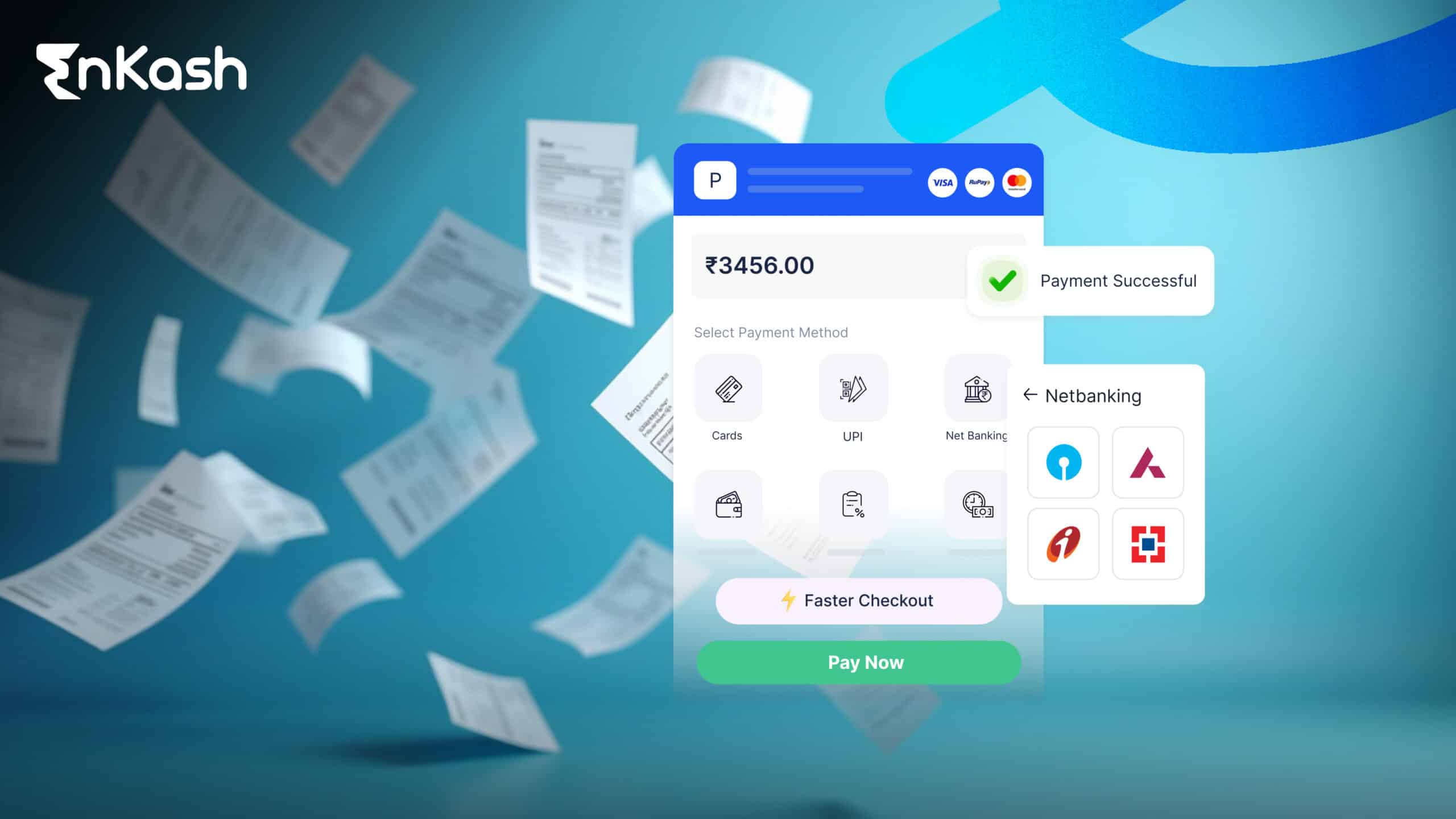

Automation can simplify and streamline the invoicing and payment collection process.

Implementing accounting software or dedicated accounts receivable systems can automate invoice generation, delivery, and payment reminders. Automated payment collection methods, such as online payment platforms or recurring payment options, can ensure faster and more efficient collection of funds.

Improving Data Accuracy and Information Management

Accurate and up-to-date data is crucial for effective accounts receivable management. Implementing systems and processes to ensure data accuracy, such as automated data entry and validation, can reduce errors and improve the efficiency of the accounts receivable process. Centralizing and organizing customer and invoice information in a structured manner can help streamline data management and facilitate timely reconciliations.

Streamlining the Reconciliation Process

Reconciliation is a critical step in accounts receivable management, but it can be time-consuming and prone to errors. Businesses should leverage technology, such as accounting software or dedicated reconciliation tools, to automate the reconciliation process. Automating the matching of payments with invoices and flagging any discrepancies can help streamline the process and ensure accurate and timely updates to accounts receivable records.

Enhancing Communication with Customers

Effective communication with customers is key to successful accounts receivable management. Regular and proactive communication, such as payment reminders, updates on outstanding balances, and prompt responses to customer inquiries, can help maintain strong relationships and improve payment collection rates. Leveraging technology, such as automated email or messaging systems, can facilitate efficient and consistent communication with customers.

The Role of Technology in Accounts Receivable Management

Technology plays a crucial role in modern accounts receivable management, enabling businesses to streamline processes, enhance efficiency, and improve overall financial performance. Let us explore some of the technologies that businesses can leverage for effective accounts receivable management:

Accounting Software

Accounting software provides businesses with the tools and functionalities to manage their accounts receivable processes effectively. It enables automated invoice generation, tracks customer payment histories, and provides real-time visibility into outstanding balances. Accounting software also integrates with other financial systems, such as inventory management or customer relationship management (CRM) systems, to ensure seamless data flow and improve overall financial management.

Customer Relationship Management (CRM) Systems

CRM systems help businesses manage customer relationships and interactions more effectively. They provide a centralized database of customer information, including contact details, purchase histories, and communication records. Integrating CRM systems with accounts receivable processes can improve communication and collaboration between sales, customer service, and accounts receivable teams, leading to better customer relationships and more efficient payment collection.

Automated Payment Solutions

Automated payment solutions simplify and accelerate the payment collection process. They enable customers to make payments quickly and securely, eliminating the need for manual processing. Businesses can integrate automated payment solutions into their invoicing systems, allowing customers to pay directly from their invoices, reducing friction, and improving payment collection rates.

Data Analytics and Reporting Tools

Data analytics and reporting tools provide businesses with valuable insights into their accounts receivable performance. These tools enable businesses to monitor key metrics, such as Days Sales Outstanding (DSO), collection rates, or ageing reports, and identify trends or patterns that may impact cash flow or customer payment behavior. By leveraging data analytics and reporting tools, businesses can make data-driven decisions, optimize collection strategies, and improve overall financial performance.

Traditional vs. Modern Accounts Receivable

Aspect |

Traditional Accounts Receivable |

Modern Accounts Receivable |

Processes |

Manually created invoices where invoices are generated using spreadsheets or written documents |

Generation, follow-up and reminder of invoices are done, largely through an accounting program. |

Payment Tracking |

Relied on paper-based systems which had an increased risk of loss or mismanagement of data. |

Real-time tracking of payment statuses using software like QuickBooks or ERP systems. |

Delivery of Invoices |

Physical delivery through postal services caused delays. |

The electronic version of an invoice – is generated, attached and sent via email, or print to the online portal. |

Customer Convenience |

Few methods of payment and delayed communication |

The diversity of payment options and quicker modes of interaction promotes ease of use. |

Efficiency and Accuracy |

Records and processes were also affected by inefficiencies and inaccuracy. |

Improvement of processes leads to an increase in the precision and productivity of operations.

Streamlined processes enhance accuracy and improve operational efficiency. |

Best Practices for Accounts Receivable Management

Adopting best practices can significantly enhance the effectiveness of accounts receivable management.

Set Clear Credit Policies

Establish clear credit policies that define the criteria for extending credit to customers. This includes conducting credit checks, setting credit limits, and defining payment terms. Clear credit policies help manage credit risk and ensure that customers are qualified and capable of meeting their payment obligations.

Perform Credit Checks

Conducting credit checks on new customers before extending credit can help assess their creditworthiness and potential risks. Credit checks provide insights into a customer’s payment history, outstanding debts, and overall financial stability. This information helps businesses make informed decisions regarding credit terms and payment conditions.

Establish Strong Customer Relationships

Building strong relationships with customers is essential for successful accounts receivable management. Regular communication, personalized interactions, and proactive customer service can foster trust and cooperation. Strong customer relationships increase the likelihood of timely payments, improve dispute resolution, and strengthen overall customer loyalty.

Monitor and Analyze Key Metrics

Regularly monitor and analyze key accounts receivable metrics to gain insights into the effectiveness of the collection process. Key metrics include DSO, collection rates, ageing reports, and customer payment trends. Monitoring these metrics helps identify areas for improvement, track progress, and make data-driven decisions to optimize the accounts receivable process.

Regularly Review and Update Processes

Review and update accounts receivable processes regularly to ensure they remain efficient and aligned with business objectives. Evaluate the effectiveness of invoicing, payment collection, and reconciliation processes. Identify bottlenecks, areas for automation, or opportunities for improvement. Regularly reviewing and updating processes helps businesses stay agile and responsive to evolving market dynamics.

Conclusion

Effectively managing accounts receivable is crucial for maintaining a healthy cash flow, optimizing financial performance, and fostering strong customer relationships. By understanding the accounts receivable process, identifying common challenges, and implementing strategies to overcome them, businesses can streamline their operations, improve payment collection rates, and ensure financial stability. Leveraging technology, adopting best practices, and prioritizing effective communication with customers leads to successful accounts receivable management. By implementing these strategies, businesses can navigate the complexities of accounts receivable and unlock their full potential for financial success.

FAQs

What is the primary purpose of accounts receivable?

To track and collect payments owed by customers, ensuring a stable cash flow for the business.

What happens if accounts receivable are not managed effectively?

Poor management can lead to cash flow issues, increased bad debts, and financial instability.

How do early payment discounts work?

Discounts (such as 2%) are given to customers who settle their dues earlier than the actual date.

How does automation benefit accounts receivable management?

Automation minimizes the risk of human error, quickens the process of invoicing and enhances the capabilities of sending reminders.

Can accounts receivable impact a company’s financial health?

Of course, the collectability of receivables is especially important as it affects liquidity management and cash flow forecasting.

Which software is best for managing accounts receivable?

Some of the most used ones include QuickBooks, Xero, and FreshBooks as well as ERP systems like SAP and Oracle.