Developer-Centric Payments Start With APIs That Scale

Building a smooth payment system is no longer just about sending money from one point to another. Today, payments are tied to real-time events, authentication steps, retries when something fails, and live status updates. For developers, every one of these steps depends on the quality of the payment API they are working with.

The payment API for developers forms the backbone of any modern payment system. If this API is heavy, poorly documented, or unreliable, the result is a payment experience full of errors, delays, and customer complaints. It also slows down how fast developers can build and improve products.

This blog highlights the best payment gateway API options for developers in 2025. It looks at how these APIs perform in real projects — from ease of payment API integration, to the quality of support, to how complete the payment API documentation is. We will also look at the ecosystems around these APIs and how fast they evolve.

For teams looking to build faster and reduce bugs, the goal is simple: pick tools that help you ship without friction. The right API should give you control, save time, and work well across different systems.

Read more: Payment gateway integration guide

Understanding the Role of a Payment API in Modern Architecture

APIs have become the core of how payments are handled in today’s digital systems. Before diving deeper, it is important to be clear on what these APIs do and why they matter.

What is an API payment?

An API payment is the process of handling online payments using an Application Programming Interface. It allows software systems to talk to each other to complete a transaction without manual steps. This means that when a customer pays, your system uses the payment API to connect with banks, wallets, or card networks in real time.

Payment API definition

A payment API is a set of tools and commands that lets developers build payment functions into websites, apps, or systems. These tools help send payment requests, check statuses, process refunds, and more, all through code.

What is a payment gateway API?

A payment gateway API connects your site or app directly to a payment gateway. It handles customer details, passes the payment to the provider, and returns the result — success or failure. It also supports actions like refunds, cancellations, and recurring billing.

Examples of API interactions:

- A customer inputs their payment card information on your website.

- Your system utilizes the API to transfer information to the payment provider.

- Through the API, the provider delivers a success or failure message.

- The API performs refund processing or receipt delivery when necessary.

Payment API for developers aims to create a payment flow that remains straightforward while ensuring security and reliability. When the API quality increases, payment processing becomes more seamless.

Read more: How to choose the right payment gateway for your business

Core Evaluation Criteria for a Developer-Ready Payment API

Not all payment APIs are built the same. Some are easy to use and save developers hours. Others are hard to work with, slow, or confusing. Before picking an API, developers and businesses need to look at what matters. Here are the key points that help you decide if a payment gateway API integration will work for you.

1. REST-first Design

A strong API should follow REST principles. The API maintains predictable endpoints which developers can easily understand. Stable URLs and responses lessen errors throughout payment API integration processes.

2. Versioning and Changelog Access

APIs change over time. Stable maintenance of older API versions and comprehensive changelogs are vital features of a good API. Developers can plan their updates effectively because the API preserves older versions and maintains detailed changelogs.

3. Detailed Payment API Documentation

Clear, step-by-step payment API documentation is essential. The payment API documentation must contain request/response examples alongside error codes and test case guidance. Developers spend unnecessary time trying to understand the system without proper documentation.

4. Authentication Options

APIs must be secure. Choose systems that use API keys and OAuth2 security methods or other comparable authentication strategies. Your app’s access control level should determine which method you choose.

5. Webhook Availability

Through webhooks, systems receive notifications about events such as successful payments or payment failures. Through webhooks, real-time updates help keep systems in sync by using reliable APIs.

6. Error Handling

Good APIs provide clear error messages. These systems need to propose the next steps for users. When problems occur without clear error messages, developers encounter delays in finding solutions.

7. Sandbox Environments

Before going live, developers need to test. A robust online payment processing API needs to include a sandbox environment that emulates the production system so that developers can experience real-world testing conditions.

8. Modular API Sets

Developers may require separate components, including payment link API, together with subscription management and payout processing. Flexible APIs enable developers to access essential functionalities without unnecessary complexity.

9. Native SDKs

Teams can launch projects faster using SDKs available in Java, Python, and PHP. These tools enable quicker development because they provide ready-made solutions.

10. Metadata and Idempotency Support

APIs of superior quality permit customization through metadata and protect against transaction duplication by utilizing idempotency keys. This adds control and safety to payments.

Read more: Common mistakes to avoid while integrating payment gateways

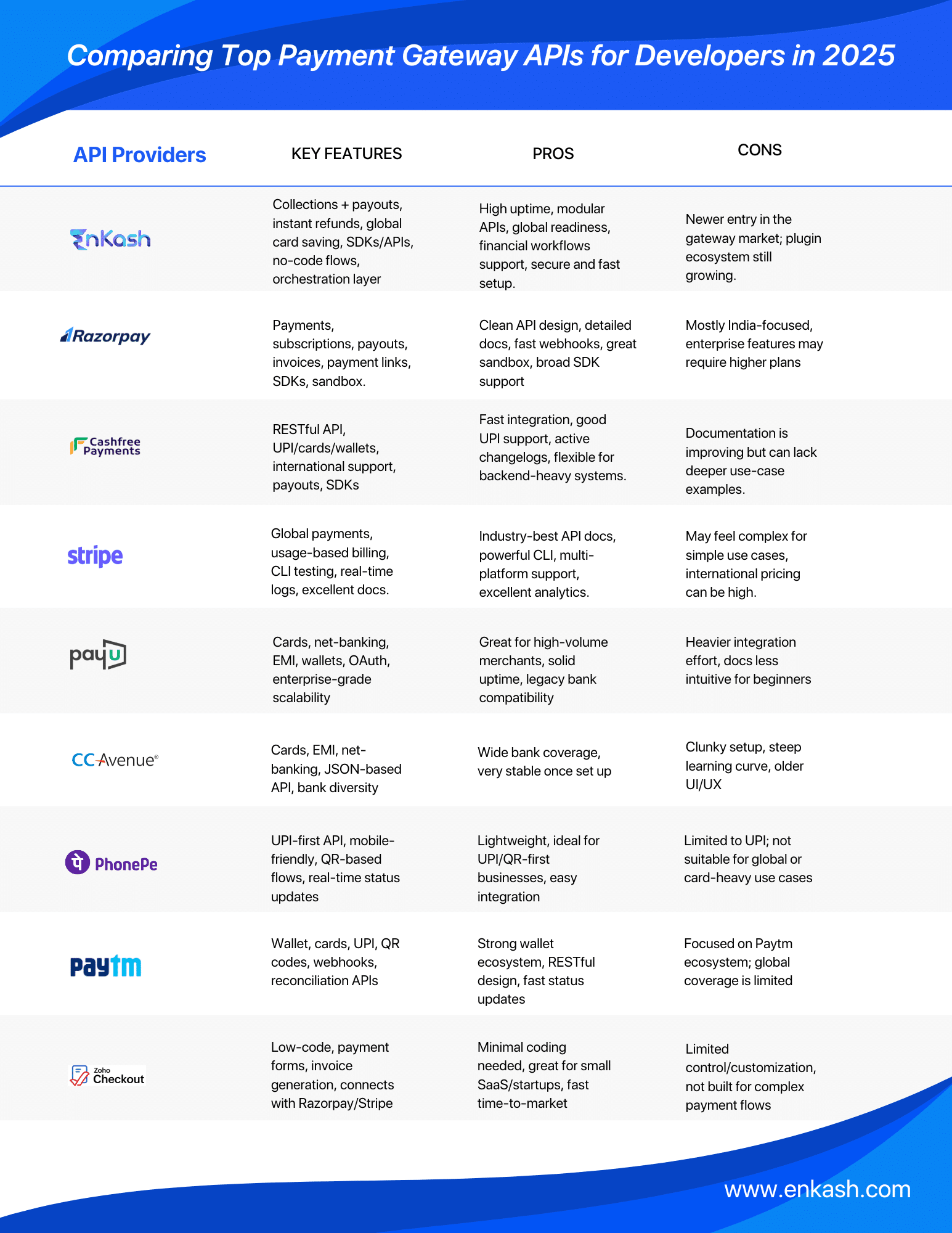

Top Payment APIs for Developers in 2025

When it comes to choosing the best payment gateway API, developers have a lot to think about. It’s not just about moving money from one place to another. It’s about how easy the integration is, how well it performs under load, how quickly support responds when something breaks, and how smooth the experience is for the end-user. Below is a closer look at the payment API for developers in 2025 that stand out for their features, reliability, and developer-friendly tools.

Razorpay API

Razorpay is widely used by startups and growing businesses in India. Its payment gateway API integration is known for being clean and straightforward. Razorpay offers more than just payments. It provides tools for subscriptions, payouts, and invoices.

- The API structure is easy to follow, with clear endpoints.

- Webhooks work fast and help keep systems updated on payment events.

- The sandbox works almost like the live environment, which makes testing easier.

- Their payment API documentation is detailed, with examples that save developers time.

- The SDKs for Node.js, Python, and Java are well-maintained and simple to use.

- Razorpay allows payment link API creation, so payments can be collected through simple links.

Cashfree Payments API

Cashfree focuses on speed and flexibility. It supports a wide range of payment methods, with strong UPI support. Their API is RESTful, which means it is built in a way most developers are already familiar with.

- Integration is quick, with support for payments, payouts, and refunds.

- The API supports UPI, cards, wallets, and even international payments.

- Developers can trigger webhooks for success, failure, and other key events.

- Cashfree provides SDKs for backend setups that are heavy on server-side logic.

- Their team updates the API regularly and shares clear changelogs.

Stripe API (India Compliant)

Stripe has long been known for having one of the cleanest APIs in the world. It now works well for India-based businesses too. Stripe is ideal for global SaaS companies or apps with usage-based billing.

- The API offers a high level of control, yet keeps things simple.

- Stripe CLI allows developers to test live flows without waiting for the production cycle.

- Their payment API integration works well across web, mobile, and backend systems.

- Detailed reporting and real-time logs help developers track every transaction.

- Stripe’s payment API documentation is one of the most complete in the industry.

PayU API

PayU is a strong choice for enterprise-level businesses. It handles large volumes and supports a variety of payment types.

- The API supports EMI, wallets, cards, and net banking.

- OAuth-based authentication allows more control for app-level access.

- The integration guides are detailed, with special focus on high-volume needs.

- PayU works well for companies that need a scalable payment gateway API integration.

- It is trusted by many large businesses in India.

CCAvenue API

CCAvenue is a trusted name, especially among traditional businesses. It has been in the market for a long time and supports a wide range of banks and payment methods.

- The API is JSON-based and supports different styles of integration.

- CCAvenue is strong in card payments and EMI processing.

- It comes with extensive documentation, though it may take more time to understand.

- Once set up, it is very stable and does not require frequent changes.

- Best suited for businesses with specific banking needs.

PhonePe for Business API

PhonePe is known for UPI payments and is popular across India, including smaller towns.

- The API is lightweight and focuses on UPI and QR-based flows.

- Sandbox testing is smooth and helps developers test without delays.

- The endpoints are clean, with easy payment API integration into mobile-first apps.

- Ideal for businesses serving Tier 2 and Tier 3 markets.

- Real-time payment status updates make it easier to track transactions.

Paytm for Business API

Paytm is strong in wallet payments but also supports cards and UPI. It works well for apps that want to offer many ways for customers to pay.

- The API is RESTful and well-structured.

- It supports quick status checks for reconciliation.

- Webhooks are reliable and help keep the backend in sync.

- Good for apps where Paytm wallet usage is high.

- Developers can use the API for payment link API and QR code payments.

Zoho Checkout API

Zoho Checkout is different. It is a low-code tool built for startups that need to accept payments but don’t want to write full billing systems.

- It connects to Razorpay or Stripe in the background.

- The API helps create payment forms and send invoices with little coding.

- Great for small SaaS apps or services that need fast deployment.

- Supports simple payment API integration for links and one-time payments.

- Saves time for small teams that want a working solution without heavy development.

These are some of the best payment gateway API options available to developers in 2025. Each one has its strengths. Some focus on speed, others on control or flexibility. What matters most is choosing the API that fits your project and helps your team work better, not harder.

Challenges Developers Face During API Payment Integration

Integrating a payment API can look easy at first, but many developers face real struggles once they begin. From unclear errors to slow responses, these problems can slow down the entire project. Knowing what issues to expect helps teams prepare and choose better tools. Below are some common challenges developers deal with during payment gateway API integration.

- Error messages are not always clear. When something fails, it’s hard to know why, and this makes fixing the issue take longer.

- Some APIs don’t have enough test cards. Developers can’t fully check how payments will behave when things go wrong.

- Webhook updates are slow at times. This leads to delays in showing the correct payment status to the customer.

- Guides are either missing or too hard to follow. Without examples, integration takes more time and comes with more mistakes.

- Rate limits show up without warning. This blocks important transactions, especially when traffic suddenly increases.

- Some APIs change without notice. Version updates break working code, and there’s no time to adjust before things stop working.

- No live status page means developers don’t know if an issue is on their end or with the provider.

Read more: How to Make UPI Payment: Key FAQs Answered

Future of Payment APIs in Developer-First Ecosystems

The way developers use payment APIs is changing. New systems are making it easier to control payments and build better apps. GraphQL is starting to replace older REST methods, giving more flexibility in how data is handled. APIs are now linking collections and payouts in one place. Developers also get better tools to track each payment in real time. Some platforms use AI to choose the best route for every transaction. Soon, many teams will rely on API-first tools that replace full billing systems, saving time and giving more control over how payments are managed.

Conclusion – The Best Payment API Is the One You Don’t Fight With

For developers, the best payment gateway API is the one that works without getting in the way. It should be easy to set up, simple to test, and reliable in live use. A good payment API for developers saves time and reduces errors. It offers clear support, strong documentation, and updates that don’t break things. When an API just works, teams can focus on building great products instead of fixing payments. Choosing the right one means fewer problems, better customer experiences, and more time spent on what matters most — growing the business. A smooth API makes all the difference.