In this Article

ToggleIntroduction

In the present digital world, businesses heavily depend on smooth and secure transactions. Choosing the best payment gateway is important in carrying out payments smoothly, providing security, and offering various options to the customers. An efficient online payment gateway simplifies transactions and builds user trust. There exists myriad of payment gateway providers in India for businesses to choose from, which have easy integration and fraud protection with minimal settlements. Thus, whether for an eCommerce platform, subscription management, or service offerings, the right payment method in a website will enable easy management. Here is some information about a few of the top payment gateways that will help businesses make their choice.

Key Features to Consider When Choosing the Best Payment Gateway

Selecting the right payment gateway is a critical decision that impacts transaction success rates, customer experience, and business growth. Beyond just processing payments, a payment gateway should offer seamless integration, robust security, competitive pricing, and responsive support. Below are the essential factors to evaluate before integrating a payment solution into your business:

1. Seamless Integration & Developer-Friendliness

A payment gateway should integrate effortlessly with your website, mobile app, or e-commerce platform without requiring extensive development efforts. Look for:

- Developer-Friendly APIs & SDKs – Ensure the gateway supports multiple programming languages such as Java, PHP, Python, and Node.js.

- Plug-and-Play Integrations – Ready-to-use extensions for platforms like Shopify, WooCommerce, Magento, and OpenCart streamline the setup.

- Comprehensive Documentation & Support – A well-documented API, sandbox environment, and 24/7 developer support can reduce downtime and ensure a smooth integration process.

Also read: How to integrate payment gateway to your mobile app

2. Advanced Security & Compliance

Security is non-negotiable in digital transactions. A payment gateway must provide industry-standard security features to protect customer data and prevent fraud:

- PCI DSS Compliance – Ensures cardholder data is securely stored, processed, and transmitted.

- End-to-End Encryption – Protects payment information from unauthorized access.

- Fraud Detection & Risk Management – AI-powered fraud-prevention mechanisms monitor transactions and detect suspicious activities in real time.

- Tokenization & Data Masking – Sensitive payment data is replaced with unique tokens to minimize security risks.

Transparent Fees and Pricing

Understanding the fee and pricing structure of the payment gateway is crucial to avoiding hidden costs and optimizing profitability. Look for:

- Zero or Low Setup Fees – Some gateways waive initial costs, especially for startups.

- Transaction Fees Based on Payment Mode – Charges vary for credit cards, UPI, net banking, and international transactions.

Flexible Pricing Models:

- Flat-Rate Pricing: A fixed charge per transaction, ideal for businesses with predictable volumes.

- Tiered Pricing: Rates vary based on transaction volume, which is beneficial for scaling businesses.

Subscription-Based Pricing: A fixed monthly/annual fee covering a set number of transactions.

4. Payment Options Available

A good payment gateway should accommodate many methods of payment to present flexibility to customers.

- UPI — for making transactions fast and secure

- Credit/Debit cards such as Visa, Mastercard, RuPay, and American Express

- Net banking through major banks

- Digital wallets such as Paytm, PhonePe, Google Pay, and Amazon Pay

- EMI and buy now pay later (BNPL) to improve affordability

- International payments for businesses focusing on global customers

5. Settlement Time and Fund Transfers

Efficient settlement cycles are crucial for cash flow management. Consider:

- Standard Settlements: T+1 to T+3 days (typical industry standard).

- Instant Settlement Options: Some gateways offer real-time settlements for an additional fee, ensuring quicker access to funds.

- Automated Settlements: Daily or weekly auto-transfer options reduce manual intervention.

- Bank Partnerships: Direct banking relationships can optimize transaction success rates and reduce settlement delays.

6. Reliable Customer Support & Dispute Resolution

A responsive and proactive support system can make a significant difference in handling payment-related issues. Look for:

- 24/7 Multichannel Support: Assistance via live chat, phone, and email for real-time problem resolution.

- Dedicated Account Managers: Ideal for enterprise clients needing personalized support.

- Chargeback & Refund Management: Efficient handling of disputes to minimize revenue losses and customer dissatisfaction.

A well-chosen payment gateway goes beyond just processing transactions—it enhances customer experience, improves cash flow, and ensures security. Businesses should prioritize integration ease, security standards, payment flexibility, settlement speed, and customer support when selecting a provider. The right payment solution can be a game-changer, helping businesses scale seamlessly in today’s digital economy.

Learn more about: Types of Payment Gateways

Top 10 Payment Gateways in India

With the rapid expansion of digital transactions in India, businesses today require payment gateways that offer not just seamless processing but also high security, multiple payment options, and quick settlements. Whether you’re an e-commerce startup, a SaaS provider, or a global enterprise, the right payment gateway can significantly enhance customer experience and optimize financial operations.

Now that we’ve explored the key factors to consider when selecting a payment gateway, let’s take a closer look at some of the top payment gateways in India. Each of these solutions offers distinct features tailored to different business needs, from high transaction success rates to robust security, automation, and international payment capabilities.

Below is a breakdown of the leading payment gateways in India and what makes them stand out.

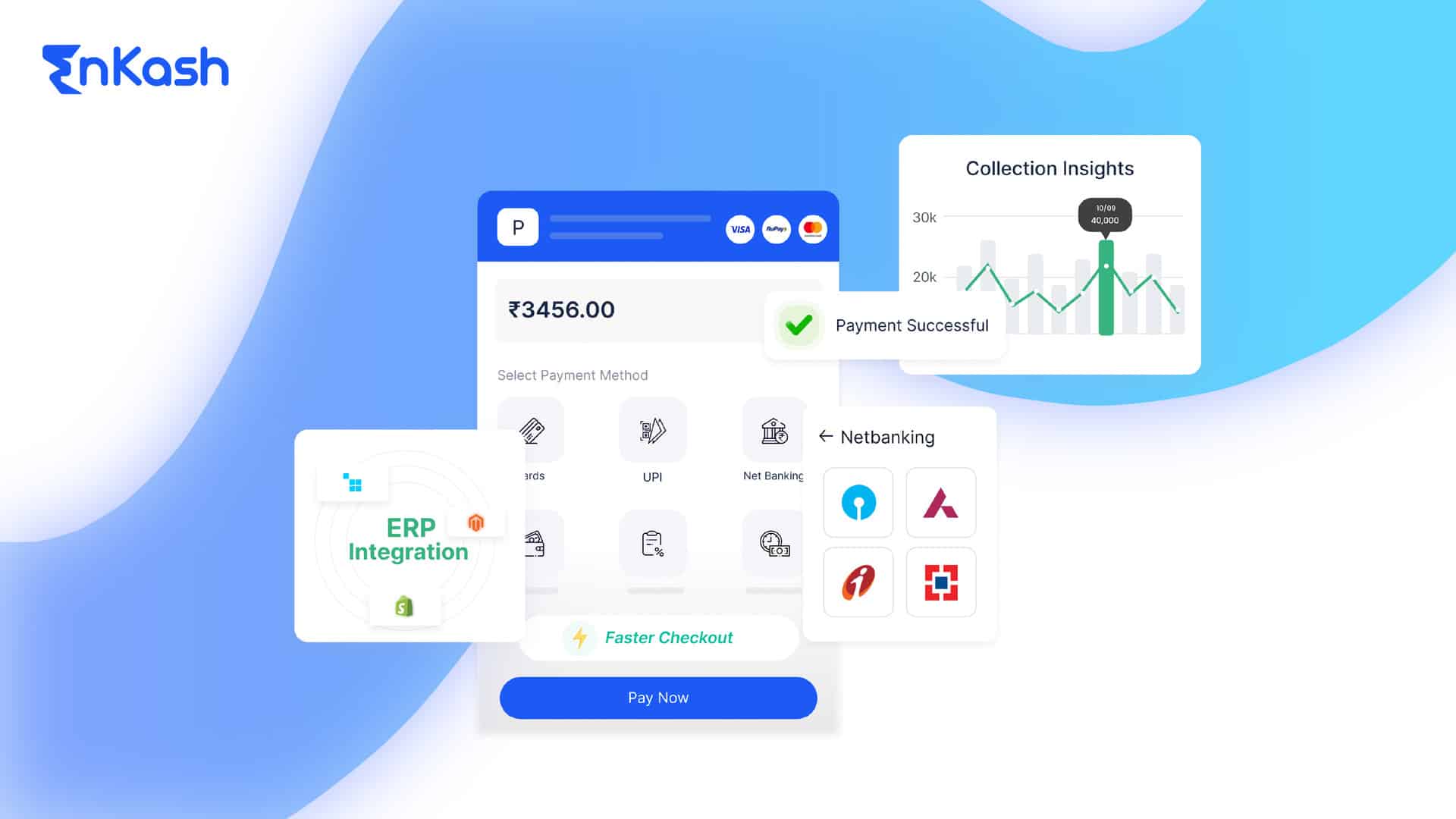

#1 EnKash Payment Gateway

EnKash Payment Gateway is built to streamline, secure, and accelerate business transactions with a seamless payment experience. Designed for modern enterprises, it enables businesses to accept and process payments effortlessly while ensuring high security, compliance, and scalability.

With 100+ payment options, developer-friendly integrations, and an enhanced checkout experience, EnKash empowers businesses to optimize collections, automate vendor payments, and improve cash flow management. As an RBI-licensed payment aggregator, it guarantees secure and compliant transactions, making it the ideal choice for businesses looking for a powerful and reliable payment gateway solution.

Key Features

- RBI licensed payment aggregator: Among the first five entities to receive the PA license

- Compliance and Security: Awarded SOC2 Type 2 Safety Badge

- 100+ Payment Options: From net banking to UPI, digital wallets, credit and debit cards and more, the customers have the option to pay using the platform of their choice

- Developer-first integrations: Offers robust SDKs, APIs, and plugins for seamless setup, detailed documentation, and a secure sandbox environment.

- Enhanced checkout Experience: With frictionless payments, secure global card saving, and personalized payment options for a seamless experience.

- Powerful Dashboards: Gain deep financial insights with powerful dashboards, real-time transaction tracking, seamless reconciliation, and an intuitive user interface.

Get Started with EnKash Payment Gateway Today!

#2. Razorpay Payment Gateway

Razorpay is one of the most widely used payment gateways in India, trusted by startups, small businesses, and e-commerce companies. It provides payment solutions covering UPI, net banking, digital wallets, credit/debit cards, and even international payments.

Key Features:

- Multiple Payment Modes Supported – Accepts UPI, net banking, digital wallets, and major debit and credit cards.

- Subscriptions and Recurring Payments – Best suited for SaaS businesses, providing automated billing solutions.

- Instant Payment Settlements – Good for cash flow, this feature gives businesses fast access to their funds.

- Strong Security Background – PCI DSS compliant and AI risk detection mechanisms enabling fraud prevention.

- Developer-friendly API & SDK- Allows integration in no time on website, mobile applications, and e-commerce platforms such as Shopify and WooCommerce.

- Smart Invoice- Generates invoices while keeping customers automatically up to date with tracking and reminders.

Razorpay is the right choice for those million-dollar businesses looking for a highly secure and flexible app integration direction.

#3. PayU Payment Gateway

PayU is a strong payment gateway in India for e-commerce businesses, online service providers, and digital marketplaces. It guarantees high transaction success rates to ensure smooth payment processing.

Key Features:

- Support for numerous payments, such as credit/debit cards, UPI, digital wallets, and net banking.

- Super-fast payment processing with minimized downtimes.

- Integrates with e-commerce platforms such as Shopify, WooCommerce, Magento, and BigCommerce.

- Available in international payments and multiple currencies, thereby being excellent for businesses with global customers.

- PayU Express Checkout – A feature that allows quick payments, preventing cart abandonment.

If your business needs high transaction success rates and seamless integration with e-commerce platforms, PayU would be the right solution.

#4. PhonePe Payment Gateway

PhonePe is a popular digital payment platforms in India, providing powerful payment gateway solutions. With its vast UPI infrastructure, transactions are extremely fast and safe.

Salient Features Offered:

- Multiple Payment Acceptance – UPI, debit/credit cards, net banking, PhonePe wallet can be accepted.

- No Set-Up Fees – No upfront cost involved, making it suitable for start-ups and small businesses.

- Real-Time Analytics – Analytics are helpful for any business to track transactions, customer likings, and payment trends.

- Seamless Checkout – User experience is enhanced by one-click payments.

- Sturdy Security Systems – End-to-end encryption avoids fraud.

This makes PhonePe Payment Gateway an excellent choice for companies looking for an interface that is UPI-powered and fast and secure for receipt of payments.

#5. Stripe Payment Gateway

Stripe is an internationally accepted payment gateway popular for hassle-free cross-border payment processing, which looks after the needs of Indian businesses aspiring to go global.

Core Features:

- Multi-Currency Transactions Supported – Great for businesses serving customers around the globe.

- Advanced Fraud Detection – Prevents disabling fraudulent transactions using AI-based risk analysis.

- Customizable Checkout Solutions – Businesses can build their own unique payment experiences.

- Subscription Billing & Recurring Payments – Perfect for SaaS companies and digital content providers.

- Developer-Friendly API – Ease of integration and customization into mobile and web applications.

It is for businesses dealing with international customers that need a solid payment gateway with advanced security.

#6. Cashfree Payment Gateway

Cashfree is fast in transaction processing and instant settlements, making it great for those businesses that need urgent access to funds.

Key Features:

- No Maintenance Costs – A viable alternative for small-scale and medium-sized businesses.

- Over 100 Payment Modes – UPI, wallets, Net banking, and international cards are supported.

- Refund & Payouts – Makes refunds easier to manage by businesses.

- Auto-Collect – Tracking and payment management are made easy for businesses.

- Subscription & Recurring Payments – Relevant for businesses that provide subscription services.

Cashfree is great for businesses that need instant settlements and smooth payment tracking.

#7. CCAvenue Payment Gateway

CCAvenue is among India’s foremost and most trusted payment gateways, extensively used by e-commerce giants and retail businesses.

Key Features:

- International Transaction Acceptance – Multi-currency payment support for businesses catering to global customers.

- Customizable Checkout Page – Add to user experience with a brandable payment page.

- Enhanced Security – Strong encryption to fend off fraud and data theft.

- Multi-Payment Modes Supported – Accepting debit/credit cards, UPI, wallets, and net banking.

- Merchant Support – Suited for large enterprises and high-volume businesses.

When looking at the international transaction options, CCAvenue fits best for a business looking for a trusted and secure payment gateway.

#8. PayPal Payment Gateway

A payment gateway recognized and accepted globally, PayPal is known for its buyer and seller protection features it is an ideal payment solution for businesses targeting international clients.

Key Features:

- Accepts Payment Worldwide – Supports more than 25 currencies; ideal for any cross-border transaction.

- One-Tap Checkout – This saves transaction time, greatly improving user experience.

- Easy Integration – It works seamlessly with Shopify, WooCommerce, and Magento.

- Fraud Protection – Latest fraud detection and dispute resolution services.

- Secure Payment – PCI-DSS Compliant, giving a guarantee for safe transactions.

PayPal is great for businesses with a focus on global customers and secure payments for international transactions.

#9. Instamojo Payment Gateway

Instamojo is a simple payment gateway for small businesses, freelancers, and individual sellers.

Key Features:

- Easy Link-Based Payments – No website is required; just share links via e-mail, WhatsApp, or social media.

- No Annual Maintenance Fee – This is very affordable for startups.

- Very Simple User Interface – Easy to set up and quick onboarding.

- Digital Store Integration – Allows businesses to put their products/services online with ease.

Instamojo is the perfect option for freelancers, entrepreneurs, and small business owners looking for an easy-to-use payment solution.

#10. Juspay Payment Gateway

Juspay is a payment gateway focused on providing an optimized mobile transaction experience with one-click checkout.

Key Features:

- One-Click Checkout – This convenience improves user experience and reduces cart abandonment.

- AI-Driven Fraud Detection – Identifies and prevents fraudulent transactions.

- Works with Major Banks & Payment Networks – Ensure success rates for transactions.

- Tokenization Services – Provides security for customer payment data.

Juspay is best suited for businesses that put mobile payment and fast, seamless checkout at the top.

Conclusion

Selecting the best payment gateway India depends on factors like security, payment options, and settlement speed. The best online payment gateways in India are meant for different kinds of businesses, from small start-ups to large enterprises. It may be required for an e-commerce project or SaaS, retail, or international transaction environments; the right gateway would be chosen on such considerations as payment methods, transaction fees, security, and settlement speed. These considerations would ensure smooth, secure, and efficient payment processing for a business. Choosing the right payment gateway enhances customer experience, reduces cart abandonment, and streamlines internal processes. Therefore, investing in a sound and feature-rich payment solution will enable an organization to grow, scale, and compete in the growing digital economy.