An effective management of accounts receivable is crucial for maintaining healthy cash flow and financial stability in a business. One powerful tool that significantly enhances the efficiency of collection processes is collection analytics. By utilizing advanced data analysis techniques, businesses can gain valuable insights into customer payment behavior, optimize debt recovery strategies, and ultimately improve their overall financial management.

What is Collection Analytics?

Collection analytics is a tool to assess and predict payment behavior, allocate resources efficiently, and reduce potential risks allowing businesses to manage their cash inflow processes and enhance overall financial management. With collection analytics, businesses can analyze historical data and gain insights into patterns, trends, and potential risks related to accounts receivable. It can benefit your business by efficient debt recovery, reducing bad debt, and enhancing overall cash flow management.

Benefits of Collection Analytics for Businesses

By using a collection analytics tool, businesses can improve their processes and establish long-term efficiency.

Improved Efficiency in Debt Recovery

By leveraging collection analytics, businesses can create targeted and personalized collection strategies for different customer segments. Historical data and customer payment patterns are analyzed to create models that predict future payment behavior. These predictive models consider factors such as payment history and average Days Sales Outstanding (DSO) to assess the likelihood of timely payments. This proactive approach allows businesses to manage collections more effectively, prioritize high-risk accounts, and optimize resource allocation for better results.

Reduced Bad Debt

One of the major challenges businesses face is dealing with bad debt, which can significantly impact cash flow and profitability. Collection analytics helps identify potential risks associated with accounts receivable, enabling businesses to take proactive measures to mitigate the chances of bad debt. By analyzing payment trends, customer behavior, and other relevant metrics, businesses can make informed decisions and implement strategies to minimize bad debt and improve overall financial stability.

Enhanced Cash Flow Management

Collection analytics provides valuable insights into the average time it takes to collect payments from customers, known as the Days Sales Outstanding (DSO). By measuring and managing DSO, businesses can optimize their cash flow by identifying trends, assessing the effectiveness of credit and collection policies, and making informed decisions to improve their cash conversion cycle. Improved cash flow management allows businesses to allocate resources effectively and ensure financial stability.

Streamlined Collection Processes

Traditionally, collection processes involved manual data entry, which often led to discrepancies. This method heavily relied on spreadsheets and disconnected systems, leading to inefficiencies in data management. Collection analytics automates the data collection process by pulling real-time data directly from the dashboard, reducing manual errors, and accumulating the data in a centralized system. This simplifies analysis and reporting, streamlining the entire collection process and improving operational efficiency.

Improved Customer Relationships

Businesses can decipher their customer needs and challenges with the help of collection analytics and adopt a customer-centric approach for better collections. The communication for collection purposes can be personalized enhancing customer relationships and retention for the long-term.

How Collection Analytics Works

Collection analytics employs advanced data and modeling techniques to provide insights into payment patterns, helping businesses proactively manage collections, prioritize accounts, and optimize resource allocation for effective debt recovery. Let’s delve into the key components and functionalities of collection analytics:

Data Collection and Accessibility

Collection analytics tools streamline the data collection process by automating the retrieval of real-time data from various sources. This eliminates the need for manual data entry and ensures the accuracy and timeliness of the collected data. By centralizing all the data in a unified system, businesses can easily access and analyze the information, gaining valuable insights into the payment pattern.

Customizable Dashboards

Collection analytics platforms offer customizable dashboards that allow businesses to tailor reports according to their specific needs. Reports can be generated based on different time frames, such as weekly, monthly, or custom date ranges, ensuring relevance and clarity. These dashboards provide a comprehensive view of key metrics and indicators, enabling businesses to monitor collection performance effectively.

Visibility and Monitoring

Effortlessly tracking the collection process is crucial for prompt follow-ups and effective debt recovery. Collection analytics tools provide complete visibility by monitoring invoice status, outstanding amounts, total collections, and overdue payments. With real-time insights, businesses can identify bottlenecks in the collection process and take proactive measures to address them, resulting in improved cash flow.

Automated Reporting

Collection analytics tools eliminate the need for manual compilation of reports by automatically generating comprehensive downloadable reports. This not only saves time and effort but also reduces the risk of errors associated with manual data entry. By having access to accurate and up-to-date reports, businesses can make informed decisions and take necessary actions to optimize their collection processes.

Implementing Collection Analytics for Business Success

To implement collection analytics effectively, businesses should consider the following steps:

Identify Key Metrics and Indicators

Start by identifying the key metrics and indicators that are critical for evaluating the efficiency of your collection processes. These may include DSO, customer behavior, payment trends, and other relevant factors. By understanding these metrics, businesses can evaluate their current performance, identify areas for improvement, and set benchmarks for success.

Choose the Right Collection Analytics Tool

Select a collection analytics tool that aligns with your business requirements and objectives. Look for features such as data collection automation, customizable dashboards, and robust reporting capabilities. Consider factors such as ease of use, integration with existing systems, and scalability to support your business’s growth.

Integrate Data Sources

Ensure that the collection analytics tool integrates with your existing data sources, such as accounting software, CRM systems, and payment gateways. This integration enables seamless data flow and provides a comprehensive view of your collection performance. By consolidating data from multiple sources, businesses can gain a holistic understanding of their accounts receivable and make data-driven decisions.

Analyze and Interpret Data

Once the data is collected and consolidated, it’s time to analyze and interpret the insights provided by the collection analytics tool. Look for payment patterns, trends, and potential risks. Identify high-risk accounts, prioritize collection efforts, and develop targeted strategies to optimize debt recovery.

Implement Actionable Strategies

Based on the insights gained from collection analytics, implement actionable strategies to improve your collection processes. This may involve refining your credit and collection policies, implementing automated reminder systems, offering incentives for prompt payments, or adopting alternative payment methods. Continuously monitor the impact of these strategies and make adjustments as needed to achieve optimal results.

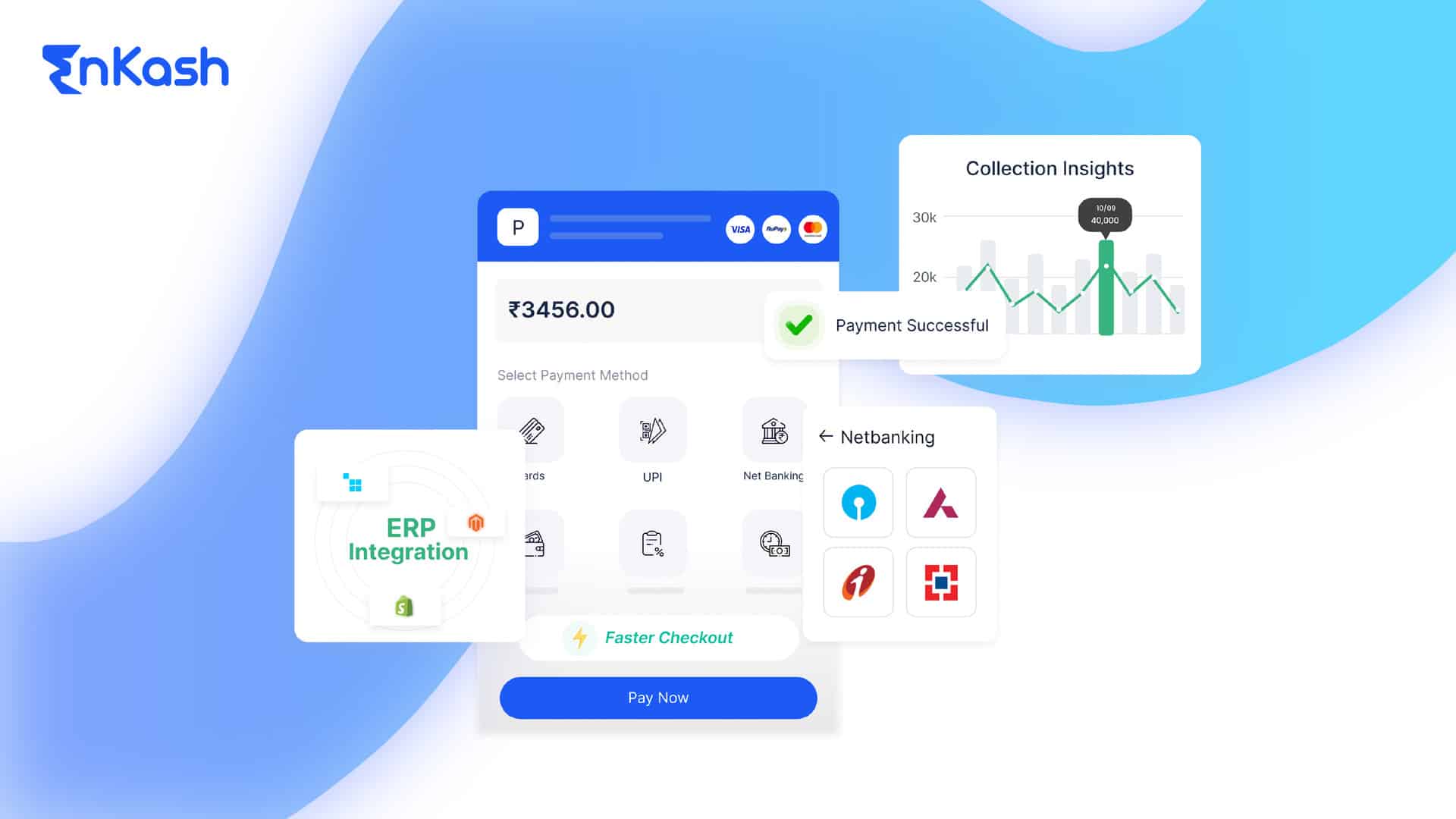

EnKash Collection Analytics: The Better Way

EnKash’s Collection Analytics tool offers a comprehensive solution for businesses seeking to optimize their accounts receivable. With advanced data analysis capabilities and user-friendly features, EnKash empowers businesses to predict and manage collections effectively, leading to reduced bad debt, improved cash flow, and overall financial stability.

How EnKash’s Collection Analytics Tool is Better and Why it is Needed?

EnKash’s Collection Analytics tool stands out from the competition due to its superior features and benefits. Here are some reasons why businesses should consider implementing EnKash:

Comprehensive Data Analysis: EnKash’s Collection Analytics tool utilizes advanced data analysis techniques to provide deep insights into payment patterns and customer behavior. This enables businesses to make informed decisions and take proactive measures to optimize debt recovery.

Personalized Strategies: With EnKash, businesses can create targeted and personalized collection strategies for different customer segments. By leveraging historical data and predictive models, businesses can prioritize high-risk accounts and allocate resources effectively for better results.

Streamlined Processes: EnKash automates the data collection process, eliminating manual errors and delays. By centralizing all data in a unified system, businesses can streamline their collection processes, improve operational efficiency, and reduce the risk of errors associated with manual compilation.

Customizable Dashboards: EnKash’s Collection Analytics tool offers customizable dashboards that allow businesses to generate reports based on their specific needs. This ensures relevance and clarity, enabling businesses to monitor collection performance effectively.

Enhanced Visibility and Monitoring: With EnKash, businesses can effortlessly track the collection process with complete visibility. Real-time insights into invoice status, outstanding amounts, and overdue payments enable prompt follow-ups and proactive debt recovery.

Automated Reporting: EnKash’s Collection Analytics tool automatically generates comprehensive downloadable reports, saving time and effort associated with manual compilation. Accurate and up-to-date reports enable businesses to make informed decisions and optimize their collection processes.

Conclusion

Collection analytics plays a vital role in improving a business’s accounts receivables management. By leveraging advanced data analysis techniques, businesses can gain valuable insights into their customer’s payment patterns, optimize debt recovery strategies, and enhance overall financial management. Implementing the right collection analytics tool, such as EnKash’s Collection Analytics tool, can significantly contribute to reducing bad debt, improving cash flow, and ensuring financial stability. Make the switch to EnKash today and unlock the power of collection analytics for your business’s success.