Whether you are a startup or a established business, optimizing revenue streams and ensuring a steady cash flow are crucial for sustainable growth. One effective way to achieve this is through the implementation of the invoicing process for recurring transactions. By automating the billing and payment collection for services or products provided on an ongoing basis, businesses can save time, improve cash flow, and enhance customer satisfaction.

This comprehensive guide will delve into the intricacies of recurring invoices, exploring their definition, types, benefits, and suitability for different business models. We will also provide practical tips for setting up and effectively using recurring invoices, as well as discuss challenges and compliance considerations. Furthermore, we will explore the integration of recurring invoicing with accounting systems and highlight key factors to consider when choosing the right invoicing solution. Finally, we will examine real-life case studies that demonstrate successful implementation of recurring invoicing.

Understanding Recurring Invoices

What are Recurring Invoices?

Recurring invoices are a specific type of invoicing where customers are billed at regular intervals, such as weekly, monthly, quarterly, or annually. Unlike one-time invoices, recurring invoices automate the billing process, ensuring that customers are charged consistently and on time.

Types of Recurring Invoices

There are two main types of recurring invoices: fixed invoices and dynamic invoices. Fixed invoices are used when the billing amount remains consistent over each billing cycle, such as monthly subscription fees. On the other hand, dynamic invoices are utilized when the billing amount fluctuates based on usage or consumption, such as utility bills or usage-based mobile plans.

Benefits of Recurring Invoices

Recurring invoices offer several benefits for businesses that rely on recurring revenue models.

Improved Cash Flow

Recurring invoices provide predictability and stability in cash flow, allowing businesses to accurately forecast their revenue. By ensuring regular invoicing and automated payments, businesses can effectively allocate resources, plan for growth, and meet financial obligations with confidence.

Enhanced Payment Convenience

Recurring invoices streamline the payment process for customers by providing timely notifications and allowing for automatic payments. This convenience not only improves customer satisfaction but also reduces the risk of late or missed payments, ensuring a steady cash flow for the business.

Time and Resource Savings

By automating the invoice generation and delivery process, recurring invoices save significant time and resources for businesses. Manual invoicing tasks can be redirected towards core business activities, such as product development or customer service, leading to increased productivity and efficiency.

Strengthened Customer Relationships

Recurring invoices demonstrate professionalism and reliability, enhancing customer relationships. By providing clear and consistent billing information, businesses can build trust and loyalty with their customers, leading to long-term partnerships and repeat business.

Is Recurring Invoicing Suitable for Your Business?

While recurring invoicing offers numerous benefits, it may not be suitable for every business model. Let’s explore some scenarios where recurring invoicing is particularly effective:

Subscription-based Businesses

Businesses that offer products or services through subscription models, such as software-as-a-service (SaaS) companies or membership-based organizations, can greatly benefit from recurring invoicing. It simplifies the billing process for recurring subscriptions and ensures timely payments from customers.

Service Providers with Fixed Projects

Service-based businesses that provide fixed projects or deliverables on an ongoing basis, such as marketing agencies or consulting firms, can streamline their invoicing process with recurring invoices. It eliminates the need to manually create invoices for each project and ensures regular and consistent billing.

Usage-based Billing Models

Businesses that charge customers based on usage or consumption, such as utility providers or telecommunications companies, can leverage recurring invoicing to automate the billing process. It simplifies complex billing calculations and ensures accurate invoicing based on usage data.

Setting Up Recurring Invoices

To effectively implement recurring invoicing, businesses need to choose the right invoicing software and establish a well-defined invoice schedule.

Choosing the Right Invoicing Software

Selecting the appropriate invoicing software is crucial for seamless recurring invoicing. The software should offer features such as automated invoice generation, customizable templates, and integration capabilities with accounting systems.

Mandatory Invoice Fields

When setting up recurring invoices, it is essential to include all mandatory invoice fields as specified by relevant tax and regulatory authorities. These fields typically include the business’s name and address, customer details, invoice number, invoice date, itemized charges, and applicable taxes.

Establishing the Invoice Schedule

Determine the frequency at which recurring invoices will be generated and sent to customers. Common intervals include weekly, monthly, quarterly, or annually, depending on the billing cycle and the nature of the business.

Automation Options

Choose whether to automate the entire invoicing process or manually review and approve invoices before they are sent to customers. Automation can save time and reduce the risk of errors, but manual review allows businesses to have more control over the invoicing process.

Practical Tips for Effective Use of Recurring Invoices

While setting up recurring invoices is a crucial step, effectively using them is equally important. Here are some practical tips for maximizing the benefits of recurring invoices:

Clear and Concise Invoice Templates

Design clear and concise invoice templates that provide all necessary information in a professional and easy-to-understand format. Include relevant details such as billing period, payment due date, accepted payment methods, and contact information for customer support.

Regular Invoice Reviews and Updates

Regularly review and update recurring invoices to ensure accuracy and relevance. Update pricing information, terms and conditions, or any changes in the business’s offerings to avoid confusion or disputes with customers.

Proactive Communication with Customers

Maintain open lines of communication with customers regarding their recurring invoices. Send reminders before the payment due date, provide options for payment methods, and address any questions or concerns promptly. Proactive communication can help avoid payment delays and improve customer satisfaction.

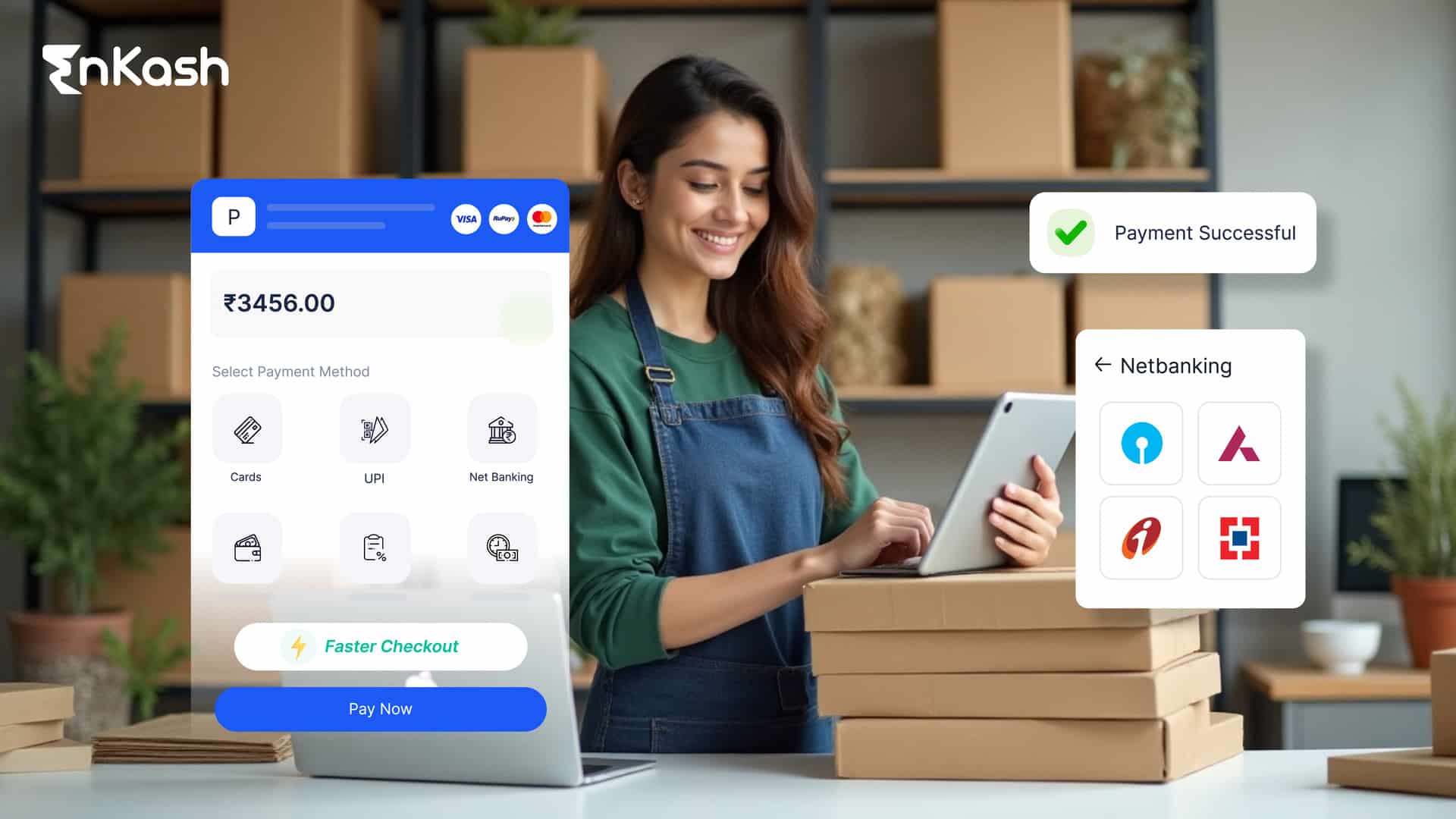

Streamlining Payment Methods

Offer a variety of convenient payment methods to customers, such as credit cards, direct debit, or digital wallets. Streamlining the payment process increases the likelihood of timely payments and reduces friction for customers.

Overcoming Challenges in Recurring Invoicing

While recurring invoicing offers numerous benefits, businesses may face challenges in its implementation.

Handling Invoice Variations

For businesses with dynamic invoices or complex billing structures, managing variations in recurring invoices can be challenging. Implement robust systems and processes to accurately calculate and generate invoices based on usage data or changing billing rates.

Dealing with Late Payments

Late payments can disrupt cash flow and impact the financial health of a business. Implement automated payment reminders and penalties for late payments to encourage timely payment behavior from customers.

Managing Customer Preferences and Changes

As businesses grow and evolve, customer preferences and billing requirements may change. Regularly review and update recurring invoices to accommodate customer preferences, changes in billing terms, or updates to pricing structures.

Compliance and Legal Considerations

When implementing recurring invoicing, businesses must comply with relevant tax and regulatory requirements, ensure data privacy and security, and adhere to contractual agreements. Here are some key considerations:

Tax and Regulatory Requirements

Understand the tax and regulatory obligations related to recurring invoicing in the jurisdictions where the business operates. Ensure that invoices comply with applicable tax laws, include necessary tax information, and adhere to reporting requirements.

Data Privacy and Security

Protects the customer data by implementing robust data privacy and security measures. Comply with data protection regulations, secure customer payment information, and ensure secure transmission of invoice data.

Contractual Agreements

Review and update contractual agreements with customers to incorporate recurring invoicing terms and conditions. Clearly outline billing cycles, payment terms, and any other relevant contractual obligations to avoid disputes or misunderstandings.

Choosing the Right Invoicing Solution

When selecting an invoicing solution for recurring transactions, businesses should consider the following factors:

Features and Functionality

Assess the features and functionality offered by different invoicing solutions. Look for features such as automated invoice generation, customizable templates, payment reminders, and integration capabilities with accounting systems.

Scalability and Customization

Choose an invoicing solution that can scale with the growth of your business. Ensure that it allows for customization to accommodate evolving billing requirements, pricing structures, and customer preferences.

Integration Capabilities

Consider the integration capabilities of the invoicing solution with other business systems, such as accounting software, customer relationship management (CRM) systems, or payment gateways. Seamless integration can streamline financial processes and improve efficiency.

How EnKash Can Help?

EnKash offers a comprehensive solution for managing recurring invoices, enabling businesses to streamline their invoicing process, improve cash flow, and enhance customer satisfaction. Here’s how EnKash can specifically assist you:

Automated Invoice Processing: Automate the entire invoice processing workflow, from invoice upload to dispatch all within a single dashboard

Multiple Payment Options: Offer customers a variety of convenient payment methods, including NEFT, IMPS, RTGS, debit, UPI, etc

Automated Payment Reminders: Set up automated email or SMS reminders to nudge customers about upcoming invoice due dates, reducing the risk of late payments

Real-time Payment Tracking: Gain real-time insights into invoice status and payment history, allowing you to track outstanding balances and manage your cash flow effectively

Seamless Integration: Integrate EnKash with your existing accounting software for effortless data synchronization and streamlined financial management

Improved Reporting and Analytics: Access comprehensive reports and analytics to gain valuable insights into your recurring revenue, identify trends, and make informed business decisions

Reduced Administrative Costs: By automating manual tasks and streamlining the invoicing process, EnKash helps you save time and resources, reducing administrative costs associated with traditional invoicing methods.

By leveraging EnKash’s features and functionalities, businesses can experience the full potential of recurring invoicing, improving their financial efficiency and achieving sustainable growth

Conclusion

The invoicing process for recurring transactions plays a vital role in the success of businesses that rely on recurring revenue models. By automating the billing process, businesses can improve cash flow, enhance customer relationships, save time and resources, and streamline financial management.

To effectively implement recurring invoicing, businesses should carefully choose the right invoicing solution, establish clear invoice templates, communicate proactively with customers, and integrate invoicing with accounting systems. By overcoming challenges and complying with legal and regulatory requirements, businesses can maximize the benefits of recurring invoicing and drive long-term success.