Introduction

Managing any business requires considerable effort. From procurement to vendor selection to payments, generating revenue, and gaining profit, it’s a period of rapid fluctuations. As a business owner, you would want to simplify certain areas of your business. Collections or receivables in one such crucial area that requires simplification. eNACH is one such payment mandate that helps businesses in collections from their customers.

What is eNACH?

National Payments Corporation of India (NPCI) introduced the eNACH or electronic National Automated Clearing House (NACH) to simplify electronic payments and collections. An electronic mode of payment, eNACH allows businesses to automate their recurring payments such as SIPs, EMIs, insurance premiums, utility bills, and more.

eNACH example for business collections

A company known as X enterprises sells subscription-based diet plans to their customers. They depend on manual bank transfers or credit card payments from their customers.

Sometimes this leads to missed or delayed payments by customers. The subscriptions get canceled if the card applied is expired resulting in losing customers.

X enterprises integrate eNACH for recurring subscription payments. eNACH allows them to collect recurring payments from their subscriber’s bank accounts digitally on the designated date each month. This way they do not lose their customers and they don’t have to follow up with their customers for monthly payments.

Benefits of eNACH for businesses in collections

eNach helps streamline business collections in the following ways:

Automation At Work: Businesses can easily ditch manual payment collection and choose automation with eNACH. This will allow them to focus on other tasks like customer service or growth initiatives.

Quick Collections: eNach payments are settled within a few business days when compared to cheques or credit card processing. This allows businesses to receive their funds faster, improving their cash flow.

Less Failed Payments: eNACH debits the amount due directly from the customer’s account on a scheduled date. This reduces the risk of failed payments and overdue accounts.

Enhanced Customer Experience: Businesses can integrate eNACH into their websites and be rest assured about customer convenience. The user-friendly mode of payment leads to higher customer satisfaction and retention.

Reduced Operational Costs: eNACH helps businesses save money on administrative costs and collection efforts.

Competitive Edge: Businesses using eNACH for payment collection have a competitive edge over their competitors. Integrating eNACH can help them attract and retain customers while building a build a positive reputation in the marketplace.

Flexibility: eNACH facilitates flexibility as it can be customized to meet the unique demands of different businesses depending on their industry type, size, and payment requirements.

Security: A secure and reliable payment solution, eNACH reduces the risk of fraud and errors associated with manual payment processing. Electronic transactions processed via eNACH are accurate and secure.

How to Register for eNACH?

Registering for eNACH is an efficient way to streamline and automate recurring payment collections for businesses. The procedure is straightforward but involves specific steps to ensure smooth integration and setup. Below is the step-by-step procedure to register for eNACH.

1. Choose an eNACH Service Provider

The first step is to select a reliable eNACH service provider. Choose a provider that integrates seamlessly, offers strong security, and provides a user-friendly platform for managing recurring payments. Some well-known providers include EnKash, which specializes in eNACH solutions tailored to various business needs. Last but not least, ensure the provider is compliant with RBI and NPCI regulations to guarantee the safety, accuracy, and reliability of payment processing.

2. Create Your Business Account

After you decide on the service provider, the next step would be setting up your eNACH account.

The following documents are typically required to create an account:

- Company registration documents

- KYC details

- Bank account info

- Business authorizations or GST certificates, if required

The service provider would verify these and finish the validation process.

Once the validation is complete, your business account will be ready for eNACH integration.

3. Enable API Integration

The service provider provides APIs (Application Programming Interfaces) to enable automated recurring payments.

These APIs are essential for integrating the eNACH platform with your existing systems, such as: Customer Relationship Management (CRM) tools and Billing or invoicing software.

API integration facilitates seamless onboarding and offboarding, ensuring smooth payment processing for end users.

This method minimizes human efforts, reduces errors, and thus increases the overall efficiency in managing collections.

4. Customer Authorization for eNACH Mandate

Once the eNACH system is integrated, businesses should gather acceptance to initiate the process of recurring payment from their customers. The customer has to consent to the eNACH mandate by entering the following details: Bank account number, IFSC code, and net banking credentials or Aadhaar details for authentication.

The process can be done digitally using either of the following:

Net Banking: The customer logs into his net banking and then approves the mandate.

Aadhaar-based Verification: The customer authenticates the mandate using an OTP sent to their registered mobile number, which is linked to Aadhaar.

e-NACH Authorization must be user-friendly and swift to facilitate customer participation.

5. Mandate Submission and Bank Approval

Once the client issues an eNACH mandate, it is sent for verification to the client’s bank.

The mandate gets validation by the bank based on the details provided, which includes:

- Customer bank account information

- Consent and authorization by the customer

Upon confirmation of the mandate by the bank, the payment becomes activated, and the recurring payment process is ready to start. A message is sent to both the organization and the service provider regarding the successful activation of the mandate.

6. Monitor and Manage Transactions

Once an eNACH is set in place, businesses can seamlessly monitor and manage their payment collections through the service provider’s platform.

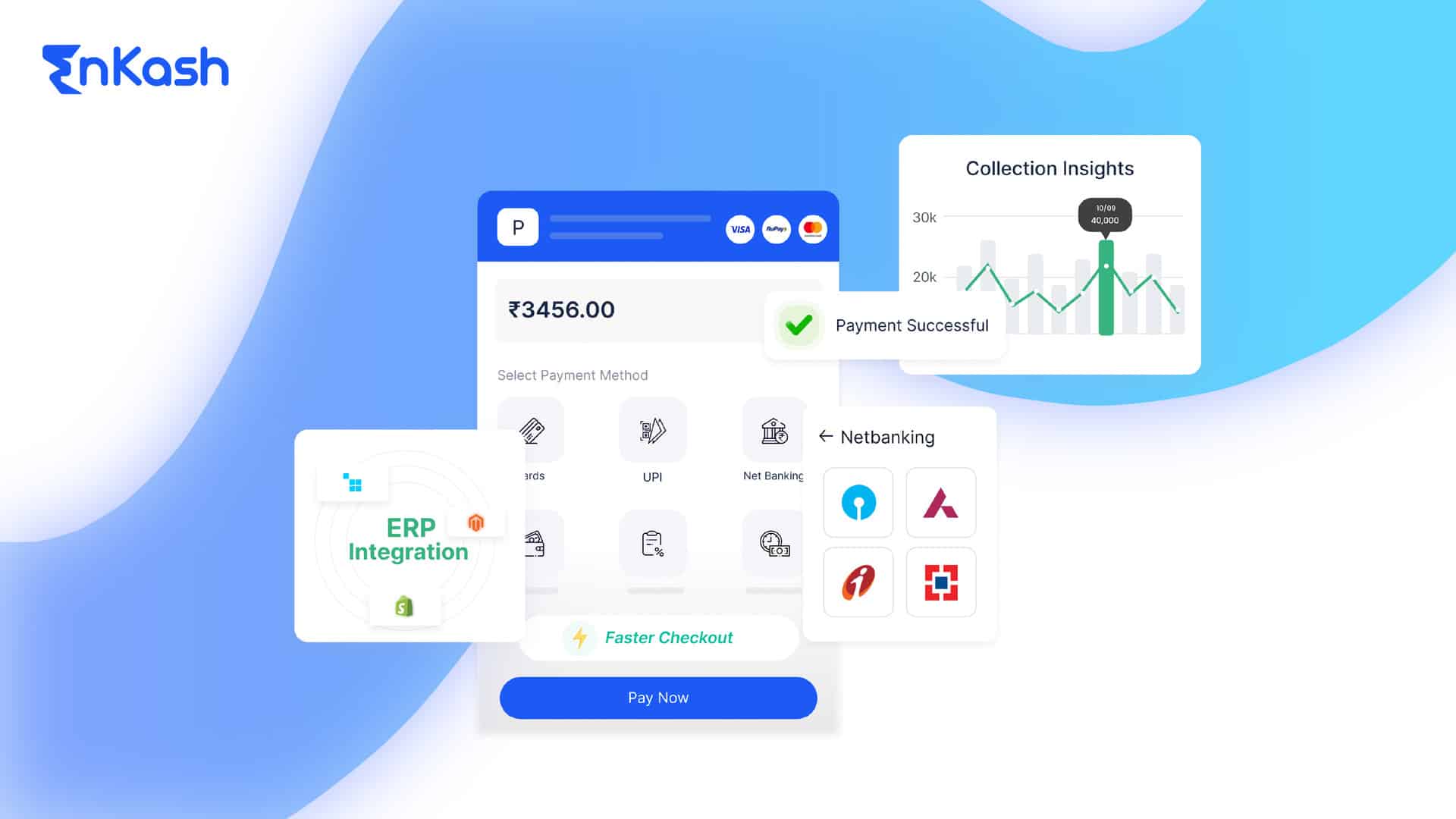

Most such service providers, for example, EnKash, offer a central dashboard through which a business can perform the following tasks:

- Track in real-time the payment transactions.

- Resolve payment failures and retry transactions.

- Generate insightful reports to analyze cash flow and finances.

Real-time transaction monitoring ensures on-time collections, and improves operational efficiency.

eNACH for Recurring Payments

Businesses can easily integrate eNACH into their website and start collecting recurring payments from their customers. Customers have to authorize eNACH to deduct their monthly fee or payment directly from their bank on a specified date. This helps businesses save time in chasing payments and reduces processing costs compared to credit cards. With eNACH, businesses have predictable cash flow allowing customers to pay in a convenient, automated manner.

How to activate NACH Mandate?

Activating a NACH mandate is a crucial step in setting up automated recurring payments for businesses and customers. This is done through a number of steps to ensure a payment processing experience that seamless, secure, and verified. The detailed process to activate the NACH mandate is provided below:

1. Mandate Form Submission

The activation process begins with the filling and submission of the NACH mandate form. Customer filling within two methods applies for the mandate form;

Physical Submission of Form: This is the process where the mandate form is printed, signed by the customer, and submitted physically to the service provider or the business.

Electronic Submission of Mandate (eMandate): This method involves filling and submitting the form through the service provider’s platform for faster and more efficient processing. Most providers use eMandates due to their efficiency and minimal paperwork.

It includes:

- Bank account details of the customer (account number and IFSC code)

- Amount of deduction (in maximum format)

- Consent from the customer through signature (only physical form) or authentication (only eMandate).

- Frequency of payment (e.g. monthly, quarterly, etc.).

2. Customer Authentication

After submission of the mandate form, customer authentication will take place to ascertain the mandate’s authenticity.

The mandate is authorized by customers through one of the following secure means:

Net Banking Authentication:

The customer logs on to the net banking portal and approves the NACH mandate via credentials.

The bank verifies the approval of the customer and sends confirmation.

Aadhaar-based OTP verification:

The customer receives a One-time password onto his mobile number upon which Aadhaar is registered.

Customers validate and authorize the eMandate by entering the OTP on the mandate platform.

The above authentication generally involves customers approving the recurring debit willingly and will help prevent unauthorized access.

3. Bank Verification

The bank then sends these details to the customer’s bank once the customer affirms the mandate.

While the verification is undertaken by the bank, the check undertaken is with respect to the following:

Correctness of the bank account details mentioned in the mandate (account number, IFSC code, and so on).

Verification of validity of customer’s authorization through net banking or Aadhaar OTP.

Banks may also cross-check the maximum limit and frequency of payments for compliance with the consent given by the customer.

Verification ensures activation of valid mandates only, thus minimizing erroneous or fraudulent transactions.

4. Activation Confirmation

After successful verification, the NACH mandate gets activated by the bank.

The service provider or business receives an acknowledgment of activation from the bank of the customer.

The activated mandate is now in force for automated recurrences of payment as indicated in the schedule.

The business and the consumer are both apprised of the successful activation so as to ensure transparency.

5. Initiate Collection of Payments

Once activated, the NACH system shall deduct on the scheduled date from the customer’s bank account the amount authorized for payment.

The deducted amount directly gets credited to the bank account of the business, so collections are therefore timely and without hassles.

All transactions can be tracked and monitored by businesses through a dedicated dashboard provided by the service provider.

In the case of payment failures, businesses are alerted quickly to enable them to take corrective measures, such as retrying the debit or informing the customer.

What are the rules for eNACH?

The eNACH is formed based on various rules and guidelines of the NPCI along with the Reserve Bank of India. Thus, the entire procedure for eNACH is intended to make it safe, secure, transparent, and regulatory approved. Below are the important rules for eNACH:

1. Customer Consent

The business obtains clear and unambiguous consent from the customer to initiate the eNACH mandate. The customer may give an explicit consent via signing the mandate form, or he may provide a customer-provided digital verification through net banking or Aadhaar OTP. By such consent, he is assured of automatically carrying out the recurrence of debit from the concerned ideal bank account.

2. Mandate Validation

All eNACH mandates are validated by the customer’s bank and then only activated by the registered branch. Validation proves the identity of the customer by showing the bank account number, payment amount, and authorization method. These types of secured methods like net banking login or Aadhar-based OTP make sure the authenticity of the mandates is free from tampering.

3. Frequency and Amount

The payment’s frequency, such as monthly, quarterly, or annually, needs to be stated clearly in the mandate, and maximum amount allowed to be deducted. On payment not exceeding the agreed amount, the business cannot carry out further or change the frequency without taking fresh consent from the customer.

4. Notification Requirements

All customers should be knowledgeable to keep them well informed before each scheduled debit. This will help prevent disputation.

They may get a notice either via e-mail, short messaging service, or through other electronic broadcast channels, informing the customer of an impending debit from one’s account.

It must contain the details such the amount, debit date, and reason for payment.

5. Cancellation Policy

The scheme allows the customers to cancel or change their eNACH mandates at any time.

As it is, the customer may inform his or her bank, or company in writing or through an authorized means, about any cancellation or amendments to the mandate.

Businesses should take care of such requests and act quickly to avoid such further debits.

6. Managing Failed Payments

In the event of a failure in payment because of insufficient funds, it can retry the debit in the same way as prescribed under the mandate.

The business will have to notify the customer about such failed transactions and give them an opportunity to rectify the cause of failure.

If it continues for several attempts, new authorization or changes in payment methods might be needed.

7. Data Safety

It will help if the businesses ensure about amassing all these while keeping secrecy and safety on all customer data, including bank account data.

It should conform to all the data security norms laid down by the RBI for an eNACH transaction against any unauthorized access or misuse.

Processing of mandates has to be duly secured by encrypting and complying with standards of IT security.

8. Regulatory Compliance

All businesses have to comply with the NPCI and RBI regulations while processing eNACH mandates.

It imposes penalties or suspension of eNACH services in the eventuality of non-compliance.

A business needs to preserve all the mandates and transactions relating to the customer communications for audit purposes.

How to integrate eNACH into my business?

Follow these steps to integrate eNACH into your business:

Find an eNACH Service Provider: You need a partner that facilitates eNACH transactions. EnKash is one such provider with a user-friendly platform.

Account Setup: The service provider will help establish an eNACH account for your business. This involves document verification and approvals.

API Integration: eNACH providers offer APIs to connect their platform with your existing billing or Customer Relationship Management (CRM) system. This enables automated data exchange simplifying the process.

Customer Onboarding: During sign-up, customers provide their bank account details and authorize recurring eNACH debits for their monthly fee.

Payment Processing: After a customer authorizes eNACH, the system handles automatic deductions on the designated dates. EnKash provides a single dashboard for monitoring transactions and managing exceptions.

Technical Support: EnKash provides reliable technical support to assist you with any integration or transaction issues.

Conclusion

By using eNACH for payment collections, businesses can stay ahead of the curve and facilitate their cash inflow. Businesses can easily automate their manual collection process with seamless integration and complete security while increasing their customer retention.

FAQs

What is the difference between NACH and eNACH?

NACH refers to the National Automated Clearing House, which processes physical mandates, while eNACH is its electronic version that simplifies the process through digital means.

Is eNACH secure for businesses and customers?

Yes, eNACH is a secure payment method that follows stringent RBI and NPCI guidelines to ensure data protection and prevent fraud.

How long does it take to activate an eNACH mandate?

Activation of eNACH mandates takes about 2-3 working days after completion of customer verification by the bank.

Can customers modify or cancel their eNACH mandates?

Yes, it allows a customer to modify or cancel the eNACH mandates at his/her option by calling the bank or service provider.

What types of businesses can use eNACH?

Businesses which incur financial payments of recurring nature can opt for the eNACH like subscription models, EMIs or paying utility bills.

How are failed eNACH payments handled?

In case of failure of payment, information is sent to customer on how to fix it, and businesses can resubmit the debit request.

What is the maximum amount allowed for eNACH payments?

Maximum limits for payments by eNACH depend on the understanding between the client, the business, and the bank.

Do customers need to approve eNACH mandates every month?

No, once an eNACH mandate is approved, payments are deducted automatically as per the specified schedule.