The subscription business model is one of the most catching fires in the digital economy today. Many types of businesses apply this model, such as Software as a Service (SaaS) platforms, streaming services, and online memberships. All of them, with their ever-increasing number, adopt recurring billing strategies to ensure that there is a steady revenue stream and build a long-term relationship with their customers. There is one very important aspect of this model payment gateway that needs to have the provision of recurring billing and very effective subscription management.

Understanding Recurring billing and subscription payments

Recurring billing is when a customer is automatically charged periodically, such as monthly, quarterly, or annually, for products or services the customer is subscribed to. Recurring billing is common in industries such as SaaS and Over-The-Top (OTT) streaming platforms and various online membership services. Subscription payments make it convenient for customers and prevent any predictable revenue loss for the business, ensuring financial projections and stability.

Essentials of a SaaS Payment Gateway

A safe SaaS payment gate should incorporate all essential requirements of the subscription model business. An efficient payment gateway would not only facilitate fast processing of transactions but also offer security and efficient processing of payments.

- Automatically Handles Billing

- Elimination of manual touch points, thus reducing administrative workload.

- Payment timeliness – no pay, missed or late

- Supports customization: monthly, quarterly, or yearly billing cycle.

- Provides Multi-Payment Options

- Allows credit card payment, debit card payment, net banking, UPI, and many more digital wallets for consumers to pay.

- Enrolls prospects because of the convenience that is offered to customers, thus reducing drop-offs during the time of payment processing.

- Supports international payments for SaaS businesses to scale globally.

- Secured Transaction with Fraud Detection

- Prevents unauthorized transactions using detection algorithms.

- Typically secures customer payment details by encrypting and tokenizing them.

- It is PCI-DSS compliant to ensure security.

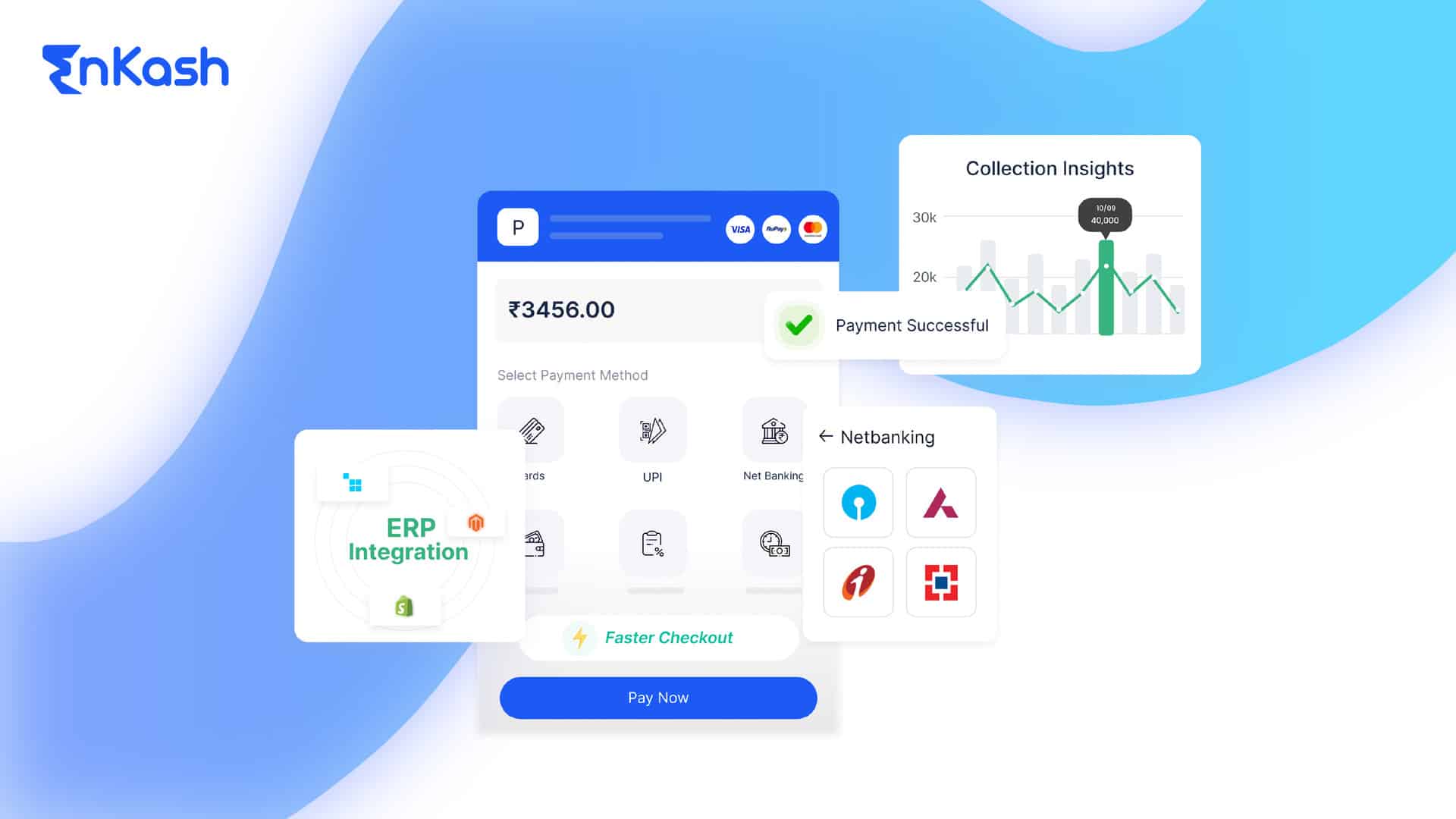

- Seamless Integration with Business Tools

- Easily integrates with their CRM systems, accounting software, and customer portals.

- Provides real-time tracking and automated invoicing.

- Helps businesses efficiently manage customer subscriptions with no need for switching between multiple channels

Role of eNACH in Subscription Payments

What is e-NACH?

eNACH, or Electronic National Automated Clearing House, is a digital payment system introduced by the National Payments Corporation of India to automate the recurring payments process. It replaces old traditional paper mandates with electronic processes for easy and hassle-free subscription payments.

When eNACH Works for Subscription Payments

- Customer Authorization

Customers approving for auto-debit of accounts with auto-debit authorized by customers for one time using net banking or debit card.

- Automated Funds Collection

Once the authorization is processed, the funds will be collected automatically on the predetermined date by the businesses, and the customer has no role in approving individual transactions.

- Error-Free Processing

Zero risk of human error in payment collection. Automated clearing of the receipts of payments does not require receipts of payments to be received in time, hence making it consistent in revenue for businesses.

Benefits of eNACH for Subscription Payments

- Simplified Payments Collection

No more filling up payment details every time. Customers can use services continuously without interruption.

- Reduction of Transaction Failures

Unlike card-based recurring payments, eNACH would allow direct deductions from bank accounts rather than having payments declined.

- Cost Effective

Cut down on administrative expenses on manual collection of payments; reduce dependency on clients for other follow-ups if payment has failed.

Benefits of Automatic Billing for SaaS Businesses

Automatic Billing is a revolution in managing Software as a Service (SaaS) businesses to optimize operations and improve customer experience. Such businesses do not need to depend on manual invoicing and payment collections; everything will be automated in terms of subscription charges that can be timely done, are less error-prone, and are predictable in cash flow. Here is what automatic billing means to SaaS companies:

1. Time and Error Reduction

- Automated repetitive task of billing so there will be no manual payment processing needed.

- Time-saving by a finance team who can focus on other strategic work.

- Low chances of human errors, such as amounts in invoices or missed cycles of billing.

- Never misses an end, and thus, all transactions flow into the business as revenue increases.

2. Better Customer Experience

- Soft and smooth payment process without having to select options and renew manually.

- Gives numerous alternative payment options, thereby increasing the convenience factor for customers.

- Reduced payment interruptions mean that customers can access SaaS products without any interruptions.

- Automatically alerts and reminds customers on billing will keep them up to date on what they owe.

- Builds goodwill and improves trust as billing is clear and on time.

3. Tracking of Revenues and Financial Forecasting

- The platform provides real-time data on billing, revenue streams, and unpaid bills.

- It helps companies keep a good track of churn rates, renewals, and cancellations.

- SaaS companies can predict revenue trends, thus making financial planning more efficient in their operations.

- Automated invoicing with tax breakdowns, thereby complying with financial regulations.

4. Reduction of Payment Failure and Subscription Cancellation

- Automated billing also makes sure the customers are charged on time, reducing involuntary churn.

- In case a payment method fails, the system retries transactions automatically, therefore lessening revenue loss.

- Integrates into fraud detection systems so that only authorized transactions are processed.

5. Scalability for Growing Businesses

- Manual billing, as a SaaS company grows, gets complicated and time-consuming.

- Automated billing situations allow companies to scale enterprises wisely, easily managing thousands of subscriptions.

- Supports multi-currency payments so that businesses can cater to global markets.

Choosing the Right Payment Gateway for SaaS Subscription Management

Choosing the best payment gateway would keep the subscription-based transactions in a regular flow. Therefore, it must satisfy several requirements regarding the gateways:

1. Security

- Using PCI-DSS compliance and encryption, the software protects from any unauthorized access to sensitive financial data.

- Multi-layer fraud detection is implemented in the system to prevent fraudulent transactions.

- Tokenization of card details is ensured to lessen further data breach risk.

2. Ease of Integration

- A good payment gateway integrates seamlessly into SaaS platforms like CRM, ERP, and accounting tools.

- Friendly and developer-oriented APIs and SDKs allow for quick and seamless implementation.

- The payment gateway chooses the one that allows customization to correspond to the business’s branding needs and workflows.

3. Global Support

- Enable businesses to accept foreign currencies for their purchases and support internationalization.

- Able to process cross-border transactions so that customers may use local payment methods for their payments.

- Able to comply with local regulations for each country to ensure smooth processing in the world, thus ensuring customers won’t face any interruptions while processing.

4. Cost Effective

- In payment gateways, transparent pricing structures should be preferred to avoid hidden fees.

- Cost-effective payment gateways will allow SaaS companies to maximize revenues without incurring excessive overhead expenses.

- Businesses should also look for other cost-effective solutions, for example, SaaS Cards by EnKash, as they help in better management of costs and reduce transaction overheads.

Challenges in Managing Subscription Payments and How to Overcome Them

The challenges to an organization concerning subscription payments can affect revenue, customer satisfaction, and operational efficiency. The following highlights certain common problems and strategies to counteract them:

1. Payment Failures- How to Prevent and Recover from Failed Transactions

Payment failures, which are caused by anything from expired cards and insufficient funds to technical issues, disrupt services and annoy customers.

Solutions:

- Smart Payment Retries: Automated retries where payment attempts occur multiple times on a scheduled basis.

- Multiple Payment Methods: We are Open to giving choices such as credit and debit cards, payment through UPI, wallets, and net banking.

- Customer Notifications: Send automated email or SMS recovery alerts to keep reminding users to update expired or declined payment methods.

- AI-Based Fraud Detection: Use AI systems for transaction intelligence to determine fraud and minimize chargebacks.

- Tokenization and Card Updater Services: Store customer payment details safely, along with the capability to update expired cards through card-updater facilities.

2. Customer Churn Strategies to Reduce Subscription Cancellations

Customer churn remains a constant pain for subscription-driven businesses. Higher churn rates can hamper long-term revenue growth.

Solutions:

- Personalized Customer Engagement: Interact with subscribers through regular emails, newsletters, and exclusive member offers all aimed at keeping subscribers engaged.

- Flexible Subscription Plans: Provide customers with multiple pricing options and allow them to either pause or downgrade subscriptions as an alternative to outright cancellation.

- Loyalty Programs and Discounts: Long-term subscribers should be rewarded with discounts or exclusive advantages to encourage retention.

- Seamless Customer Support: The faster you put your 24/7 support services in place- via chatbot, live chat, or phone the more likely you are to resolve customer issues.

- Analyze Customer Feedback: Analyze customer feedback for insights that point to problem areas within the service for improvement.

3. Regulatory Compliance: Enabling Compliance with Global Financial Laws

Involving sensitive financial data, subscription payments provide a strong case for prioritizing compliance with regulatory standards for any such enterprise.

Solutions:

- PCI-DSS Compliance: Ensure that payment gateways follow Payment Card Industry Data Security Standards (PCI-DSS) to protect customer data.

- Strong Customer Authentication (SCA): Implement two-factor authentication (2FA) for better security.

- Data Privacy Laws: Follow GDPR, CCPA, and other regional data protection laws to avoid falling into legal issues.

- Automated Compliance Monitoring: Establishment of AI tools to monitor compliance updates and changes in regulations while adjusting payment processes accordingly.

Future Trends in Automated Billing and Subscription Management

The economy is rapidly changing as far as subscriptions are concerned, and with the introduction of technology, automated billing and subscription payments will soon see improved ways of functioning. Here are the most important trends shaping the future:

1. Rise in AI-powered Billing Automation

The billing processes reduce errors and enhance overall customer experience by utilizing many ways to optimize billing cycles, including such as Artificial Intelligence (AI) into SaaS payment processing.

Key Innovations:

- Predictive Analytics: AI tracks client behaviors to measure churn and recommend retention strategies.

- Automating Dispute Resolution: AI allows fraud detection to facilitate chargeback resolution.

- Chatbots for Payments Support: Enable customers to settle their billing concerns using overdue payment facilities extended with AI chatbots.

2. Increasing Adoption of Blockchain in Payment for Security

The technology of Blockchain is now being combined into the payment gateway to improve and secure the transaction from its transparency and speed.

Benefits:

- Decentralized Transactions: Cuts costs by removing intermediaries in charge of the transactions.

- Advancement in Security: Minimizes fraud and unauthorized access using Blockchain-based encryption.

- Smart Contracts: Automate agreements on billing and ensure that conditions have been met before any payments are made.

3. Emerging Global Regulations in SaaS Payment Processing

Countries across the continents are becoming strict on various regulations for the improvement of payment security as well as the protection of data.

Key Types of Regulatory Trends:

- Strings on Recurring Transactions: The RBI and other financial authorities have recently implemented stricter provisions regarding recurring billing authorization.

- Stronger KYC Norms: Additional checks to verify the identity of every customer must be done by businesses.

- Cross-Border Compliance: Highly required and adopted as SaaS companies are now going global.

EnKash: Innovating Subscriptions Management

What is EnKash?

It is an intuitive payment option for subscription management through automatic billing, transforming SaaS companies in automating invoice creation, and recurrent payments, and propagating customer retention for its simplified handling of finances.

- Automated Invoices and Recurring Payments

- Each billing cycle generates invoices automatically, thus minimizing manual work.

- Guards against customers for mooting due payment on time.

- Customizes billing cycles: Unlocks monthly, quarterly, and annual billing cycle creation.

- Multiple payment methods, including UPI, cards, and net banking, are very flexible.

- Automatic Billing Cycle

- Renewal and cancellation are automated and thus do not require any intervention from customers.

- Notice of payment reminders to avoid unsuspecting lapses on subscriptions.

- Any prorated billing for users switching plans, either upgrading or downgrading, is adjusted.

- Single Dashboard Access for Complete Control

- A single dashboard to monitor all subscription and revenue streams

- User activity defaults on payments and renewals to view in real-time Dash

- Comprehensive reporting for financial and tax compliance.

- Customer Retention and Churn Prevention

- Automated reminders and follow-ups for expiring subscriptions. It provides a secure and seamless payment experience to remove friction.

- Use data analytics to identify at-risk customers and employ retention strategies.

- Enrolled for Simplification eNACH Services of Automatic Debit Payment

- EnKash’s service integration with eNACH will allow setting up such automatic periodic payments.

- These will ensure the collections are done fully and timely without a single manual effort and virtually eliminate the risk of losing or missing payments, thus improving the overall cash flow of a business.

Conclusion

The proper management of subscription payments and recurring bills is essential for the survival of subscription-dependent businesses. A good SaaS payment gateway, such as EnKash, not only makes payments easier but also contributes significantly to customer satisfaction and helps businesses grow. With automated billing systems, combined with tools such as eNACH, businesses can record on-time payments from their clients without getting overburdened with operational complexities and instead spend their time and efforts on providing customer value.