Nowadays, when everything is so competitive, efficient management of accounts receivable is crucial for maintaining a healthy cash flow, when it comes to business. Many organizations are turning to Software as a Service (SaaS) solutions for their accounting needs, including accounts receivable collection analytics. In this article, we will explore the benefits of using Saas-based AR tools and how they can enhance the collection process. We will also delve into the concepts of SaaS and SaaS CRM to provide a comprehensive understanding of these technologies.

Understanding Software as a Service (SaaS)

Software as a Service, or SaaS, is a cloud-based software delivery model where applications are hosted by a service provider and made available to users over the internet. With SaaS, organizations can access powerful software tools without the need for complex installations or hardware infrastructure. This model offers numerous advantages, including cost-effectiveness, scalability, and seamless updates.

The Role of SaaS CRM in Accounts Receivable

SaaS CRM, or Customer Relationship Management, is a type of software that helps organizations manage their interactions with customers. It enables businesses to streamline their sales, marketing, and customer service processes, ultimately leading to improved customer satisfaction and retention. When it comes to accounts receivable, SaaS CRM can play a vital role in enhancing the collection process.

By integrating SaaS CRM with accounts receivable collection analytics, organizations can gain valuable insights into customer behavior, payment patterns, and outstanding balances. This information allows businesses to identify potential collection issues early on and take proactive measures to address them. With SaaS CRM, organizations can also automate collection reminders, track communication history, and collaborate effectively with internal stakeholders, such as account executives and customer success managers.

The Benefits of SaaS-based AR Tools

Saas-based AR tools offer a wide range of benefits for organizations looking to optimize their collection processes.

Automation and Efficiency

One of the primary benefits of Saas-based AR tools is automation. These tools streamline the collection process by automating tasks such as invoice generation, payment reminders, and reconciliation. By reducing manual effort, organizations can improve operational efficiency and focus on more strategic initiatives.

Actionable Data and Analytics

Saas-based AR tools provide organizations with access to actionable data and analytics. These tools offer comprehensive reporting and analytics capabilities, allowing businesses to gain insights into their accounts receivable performance, identify trends, and make data-driven decisions. With real-time visibility into key metrics such as DSO (Days Sales Outstanding), organizations can optimize their collection strategies and improve cash flow.

Customization and Scalability

Saas-based AR tools are highly customizable, allowing organizations to tailor the software to their specific needs. Whether it’s configuring workflows, designing invoice templates, or setting up collection sequences, businesses can adapt the software to align with their unique requirements. Additionally, Saas-based AR tools are scalable, meaning they can grow with the organization as its needs evolve.

Improved Customer Relationships

Effective accounts receivable management is essential for maintaining positive customer relationships. Saas-based AR tools enable businesses to provide a seamless payment experience for their customers. Features such as self-service payment portals, integrated payment options, and personalized communication help businesses build trust and strengthen customer relationships.

Enhanced Security and Compliance

Saas-based AR tools prioritize data security by implementing robust encryption measures, access controls, and regular security updates. These tools also ensure compliance with industry regulations, such as PCI-DSS (Payment Card Industry Data Security Standard), providing organizations with peace of mind.

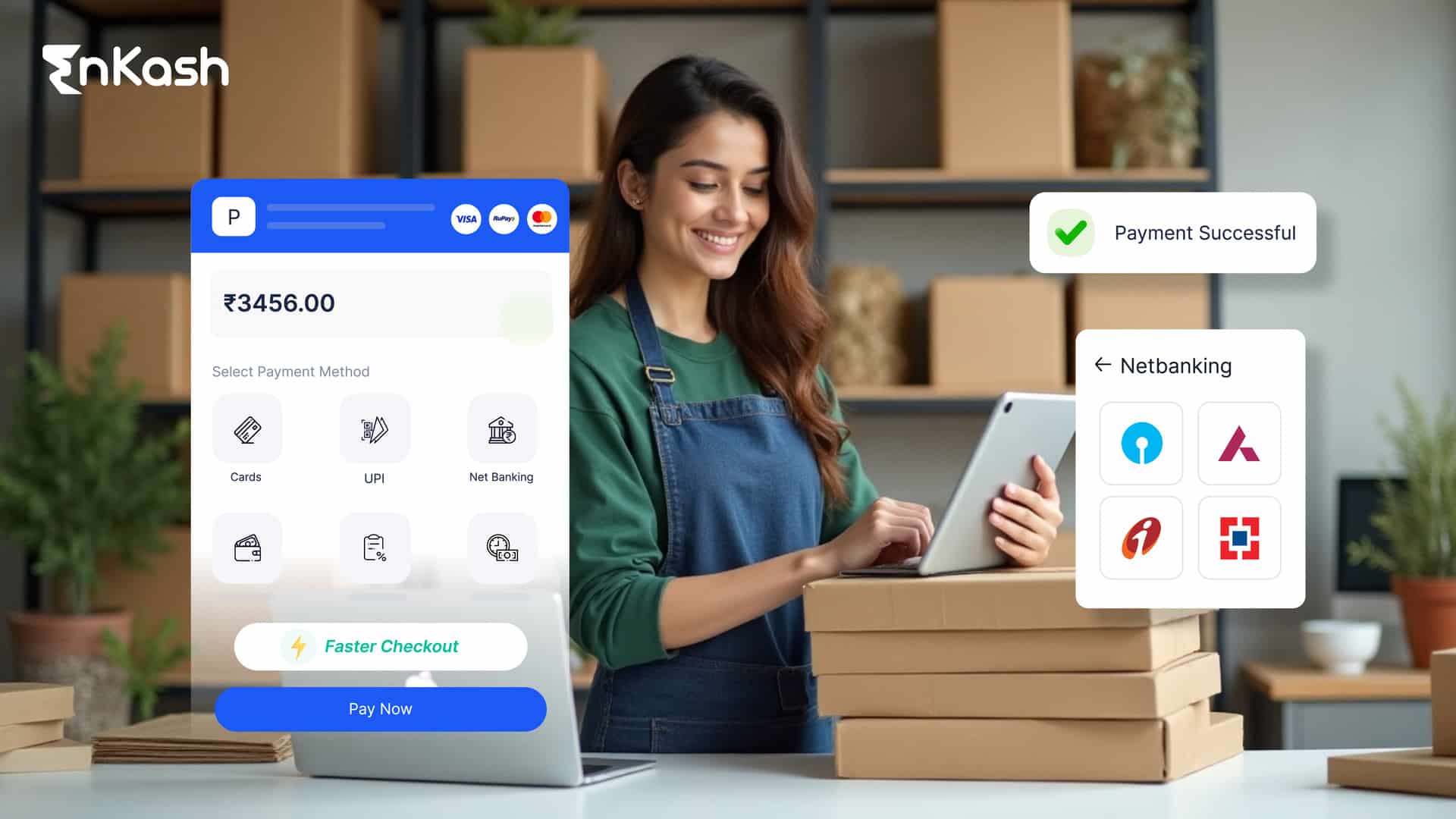

How EnKash’s AR Tool is Revolutionizing Collections

EnKash, a leading provider of Saas-based AR tools, offers a comprehensive solution for organizations looking to optimize their collection processes. EnKash’s AR tool combines powerful features, seamless integration, and user-friendly interfaces to deliver exceptional results.

Collection Sequence Automation

EnKash’s AR tool enables organizations to automate their collection sequences. With this feature, businesses can set up customized collection workflows, including automated email reminders, payment follow-ups, and escalation procedures. By automating collections, organizations can save time, reduce manual errors, and improve overall efficiency.

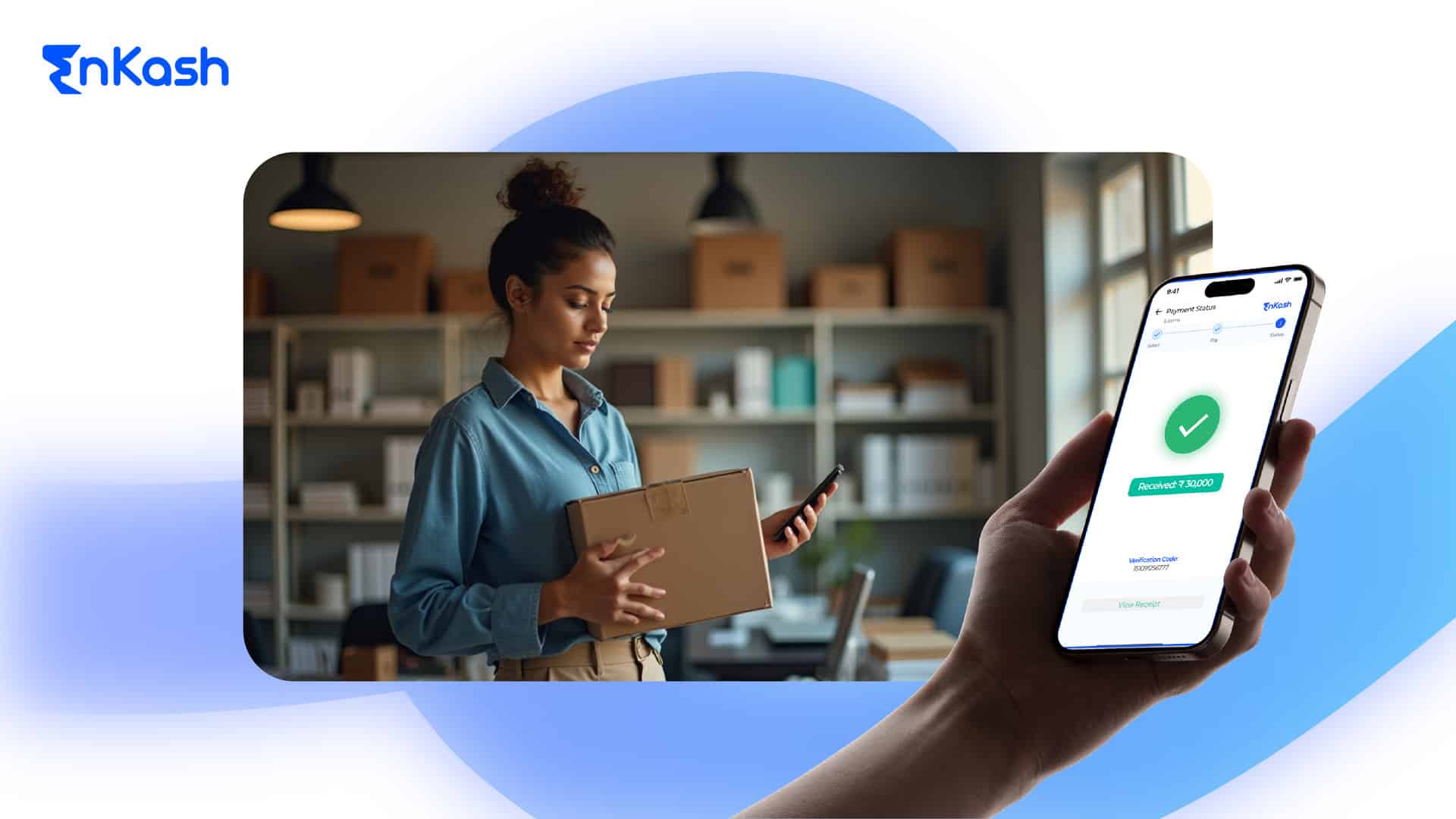

Collaborative Collections

Collaboration is crucial for successful accounts receivable management. EnKash’s AR tool facilitates collaboration by providing real-time visibility to account executives and customer success managers. These stakeholders can easily access information on outstanding invoices, customer payment history, and communication logs. By empowering internal teams to work together, organizations can enhance their collection efforts and improve cash flow.

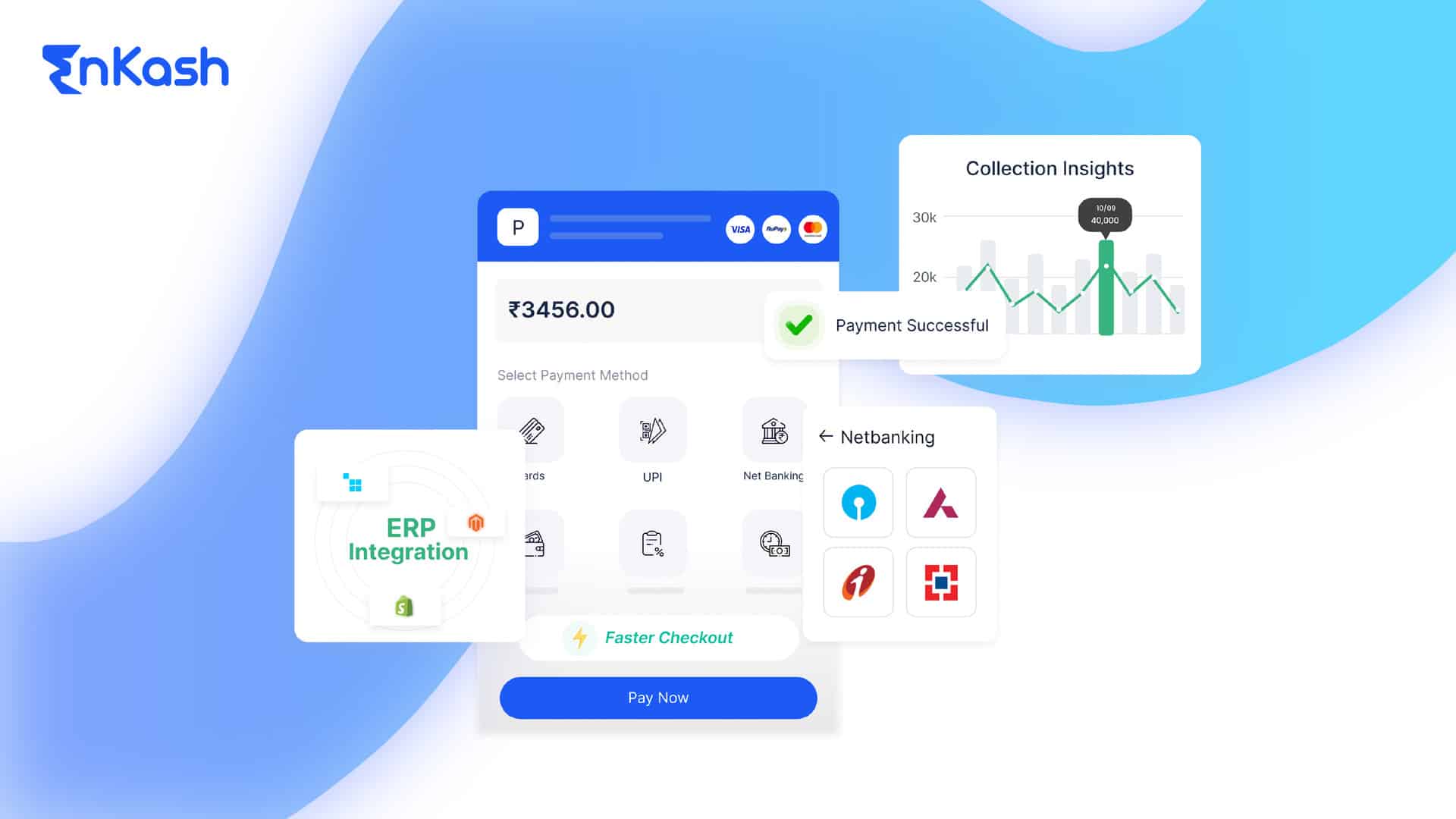

Advanced Analytics and Reporting

EnKash’s AR tool offers advanced analytics and reporting capabilities, allowing organizations to gain valuable insights into their accounts receivable performance. With customizable dashboards, businesses can track key metrics, identify trends, and generate comprehensive reports. These insights enable organizations to make data-driven decisions, optimize collection strategies, and improve overall financial performance.

Seamless Integration with Existing Systems

EnKash’s AR tool seamlessly integrates with existing systems, such as accounting software and CRM platforms. This integration ensures smooth data flow and eliminates the need for manual data entry or duplicate records. By centralizing data and streamlining processes, organizations can improve accuracy, reduce administrative overhead, and enhance overall productivity.

Enhanced Customer Experience

EnKash’s AR tool prioritizes the customer experience by providing self-service payment portals, personalized communication, and multiple payment options. By offering a convenient and seamless payment experience, organizations can improve customer satisfaction, reduce payment delays, and build stronger customer relationships.

Conclusion

Saas-based AR tools are revolutionizing the way organizations manage their accounts receivable and optimize their collection processes. With automation, actionable data, customization, and improved customer relationships, these tools offer numerous benefits for businesses of all sizes. EnKash’s AR tool stands out as a comprehensive solution, combining advanced features, collaborative capabilities, and seamless integration. By leveraging the power of Saas-based AR tools, organizations can enhance their collection analytics, improve cash flow, and achieve financial success.

FAQs

1. What is Software as a Service (SaaS), and how does it benefit organizations in managing accounts receivable?

SaaS is a cloud-based software delivery model that allows organizations to access powerful tools over the internet, offering advantages such as cost-effectiveness and scalability. In the context of accounts receivable, SaaS facilitates efficient management with seamless updates.

2. How does SaaS CRM contribute to enhancing the accounts receivable collection process?

SaaS CRM streamlines customer interactions, providing insights into behavior, payment patterns, and outstanding balances. Integration with accounts receivable collection analytics enables proactive measures, automation of reminders, and effective collaboration among internal stakeholders.

3. What are the key benefits of Saas-based AR tools for optimizing collection processes?

Saas-based AR tools offer automation, actionable data and analytics, customization, scalability, and improved customer relationships. These tools enhance operational efficiency, provide valuable insights, and grow with the organization’s evolving needs.

4. How does EnKash’s AR tool revolutionize collections?

EnKash’s AR tool automates collection sequences, facilitates collaborative collections, offers advanced analytics and reporting, seamlessly integrates with existing systems, and prioritizes the customer experience. These functionalities contribute to saving time, reducing errors, and improving overall efficiency.

5. Why is collaboration crucial for successful accounts receivable management, and how does EnKash’s AR tool facilitate it?

Collaboration is essential for successful AR management. EnKash’s AR tool provides real-time visibility to account executives and customer success managers, empowering them to access information on outstanding invoices, customer payment history, and communication logs, ultimately enhancing collection efforts.

6. How does EnKash’s AR tool prioritize data security and compliance in financial transactions?

EnKash’s AR tool ensures data security through robust encryption measures, access controls, and regular security updates. It also complies with industry regulations, such as PCI-DSS, providing organizations with peace of mind in handling financial data.

7. Can EnKash’s AR tool seamlessly integrate with existing systems, and how does it benefit organizations?

Yes, EnKash’s AR tool seamlessly integrates with existing systems like accounting software and CRM platforms. This integration ensures smooth data flow, eliminates manual data entry, reduces administrative overhead, and enhances overall productivity for organizations.

8. How does EnKash’s AR tool contribute to enhancing the customer experience in accounts receivable management?

EnKash’s AR tool prioritizes customer experience by providing self-service payment portals, personalized communication, and multiple payment options. This focus on convenience and seamless payment experiences contributes to improved customer satisfaction, reduced payment delays, and stronger customer relationships.