Nowadays, when everything is digital and fast, having a manual payment processing system can be slow and prove to be a downturn for a business’s growth trajectory. This is when payment gateways come into play, payment gateways act as the secure bridge between your customers and your bank account, facilitating smooth, fast, and efficient payments. But when thinking of opting for a payment gateway, the first thing that comes to mind is what are the charges associated with integrating it. Understanding these fees is crucial for businesses to make informed decisions and optimize their financial health.

In this blog let’s discuss and understand the different types of fees associated with integrating a payment gateway, factors influencing their cost, and strategies to navigate them effectively.

What is a Payment Gateway Price?

Payment gateway prices are the fees levied by the payment gateway provider for processing your online transactions. These online payment charges cover the costs associated with securing the transaction facilitating communication between your website/app, your customer’s bank, and your bank account, and managing potential risks like fraud.

What are the Costs Associated with Integrating a Payment Gateway?

Payment gateway charges can be broadly categorized into three main components:

- Transaction Fees: This is the most common type of online payment charge and is typically a % of the total transaction value. The specific rate can vary depending on several factors, including:

- Payment Method: Different payment methods, like credit cards, debit cards, net banking, BNPL and wallets, often have varying transaction fees. Transactions done via credit card usually have higher fees due to the added risk associated with them

- Transaction Volume: Some payment gateway providers offer different pricing structures according to the volume where the transaction fee decreases as your monthly transaction volume increases

- Industry: The industry in which the business is operating is also a factor to consider as high-risk industries may be subject to higher transaction fees due to the increased risk of fraud

- Setup Fees: Often a one-time setup fee is also charged by the payment gateway provider to cover the cost of opening your account and integrating their services with your website/app

- Monthly Maintenance Fees: A few payment gateways might charge a monthly fee for maintaining your account and providing ongoing access to their services

Understanding the Factors Influencing Payment Gateway Charges

Here are some important factors that can influence the total cost of your payment gateway services:

- Your Business Model: One of the primary factors influencing the online payment charges of your payment gateway is your business model. The type of business you operate and the average transaction value can significantly impact your payment gateway charges. A tiered pricing structure can be beneficial for high-volume businesses with smaller transaction sizes, and on the other hand businesses with fewer but larger transactions might find a flat-rate pricing model more suitable

- Geographic Location: Location also acts as an influencer on the cost of your payment gateway, charges can vary depending on the location and the region where the customers are based

- Payment Gateway Provider: There are many players in the market and each player has their own pricing models and fee structures. It’s smart to compare options and choose a provider that aligns with your business needs and budget

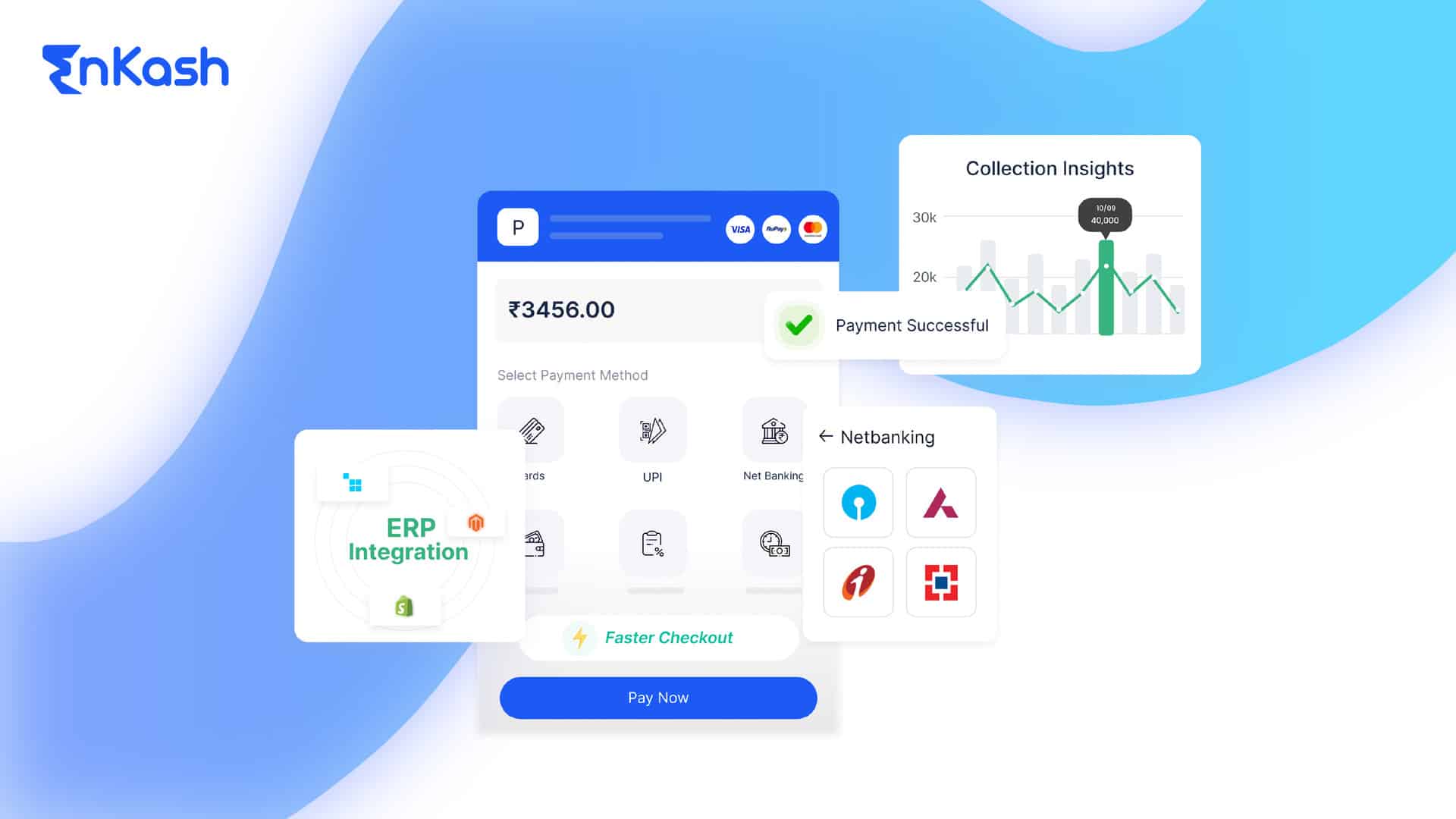

Olympus Payment Gateway

At EnKash, we understand the importance of transparent and competitive pricing. That’s why we offer a straightforward pricing structure for our Olympus payment gateway with:

- Competitive Transaction Fees: We offer competitive transaction fees starting at 1.99%*, ensuring that it suits your pocket and you get the best value for your money

- Volume Discounts: You can also enjoy lower transaction fees as your business grows and your transaction volume increases

*T&C Apply

Ready To Save And Accept Payments Securely?

Additional Things To Consider When Choosing a Payment Service Provider

While cost is an important factor, it shouldn’t be the sole deciding factor when choosing a payment service provider. Here are some additional aspects to consider:

Security: Ensure security is also a top priority for the payment service provider you choose and that they utilize robust measures like end-to-end encryption to protect the customer’s data and prevent fraud.

Payment Processing Speed: Try to give a premium experience to your customers by offering them fast and efficient transaction processing, look for a payment provider that can help you get the best payment processing speed, minimizing wait times for your customers.

Customer Support: Often times you might face some challenges while or after integrating the payment gateway, this is when a good customer support can be beneficial for you, so that you quickly get answers to your queries or dispute resolution.

Integration Ease: Choose a payment gateway with a seamless integration process to minimize disruption to your existing systems.

Scalability: Consider your future growth plans and choose a payment gateway that can scale with your business needs.

Conclusion

Payment gateways are quickly becoming the need of the hour for businesses as competition in the market increases. Nowadays, every other business has already integrated or looking to integrate a payment gateway in their website or app to provide hassle-free user experience to their customers. By carefully reading this blog, you can learn the different types of charges associated with integrating a payment gateway, and understand the factors influencing these charges, you can successfully opt for the best payment gateway for your business that suits your need and is also easy on the pocket.