People have mostly discarded paper-based transactions in favor of digital ones, whether sending money via peer-to-peer mobile apps, paying bills via electronic bill-pay systems, or receiving payments via direct deposit. However, large and small businesses have been significantly slower to adopt digital payment methods.

According to some new findings, nearly half of all business-to-business (B2B) payments are still handled by paper checks.

However, several fast-growing B2B payment trends suggest that we will soon reach the tipping point and that B2B payments will be largely digital in the future.

Five themes hastening the transition to electronic business-to-business payments

1. Faster payments are desired and expected by both the stakeholders of businesses- buyers and suppliers

It can take many days, if not weeks, for paper cheques to show up through mail. Moreover, companies that have seen the advantages of receiving payments through the much faster digital B2B payment options—are no longer willing to elongate the payment cycles. The increasing number of suppliers will demand to get paid faster as they gain experience with faster “real-time” digital payment options.

Furthermore, many corporate payers today are glancing through more efficient payment systems that can help them make their business payments easier. They want to ensure that their suppliers are paid on time, and B2B digital payment systems give them enhanced transparency and transactional information.

2. B2B digital payment options are growing significantly

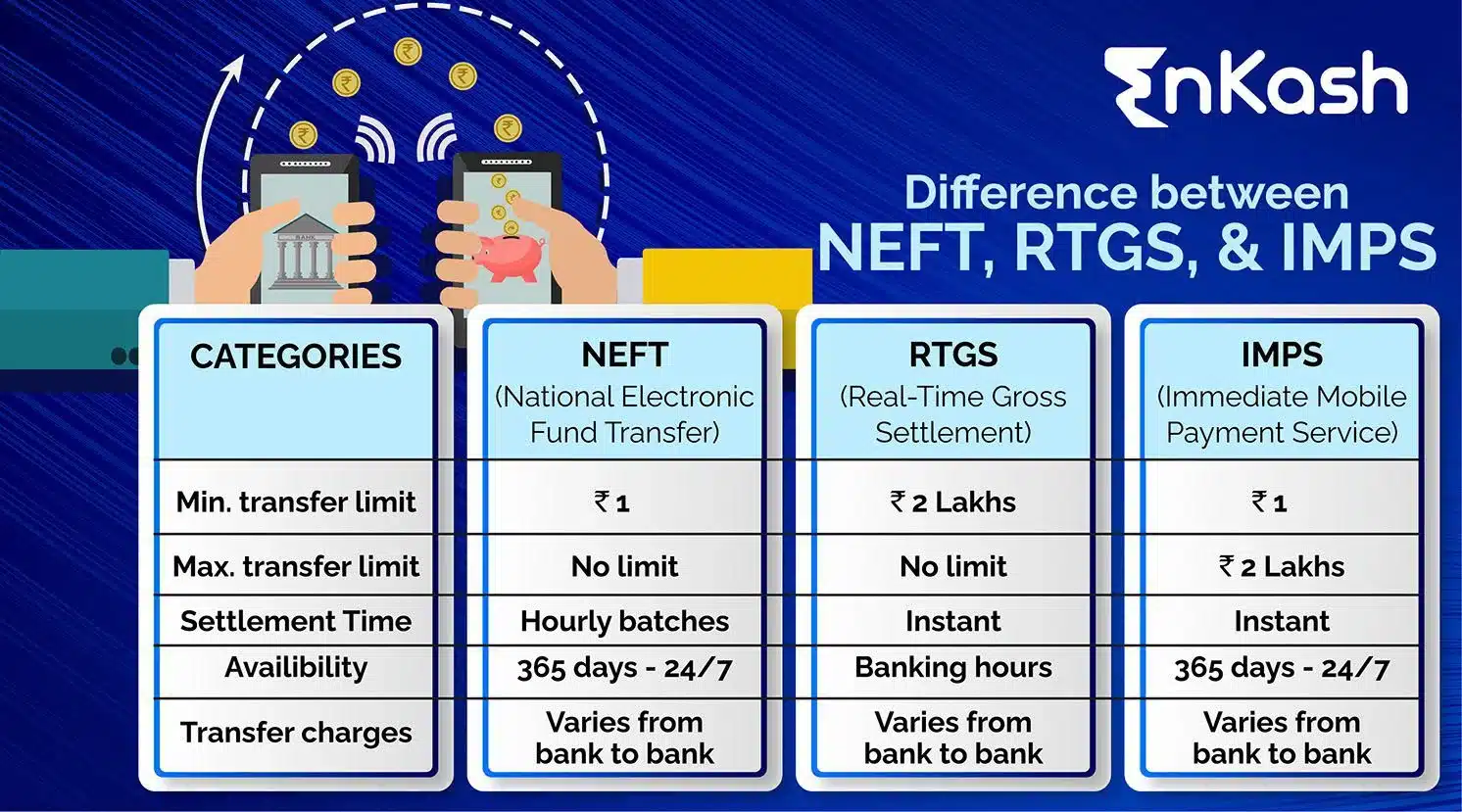

The only viable payment method was paper cheques, which took five to seven business days to clear. However, new B2B digital payment alternatives are rapidly emerging- Real-time payment alternatives that initiate, clear, and settle payments in minutes or even seconds are becoming more popular.

According to recent research, two-thirds of businesses want to shift to real-time digital payments over the next two years.

Another popular option is B2B virtual cards, which allow companies to pay their suppliers more swiftly and effectively while saving money. They’re built to prevent fraud, so they’re far safer than regular commercial credit card transactions.

According to research by one of the top firms, the market for virtual cards is predicted to expand from $197 billion to $338 billion in just two years.

3. Technology that enables businesses to outsource their accounting operations

Businesses may substantially improve their payment procedures and outsource many accounts payable (AP) tasks with today’s technology.

Integrated payables systems, for example, enable businesses to compile a single file with all of the suppliers who need to be paid and the amount owed to them. The integrated payables firm is then in charge of organizing payments with each supplier and selecting the most cost-effective payment method for them, whether it’s digital, virtual card, or even a physical cheque.

Integrated well-designed payables lessen the need for a company’s staff to oversee and review supplier payments, allowing organizations to eliminate manual processing and, in some cases, headcount.

Furthermore, they give businesses additional clarity in payment transactions because buyers can make notations indicating what the payment is for a while, also ensuring that suppliers are receiving payments on time.

4. Early-payment incentives are becoming increasingly prevalent

Because suppliers want to get paid quickly, many have begun offering early-payment discounts to their corporate clients. An early-payment discount is appealing because it is immediately recognized, unlike a refund obtained after the payment transaction.

If a company agrees to pay a supplier sooner rather than later—say, within 10 days rather than 30 or 60 days—they will receive a discount, such as 1% to 2% off their total payment.

The early-payment discount trend is helping to move enterprises toward digital payments because rapid payment timeframes are considerably less practical when a business issues paper cheques.

5. The price of B2B payments is decreasing

The good news is that as the world moves toward digital and more options become available, costs are falling—and are likely to continue to reduce. Paper cheques are costly and time-consuming to issue for purchasers. They can also be more time-consuming due to the physical processes required, which necessitate additional human work and effort.

Digital payment solutions can drastically reduce the average cost per supplier payment. Virtual cards also offer the added benefits of earning substantial rebates to businesses that use these cards frequently to pay off their suppliers.

B2B payments will be more integrated in the future

Keeping up with today’s B2B payment trends ensures that your organization stays competitive in how it pays suppliers while maximizing your potential to make your operations more efficient and effective while reducing costs.

Integrated payables solutions give businesses the best of both worlds by allowing them to offer their suppliers fast, simple, and multiple payment methods. The opportunity to outsource will enable businesses to focus on their core services while also benefiting from the importance of providing flexibility to their suppliers and the possibility of reimbursements.

To know more, visit EnKash.com. You can also click below on Signup Now and we will reach out to you soon.