Our world is changing at a much faster rate than anticipated. With rapidly evolving technology and transformations, our ways of functioning are also changing. As payment systems have evolved, we have progressed from the barter system to various types of payment modes through digital. We could only picture our lives with cash a few years ago, but now we rarely carry cash, especially in metro cities.

Since newer modes of payment are coming up and more businesses are opting for types of payment modes, let’s understand which modes of payment are best for your business.

Introduction to payment modes

Payment modes are different ways in which a person can transfer money from one account to another. Unlike in older times, when the barter system was prevalent and was the only method to get goods and services, now people have come up with different convenient modes to make payment for the goods/services they purchase. These payment modes include cash, cheques, credit, debit, prepaid cards, E-wallets, mobile payments, and much more. Digital payments are also getting more popular because they are more convenient and secure than traditional payment methods. Digital payments also give customers more financial control because they can track their spending and manage their budgets more effectively. In addition, digital payments can be utilized for various transactions, including online shopping, bill payments, and money transfers.

Experience The Ease of Versatile Payment Options

What are the different modes of payment?

There are many different modern payment methods, each with unique advantages and features. Some of the most common payment modes include the following:

- Credit Cards

Credit cards are the types of cards that give users a certain amount of credit that can be used to make purchases, the user can repay this used amount at a later date generally within a month. All credit cards are issued with a specific limit based on the credit score of the applicant. In case a person is unable to repay the amount then it can lead to potential interest charges and accumulation of debt.

- Debit Cards

Debit cards also known as ATM cards are generally those cards that are linked to an individual’s bank account. Every individual gets their own debit card when they open a bank account. These debit cards are widely accepted and can be used to make purchases anywhere and anytime given the fact that your bank account must have the amount you’re purchasing of.

- Prepaid Cards

Prepaid cards are also known as pre-loaded/pre-funded cards meaning, these cards need to be funded with a certain amount in advance. These cards are suitable for gifting purposes and for budgeting, but regular use of these cards can be a bit inconvenient as one has to load the amount in advance every time.

- Cash

Cash is the most traditional form of payment. It is widely accepted, but it can be inconvenient to carry around and there is a risk of theft.

- Cheques

Cheques are a type of payment method that allows you to pay for something by instructing your bank to transfer money from your checking account to the payee’s account. Cheques are less common than they once were, but they are still accepted by some businesses.

- Buy Now, Pay Later (BNPL)

BNPL also known as Buy Now Pay Later is a rather new mode of payment wherein a person doesn’t have to make an upfront payment when making a purchase, and can rather split the cost into installments over a set period, often without interest. It’s a relatively new option that is growing in popularity, especially for online shopping.

- E-wallets

E-wallets are digital payment services that allow users to store and manage their finances online. They are becoming increasingly popular due to their convenience and security. E-wallets enable users to store their credit cards, debit cards, bank accounts, loyalty cards, and other forms of payment in one secure location, making it easier to pay online or in-store without carrying physical cards or cash. Additionally, many e-wallets offer features such as budgeting tools, rewards programs, and other financial services. E-wallets are a great way to manage finances, make payments, and stay secure.

- Mobile payments

Mobile payments refer to mobile devices, such as smartphones and tablets, to make financial transactions. This payment type has become increasingly popular due to its convenience, speed, and security. Mobile modes of payment can be used for various purposes, including making purchases in stores, paying bills, and transferring money to other people. Additionally, many mobile payment services offer rewards and discounts for customers who use their services. Mobile payments are quickly becoming the preferred payment method for many people, as they provide a safe and easy way to manage finances.

- Cryptocurrency

Cryptocurrency uses cryptography for security. This mode of payment is a decentralized form of currency, meaning any central authority, such as a government or bank, does not issue it. Cryptocurrency is often used as a medium of exchange and is typically stored in digital wallets. Transactions are recorded in a blockchain public ledger, which verifies and secures transactions. Cryptocurrency is becoming increasingly popular as it offers a secure and anonymous way to send and receive payments. It is also becoming more widely accepted in various industries, such as online retail, gaming, and banking.

- Electronic bank transfers

Electronic bank transfers allow you to transfer money from your checking account to another person’s account electronically. They are a fast and secure way to send money, but they may require you to know the recipient’s bank account information.

- Online banking

Online banking is one of the convenient modes of payment to manage your finances from the comfort of your home. It allows you to access your bank account information, transfer funds, pay bills, and more. With online banking, you can easily keep track of your spending and deposits and set up automatic payments to ensure bills are paid on time. You can also use online banking to apply for loans, open new accounts, and monitor your credit score. Online banking is a secure and efficient way to manage your finances and stay on top of your financial goals.

Each of these payment modes has unique benefits, so it is essential to consider which one best suits your business’s requirements.

What are the benefits of digital payment modes?

Digital payment modes, like debit cards, mobile wallets, and electronic bank transfers, provide more benefits over traditional cash and checks. Here are some of the key benefits:

Convenience: Considering it’s a digital age, people don’t carry around cash or cheques to make payments as it is very inconvenient. Digital modes of payment like mobile payments are the most used mode these days. Survey says that over 40% of payments being made are done digitally and over 30 crore individuals in India use UPI to make purchases in their day-to-day lives.

Security: Security is also a primary factor to consider when it comes to money. Digital modes of payments are often more secure than cash or checks as all major platforms that enable payment processing have strict security guidelines in place to protect the user’s information. Whereas the traditional modes of payment like cash and check are more prone to the risk of theft and forgery.

Speed: Typically transactions done via checks take a lot of time to clear on the bank’s end raising the need for constant follow-ups. Payments done digitally are much faster and more efficient in comparison. Transactions are processed almost instantly, which can be helpful for online shopping or paying bills.

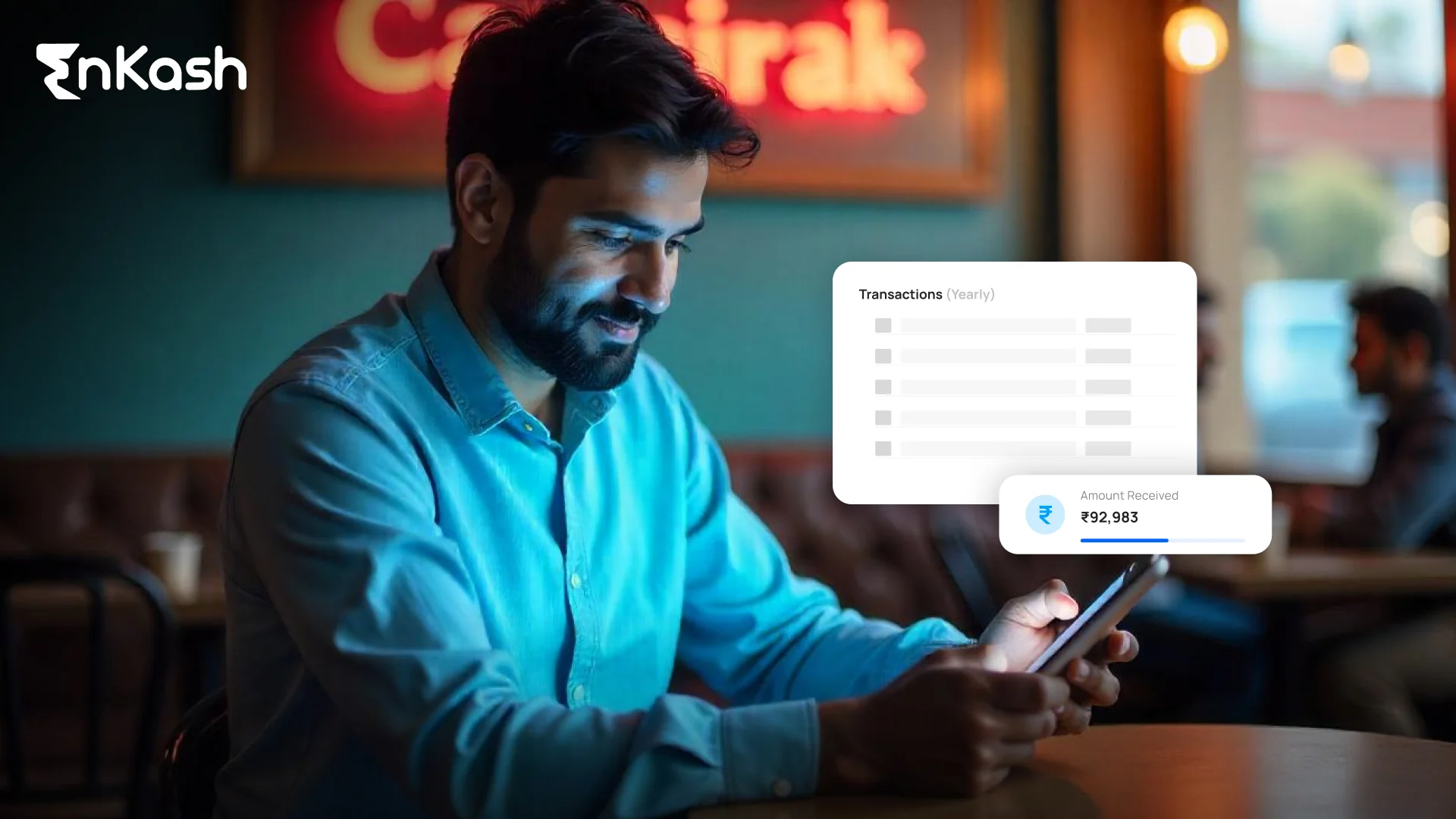

Record-keeping: When it comes to making payments via cash/checks, one does not have a way to access the record of all the transactions unless and until a person notes down the transactions manually every time he/she makes a payment. This problem can easily be addressed using digital payment modes, as whenever a person makes a payment digitally, it leaves a clear record of the transaction, which can be helpful for budgeting and tracking your spending later on.

Rewards: Many modern payment methods offer rewards programs, such as cashback or points that can be redeemed for travel or merchandise.

Which is the best mode of payment?

When deciding which digital payment mode is best for your business, there are various factors to consider. What type of business do you have? Do you have customers who prefer to pay with a credit card? What kind of fees are associated with each payment mode? Are there any security concerns you need to consider? Finally, what type of customer service does each payment mode offer? Considering all these factors, you can determine which mode of payment is best for your business. You can rely on EnKash, which is at the forefront of innovation in the modes of payment, by offering easy and technologically advanced solutions. EnKash is dedicated to assisting businesses with their cash flow management difficulties by utilizing cutting-edge technologies.

Conclusion

Start your digital payment journey today with EnKash, to experience optimization, customization, powerful tools, and the convenience of new-age digital cards for smart controls and a seamless payment experience. So, go digital, go smart today with EnKash’s modes of payment.