The digital rupee was proposed to be launched in 2017 as a planned digital form of the Indian rupee or INR. The digital rupee will be launched and offered via a few select banks and you can use it for transactions from individual to individual or from individual to merchant. Users can carry out transactions with e₹-R via a digital wallet that will be provided by banks included in the launch. You can store digital rupee on mobile phones and devices.

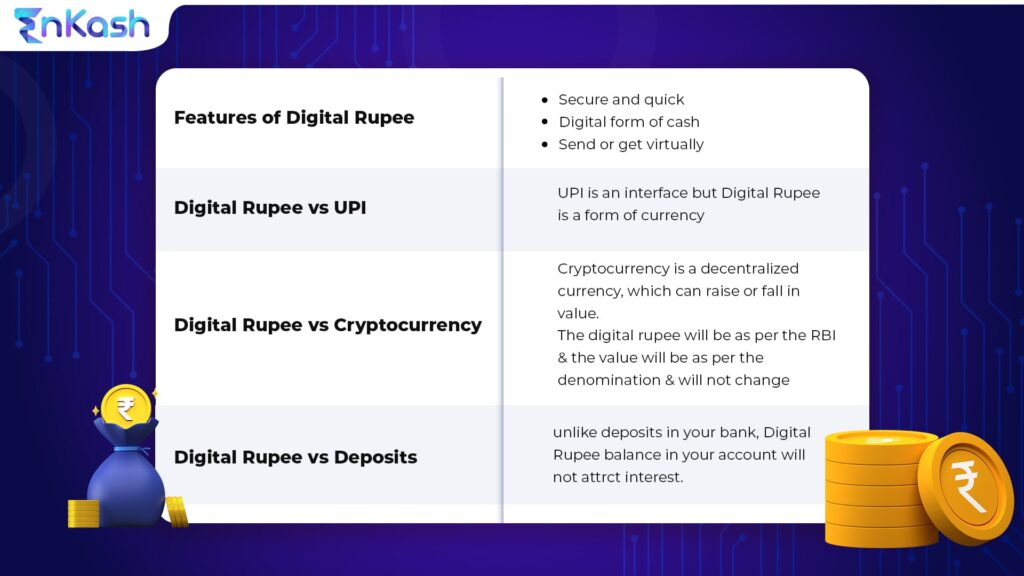

Salient features of the digital rupee

Secure and quick: Unlike the physical form of INR, blockchain technology enables the digital rupee can be transacted securely and in real time.

Digital form of cash: The Digital rupee is the digital or virtual form of rupees and you can avail of all the denominations like the physical currency.

Send or get virtually: You can send digital rupee tokens in digital form with ease instead of physical cash.

Given below are some frequently asked questions about the digital rupee and answers to these queries

Where is the Digital Rupee going to be launched?

RBI currently plans to launch the digital rupee in a controlled manner in a few cities. The cities include Bhubaneshwar, New Delhi, Mumbai, and Bengaluru.

Which banks are RBI planning to partner with to launch Digital Rupee?

RBI has partnered with IDFC First Bank, ICICI Bank, State Bank of India, and Yes Bank for the initial phase of the launch of the digital rupee.

How is Digital Rupee different from UPI?

The question that comes to mind is how is digital rupee different from the UPI. UPI or unified payments interface is a platform or interface that enables online transactions to happen but the digital rupee is a digital currency that will be regulated by RBI (Reserve Bank of India).

How is Digital Rupee different from Cryptocurrency?

The other doubt that most people have is around cryptocurrency and how the digital rupee is different from it. A cryptocurrency is a decentralized form of money that is not bound by the government or RBI. Cryptocurrency depends on blockchain technology for security and cannot be duplicated or counterfeited. Unlike Cryptocurrency, the value of the digital rupee will not fluctuate to go higher or lower. The denomination of the money will be indicative of the value of the digital rupee.

Will the Digital Rupee in your accounts attract interest?

The digital rupee will be the virtual form of INR and different denominations will have a unique identity. Like physical currency is held in wallets, the digital rupee can be held in virtual wallets. Unlike the cash balance in your account, which attracts interest, digital rupee will not attract interest.

Does using the Digital Rupee raise any privacy concerns?

Since the constant change in the market, the growth of the digital economy has been exponential in the past few years. The enforcement directorate of CBDC (Central Bank Digital Currency) has clarified that like the usage of the physical form of the rupee, the authorities will endeavor to ensure digital rupee usage will also remain private and the information will remain between the transacting parties. And the authorities are working actively to address the privacy concerns that have been raised.

Watch this space for more updates on Digital Payments at EnKash, Asia’s 1st & Smartest Spend Management Platform, we always strive to serve our customers by dealing with all matters related to finance. From collateral-free credit limits to managing accounts receivables and accounts payable, EnKash has solutions for your fintech needs.