With the rising digital economy where everything moves quickly, businesses have come to depend heavily on online transactions and seamless payments. For e-commerce, service-based platforms, and subscription models, the role of a payment gateway cannot be overstated, for it guarantees secure, smooth, and hassle-free transactions from the merchant to the customer. With the rise in digital payments, a reliable gateway is not a choice but a necessity. Beyond offering security, it streamlines and enhances user experience, increasing customer satisfaction. This blog explores the benefits of payment gateways, their importance for businesses, and how their efficiency impacts overall financial performance.

What is a Payment Gateway?

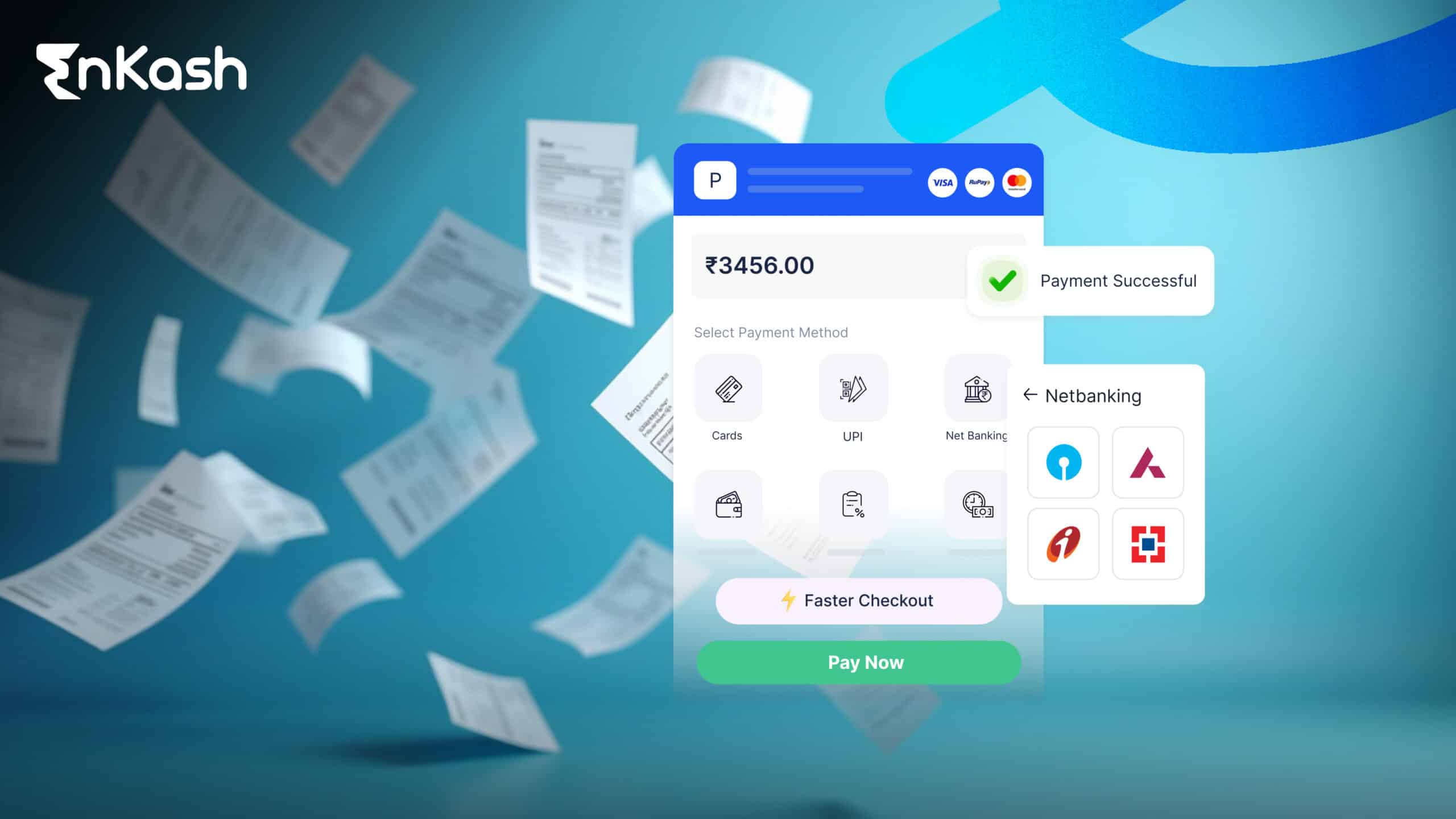

A payment gateway is a technology that facilitates online transactions by securely transmitting payment information between a merchant’s website or app and the payment processor. Acting as a digital bridge, it ensures that payments made via credit cards, debit cards, UPI, net banking, or digital wallets are authenticated, encrypted, and processed seamlessly.

Modern payment gateways need to go beyond basic transaction processing. They should offer advanced security features, global card-saving capabilities, instant refunds, high success rates, and omnichannel support, ensuring a smooth payment experience for businesses and customers. By integrating with a robust payment gateway, businesses can expand their digital footprint, enhance customer trust, and drive revenue growth while maintaining compliance with financial regulations. Whether for e-commerce, SaaS, or enterprise payments, a reliable gateway is the backbone of any digital financial ecosystem.

How Does a Payment Gateway Work?

It consists of multiple steps including safeguarding user information from the moment of payment verification to fund transfer to the merchant’s account. Thus, the payment gateway ensures the timely ordering of various activities for the completion of financial transactions.

Step By Step Guide to Payment Gateway Transaction Process

Step 1: Customer Initiates Payment

The customer selects products or services and moves to the checkout. At checkout, the customer provides payment details, which may include a credit/debit card number, UPI ID, net banking credentials, or digital wallet information.

Step 2: Encryption and Authentication

The importance of a payment gateway lies in the secure transmission of sensitive data and uninterrupted transaction flows. The information is encrypted, and transmission to the acquiring bank securely takes place.

Step 3: Bank Verification

Next, this request is forwarded by the bank to the card network (Visa, MasterCard, or RuPay) or the respective banking system for validation. The payment details will then be validated within the processing bank, which will check the balance of the account belonging to the cardholder and ultimately approve or reject the transaction.

Step 4: Transaction is Approved or Declined

If the issuing bank approves the transaction, the amount is deducted from the customer’s account. If the transaction is declined, the transaction is canceled, and the customer is notified.

Step 5: Settlement of Funds

If the transaction is accepted by the issuing bank, the amount will be deducted from the customer’s account. The transfer of the money takes a few seconds and reaches the merchant’s bank account as per the settlement period (immediately or in a few business days). Everything seems quick and reliable within just a few seconds.

Benefits of Payment Gateway

A good payment gateway integrates with your website or application. Thus making payment collection easy and fast. Let us look at some of the benefits of an online payment gateway, such as reinforced security, multiple payment options, and enhanced speed of processing.

1. Security Enhancements and Fraud Prevention

- Encrypts customer payment details to protect against cyber threats.

- Conformed to PCI DSS (Payment Card Industry Data Security Standards) to make transactions secure.

- Fraud-detection mechanisms, OTP verification, tokenization, and real-time monitoring assist in preventing fraud.

Read more: How a Secure Payment Gateway Protects Online Transactions

2. Accelerated Payment Processing

- Eliminates the requirement to handle payments manually, thereby reducing the risk of human errors.

- Ensures transactions are processed instantly or within the same business day

- Ensures a steady cash flow for the companies, and the timely collection of payments is never a worry.

3. Multiple Payment Methods Supported

- Numerous payment methods are accepted, such as credit/debit cards, UPI, net banking, and wallets.

- To give customers the flexibility to choose their preferred payment methods.

- To minimize cart abandonment by guaranteeing a payment process free from hiccups and hassles.

4. 24/7 Access with Global Reach

- Allows businesses to collect payments anytime, anywhere

- Undeniably enables cross-border transactions, therefore providing their business an international face.

- To remove the dependency from the conventional companies’ banking hours and ensure constant revenue.

5. Automation and Real-Time Reporting

- The entire transaction tracking process is automated and, therefore, reduces human effort and errors.

- The statuses of payments are updated in real-time, enabling businesses to do effective cash flow tracking.

- Duly aids in financial analytics and revenue management.

Why do we need a Payment Gateway

A payment gateway is not just a convenience but a necessity for business success in the digital world. Most businesses keep wondering, why to use a payment gateway. Well, here are some reasons why every business should consider integrating payment gateways into its operations.

Importance of Payment Gateway

1. Secure Transactions

- Secure sensitive financial data from the moment all transactions are encrypted.

- Minimizes the risk of fraud, chargebacks, and data breaches.

- Creates the most secure means of acceptance with PCI DSS compliance and 3D Secure authentication.

2. Business Operations

- Payment operations are automated, minimizing human intervention.

- Saves time and resources by ensuring the streamlining of the financial processes.

- This, in turn, allows businesses to focus on their core growth strategies rather than concerns to do with payment.

3. Builds Trust Among Customers

- A secure and smooth payment process improves customer faith.

- Trusted payment gateways reduce hesitations among customers during their online purchasing.

- Professional-looking checkout experiences lead to customer satisfaction and repeated purchases.

4. Creates Opportunities to Scale Business

- As business grows, payment gateways will provide support, maintaining seamless operations for high-volume transactions.

- This opens the opportunity to deal in multiple currencies and transact in other countries.

- Continues to support the evolving business needs by integrating with numerous platforms and technologies.

Also read: Everything You Need to Know About Payment Gateways in India

Choosing the Best Payment Gateway

Choosing the best payment gateway isn’t based solely on factors affecting security but also on user experiences. Businesses need to take their time evaluating their choices carefully to ensure transaction processes run smoothly.

1. Security and Compliance

- The payment gateway should be high-end encrypted and capable of detecting fraud.

- It should be PCI DSS-compliant, as it is a security standard that would protect customer data.

- It also needs to offer additional security features such as tokenization and two-factor authentication.

2. Ease of Integration

- It should seamlessly integrate with your business’s website or mobile application.

- Look for providers who have APIs and SDKs that support easy integration with the workflow in place.

- Ensure that the platform supports different e-commerce platforms and payment processors.

3. Transaction Fees

- Key factors for comparing providers include processing fees, hidden costs, and settlement duration.

- Check about flat-rate pricing and per-transaction fees when it comes to the payment gateway.

- Check for any additional costs associated with larger volumes of transactions or benefits afforded to them.

4. Customer Support

- Choose the payment gateway provider that renders constant 247 support and provides services for issues concerning transactions on an instant basis.

- Make sure support is available through a variety of channels, such as chat, email, or phone.

- A reliable customer service team can prevent transaction failure, minimizing downtime in business operations.

Future of Payment Gateways

The next big transformation in digital payments will be driven by rapid technological advancements. Here are the most important changes and trends anticipated to characterize the coming generation of payment solutions.

1. Emerging Trends in Digital Payments

- Increasing Acceptance of Cryptocurrencies – A growing number of entities are beginning to allow Bitcoin, Ethereum, and similar types of currencies as legal tender.

- Growth of Integrated Finance – Businesses are weaving their products into non-financial platforms to provide a more seamless experience for their customers when it comes to payments.

- Cross-Border Payments – Payment gateways will extend international limits with multi-currency and real-time forex conversion functionality.

2. Role of AI and Blockchain in Payment Security

- AI-Based Fraud Detection – Artificial Intelligence enhances fraud detection by analyzing transaction patterns and identifying suspicious activity in real time.

- Blockchain Technology for Safe Transactions – Highly decentralized and tamper-proof, blockchain technology enhances transparency and reduces fraud.

- Smart Contracts for Automation – Automated and error-free processing of payments without intermediaries occurs in blockchain-based smart contracts.

3. Rise of Contactless and Biometric Payments

- Growth of NFC and QR Code Payments – Contactless payments through NFC-baked devices and QR codes are steadily becoming a popular growing alternative for user speed and convenience.

- Fingerprint and Facial Recognition – Biometric authentication is expected to provide greater security and do away with passwords and PINs.

- Wearable payment devices – Worn devices equipped with payment features, like a smartwatch or fitness band, will make transactions more convenient.

Payment gateways in the future will be secure, fast, and AI-powered innovations to enrich customer experience and minimize fraud. These need to be utilized by business modules to keep businesses alive in the developing digital economy.

How EnKash is changing the Payment Gateway Space

Another indication of the importance of a payment gateway to the economy is that EnKash supports seamless digital payments. It goes on to provide a modern approach to revolutionizing online transactions by building efficiencies in business. Here’s how EnKash is making that difference:

1. RBI-Approved Payment Aggregator

EnKash is one of the few entities to have received the Payment Aggregator license from the Reserve Bank of India. This license further ensures compliance with industry security regulations and financial standards and provides businesses with a highly trusted platform to transact digital dealings securely.

2. Safe and Speedy Payment Transactions

Advanced encryption and fraud prevention technologies are adopted by EnKash to safeguard transactions, minimizing risks due to online payments like data breaches and cyber fraud. All the while providing immediate and uncomplicated transaction settlement that significantly improves cash flow.

3. A Wide Range of Payment Options

Being a scalable and growth-centric platform, the EnKash payment gateway caters to both the B2B and B2C segments. With 100+ payment options, such as UPI, net banking, credit and debit cards, auto-pay, NEFT, and more, businesses across industries can leverage EnKash to collect payments with ease and in record time.

4. Scalable, Flexible, and Customizable API Integration

With simple API integration, businesses can seamlessly incorporate payment solutions into their systems. This flexibility benefits startups and large enterprises alike, offering customizable solutions tailored to their needs.

5. NPCI Partnership with EnKash for the Digital Payments’ Reason

B2B invoice payments integration into the Bharat Bill Payment System (BBPS) increases speed and reduces errors in the processing of bills. This will add efficiency to digital payments across industries.

Fastrack your Payment Collection. Try EnKash Payment Gateway

Conclusion

The benefits associated with a payment gateway, from securing transactions to providing options for multiple payments, are immense. Businesses should select a secured payment gateway to ensure customer trust in operations, minimize efforts in operations, and scale seamlessly.

EnKash is changing the face of online digital payments, allowing businesses to enjoy the flexibility and safety they need for sustained success. With its innovative solutions and regulatory compliance, EnKash continues to shape the future of online transactions.