Managing expenses is an essential aspect of personal and professional financial management. Keeping track of expenses can provide valuable insights into your finances, including where your money is being spent and how much you are saving. This is where expense management can help you make informed decisions regarding your financial goals and future plans.

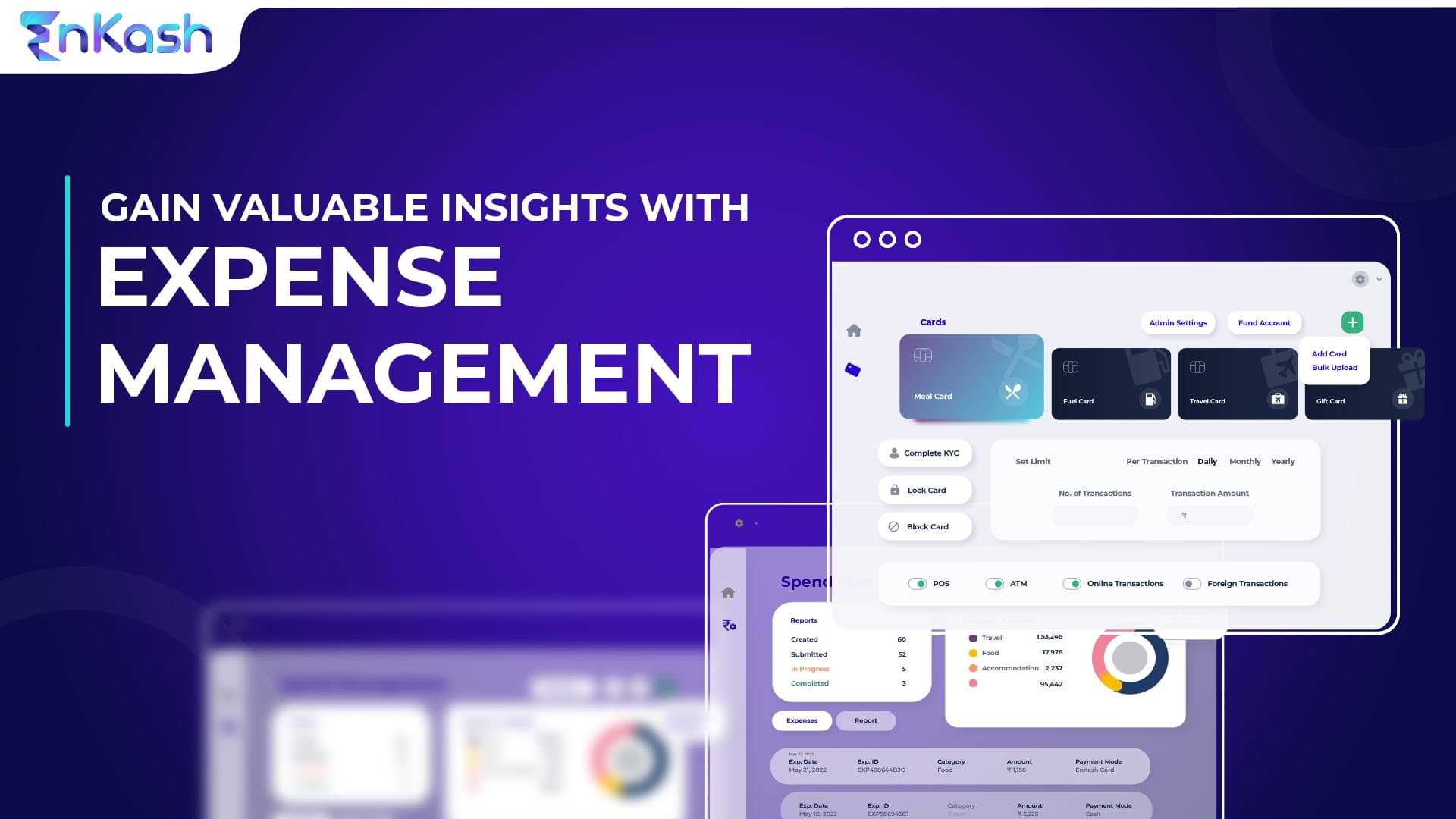

Many options are available today, from mobile apps to online expense-tracking systems. With various spend management tools and resources, you can automate the process of tracking your expenses and receive real-time updates on your spending behavior. Therefore, by using these expense management platforms, you can track, analyze, and optimize your business expenses.

Read on to learn more about expense management and its importance, how to implement an effective management system for your business, and common mistakes to avoid. Also, learn how to categorize and track business expenses for maximum efficiency.

Expense management and spend management

Expense management refers to individuals’ or organizations’ processes and strategies to control and track expenses. This includes managing expenses such as travel, office supplies, equipment, and other business-related costs.

Expense management can involve various activities, such as creating budgets, monitoring spending, tracking expenses, analyzing financial data, and identifying ways to reduce costs. By managing expenses effectively, individuals or organizations can ensure they spend their resources wisely and maximize their financial efficiency.

Spend management has become an integral part of financial management for businesses as it helps optimize expenses and improve profitability. Therefore, many spend management providers offer systems that enable businesses to monitor and control their spending more effectively.

These systems provide various spend management tools, such as expense tracking, budget management, and invoice processing. They also help businesses streamline their financial operations and make informed decisions about their spending. Furthermore, with the help of a spend management system, companies can reduce unnecessary expenses and allocate resources more efficiently, leading to improved financial outcomes.

Importance of expense management

It is essential for individuals, businesses, and organizations to maintain financial stability, achieve financial goals, and ensure efficient use of resources. Here are some reasons why expense management is important:

- Financial control: It helps individuals and businesses control their financial resources. It ensures that expenses are tracked, reviewed, and maintained, which prevents overspending and helps to identify areas where expenses can be reduced

- Cost reduction: Effective expense management helps businesses and organizations identify and reduce unnecessary expenses. It can help companies to negotiate better deals with vendors, streamline processes, and reduce overhead costs

- Budgeting: Expense management helps individuals and businesses to plan and allocate resources effectively, set targets, and track progress toward achieving financial goals

- Cash flow management: Expense management is also necessary for managing cash flow. By closely monitoring expenses, businesses can ensure that they have enough cash to cover expenses and meet financial obligations

- Compliance: It is essential for ensuring compliance with legal and regulatory requirements. It helps to maintain accurate financial records, which are necessary for tax reporting, auditing, and other compliance requirements

Common expense management mistakes and how to avoid them

Managing expenses is critical for running a successful business, and avoiding common mistakes can help you save money and improve your bottom line. There are several common expense management mistakes that businesses make, and here are some tips on how to avoid them:

- Need for a clear expense policy: It is essential to have a clear expense policy that outlines what expenses are valid, how to submit expenses, and what type of documentation is required. With a clear policy, employees may make correct assumptions about reimbursable expenses, leading to clarity and disputes

- Not enforcing the expense policy: Having an expense policy is one thing, but implementing it is another. Ensure that managers consistently enforce the policy and employees are aware of the consequences for violating it. This will help ensure that everyone is following the rules

- Manual expense management: Manual expense management can be time-consuming and prone to errors. Consider implementing an automated expense management system to streamline the process and reduce the risk of mistakes

- Not tracking expenses in real-time: Waiting until the end of the month to submit expenses can lead to delays and make it more difficult to track expenses accurately. Encourage employees to submit expenses in real-time so that you can follow them and address any issues as they arise

- Not reconciling credit card statements: Make sure you conform to credit card statements regularly to ensure that all expenses are accounted for and there are no fraudulent charges. This is especially important if you have multiple employees using company credit cards

- Not conducting regular expense reviews: Conduct periodic expense reviews to identify trends or patterns indicating waste or abuse. This will help you identify areas to reduce expenses and improve your expense management processes

The EnKash platform offers businesses an efficient and streamlined solution to manage their expenses effectively. It enables businesses to track their expenses accurately and make data-driven decisions to optimize their spending. Its user-friendly interface and comprehensive features, such as real-time spending analysis and expense categorization, are noteworthy.

Moreover, the platform offers seamless integration with accounting software and easy expense reimbursement for employees, making it a one-stop shop for all expense management needs. By using EnKash, businesses can save time, reduce costs, and improve their financial management practices, ultimately leading to increased profitability and success. Sign up with EnKash today!