Credit cards can be a convenient and useful tool for managing expenses and building credit scores. While using credit cards can be advantageous, it is essential to prioritize making timely payments. Late payments can result in incurring late fees, leading to potential damage to your credit score. By staying on top of your payments, you can avoid the burden of accumulating fees and maintain a positive financial outlook. Thus, staying organized and implementing the best credit card bill payment practices is crucial to avoid late fees and keep your credit card account in good condition.

One of the most practical ways to avoid late fees is to set up automatic payments for your credit card bill payment. This ensures that your payments are always made on time, even if you forget or are occupied with other things. Additionally, it is essential to keep track of your payment due dates and budget accordingly to ensure that you have enough funds to cover your credit card payments. By staying organized and implementing these best practices, you can avoid late fees’ stress, financial burden and enjoy the benefits of using credit cards responsibly.

Read on to learn more about credit card bill payments, the importance of staying organized with credit card payments, bill pay service, bill payment offers, tips to avoid late credit card payments, and how to choose a suitable payment method.

What do you mean by credit card bill payment and bill payment offers?

Credit card bill payment means settling the outstanding balance with the issuer on a credit card account. Using a credit card for purchasing or withdrawing cash involves borrowing money from the card issuer, which incurs interest if not fully paid by the end of the billing cycle. While charges are only incurred with late or partial payments for purchases made on credit cards, cash withdrawals are charged even if repaid on time.

The credit card bill payment process usually involves the cardholder reviewing the statement of account. This contains a summary of all the transactions made during the billing cycle and any fees or charges incurred. The cardholder can make full payment, pay a portion of the balance, or meet the minimum payment demanded by the card provider. Some credit cards also allow for an EMI (equated monthly instalment) option to restrict the interest amount.

On the other hand, bill payment offers are promotional deals or discounts offered by companies or service providers to incentivize customers to pay their bills on time. These offers can come in various forms, such as cashback, reward points, discounts, or other perks.

Bill payment offers are designed to encourage customers to stay with a particular company and make timely payments while providing additional value or benefits. For instance, a credit card company may offer cashback or reward points for paying your monthly statement balance on time. In contrast, a utility service provider may provide a discount for enrolling in automatic bill payments.

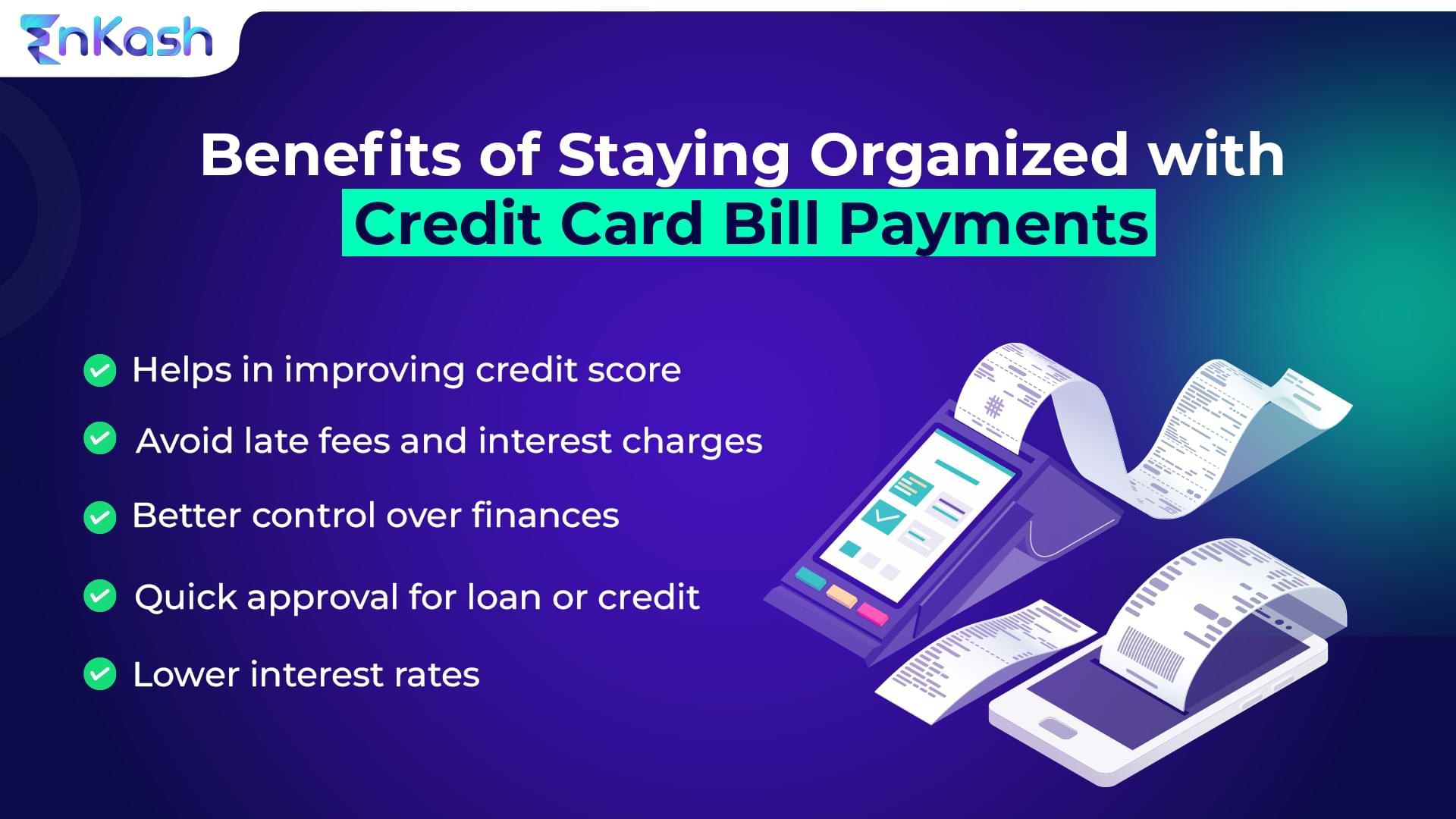

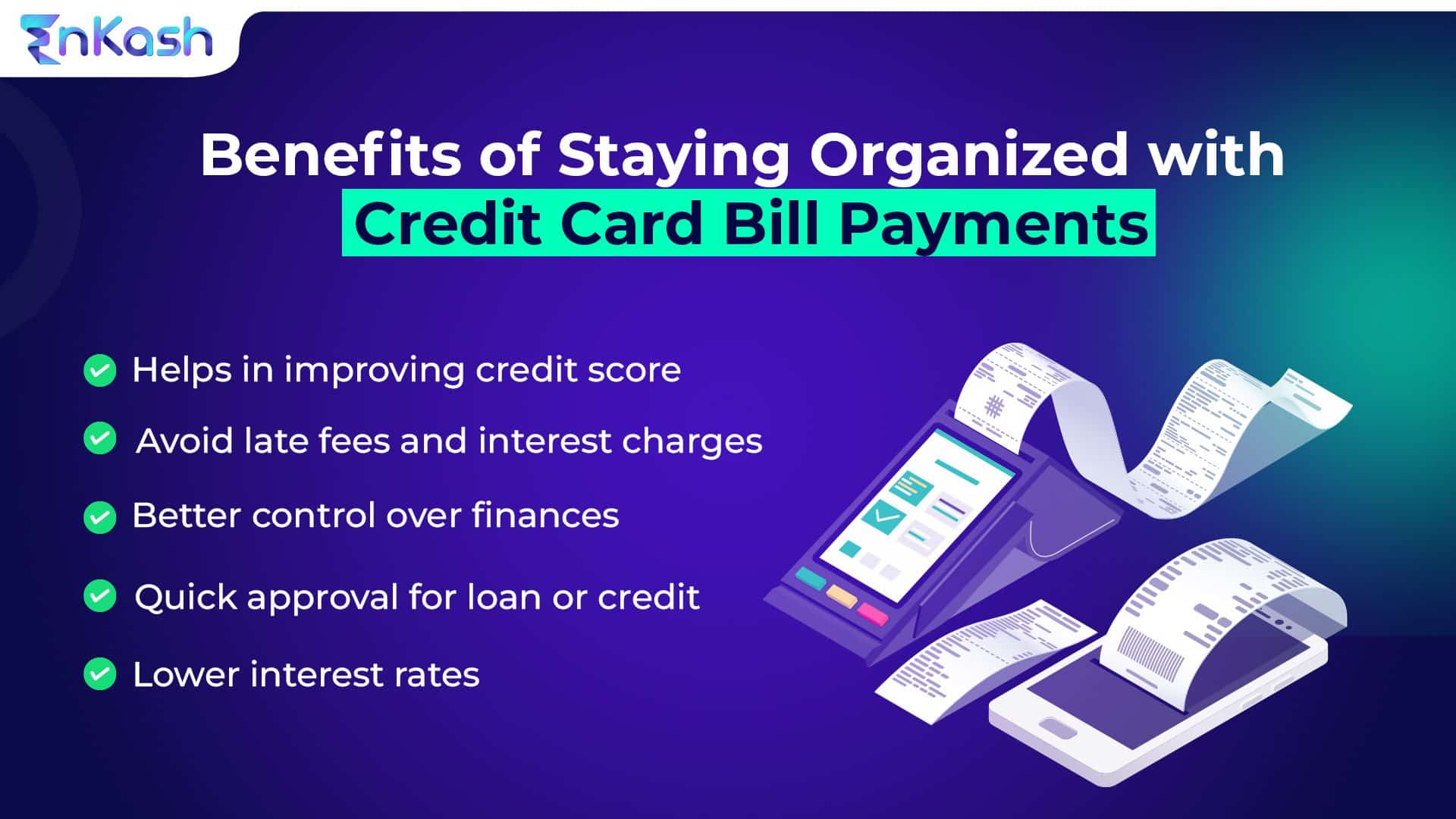

Importance of staying organized with credit card bill payment

Keeping track of due dates, payment amounts, and statements is crucial for making timely and accurate payments. This can help your company achieve its financial goals. Hence, staying organized with credit card bill payments is important for several reasons:

- Avoiding late fees and charges: Missing a credit card payment deadline can lead to late fees and interest charges. These charges can accumulate rapidly, ultimately increasing your overall credit card balance

- Maintaining a good credit score: Make payments on time to ensure that your credit score is accurate, as payment history is crucial. Hence, paying your bills promptly every month can assist you in preserving a favourable credit score

- Saving money: By staying organized and making timely credit card bill payments, you can avoid costly fees and interest charges, saving you money in the long run

- Improving financial management: Staying on top of your credit card bill payment can also help you improve your overall financial management. It helps you to stay aware of your spending habits and budget accordingly

What should you do to avoid late credit card bill payments?

To avoid late credit card payments, you can follow these tips:

- Set up automatic payments: Most credit card issuers offer the option to set up automatic payments so that your credit card bill can be paid automatically each month and ensure that you have the requisite funds to meet this obligation. This is a great way to ensure that all your payments are completed on time

- Set up reminders: If you do not want to have automatic payments, you can establish reminders for paying your bills. This can be achieved by configuring notifications on your phone or computer or using a budgeting application

- Create a budget: Crafting a budget enables you to monitor your spending and guarantee that you possess sufficient funds to settle your bills on time

- Pay attention to due dates: Make sure you know when your credit card bill payment is due each month, and try to pay it a few days in advance to avoid any potential issues

- Use online banking: Most credit card issuers offer online banking services, making tracking your payments and managing your account easier

How to monitor credit card statements for accuracy?

Monitoring your credit card statements is important to ensure that all charges on your card are accurate and authorized. Below mentioned are some steps you can take to monitor your credit card statements for accuracy:

- Review your credit card statement: Take the time to review your statement every month carefully. Look for any charges you don’t recognize or errors in the statement

- Check for fraudulent charges: Look for any unauthorized charges on your statement. In case you notice any fraudulent charges, report them to your credit card company immediately

- Keep track of your receipts: Keep receipts safe and compare them to your credit card statement to ensure that all the charges match up

- Sign up for alerts: Many credit card companies offer alerts that notify you of unusual charges on your account. Sign up for these alerts to catch any potential fraud at an early stage

- Use online banking: If your credit card company offers online banking, use it to monitor your account regularly. This way, you can quickly check your balance, view recent transactions, and report any errors or fraud

EnKash is an excellent spend management platform for credit card bill payment or bill pay services due to its user-friendly dashboard and comprehensive features. It lets users quickly pay their bills online or through a mobile app, saving them time.

EnKash offers a wide range of payment options, including credit or debit cards issued by their trusted banking partners, net banking, and UPI. Its robust security measures ensure users’ payment information is safe and protected, giving them peace of mind while making transactions. Hence, EnKash is an ideal payment method for businesses looking for a reliable, secure, and convenient way to pay their bills. Start your EnKash journey now!