As a small business or startup, you are often faced with managing many aspects of your operations with limited resources. As a result, you may miss some vital aspects not directly connected to the development of your core business, such as human resource management (HR management).

For instance, some compliance-related tasks cannot be ignored. If you do so and this is discovered, it could result in penalties, loss of business reputation, and other dire consequences. When dealing with certain entities, either within India or abroad, they require the company to comply with local HR laws before they sign a contract with you.

In this article, we will examine the HR compliance checklist that you as a startup or small business owner should follow.

What is HR Compliance?

HR compliance is the concept of following the relevant laws and regulations surrounding the conduct, management, and administration of employees in an organization. Such provisions are aimed at safeguarding the rights of employees, ensuring equal opportunities at the workplace, and keeping the organization’s activities within the law. Compliance covers a broad scope of aspects such as payroll and employee benefits, compliance with safety practices, working hours, recruitment, and taxation.

In the case of new enterprises or small companies, HR compliance is very important for preventing potential legal suits, penalties, or loss of reputation. It is important to ensure that the organization adheres to the various local and national employment practices while at the same time promoting a conducive work environment. It entails ensuring that the policies and actions of a firm with respect to its employees are consistent with the relevant employment laws such as those related to taxation, discrimination, benefits, and health safety.

HR compliance is a continuous exercise, therefore businesses are expected to cope with the changing labor laws in the economy. When start-ups take care of the HR compliance requirements, they create a positive environment for growth and expansion, promote employee morale, and minimize any legal risks that may threaten the organization.

Here’s the checklist that you need to adhere to:

Why is HR Compliance So Essential?

HR compliance is crucial in ensuring that employees are protected as well as in ensuring the success of the business entity. It makes certain the company practices its operations legally, the work environment is safe and just, as well as the relationship between the employees and the employer is cordial. This is why HR compliance is so essential.

1. Avoiding Penalties and Fines

In a business structure where the human resources unit is not compliant with the legal requirements, there are serious implications that are attached for instance loss of business money through payment of penalties or even lawsuits. For instance, payment of wages below what is required by law, tax evasion, and violation of health and safety codes could lead to huge fines, depending on the extent of the violation. For start-up level and small businesses, such penalties could be very adverse economically, taking the focus off the business development and expansion

2. Safeguarding the Company’s Reputation

When a business operates within the requirements of the law and meets labor regulations, such a business is perceived as responsible and dependable. This kind of image can encourage more business, attracting clients, investors, and even job seekers. On the contrary, a negative image because of non-compliance, for example, can ruin the company so much that there will be a loss of business.

3. Improving Employee Satisfaction and Trust

Working in a workplace that is compliant with the laws and standards makes the employees feel appreciated and encourages them. When companies follow labor codes and pay the necessary portion for benefits, it shows that the enterprises care for the employees. This kills work-related stress but nurtures loyalty hence decreasing the turnover rate. An environment that encourages compliance also promotes trust, a sense of safety, and openness, which are all factors that contribute to productivity and growth.

4. Ensuring a Healthy Workplace

Ensuring HR compliance, it also means that all safety standards in the workplace are met thus the chances of people getting injuries or health conditions are minimal. When a safe working condition is maintained and the relevant safety regulations are followed, the business protects its workers from harm and lessens the chances of incurring expensive compensation claims or litigation from employees.

5. Ensuring Business Continuity

The business activities of such a business will be at risk of being interrupted by legal or financial issues. Firms that comply with the demands of HR are less exposed to risks such as audits and lawsuits that threaten their operations and lead to interruptions. Such stability is of utmost importance for new entrepreneurs and small enterprises trying to establish themselves in saturated markets.

Statutory Compliance in HR

Statutory compliance in HR refers to the mandatory legal obligations that businesses must meet to ensure that they are operating within the framework of the law. These legal requirements aim to safeguard the rights of employees and promote fair treatment within the workplace. Statutory compliance regulations differ from country to country and may vary based on state, industry, or region.

It can also be noted that in the case of India, statutory compliance involves the following:

- Provident Fund Compliance (PF): Making sure that the way ordinary citizens save for their retirement, the government provides an Employer’s contribution and/or Employee’s contribution in terms of an employee’s provident fund, which is a compulsory retirement benefit scheme.

- Employees’ state insurance or ESI: To ensure that employees have health and health insurance in case they are sick, injured, or involved in accidents; offered irrespective of whether it’s work-related or not.

- Payment of Bonus Act: Any wage-earning employee whose wages are above the limit specified in the Payment of Bonus Act is entitled to a bonus that is calculated based on the profits of the establishment where he is working and the salaries of the employees in that establishment.

- Gratuity Payments: Gratuity, often referred to as the ‘end of service’ payment, is given to employees upon resignation after serving the organization for a specified period.

- Leave management: This includes abiding by the stipulated paid leaves which incorporate many public holidays, maternity leaves, and sick leaves as applicable under the law.

- Occupational Health and Safety: The rules should be strictly adhered to in order to maintain proper organization and conditions at the workplace.

- Inability to adhere to statutory clauses: It may yield penalties, fines, or audits. Thus, companies need to keep pace with the progression of these requirements to counter any risks and avoid legal actions.

HR Compliance Roles and Responsibilities

Labor laws and all the laws and regulations governing the treatment of employees are binding on every organization and Human Resource Management is at the heart of the organizational processes that facilitate compliance. The scope of the department includes numerous other aspects like policy formulation, record management, taxation and benefits administration, training, internal controls, and supervision of activities among others.

The HR department plays a key role in maintaining compliance through the following responsibilities.

- Policy Development and Implementation: Every HR practitioner has the role of developing HR policies, revising them, and implementing them to the letter as well as respecting the labor laws. This pertains to safety at the workplace, leave, wages, and level of harassment and discrimination among other policies. In those cases when a law changes, the policies must change as well.

- Employee Records Maintenance: HR must provide complete and current information and documents on every employee, such as signed contracts, payment details, attendance and leave records, tax information, and performance appraisals. Such documentation is imperative for compliance audits and tax submissions.

- Tax and Benefits Administration: HR makes sure that the computation of tax withholding measures such as TDS which is tax deducted at source among other local taxes, and professional tax is done accurately and remitted on time to the respective bodies. Further, HR takes care of promoting officials’ statutory expectations, which include, but are not limited to, provident fund provision, insurance, and timely remittance of systems.

- Training and Awareness: Strategies on how to inform employees of their rights and duties in response to employment laws fall within the HR scope. Training may also comprise anti-harassment or workplace safety and tax compliance external workshops. HR also makes sure that the senior managers and leaders are aware of the implications of the employment laws and how they have effectively enforced by the organization’s policies.

- Compliance Audits and Reporting: Helps in carrying out assessments on labor laws and employment regulations’ observance within the firm on a regular basis. This also includes reporting to the appropriate parties including the government agencies and tax authorities wherever necessary. Regular audits help bridge the differences in compliance and enable the correction of current and future situations.

- Risk Mitigation: Any threats in regard to compliance such as changes in tax policies, new laws, or hazards in the work environment are identified and dealt with by the HR. This enhances avoiding any potential lawsuits, fines, and even negative publicity to the organization.

By effectively managing these responsibilities, HR helps ensure that the business operates smoothly within the confines of the law while fostering a fair and compliant workplace.

What does the HR compliance checklist for startups look like?

The human resource department, while not directly connected to the business aspects of your company, plays a vital role in ensuring that your most important resources—are taken care of.

Also Read: Essential HR Policies for a Startup Company

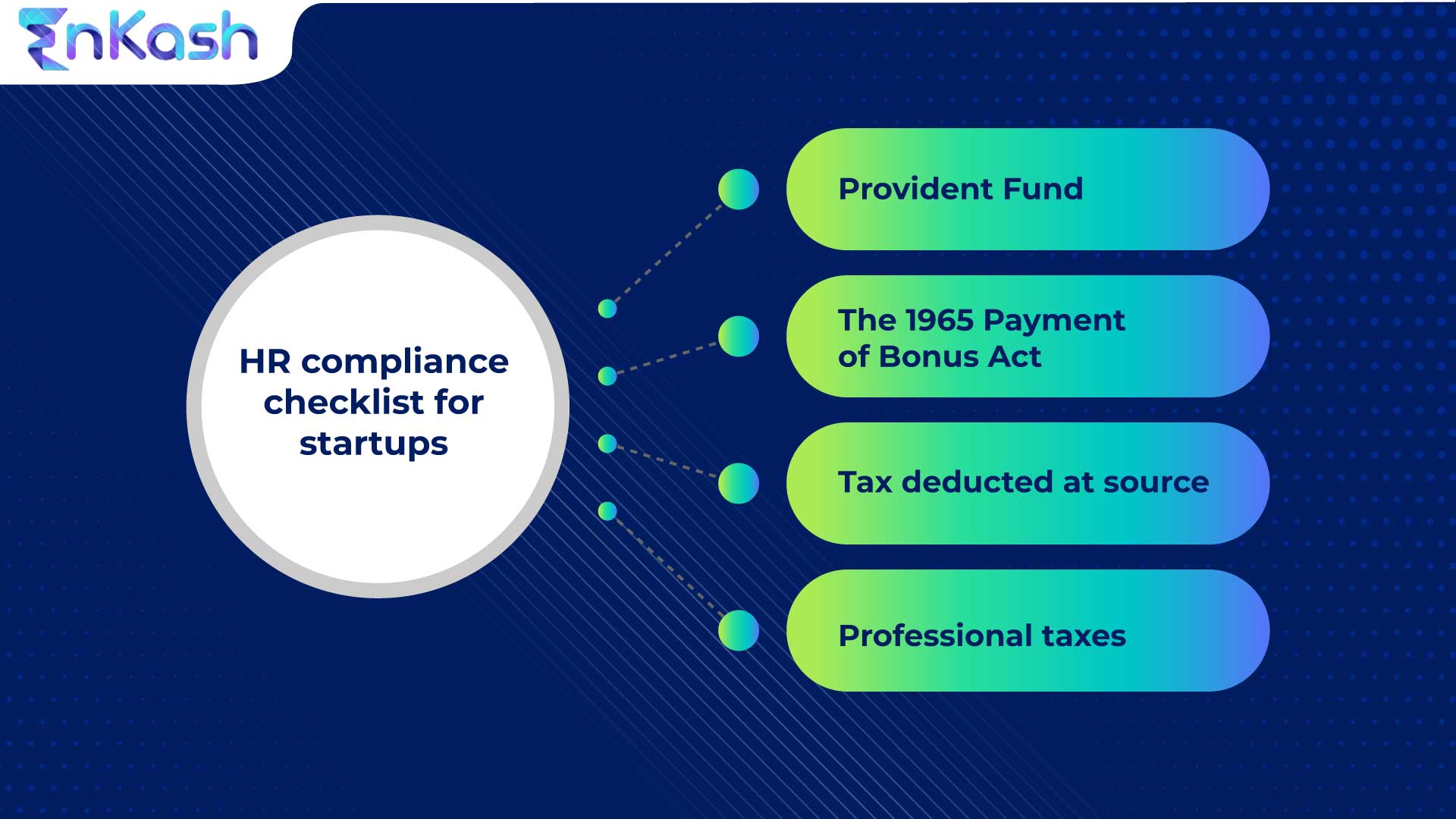

Apart from ensuring the well-being of employees with safe premises, offering market-relevant remuneration, and having practices like POSH, Leave Policy, Maternity Leave Policy, Travel Reimbursement Policy, and other such processes, there are some compliance-related aspects that you need to take care of. Here’s the checklist that you need to adhere to:

HR Compliance checklist for startups

Provident Fund

Provident fund or PF as it is called is a vital component of HR compliance. A part of the employee’s salary is (the employee can choose to have a percentage higher than mandated by the government) added to the provident fund and a contribution of the minimum percentage mandated by the government, comes from the company.

PF can be either state-run or companies can create a trust to manage provident funds. The PF amount can be withdrawn by the employee when he or she retires or is given to the family in case of the employee’s death. Non-compliance with PF has dire consequences for the business and should be taken seriously by companies.

The 1965 Payment of Bonus Act

The employer must provide a bonus to employees under this act if the business has 20 or more employees. The bonus is determined by the profits your company makes and the salary of the employee. If an employee works 30 days and has a salary less than INR 21000, then they need to be paid a bonus for the current financial year. The range for bonus payment ranges from a minimum of 8.33% to a maximum of 20%. Employees who are caught in a fraudulent act will not qualify for the bonus payment.

Tax deducted at the source

Tax deducted at source or TDS, as it is called is another aspect of HR compliance. The Central Board of Direct Taxes (CBDT) monitors this deduction. The income tax department considers the tax deducted at source when you file your taxes to ensure the right deductions have been made. You can consider perquisites like education allowance, medical allowances, investments, leave travel concession, etc while calculating TDS as these have an impact on the TDS amount.

Professional taxes

Each state government requires professional tax to be applied to individuals who earn in the state in any profession. The HR department must determine the applicable tax slab in the state where the business operates to ensure the correct amount is deducted. There are certain union territories and states in India where the professional tax may not apply and the HR team has to take this into account while deducting professional tax.

HR compliance is mandatory as per the law and can attract serious penalties if not followed. However, the responsibility of the department does not end there. There are many aspects, such as payroll, safety, welfare, etc., that an HR department must be mindful of.

At EnKash, Asia’s first and most innovative spend management platform, we are committed to extending support through our smart fintech solutions. We offer facilities like purpose-made cards to be used for HR-related functions like fuel, rewards and recognition, reimbursements, travel and entertainment expense management, and more. Visit our website to learn more.

Gratuity Act

The Gratuity Act applies to those employees who have completed at least five years of continuous service in an establishment. The main purpose of this Act is to ensure the financial stability and safety of employees even after they are no longer working with the organization whether on retirement, resignation, or any other reason. The calculations on the gratuity depend on the last salary drawn by the employee and the term (in years) served on the employee, therefore, gives nutrition after serving them for a long time.

Maternity Benefits

The Maternity Benefits Act obliges the employer to provide a female employee on maternity leave with twenty-six weeks’ paid maternity leave. This is effective for industries with 10 or more employees. This is beneficial to the female employees who may go on maternity leave without the fear of not having a salary throughout the period, thus concentrating on their health. Whereas it is imperative to respect the existing law, it is equally important for the promotion of women’s rights and employee welfare.

Labor Welfare

Labor welfare promotes the right to proper working conditions, limited weekly working hours, and access to welfare amenities, including health and recreation, to which individuals are entitled. It is a fundamental concern in ensuring employees’ healthy and productive workings. Ignoring the labor welfare policies may lead to penalties and destroy the image of the corporation which will affect the staff retention and loyalty in the long run.

Employee Contracts and Documentation

Having written employee contracts eliminates ambiguity in issues such as job descriptions, payments, benefits, and policies of the employers and employees. These contracts assist in minimizing conflicts by stating the intricate details of employment. Based on the documentation, the parties understand the relationship and its expectations which help avert or deal with disputes or legal issues

Employment Law

Employment Laws and Policies stipulate that the management should take proper care and protect the personal and sensitive information of its employees. This has become very pertinent especially as the value placed on an individual’s record has greatly risen. Using the Personal Data Protection Bill, no employee’s private details will be exposed to unwanted elements, which would in turn protect the firm’s reputation from possibly facing legal implications.

Health and Safety

Occupational health and safety rules should be strictly adhered to promote proper organization and condition at the place of work. This entails ensuring proper health and safety practices are observed, carrying out risk control surveys frequently, and providing appropriate protective equipment and facilities to the employees. In addition, regular medical examinations and compliance with health regulations help to reduce accidents and ill health in the workplace thereby promoting the safety of the employees and the organization.

Points to Remember for the HR Compliance Checklist

When it comes to the HR compliance checklist implementation, both startups and small businesses should take into consideration the following points:

- Regular Updates: With the laundry list of compliance requirements, there is no doubt that some will be added while some will be removed. This therefore means that the checklist will have to be updated whenever any country’s statutes change or new laws come into play.

- Employee Awareness: Every employee must know his or her rights and duties. In addition, everybody must know what is allowed and what is not in the organization so that there is no misunderstanding or non-compliance.

- Proper Record Keeping: There should be perfect execution of all human resource services to make the records clear for purposes of audit and to prevent conflicts.

- Regular Audit by External Parties: Conduct regular audits by third-party professionals to verify that all laws are observed.

- Develop a Compliance Calendar: Implement a time frame within which strict deadlines will be imposed for every statutory obligation such as tax payment, filing returns, and necessary annual audits.

Why Do Startups and Small Businesses Need an HR Checklist?

Startups and small businesses typically operate with limited resources and may face a steep learning curve as they grow. One aspect that is particularly missed out in the early stages of growth is HR compliance. An HR checklist provides the ability to maintain employee-related issues and in themselves, the legal requirements of the business.

For instance, for a small business organization in this case, HR work-related cases assigned to HR personnel like tax filing, payroll, employee benefits health and safety, etc., can be said to be responsible. Learning from a checklist, a startup can be able to prevent normal HR functions from going wrong, mitigate some legalities in the process, and finally address all issues that need addressing about the business whether inclusive of all the requirements or not.

Some of the advantages of an HR checklist are:

- Keeping everything in order: Assists in recording important HR-related activities and their respective deadlines.

- Avoiding noncompliance: Ensures that all the legal requirements are fulfilled which helps to avoid incurring penalties.

- Improvement of employee morale: Women and men in an organization are assured of equity and even entitlement to the Board a chance of benefits.

- Facilitating activities: This diminishes the task of a small business person by providing a stepwise approach to HR activities.

- In the end, a cost-effective hr checklist can help manage growth from the very beginning and prevent any legal issues associated with the business.

Components of an HR Checklist for Startups

An HR checklist for startups should consist of various components so that all the legal and regulatory obligations are adhered to. The following is an outline of what should be set forth:

- Employee Documentation: Make sure that all the relevant documents such as employee contracts, offer letters, and background checks are available.

- Payroll Processing: Making sure that wages, taxes, and benefits are calculated and paid correctly and on time.

- Providing Fund (PF) Contributions: Making sure there is an employer and employee contribution to the provident fund.

- Professional Tax Rates and Deductions: Following the state’s relevant tax and regulation based on the state of business.

- Employee Benefits: Administering provided for health care, maternity, and sick leave insurance among other legally provided benefits.

- Workplace Safety: Assurance of adherence to occupational health and safety procedures and measures.

- Tax Filings: Adhering to tax regulations by calculating and deducting the correct TDS from employees’ salaries.

These components should be done periodically to reflect the changes in the laws and also to ensure the compliance levels are maximum.

Also read: Best HR practices for small businesses

What is the Purpose of an HR Compliance Checklist?

An HR compliance checklist’s primary aim is to offer a concise and systematic method of achieving compliance with the various legal and regulatory requirements that businesses face. For young and budding businesses, the HR compliance checklist is of the following importance:

1. Systematic Approach to HR Tasks

An HR compliance checklist aids in the accurate performance of important HR functions such as payroll administration, tax remittances, management of employees’ benefits, and even workplace safety, which is often a process of complex timelines or steps. It provides clarity for the HR department, ensuring they do not overlook any important tasks.

2. Minimizing Possible Fines

Adhering to the checklist allows businesses to be more forward-thinking and accomplish any assignments due before the timeframe expected, thus lowering the chances of failing to complete the task and incurring fines for noncompliance as a result. This assists in containing the legal and financial obligations that might jeopardize the existence of the business.

3. Streamlining HR Processes

The list enables the HR departments to be well-coordinated and effective. It assists in the control of routine HR functions, lessens the variation in difficult compliance issues, and cuts down on the workload. This frees the HR unit to handle other critical areas, such as employee engagement and development.

4. Protecting the Business

The list serves a further function as a safeguard to the business in that it helps to deal with concerns relating to legalities and finances. It also protects the business from threats due to non-compliance with labor, health, safety, and employee protection. The soundness of this protection is essential for the business’s viability over time.

5. Ensuring a Compliant Working Culture

In the end, every HR compliance checklist plays the role of fostering a working environment that is compliant, open, and free from any negativity.

Leverage the power of streamlined payroll processing with EnKash!!

FAQs

What exactly is compliance in human resource management?

HR compliance is the process of keeping all your HR policy procedures in line with the laws, ethics, regulations, and any other factors that apply to your organization and modifying them in case there are new developments. It is one of the major functions within HR.

What is the checklist for compliance in human resources?

This is a checklist that helps employers ensure that they are complying with all the employment laws and regulations relevant to them. Its contents often include employment contracts, minimum wage, hours of work, equal pay and discrimination, data protection, health and safety matters, and policies relating to termination of employment.

How does HR compliance affect employee trust and satisfaction?

Adhering to HR compliance demonstrates care for employee rights, ensuring fair treatment, timely benefits, and a safe work environment. This fosters trust, loyalty, and higher job satisfaction among employees.

How can early-stage companies ensure HR regulatory compliance?

Early-stage companies can achieve compliance by:

- Being aware of current employment laws and regulations

- Keeping and updating all employee files

- Performing compliance checks regularly

- Establishing specific HR directives

- Using HR management tools for payroll and tax compliance

Define Statutory compliance HR

It means complying with fulfilling the extensive legal requirements established by governing policies. This includes adhering to acts like Provident Fund (PF), ESI, Payment of Bonus, Gratuity, Maternity Benefits, and more. Learn more about statutory compliance in HR.

How is HR ensuring compliance?

The HR department outlines and puts into effect rules and procedures, keeps records of employees, manages health insurance, taxes, and other benefits, performs compliance checks, and creates educational programs for staff and management.

Provident Fund

Provident fund or PF as it is called is a vital component of HR compliance. A part of the employee’s salary is (the employee can choose to have a percentage higher than mandated by the government) added to the provident fund and a contribution of the minimum percentage mandated by the government, comes from the company.

Also Read: 7 Benefits of Payroll cards for Employees

PF can be either state-run, or companies can create a trust to manage provident funds. The PF amount can be withdrawn by the employee when he or she retires or is given to the family in case of the employee’s death. Non-compliance with PF has dire consequences for the business and should be taken seriously by companies.

The 1965 Payment of Bonus Act

The employer needs to provide bonus to employees under this act if they are a business with 20 or more employees. The bonus is determined by the profits your company makes and the salary of the employee. If an employee works 30 days and has a salary less than INR 21000, then they need to be paid a bonus for the current financial year. The range for bonus payment ranges from a minimum of 8.33% to a maximum of 20%. Employees who are caught in a fraudulent act will not qualify for the bonus payment.

Tax deducted at source

Tax deducted at source or TDS as it is called is another aspect of HR compliance. The central board of direct taxes (CBDT) monitors this deduct. The income tax department considers the tax deducted at source when you file your taxes to ensure the right deductions have been made. You can consider perquisites like education allowance, medical allowances, investments, leave travel concession, etc while calculating TDS as these have an impact on the TDS amount.

Professional taxes

Each state government requires professional tax to be applied to individuals who earns in the state in any profession. The HR department needs to find the slab in the state in which the business is to deduct the right amount. There are certain union territories and states in India where the professional tax may not apply and the HR team has to take this into account while deducting professional tax.

The HR compliance is mandatory as per the law and can attract serious penalties if not follow. However, the responsibility of the department does not end there. There are many aspects like payroll, safety, welfare, etc., that a HR department has to be mindful of.

At EnKash, we believe in extending our support through our smart fintech solutions. We offer facilities like purpose-made cards to be used for HR-related functions like fuel, rewards and recognition, reimbursements, travel and entertainment expense management, and more. Visit our website to learn more.