Today, ensuring your business is up and running consistently is considered a necessity. With the increasing competition, any break in your supply of goods or services to your customers can result in lost orders and revenue.

One of the aspects that you need to manage to ensure your business runs seamlessly is ensuring that you meet your payment obligations on time. However, as your company expands and the number of vendors and third parties you need to pay for increases, your finance department will find it difficult to manage payments.

When you look at a payment process individually, it looks simple enough. Match the invoice amount with the order specifications, check whether the delivery was agreed upon, and start the payment process. However, any finance team will tell you it is not as simplistic as stated.

First of all, most businesses are dealing with numerous vendors and suppliers and not one. Another layer of complications is added when considering that your business will likely have branches and departments that place orders independently. Add to this discrepancies due to differences in the quality and quantity delivered.

Moreover, due to audits and to overcome manual errors, companies have a three or four-level approval process to dispense payments. There is a request to pay after checking on the details, checking the facts, and the approval process, which could consist of multiple levels.

At EnKash, we realize businesses need a simple mechanism to help them make bulk payments. And our smart platform offers a solution to help with this.

Let’s start by looking at what bulk payment means and the benefits of bulk payment.

Bulk payment, or bulk payout, is the mass processing of payments at once. Companies will often opt for bulk payout when several payments are to be made simultaneously, like payroll or contractual payments. A single account, owned by the company, is used to make the payments.

The bulk payment option allows you to check all the payment details before clicking the button to activate the payment.

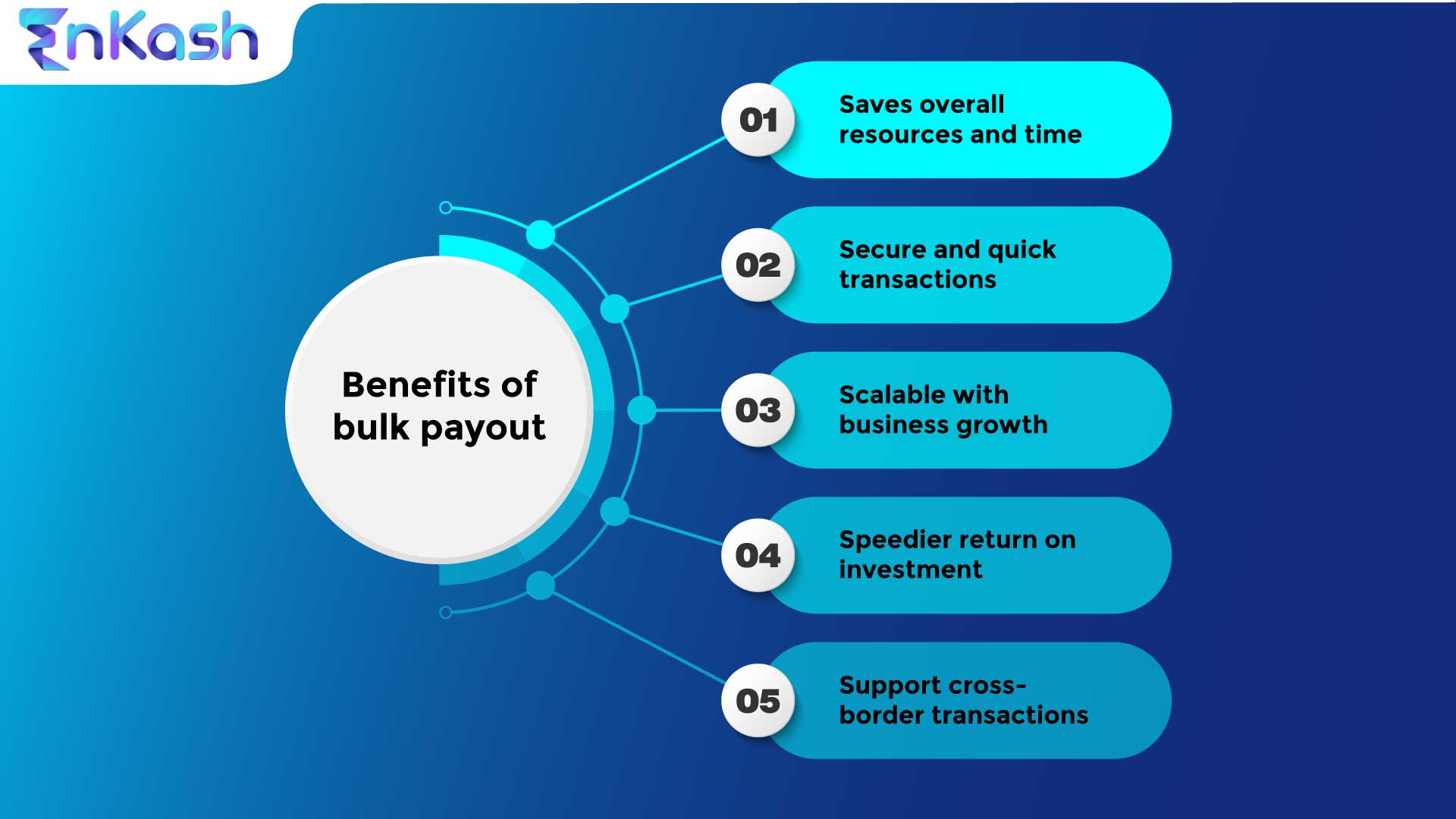

What are the benefits of bulk payout?

Saves overall resources and time

As mentioned earlier, the process of checking the invoices and making payments manually can be a long and laborious process that can take a large team and a lot of time. With bulk payout or batch payments, the process can be automated to take less time and use minimal resources.

Secure and quick transactions

Bulk payments adhere to bank security guidelines or the security measures that payment gateways implement, which minimizes the chance of fraud or delay. There are also built-in security measures like checks and approvals within the system even before the payment is dispensed, which ensures added measures.

Scalable with business growth

As your business grows, you need a robust mechanism to make timely payments to vendors, contractors, and employees. A bulk payout solution grows to accommodate your changing business needs, making it completely scalable and adaptable to changing circumstances.

Speedier return on investment

With a bulk payout module in place, you will see a dramatic increase in the productivity of your finance team as they are freed from mundane and repetitive tasks. The increased satisfaction from your vendors will ensure that you get quality goods on time at excellent rates. The drastic reduction in paperwork will promote increased speed. All these factors add up to substantial savings and faster ROI.

Supports cross-border transactions

Businesses today grow across borders, and to do that, you must have the means to make international or cross-border payments. With an array of secure options, bulk payout supports cross-border transactions easily and with complete security.

Some of the most common use cases which businesses leverage bulk payout are for payments that include rent, payroll, vendors, and more.

What are the features and types of bulk payout?

As you have already seen, bulk transfers or bulk payouts have various benefits. Here are some notable features of the bulk payments:

It is flexible

You have many options for bulk transfer or bulk payments, which include NEFT (National Electronic Funds Transfer), IMPS (Immediate Payment Service), and RTGS (Real-Time Gross Settlement). It becomes easier to pick the option that suits your business.

They can be automated

Bulk payouts can be scheduled (checked, approved, and payment amounts added) before the due date to ensure that they go out on time without any human intervention. This means that your team can use their time for maximum efficiency.

It supports many file formats

You can use different file formats like Excel sheets, CSV, or XML files to upload the data required for bulk payments. This means that your team can use the file formats that they are comfortable without having to make any changes.

Real-time tracking

When you use the bulk payout option to bulk transfer funds, it also allows you to track the status of payments sent and completed in real time without any delays. With this feature, you can track your cash balance in real time for further steps.

Integration with existing finance software

It is easy to sync the feature for bulk payout or bulk transfers within your existing system to enable a single source of truth.

Types of bulk payout

The types of bulk payout include Immediate Bulk Payments, Next-Day Bulk Payments, and Future-Dated Bulk Payments.

Challenges that you can face with bulk payments

While bulk payouts can be a blessing in many ways, they can also pose some challenges that one needs to be aware of to avoid any issues in the future.

Lack of updated information

To make bulk transfers, the critical challenge is to ensure that your finance team has the latest data. For instance, for payroll processing, it is vital that the list of employees and their latest compensation is updated on time, or it could lead to issues.

Security concerns

Since bulk payouts require you to collate sensitive information related to identity and financial aspects, there is always an issue with the security of data. This can be overcome with the use of the right technology and security protocol.

Payment discrepancies or errors

With the need to collect, correct, and update bulk data required for bulk transfers, the chances of wrong payments or missed payments increase.

Regulatory requirements

There are specific protocols and processes that a business has to follow to ensure that bulk transfers occur on time and without issues, which can sometimes be a challenge.

Tips to implement bulk transfer successfully

While the process to implement bulk transfer will differ from one solution to another, here’s a logical process flow you can follow to ensure successful bulk payment transfer implementation. Please ensure that your team is aware of all there is to know about online transfers and has a guide to the dos and don’ts.

- Check what is the format that your bulk transfer solution will accept

- Fetch the data from the system

- Check the details like name, bank account, amounts to be transferred, IFSC code, and other details if any

- Get the approvals for the bulk transfer after checking the fund availability

- Upload the data within the system, select the mode for transfer, the date and time, and then press the buttons required to take it forward

EnKash is Asia’s first and smartest spend management platform that has been transforming how growing businesses manage their financial operations. With a robust technology layer over regular financial operations, it adds security, speed, and efficiency to the way your finance team works.

Many modules in our smart spend management platform support bulk payout and optimize your financial operations.

Still confused about bulk payouts or bulk transfers? Please refer to the FAQs below to get clarity.

Why does a business need to use bulk payments?

Bulk payments are not only safe and quick but will also help your finance team manage payments like payroll, dividend payments, rent, etc., with maximum efficiency. You have various options to choose from when it comes to bulk transfers.

How much training does my team need to execute bulk payouts?

Even with manual financial management, your team is likely to be doing some level of bulk payouts. With the change over to electronic bulk payouts, the staff will have to be trained on basics like how to upload, how to check details of payment and the security precautions they should take while using bulk transfer.

What is the process for updating bulk transfer details in my core system?

With a solution like EnKash, there is a quick and real-time update of details of bulk payouts to your core finance system with minimal delay. You do not have to undertake a manual process to do this.

How to handle audit concerns around bulk payments?

Set up processes that enable your staff to have maker, checker, and approver levels to ensure that there is a definite audit trail. Moreover, ensure that the system is updated at once to also mitigate audit concerns.

What role does technology play in ensuring security and speed in bulk transfers?

The use of the right technology will ensure that the data related to bulk transfers is encrypted without compromising security concerns or affecting the speed of processing.