Introduction

For businesses operating in India, verifying the credentials of potential business partners is crucial, and a key aspect of this verification process involves checking the validity of a Goods and Services Tax Identification Number (GSTIN), a unique alphanumeric code assigned to every registered taxpayer. This ensures smooth transactions, protects you from fraudulent activities, and helps you comply with tax regulations in India. You can search GST number by PAN, search GST number by name, and do a GST search by number as well. In this article, we will learn how any individual can GST number search in India both online and offline in a step-by-step process

What Is GSTIN?

The Goods and Services Tax (GST) is a comprehensive indirect tax regime implemented in India in 2017. It replaced a multitude of state and central-level indirect taxes, streamlining the taxation process. Every business exceeding a specific turnover threshold or voluntarily opting for GST registration receives a unique 15-digit GST Identification Number (GSTIN). This number acts as a vital identifier for businesses involved in the supply of goods and services under the GST regime and facilitates the collection and deposition of taxes levied on goods and services.

What is a GST Number Search?

A GST number search, also known as GSTIN verification, allows you to confirm the legitimacy and validity of a business’s GST registration. The process involves entering a GST Identification Number (GSTIN) into a designated search tool and retrieving details about the registered taxpayer.

Why Conduct a GST Number Search?

Verifying a GST number offers several benefits:

Prevents fraudulent transactions: By confirming the legitimacy of a business’s GST registration, you can protect yourself from fake companies or those involved in tax evasion.

Ensures accurate tax credit claims: When dealing with registered businesses, you can claim an input tax credit (ITC) on the GST paid on purchases. Verifying the GST number ensures you claim credit from a legitimate taxpayer.

Facilitates smooth business transactions: A valid GST number streamlines business processes and avoids delays due to discrepancies during tax filing.

Reduces compliance risks: Validating the GSTIN confirms that the business is registered under the GST regime and authorized to collect and deposit taxes. This safeguards you from potential issues with tax authorities.

Read more: How to pay gst online with enkash

GSTIN Format

Understanding the format of a GSTIN is essential for proper identification and verification. Here’s a breakdown of the 15 digits:

First two digits: These represent the state code of the Indian state where the business is registered.

Next ten digits: These correspond to the Permanent Account Number (PAN) of the business entity.

Thirteenth digit: This represents an entity number within the state (ranging from 0 to 9).

Fourteenth digit: This is a fixed character ‘Z’ by default.

Fifteenth digit: This is a check digit generated using a specific algorithm to ensure the validity of the GSTIN.

For example, if a business in Maharashtra with PAN ABCDE1234F obtains its first GST registration in the state, its GSTIN might look like 27ABCDE1234F1Z6.

How to Search GST Number

There are three primary ways to search and verify a GST number in India:

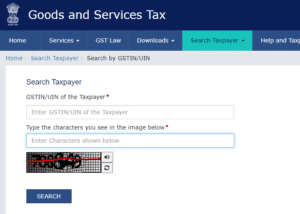

Using the GST Portal (With GSTIN/UIN):

The official GST portal offers a free and convenient method for GST number search. Here’s a step-by-step guide:

- Visit the GST portal (https://www.gst.gov.in/)

- Click on the “Search Taxpayer” option on the homepage

- Select “Search by GSTIN/UIN” from the drop-down menu

Enter the 15-digit GST number you want to verify in the provided field

Enter the 15-digit GST number you want to verify in the provided field - Enter the CAPTCHA code displayed on the screen

- Click on “Search”

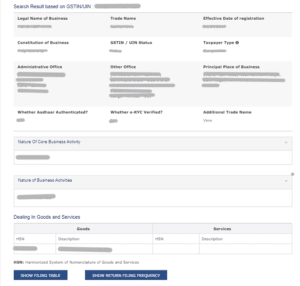

The portal will display the details of the taxpayer associated with the entered GSTIN, including:

- Legal Name of Business

- Trade Name

- Date of Registration

- Constitution of Business

- Taxpayer Type

- GSTIN/UIN Status

- Administrative Office

- Other Office

- Principle Place of Business

Read more: Types of GST in India

Read more: Types of GST in India

Using the GST Portal (With PAN):

Follow the below steps to search GST number by PAN:

- Go to the official Goods and Services Tax (GST) portal of India

- On the GST portal homepage, locate the “Search Taxpayer” section. This might be displayed as a tab or a dropdown menu

- In the “Search Taxpayer” options, select “Search by PAN” from the drop-down. This will direct you to a specific search bar for PAN-based GSTIN lookups

- In the designated field, carefully enter the Permanent Account Number (PAN) of the taxpayer whose GSTIN you want to search

- A captcha image will appear to confirm you’re a real user. Type the characters displayed in the captcha image accurately

- Once you’ve entered the PAN and completed the captcha, click the “Search” button

- The portal will display the details of the GST registration(s) associated with the provided PAN

This information might include:

- State and status of the GST registration(s)

- Individual GSTIN number(s) (if applicable)

Additional notes:

- You can search for multiple PANs one after another

- By clicking on a specific GSTIN displayed in the results, you might be able to access further details about the registered business, such as name, address, and nature of business (depending on portal functionalities)

Using Third-Party Tools:

Several reputable websites and applications offer GST number search functionalities. These tools often provide additional features like bulk verification, historical data access, and integration with accounting software. However, it’s crucial to choose reliable platforms with a proven track record of data accuracy and security.

Important Note: While third-party tools can be convenient, the official GST portal remains the most authoritative source for GST number verification.

Other ways to check the GST number

While the methods mentioned above are the primary ways to verify a GST number, there are a few additional resources you can explore:

Government Websites: Certain government websites, like those of state tax departments, might offer functionalities to search for GST-registered businesses within their jurisdiction.

Company Websites: Reputable companies often display their GST number on their official websites for transparency purposes.

Invoice Verification: If you have received an invoice from a business, check if the mentioned GST number is printed on it. You can then proceed with verification using the methods mentioned earlier.

It’s important to remember that these alternative methods may not always provide comprehensive details or guarantee complete accuracy.

Check GSTIN Validity Status

Verifying a GST number not only confirms its existence but also checks its validity. The GST portal displays the current status of the GSTIN as “Active” or “Cancelled.” Dealing with a business with a canceled GST number can lead to complications in claiming ITC and pose potential legal issues.

Additional Tips for Conducting GST Number Searches

Always double-check the GSTIN: Typos can lead to inaccurate results.

Beware of fake GST registrations: If the search results are unavailable or seem suspicious, consider contacting the tax authorities for further verification.

Maintain a record of your searches: Keep a record of the GSTIN searches you conduct for future reference and compliance purposes.

Utilize additional verification methods: While GST number searches are valuable, consider combining them with other verification methods like contacting the business directly or checking their online presence.

Final Takeaway

Verifying a GST number is a crucial step in safeguarding your business interests and ensuring smooth financial transactions. By utilizing the methods outlined in this guide, you can efficiently search and confirm the validity of GST numbers, fostering trust and compliance in your business dealings. Remember, prioritizing the official GST portal for verification and staying vigilant about potential discrepancies are key aspects of responsible business practices in the Indian GST regime.