If you own a business, you might have come across a need to raise working capital finance. While the traditional way of going about it is to go to banks and other such financial institutions, however in today’s world, it is not the only recourse!

With a digital revolution ongoing in the financial world, fintech companies have cropped up in recent years to help in securing working capital finance.

Ways to Raise Working Capital Finance for Business

These fintech organizations are a boon for small businesses since their processes are less stringent and need less documentation. Whereas most small businesses avoid going to banks for fear of being denied a loan, fintech firms may provide the same service.

One another mode of raising working capital finance is marketplace lending. Also commonly known as peer-to-peer lending, this mode of raising funds is fast becoming popular among micro-enterprises.

In recent years, it has come to light that the majority of small businesses struggle to raise working capital finance. This could be due to various reasons, such as a lack of foresight and planning for high-risk assessment by credit companies. Therefore, there is a big opportunity for moneylenders to jump in. This not only aids in the survival of a firm but also adds to the services and jobs it provides for the country’s growth.

It is also a win-win for marketplace lenders because there is a huge scope to enjoy the potential rewards of such a partnership.

While banks and financial firms are more stable, the benefits offered by banks do not reach all. Most of the benefits of working capital finance from banks go to businesses that have a good credit score. For small businesses that are still dependent on cash payments without maintaining proper ledgers, banks are a no-go. This is where P2P or marketplace lending shines.

This type of lending is classified as NBFC and is rapidly being adopted for raising working capital finance. It takes into account the idle wealth of individuals and turns them into working capital finance required by businesses.

It also eliminates the limitations brought to the fore by geography. When businesses are separated by miles of land, going to banks is not always a possibility. Some banks will not have a physical branch at said location. Moreover, covering long distances to secure working capital finance is not a smart choice. This can be bypassed with marketplace lending.

P2P lending does not care for physical borders or state lines. With the power of the internet and Pan India operations, marketplace lending transactions can happen from anywhere, anytime. It doesn’t matter where the business is located, working capital finance can be made available from the lender who lives in a different part of the country.

Marketplace lending also addresses the disparity between different industry sector needs. While banks can be more generous towards industries that are doing well, they might not be willing to take a risk on sectors that have less than stellar records or profits in the future. Also, a repeat customer for a bank is a reliable customer but a new business in the same sector may not be the same. This is where marketplace lending comes into even the field. By bringing in individuals from different places and with different objectives, marketplace lending ensures that no business is left behind.

If you’re a startup, the working capital loan for startups and VC working capital finance is probably what you need. But if you’re a micro-enterprise, marketplace lending of working capital finance could be one way to secure funds for your business purposes such as hiring new personnel, buying new equipment, etc.

Today, as more and more avenues and opportunities are being opened and people are moving into the digital age, the scope for businesses and entrepreneurs will only grow upwards. The Indian marketplace lending space makes use of the idle wealth of individuals while helping them build a portfolio of assets.

Also Read: Electronic payment for businesses

Current Market Size And Working Capital Finance Of Marketplace Lending

While online marketplace lending is currently a small component of the loan business, it is a rapidly developing and dynamic sector. The U.S. market is now dominated by prime and near-prime consumer unsecured working capital finance, followed by small company loans and student loans.

Market experts anticipate a $1.0 trillion potential market for online marketplace lenders and working capital finance origination volumes of $90.0 billion by 2020.

Online marketplace lenders are now beginning to offer mortgage and vehicle loans, albeit this is still a small portion of the total industry. Companies are now marketing directly to customers willing to refinance corporate cards, small companies neglected by financial institutions, students looking to refinance current student loans, and individuals purchasing vehicles using non-bank financing.

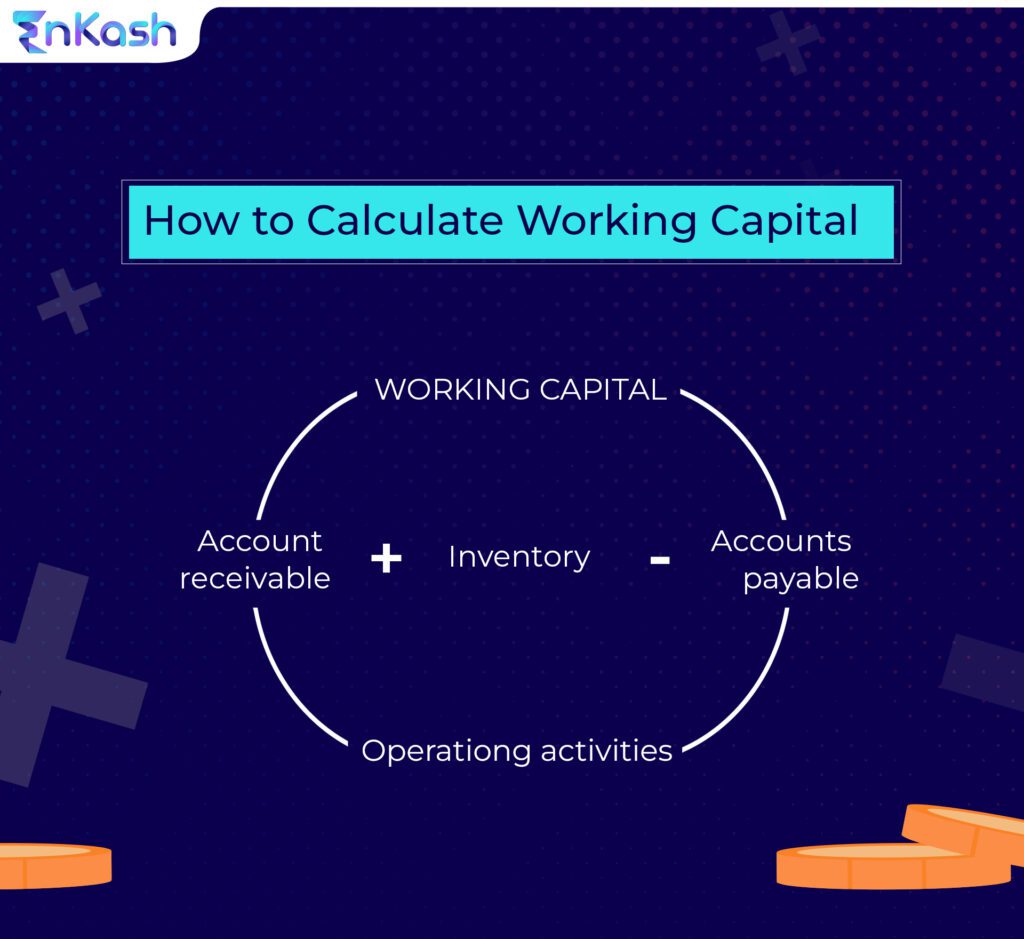

To calculate a business’s working capital, all you have to do is add account receivable with inventory and subtract account payable as shown below.

This industry has grown rapidly due to strong interest from institutional investors, venture capital, financial institutions, and hedge funds. From 2014 to 2015, venture capital-backed online marketplace lenders raised $2.7 billion in 36 agreements in the United States. In 2014, investor enthusiasm prompted the marketplace lending industry’s first initial public offerings (IPOs), with Lending Club and OnDeck generating $1.0 billion and $230.0 million, respectively.

Furthermore, the entry of institutional investors has fueled the development of an ecosystem of online marketplace lending-focused information services, risk analytics, and trading technology businesses.

On the debt side, online marketplace lending full of working capital finance has emerged as a compelling investment for investors seeking diversity and high yield.

Increased investor demand boosted the market for securitization of whole loans offered by online marketplace lenders, with the first unrated securitization transaction pricing in 2013 and the first rated securitization transaction pricing in 2014.

The Bottom Line

The new business models and underwriting technologies that are driving the expansion of online marketplace lending have emerged at a period of extremely low interest rates, reducing unemployment, generally favorable credit conditions, and operating cash flow ratio. It will be crucial to track how online marketplace lenders test and change models when credit conditions deteriorate.

To know more, visit: EnKash. You can also click below on Signup Now and we will reach out to you soon.