Unified Payments Interface (UPI) is a revolutionary system that has transformed digital transactions in India. The National Payments Corporation of India (NPCI) is an organization that initially developed UPI, allowing instant bank-to-bank money transfers using a mobile device with little or no requirements for cash or card-based payments. The widespread adoption of UPI has significantly simplified financial transactions for individuals, businesses, and service providers. With QR code payments, UPI ID-based transfers, and multi-app integration, UPI has made the most common transactions easier, thereby propelling the cashless economy and enhancing financial inclusion across the country.

What is UPI, and How Does It Work?

UPI stands for Unified Payments Interface and is a real-time digital payment system developed by the National Payments Corporation of India (NPCI). The main purpose is to serve instant money transfers between bank accounts using mobile devices. In contrast to older systems, where the user had to give account numbers and IFSC codes for validating the transactions, UPI uses very simple methods of transferring money with the help of VPA or UPI ID.

Contemporary Functions Offered by UPI

- Instant Transfers: Moving money occurs instantly and uninterrupted 24 hours a day, on all days, including Saturdays, Sundays, and bank holidays.

- No Need for Account Details: Transactions can be completed through mobile numbers, UPI IDs, or QR codes.

- Multiple Accounts: One UPI app can link to more than one bank account.

- Interoperable: UPI works on various banking apps and third-party payment apps.

- Two-factor authentication: This feature verifies transactions on the UPI interface by the UPI PIN.

How UPI Payment Works

- User Registration: A customer registers on a UPI-enabled banking app/third-party app.

- UPI ID Generation: The user creates a unique UPI ID (for example, yourname@bankname).

- A bank account is linked with the app for purposes of the transaction.

- Payment Authentication: The transactions are authenticated using the UPI PIN.

- Instant Fund Transfer: Within seconds, the money is sent or received.

UPI operates on a peer-to-peer (P2P) and peer-to-merchant (P2M) basis, making it useful for both individuals and businesses looking to pay via UPI efficiently.

How to Set Up UPI for Payments

All you need is a smartphone and an active bank account. The following steps will guide you through your first activity with UPI:

Step 1: Register via a Bank or Payment App

- Acquire your UPI-enabled app, such as Google Pay, PhonePe, Paytm, etc., or download the app directly from your bank.

- Open the app and register using your mobile number linked to your bank account.

Step 2: Create a UPI ID (VPA)

- Start by creating a unique UPI ID, which will be your virtual payment address (e.g., john123@upi), after registration.

- UPI replaces the need for traditional bank account details for transactions, making it easier.

Step 3: Link Your Bank Account

- Select your bank from the given list in the app.

- It will fetch your bank details based on your registered mobile number.

- Enter the OTP sent to your registered mobile number to verify your account.

Step 4: Setup Your UPI PIN

- Create a 4- or 6-digit UPI PIN to authorize transactions.

- Keep this PIN secure and refrain from sharing it with anybody.

With this setup, you can engage in instant sending and receiving of money through UPI. And for those wondering how to transfer from UPI to a bank account, here is the secret: just fill in the required information about the recipient and finish the transaction with your UPI PIN.

Payment Modes Via UPI

UPI offers multiple payment methods to cater to different user needs. Read along to know the steps for each of them:

1. Pay using UPI ID

- Go to Send Money in the UPI app.

- Type the receiver’s UPI ID (VPA).

- Enter the amount and a message if needed.

- Authorize the transaction using your UPI PIN.

It is best to know how to pay using a UPI ID in a quick, secure manner.

2. Pay via QR Code

- Scan the QR code of the payee with your UPI app.

- Details of payments will be auto-filled.

- Enter the amount, authorize, and pay using your UPI PIN.

3. Pay using a Mobile Number

- If the recipient’s mobile number is linked to their UPI ID, you can transfer funds using their phone number.

- Open the UPI app, click Send Money, type in the mobile number, and carry out the transaction.

4. Send Money to a Bank Account

- Open your UPI app and select Bank Transfer.

- Enter the recipient’s account number and IFSC code.

- Enter the amount and confirm the transaction using your UPI PIN.

- UPI is instant, and the money gets notified in real-time to both parties, whether sender or receiver.

A very useful one for those who want to know how to send money through UPI ID into a conventional bank account.

All UPI transactions are instantaneous, and both users receive real-time notifications. Whether you’re wondering how to pay through UPI ID or using other methods, the process remains secure and straightforward.

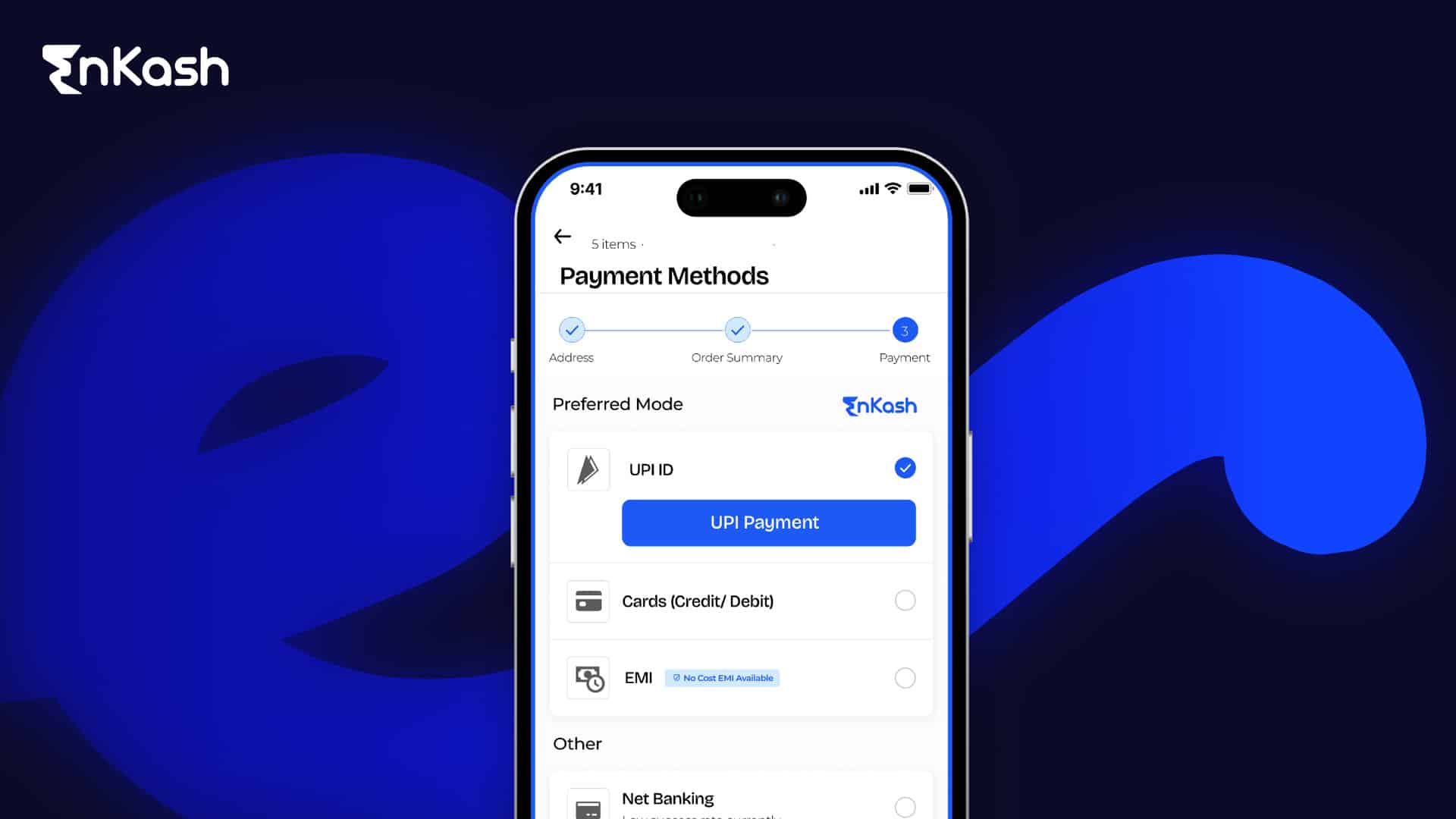

UPI Payment Page for Businesses

UPI is not just for individuals—it has become an essential tool for businesses, enabling fast and secure digital payments.

How Businesses Can Use UPI Payment Pages:

Businesses can integrate a UPI payment page into a website or app. Customers pay using UPI ID(s), QR codes, and mobile numbers. This eliminates the need for customers to enter card details, reducing fraud risk.

Advantages of UPI for Business

- Immediate Settlements: Transactions are processed instantly, reducing cash flow delays.

- Less Cost: The expense of POS terminals and card transaction costs is eliminated.

- Easier for Customers: The best and easiest payment method an individual can choose from; therefore, it helps build a good customer relationship.

EnKash: Enabling Seamless UPI Payments for Businesses

EnKash delivers customized UPI payment solutions to help businesses streamline the payment processes within their organization.

Why Choose EnKash?

- Simple Integration: With simple codes, businesses can set up a UPI payment page.

- Multiple Payment Pages: Make several payment pages for invoices, subscriptions, and donations.

- Excellent Security: EnKash is a fraud-smart payment system that operates within strong encryption codes.

- Automated Receipts: Prompt receipts are sent to customers via email and SMS for every payment made.

By leveraging EnKash’s UPI solutions, businesses can enhance security, automate transactions, and improve financial management.

Security Measures While Using UPI

Although the interface is secure, there are still a few best practices to follow in order to avoid any kind of fraud or unauthorized transactions.

1. Use a Strong UPI PIN

- Always choose a strong and unique PIN to authorize transactions.

- Never share your UPI PIN with anyone, including bank representatives.

2. Stay Alert for Any Fraudulent Calls or Messages

- Banks and UPI service providers never ask for PINs or OTPs on calls or messages.

- Never open suspicious links related to UPI payments.

3. App Lock and Two-Step Authentication

- If you can, choose a biometric lock or app lock for added security.

- If using someone else’s device, log out of the app after making a payment.

Common Problems and Troubleshooting for UPI Payments

Although UPI is reliable, users may occasionally face transaction issues. These may range from payment failures to delays in the transfer of funds.

Various problems that may be encountered by a UPI user in day-to-day transactions as well as troubleshooting measures are described below.

1. Why Do UPI Transactions Fail?

Most UPI transactions are usually instant, except for the few that may have minutes or even hours of delay. Payments could fail for various reasons. As a guideline, possible reasons for the failure of UPI transactions are:

- Weak Internet Connection: A Slow or disrupted Internet connection may terminate transaction processes.

- Incorrect UPI ID or Bank Details: Transactions fail when the sender correctly enters the recipient’s UPI ID, mobile number, or bank account details.

- Server Downtime: Occasionally, banks experience downtimes. This triggers transaction failures.

- UPI App Issues: Old and buggy UPI apps may trigger transaction-related problems.

- Transaction Limit Exceeded: UPI has daily transaction limits, and exceeding them may cause payments to fail.

Troubleshooting for Failed Transactions:

- Check Internet Connection: Before a transaction, always ensure a stable and active internet connection.

- Verify Recipient Details: Please cross-check the UPI ID/mobile number/bank account details to confirm the transaction.

- Retry After Some Time: If the bank’s servers are down, wait for a while and try again.

- Update UPI Apps: Keep your app updated to avoid glitches or software-related issues.

- Check Transaction Limits: Ensure you have not crossed the stipulated limit for that day on UPI for the transaction.

2. What to Do If Money is Deducted but Not Received?

Sometimes money might be deducted from the sender’s account but is not immediately reflected in the recipient’s account.

Possible Causes:

- Banking System Delays: In rare situations, the banking system may sometimes take longer than usual to process transactions.

- Network Issues: In case a transaction gets interrupted because of network failure, time would be taken for the fund to be credited.

- Technical Glitches: Sometimes due to some technical issues at the banks or UPI servers, the funds are delayed for transferring.

What to Do If Money Is Deducted but Not Credited?

- Wait for Some Hours: In most cases, the deducted amount is automatically refunded within 2-4 hours.

- Check Your Transaction Status: You may check the status of your payment via the transaction history options in the UPI app.

- Contact Customer Support: If the money is not credited after 24 hours, contact your bank’s customer support number or the help desk of the UPI app.

- Raise a complaint through NPCI: If the issue continues, raise it further through the NPCI Dispute Resolution System.

Future of UPI and Its Expanding Use Cases

UPI has grown significantly over the years, demonstrating its success. The future of UPI is now a brighter world with instant changes and upgrades. As the UPI’s payment system is evolving, it can be implemented in various segments, giving rise to new functional abilities for the users.

1. UPI in E-Commerce

E-commerce has witnessed a growth rate in which buyers prefer UPI as the payment method, mainly due to its ease and instant payment.

How UPI is Changing E-Commerce:

- Faster Checkout Process: An instant payment that requires no cumbersome entry of card details and OTPs.

- No Wallets Required: UPI is a direct bank transfer that spares the whole cumbersome loading of money and transactions.

- More Secure: UPI understands that yes, however, UPI fraud risks are less because of PIN authentication.

2. UPI for Bill Payments

UPI is making utility and service bill payments directly to the user with bills for electricity, water, gas, and mobile recharge being best paid by seamless transactions.

The usefulness of UPI in Bill Payments:

- Auto-Pay: Users can automate recurring charges for monthly bills.

- One-Click Payment: Forget about remembering account details; just one UPI ID will suffice.

- Instant Confirmation: Once the bill payment is made, users get notifications in real-time.

3. Cross-Border UPI Transactions

The Government of India and NPCI are expected to expand UPI services throughout the globe for cross-border transactions.

Expanding UPI for International Transactions:

- Collaboration with Foreign Banks: NPCI is working with foreign banks for remittance activities via UPI.

- UPI for Tourists: Tourists will be able to pay for local expenses using UPI.

- Cost-Efficient Transfers: UPI will make the remittance kind less dependent on wire remittance fees or currency conversion expenses.

4. Expected Upgrades in UPI

NPCI is working on a few forthcoming developments aimed at improving the technology underpinning digital transactions and their delivery.

New UPI Innovations Ahead:

- Let’s get UPI Lite for small-value transactions, which will not require PIN authentication.

- UPI Credit Services: Short-term credit lines associated with UPI will soon be available to users.

- Voice-enabled UPI: Plans are underway to empower UPI transactions through voice commands to promote accessibility.

Conclusion

UPI has transformed digital payments in India, offering a fast, secure, and convenient way to transact. Except for letting you know how to use UPI for your payment or how to set up UPI for business, the system is all about providing comfort and business efficiency. For businesses, using UPI integrations alongside platforms like EnKash can add a maximized degree of operational efficiency, financial management, and customer satisfaction. Adopting these technologies is a step forward in the growth of an impending digital economy.