Secure payment gateways safeguard transactions by encrypting confidential financial information and reporting suspicious as well as fraudulent activities. In India, government initiatives such as Digital India and Smartphone usage have stimulated the need for omnichannel payment infrastructure, including UPI, credit cards, and wallets. New technologies (AI-enabled fraud detection, tokenization, and biometric authentication) today are contributing to security, while the integration with various payment solutions builds trust and accelerates business expansion in the booming digital economy.

Introduction

Increasing demand for online shopping and electronic payments has re-engineered commerce, and secure payment gateways have become a mandatory element of online commerce. These gateways bridge the gap between consumers, merchants, and financial organizations, which provide online payment security by protecting sensitive financial information and providing frictionless payments. In India, the government’s Digital India campaign and the smartphone revolution have sped up the overall process. It has enabled both urban and rural citizens to make payments through digital platforms.

With evolving cyber security threats, more advanced and powerful payment gateways have become a must-have for protecting consumer data as well as tracking fraud. They also connect to multiple payment options, including UPI, credit cards, and wallets, to satisfy the various needs of Indian consumers. In addition, the increasing usage of mobile payments has created a demand for scalable, flexible gateways to serve India’s emerging digital economy.

Read More: Payment gateway

What is a Payment Gateway and How Does it Work?

Payment gateways help keep digital transactions safe and transparent by supporting secure communication between all parties involved. Some of the major functions and advantages of a payment gateway are:

- Enhanced Security: Payment gateways offer high-level encryption and fraud detection tools. This is useful for securing sensitive customer data. Moreover, payment gateways eliminate the chances of cybercrime.

- Improved Conversions: A seamless and reliable payment process increases the likelihood of customers completing their purchases. Secure gateways reassure users, leading to higher transaction success rates and improved revenue.

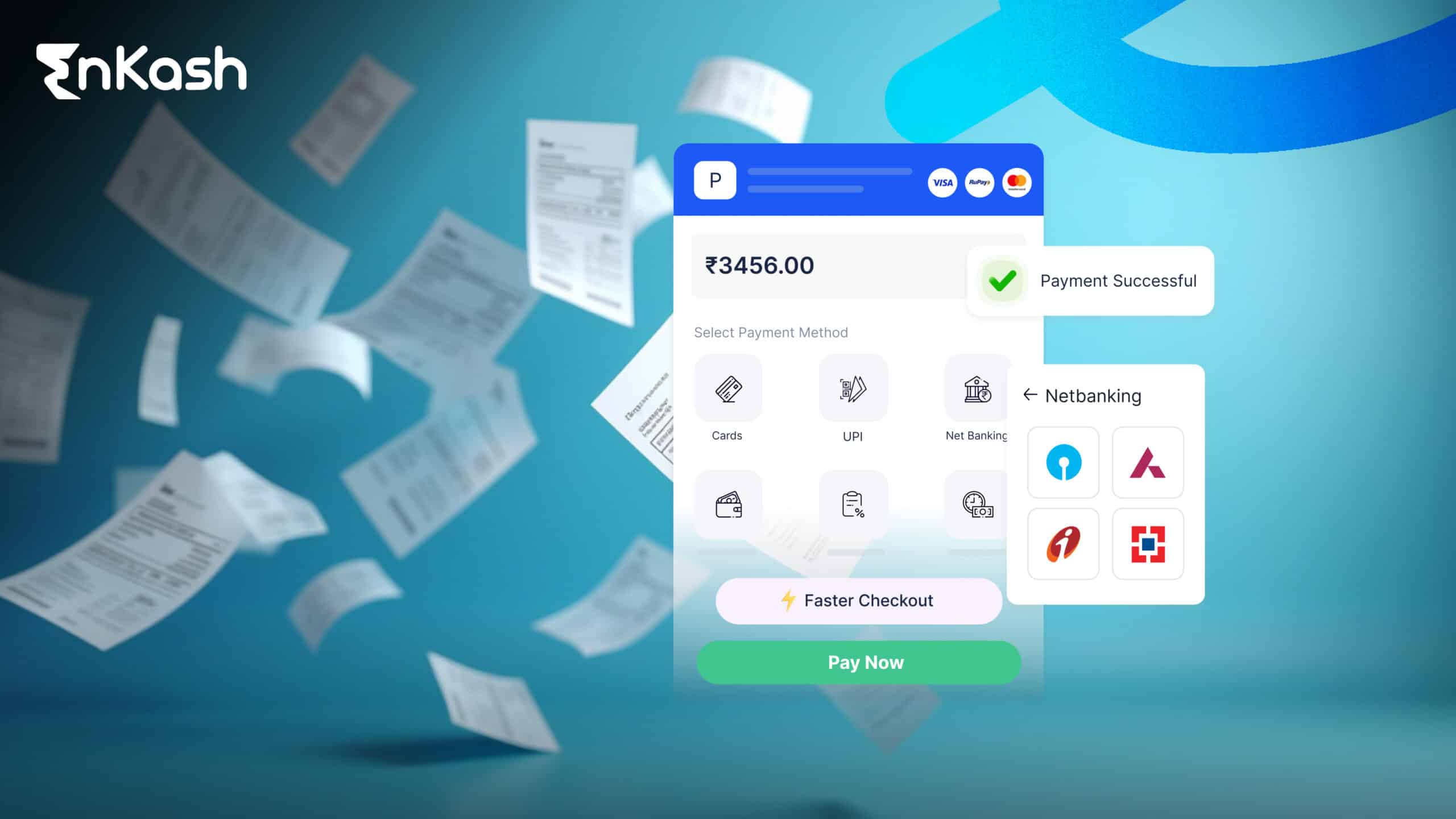

- Versatile Payment Options: The new payment gateways accept multiple payment types like credit/debit cards, UPI, digital wallets, and net banking. Such adaptability meets different customer tastes, extending the business’s reach.

- Detailed Analytics: Gateways give you detailed insights into how the transaction is going and how the customer is behaving. These insights help businesses make informed decisions, streamline their activities and spot growth opportunities.

- Cost Efficiency: Automating payment processing saves time, effort, administrative costs, and manual intervention time. This helps optimize the process.

- Reduced Chargebacks: Advanced fraud tools reduce disputes and chargebacks, which prevent losses and ensure the best performance.

- Global Reach: With multi-currency support, companies can expand worldwide and reach out to a global customer base, making cross-border transactions easy.

Payment gateways are now an important part of the Indian e-commerce space as they enable payment through multiple payment channels, including UPI, credit cards, digital wallets, and net banking. Because of their versatility, they make it easy for businesses to accommodate diverse customer tastes. In addition, as companies grow, payment gateways can offer the adaptability and security to accommodate higher volume transactions.

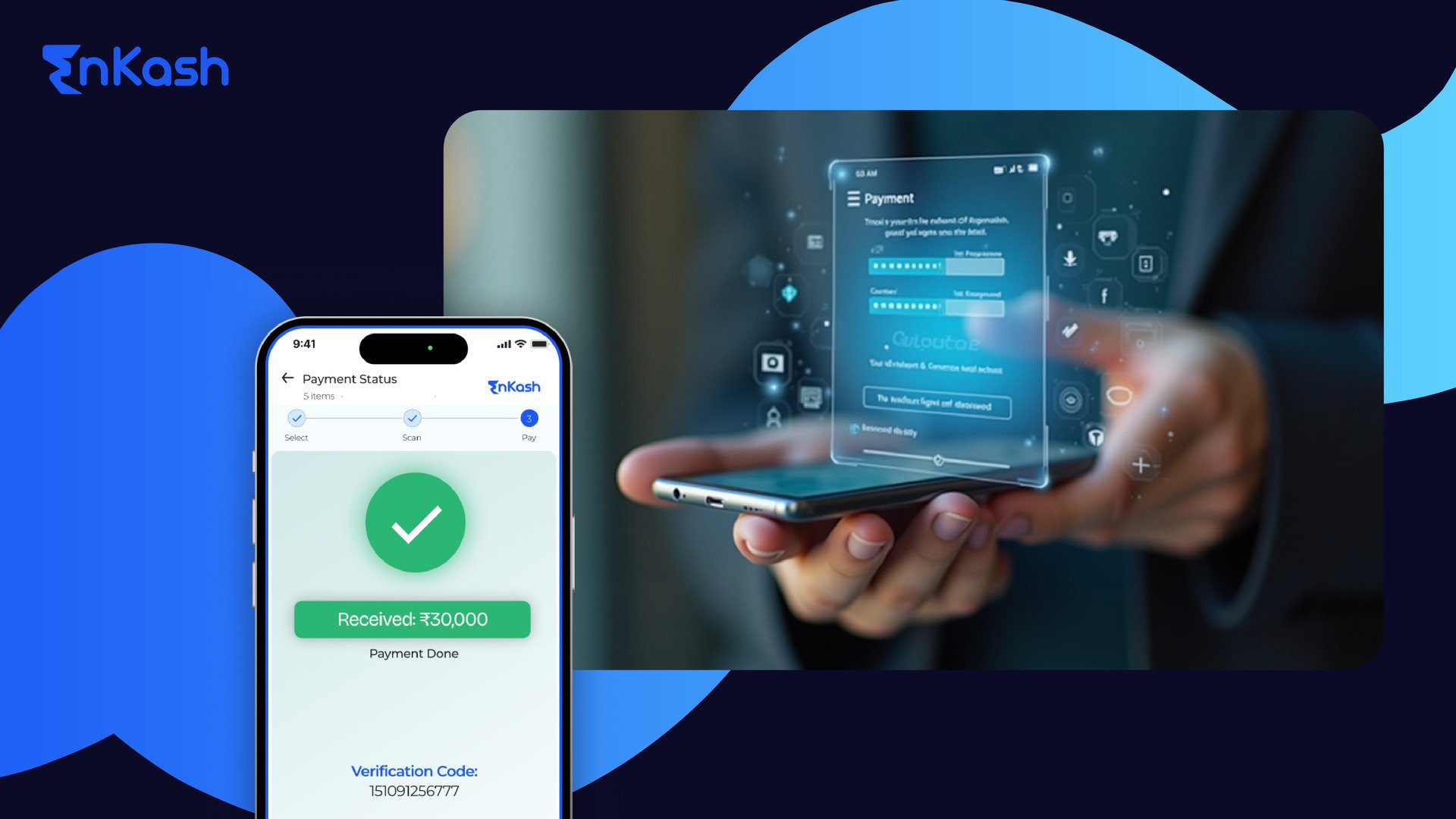

In order to provide easy transactions, payment gateways go through the following process:

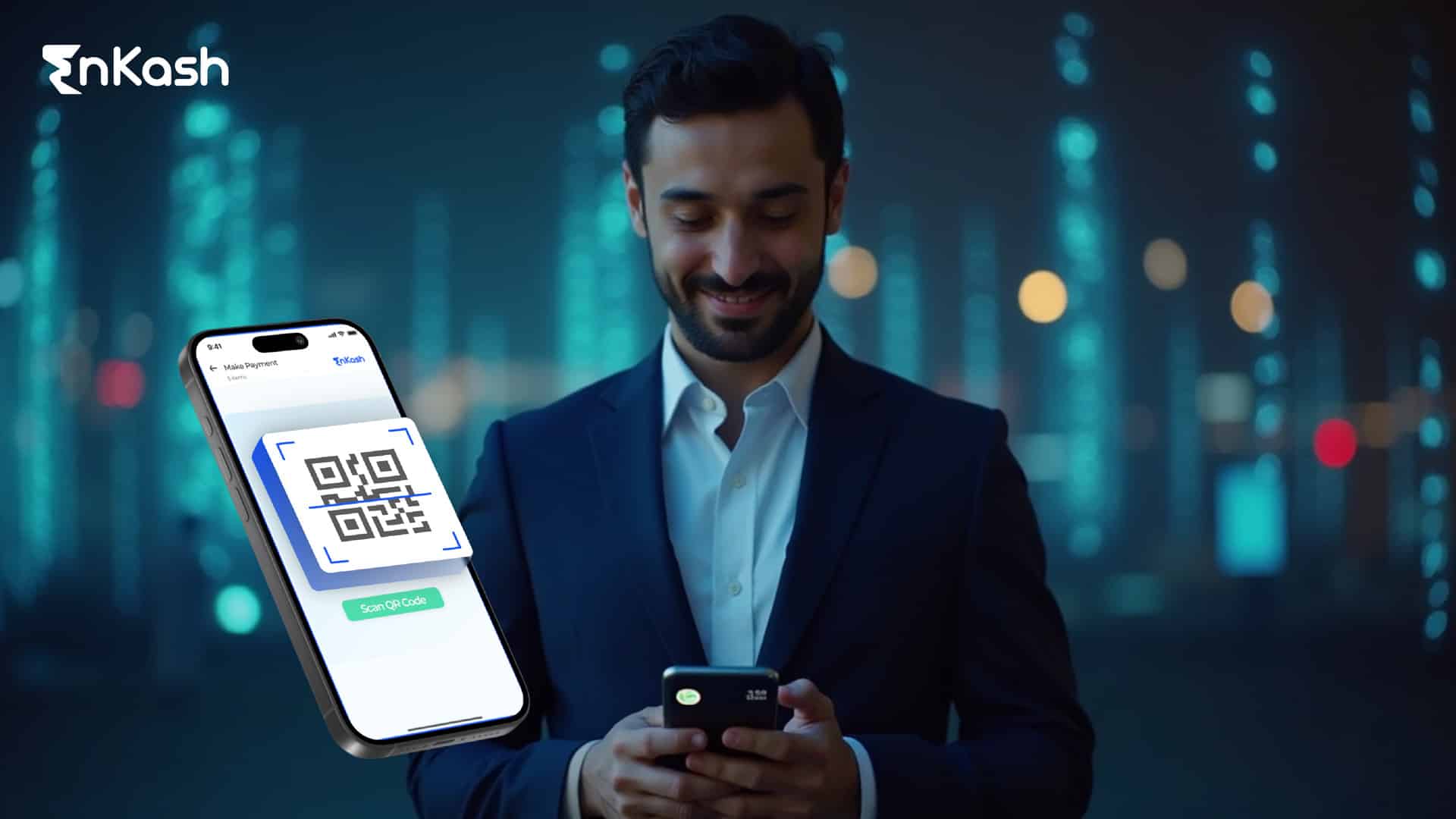

- Customer Initiates Payment: The customer selects his preferred mode of payment and makes the necessary entries. These could include anything from UPI credentials to credit card numbers.

- Data Encryption: Payment information is encrypted during the transaction to ensure that no one can access it.

- Authorization Request: Encrypted payment details get sent to the bank for validation. The system checks that the data submitted matches the bank’s databases.

- Fraud Detection: Highly sophisticated algorithms scan the transaction for any suspicious behavior, such as out-of-the-ordinary buying habits or geographical anomalies.

- Transaction Completion: Once the transaction is approved, funds are released and messages are received by the customer and merchant.

These kinds of steps are critical for online payment security. In India, innovations such as biometric authentication, real-time fraud detection and AI-based analytics have improved the functioning of payment gateways. Furthermore, the evolution of payments such as buy-now-pay-later (BNPL) has compelled gateways to adopt new layers of authentication and functionality.

Read More: Bulk payment solution

Best Practices for Secure Online Payment Processing

Secure online payment processing helps to shield businesses and their customers from attacks and loss of money. As online transactions continue to grow in number, it’s crucial that strong security measures are put in place to keep the trust and the risks at bay. These are the complete best practices for online payment security:

1. Adopt a PCI DSS-Compliant Payment Gateway

Select a payment gateway that supports the Payment Card Industry Data Security Standard (PCI DSS). This makes sure that the payment gateway has excellent security measures to protect sensitive customer data, including credit card numbers. PCI DSS-certified gateways keep companies safe from data breaches through encrypted access, strong authentication, and regular security audits.

2. Enable SSL Encryption

SSL (Secure Sockets Layer) encryption is used to protect the data in transit. It encrypted credit card numbers, login credentials, and other sensitive information to stop them from being spied on by hackers. SSL certificates not only make transactions safe but also increase customer confidence, by displaying the padlock icon and “https://” in the browser’s address bar.

3. Leverage Tokenization

Tokenization is one of the latest security features that substitutes payment data with randomly produced tokens. Such tokens don’t possess any usefulness outside of the transaction itself, which means that hackers can’t access actual payment information even if they manage to hack your system. Tokenization has become the default mechanism to safeguard cardholder data during online payments.

4. Incorporate Multi-Factor Authentication (MFA)

MFA provides additional security by requiring a user to prove themselves in multiple ways. Most typical MFA strategies involve One-Time Passwords (OTPs), biometrics like fingerprint or facial identification, and email or SMS verification. This extra step means that companies minimize the possibility of illegal transactions even if user credentials are stolen.

5. Conduct Regular Security Audits and Updates

Keeping a secure payment system requires periodic security audits and software updates. Deprecated applications or plugins can create openings that hackers could take advantage of. Regular audits detect security holes in the system, and patching keeps you in line with the latest security requirements and regulations. Robotic tools can help you keep track of system health and update it at the right time.

6. Educate Customers About Secure Payment Practices

This is a much-overlooked yet highly successful component of payment security. Teach customers to recognize phishing attempts, avoid using public Wi-Fi for transactions, and create strong passwords. Put trust badges and certificates on your website to remind visitors that the website is safe.

7. Deploy Advanced Fraud Detection Tools

Machine learning-based fraud systems can analyze transactions in real-time and detect and flag fraudulent activities. These apps track patterns (such as large purchases or multiple login attempts) and identify fraudulent transactions in advance.

8. Implement Secure API Integrations

Secure Application Programming Interfaces (APIs) ensure the data exchange between e-commerce sites and payment gateways is secure. By Encrypting API communication, organizations can stop data loss and unauthorized use during integration.

9. Minimize Data Retention

Reducing storage of sensitive customer information is one of the most effective methods to limit the impact of breaches. Only store information that’s needed for regulatory or operational reasons, and adhere to data protection regulations such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA).

10. Perform Regular Testing

Continual testing, like penetration testing and vulnerability testing, is necessary to identify vulnerabilities in your payment processing system. Work with cyber professionals to set up strong defences and improve your ability to defend yourself against new attacks.

Read More: UPI payments

How to Choose the Right Payment Gateway for Your Business

Paying with the appropriate payment gateway can be a very important decision for any company seeking secure, seamless, and reliable online transactions. A number of considerations should accompany this choice:

- Robust Security Features: Make sure to select payment gateways that provide robust security features such as tokenization, encryption and real-time fraud detection tools. These are essential to protecting confidential customer information and maintaining trust.

- Integration Capabilities: Make sure that the payment gateway integrates seamlessly with your existing systems, such as e-commerce platforms or mobile applications. Scalable solutions are particularly critical for growing businesses that may be able to manage higher transactions later on.

- Cost Efficiency: Consider setup charges, transaction costs, and other charges included. Affordability without giving up on quality is a top priority for a start-up or small business. Compare the prices between providers to opt for the most economical solution.

- Reliable Support: Go for a provider that provides 24×7 customer service to help you with technical problems in real time. This is especially important during peak times where downtime may mean lost sales and customer frustration.

- Compliance Standards: Make sure that the payment gateway is in line with industry norms such as PCI DSS and local regulations. Not only does being in compliance help keep you safe, it saves you from penalties.

In India, choosing a gateway that offers UPI, multi-currency payment, and fraud detection mechanisms is the best. Such attributes are in sync with the Indian consumers’ needs and the demands of an e-commerce market. Integrity, fast installation, and low transaction costs are also desirable features for small businesses. A good payment gateway gives a better customer experience while supporting business expansion and scalability.

Role of Payment Gateways in Fraud Prevention

Fraud protection is a feature of secure payment gateways, utilizing advanced technologies to shield companies and customers from losses. Modern machine learning algorithms do a great job of analyzing transactions to identify anomalies, like unauthorized purchases or transactions made from out of place. Monitors in real-time provide further protection by alerting against things such as repeated high-value transactions or failed login attempts to catch fraud before it happens. The tokenization decrypts sensitive data into unique tokens so that even if a hack is perpetrated, the stolen data can be completely unusable. Furthermore, MFA encrypts access by requiring additional verification beyond passwords, for example, OTPs or biometrics.

Payment processors keep developing adaptive solutions, such as geo-blocking (forbidding payments from non-legitimate countries) and variable spend caps based on the user. Collectively, these actions strengthen financial ecosystems. As cyber criminals become more advanced, payment gateways are a frontline defense that secures not only individual transactions but also the integrity of the digital economy.

Read More: Payment links

Things to Remember Before Making an Online Payment

Secure online transactions are not only the responsibility of companies but also consumers. Here are some things to know before you pay online:

- Verify Website Authenticity: Make sure that you are shopping on a legitimate website with secure URLs beginning with “https” and featuring a padlock. Don’t fill out payment information on unauthenticated or questionable websites.

- Use Secure Connections: Don’t make payments through public Wi-Fi because these networks are easy for hackers to exploit. Try to use a secure, private internet connection when possible.

- Enable Multi-Factor Authentication (MFA): Use payment platforms or options that offer additional MFA security (OTP, biometric authentication, etc).

- Regularly Monitor Transactions: Review your bills and credit cards on a regular basis so that you can spot any suspicious transactions and report them immediately.

- Update Software and Devices: Make sure your phones and wallets are updated with the newest security patches to help prevent vulnerabilities from being used.

- Avoid Sharing Payment Information: Never give anyone private information such as PINs, passwords or OTPs, even if they insist they are from your bank or payment service provider.

- Be Cautious of Phishing Scams: Inspect emails, links or texts that claim to be from a payment platform or bank.

Conclusion

Secure payment gateways play a vital role in safeguarding customer data and making online transactions secure. As the digital economy grows, businesses must leverage security and embrace cutting-edge technologies to battle new cyber risks. Strong payment gateways not only shield financial ecosystems but also provide the customer with secure and reliable payment options. In India, a nation where digital adoption is picking up speed, these gateways help to continue the e-commerce growth and satisfy the different requirements of consumers. By incorporating secure gateways and adopting best practices, businesses can be sure to grow over the long term, remain competitive and have a secure digital reputation to keep pace with the ever-shifting needs of the market.

Read More: Corporate payment collection

FAQs

How do payment gateways handle recurring payments?

Payment gateways enable recurring payments by tokenizing the customer’s payment information. They automate future transactions so you do not have to input them again and again. It is often used for subscriptions and memberships. Secure storage safeguards information while ensuring that customers enjoy hassle-free payment processing. Businesses also enjoy steady cash flow and customer retention.

What are the environmental benefits of using payment gateways?

Payment gateways facilitate paperless payments, reducing the need for printed receipts, invoices, and cash handling. By automating banking transactions, they help to reduce deforestation and waste. Also, e-receipts and electronic records reduce the carbon footprint of the traditional paper-based process in order to encourage sustainable and green commerce.

How do payment gateways ensure accessibility for differently-abled users?

The most popular payment systems incorporate accessibility features such as screen-readers, keyboard navigation, and text-to-speech capabilities. Streamlined interfaces and other input options ensure that visually impaired and differently-abled users will be able to easily make purchases. These efforts align with global accessibility requirements, make everything more inclusive, and enable all users to engage in the digital economy.

Can businesses customize payment gateways?

Most payment gateway providers offer customizations to meet the brand and business needs of a company. Logo integration, user interface customization, transactional messages, etc., can be customized to your liking. Some gateways also offer APIs for advanced technical modifications.

What is the role of AI in improving payment gateways?

AI-based payment gateways make payments secure by flagging fraud using pattern recognition. They monitor user activity to detect anomalies and identify suspicious behavior. AI also automates the transaction process, predicts user behavior to customize experiences, and gives businesses insights that they can take away from the transaction data to increase both efficiency and customer experience.

Are there specific payment gateways tailored for small businesses?

Yes, most payment gateways are built for small companies with reasonable prices, low transaction fees, and easy-to-use setup. Features such as integration with e-commerce, mobile responsive design, and access to basic analytics make them perfect for startups and SMEs.

What role do payment gateways play in cryptocurrency transactions?

Payment Gateways facilitate the use of crypto by enabling the conversion of Bitcoin or Ethereum into fiat currencies or payments in crypto. They offer safe processing and live exchange rates, along with fraud protection.

How do cross-border payment gateways handle currency conversion?

Payment gateways across borders exchange currencies in real-time using exchange rates. They are transparent as they display conversion rates and additional charges upfront. These gateways make international trade easier, and allow businesses to receive payments from customers worldwide without having to deal with currencies manually.