Payment gateways have opened the doors to secure, smooth, and hassle-free online transactions for businesses in this fast-paced digital age. In simple terms, a payment gateway provides a channel for customers, merchants, and financial institutions to transfer funds. To secure online payments, businesses must understand the workings of the payment gateway. This blog discusses the definition of a payment gateway, the different types of payment gateways, how they operate, and some major advantages. We also want to highlight how EnKash is transforming digital payments with its modern solutions for businesses, enabling them to streamline transactions, security, and financial management, with other significant possible features of the solution. We would like to invite you on board to delve deeper into this indispensable financial technology.

What is a Payment Gateway?

What is payment ga? A payment gateway is a way to authorize and process online payments for businesses. How do online payments work with a payment gateway? It acts as an intermediary between a merchant’s website or app and financial institutions to ensure that all payment information is encrypted, verified, and transmitted securely.

Key Functions of a Payment Gateway

- Transaction Authorization: Verifies that customer payment details are valid and that the customer has enough funds in his bank account to process the transaction.

- Data Encryption: Encrypts sensitive payment information through encryption protocols.

- Settlement Processing: Transfers approved funds from the customer’s account to the merchant’s bank account.

- Fraud Prevention: Fraudulent transactions are initiated using security measures such as tokenization and PCI DSS compliance.

Payment gateways establish credibility for businesses by securing authentic transaction options.

Types of Payment Gateways

As different businesses have different sets of requirements regarding payment processing, the payment gateways vary, too.

1. Hosted Payment Gateways

- Redirect customers to an external payment service provider’s (PSP) platform for transaction completion.

- Used by small and medium classes of businesses that require secure yet error-free payment processing.

- Examples: PayPal, Razorpay, and PayU.

Advantages:

- High security, as the handling of transaction processing is done by the PSP.

- Reduces the risk of storing sensitive customer data.

Disadvantages:

- Customers are redirected to another website, which can be interpreted as distrust and may result in drop-offs.

- Limited custom branding.

2. Self-Hosted Payment Gateways

- Merchants collect payment details on their website and send them to the PSP for processing.

- A balanced approach to control and security.

- Examples: Stripe, CCAvenue, Instamojo.

Pros:

- More control over the checkout experience.

- Also reduces the risk of cart abandonment due to external redirection.

Cons:

- Puts the onus on security and compliance on businesses.

- Sensitive payment details need to be securely handled.

3. API/Non-Hosted Payment Gateways

- It is integrated into a merchant’s website through an API, allowing full control over the payment process.

- For businesses requiring a customized and seamless payment experience.

- Examples: EnKash, Razorpay, and Paytm for Business.

Pros:

- Full control over the payment interface and branding.

- Offers seamless, one-click checkout for a better user experience.

Cons:

- Higher responsibility for compliance and security.

- Technical expertise is needed for integration.

- The choice of the correct payment gateway depends on a business’s volume of transactions, security concerns, and customization requirements.

Learn more: Types of Payment Gateways

How Does a Payment Gateway Work?

A payment gateway ensures smooth and secure online transactions in a sequence of events in which it works. This is how it works:

1. Customer Initiates Payment

The customer selects products/services and proceeds to checkout. They enter payment details (credit/debit cards, UPI, net banking, or digital wallet credentials).

2. Data Encryption

The payment gateway encrypts customer payment information so that sensitive information stays protected. Security protocols such as SSL (Secure Socket Layer) are useful for safely sending information.

3. Transaction Authorization

The encrypted payment data goes to the acquiring bank, which routes it to the card network (Visa, Mastercard, etc.).Then, the card network routes the transaction request to the issuing bank (customer’s bank).

4. Approval or Decline

The issuing bank handles the transaction queries, checking for available funds and fraud risks. If found valid, it authorizes the transaction; if any issues are detected, it denies the transaction. The pickup of approval or decline goes through the same channels.

5. Settlement

If found approved, the money is deducted from the customer’s account. The acquiring bank handles the payment and releases the cash to the merchant’s account. All of this will happen within seconds so that the crediting is fast, giving a secure payment experience.

Benefits of Payment Gateways

Reliably using payment gateways is always advantageous, either for the business or the hardware.

1. Enhanced Security

- Provides encryption, tokenization, and PCI DSS compliance safety for finance transactions.

- Data breaches and fraud are greatly reduced.

2. Multiple Payment Options

- By supporting a variety of payment options like credit/debit cards, net banking, UPI, and digital wallets.

- It allows greater business reach by catering to different customer preferences.

3. Improved Customer Experience

- It provides fast and seamless transactions to avoid cart abandonment.

- Allows one-click payment for return customers.

4. Automated Payment Processing

- It grows transaction support with real-time payment tracking and automated settlements.

- Minimizes human errors, boosting efficiencies.

5. Business Scalability

- Allows secure business transactions handled by the handling of increasingly growing transactions.

- Allows customization to be fitted with specific business needs.

By integrating a payment gateway, businesses can enhance transaction security, improve customer satisfaction, and streamline operations.

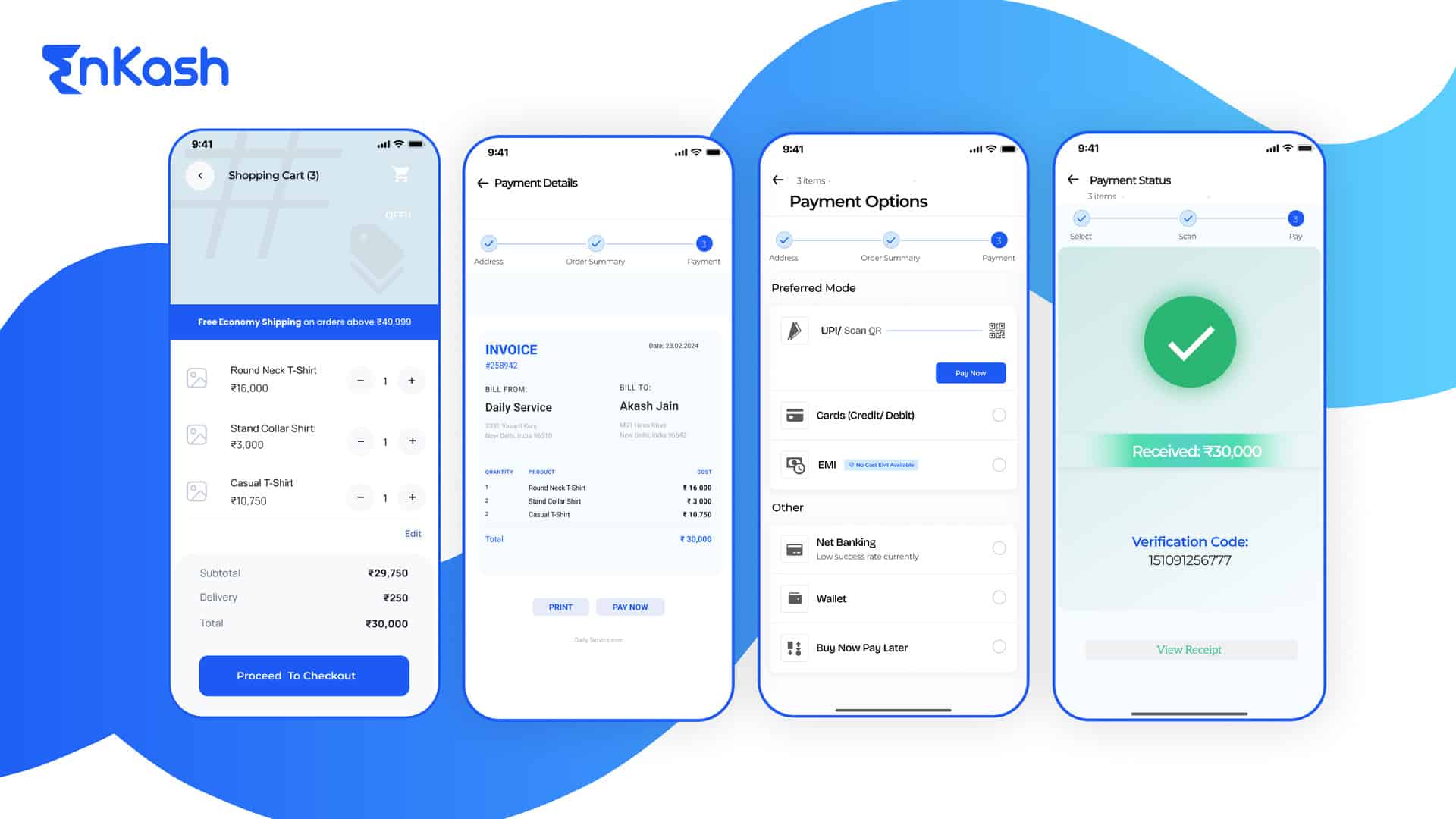

How EnKash is Simplifying Online Payments

EnKash is a leading fintech platform offering web solutions for business payments and expense management. The online payment solutions by EnKash are all secure, scalable, and efficient, directly enhancing digital transaction capabilities.

1. Payment Aggregator Service

- EnKash operates under the brand name Olympus (which is an RBI-approved payment aggregator), thus adhering to compliance and security.

- Offers businesses trustworthiness in digital payment acceptance.

2. Advanced Security Feature

- Utilization of encryption and tokenization and compliance with PCI-DSS to protect the transaction.

- Block off a fraudulent transaction with AI-based risk assessment systems.

3. Versatile Payment Systems:

- Supports different payment modes: UPI, net banking, credit/debit card, and digital wallets.

- Enables business payment flows customized to match how they operate.

4. Easy Embedding

- Offers API integration, is easy to scale, and can be customized for companies wanting to embed payment solutions with ease.

- Creates seamless end-to-end digital payment experiences.

5. Tracking Expenses on a Real-Time Basis

- Provides businesses with tools to monitor their expenses and track them in real time.

- Eliminates difficulties in financial planning and making timely decisions.

- Using the powerful platform of EnKash, businesses can enhance their payment processing with improved security and cash flow management.

Conclusion

Businesses need to understand how payment gateways work when it comes to truly enhancing their digital transactions. Transferring funds smoothly, storing customer data safely, and finally, guaranteeing the trustworthiness of the transaction all depend on a secure and efficient payment gateway. Thus, payment gateways integrate operations for businesses, minimizing the risk of fraud while giving a unique customer experience.

EnKash has proven its mettle by providing safe, scalable, and customizable payment processing to businesses of all sizes. This web-accepting payment is designed with strong security features but offers real-time tracking of expenditure and various modes of payment, thus encouraging businesses to better their financial management and excel in an ever-evolving digital economy.