Mobile payments are the answer to whether to pay for a cup of coffee, go shopping, or send money to a friend. Any amount can be paid anytime, anywhere, using the mobile payment method. Managing funds and doing business at any time was just the introduction of smartphones, tablets, wearable devices, and mobile payment gateways, which have caught on like wildfire.

A mobile payment gateway makes payments secure, efficient, and easy. These gateways, from mobile commerce payments to peer-to-peer (P2P) payments, are changing the paradigm for money and payments. Learn all about mobile payment gateways, their uses, their advantages, and how they enable businesses and consumers to go cashless.

What are Mobile Payment Gateways?

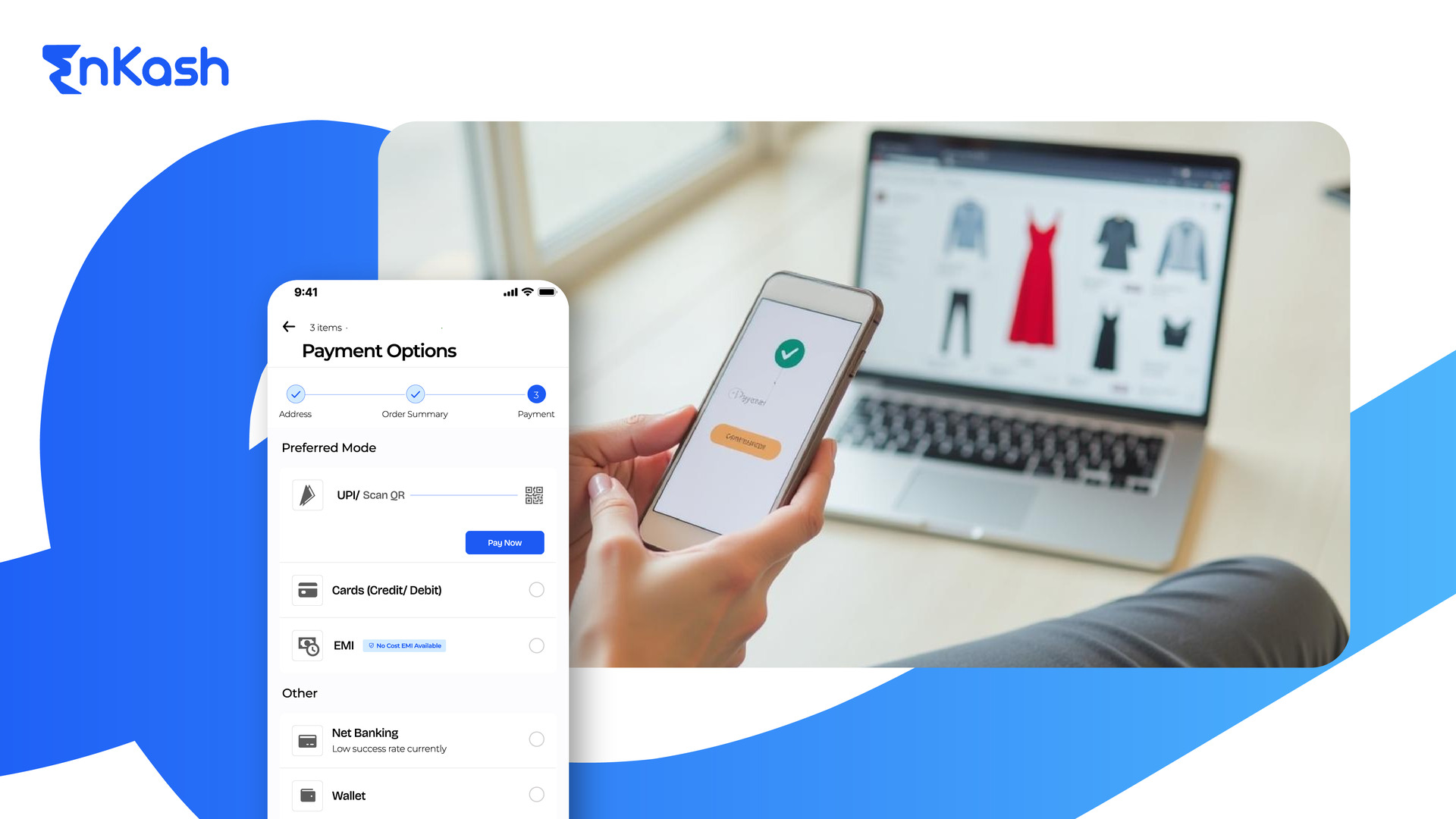

Mobile payment gateway is the technology used for mobile payment transactions. It’s the connection between the merchant’s website, mobile app, or POS and the customer’s bank or payment processor. As it sends important payment information safely, the mobile payment gateway can handle the transactions and do the hard work with zero errors to ensure smooth and fast mobile commerce payments.

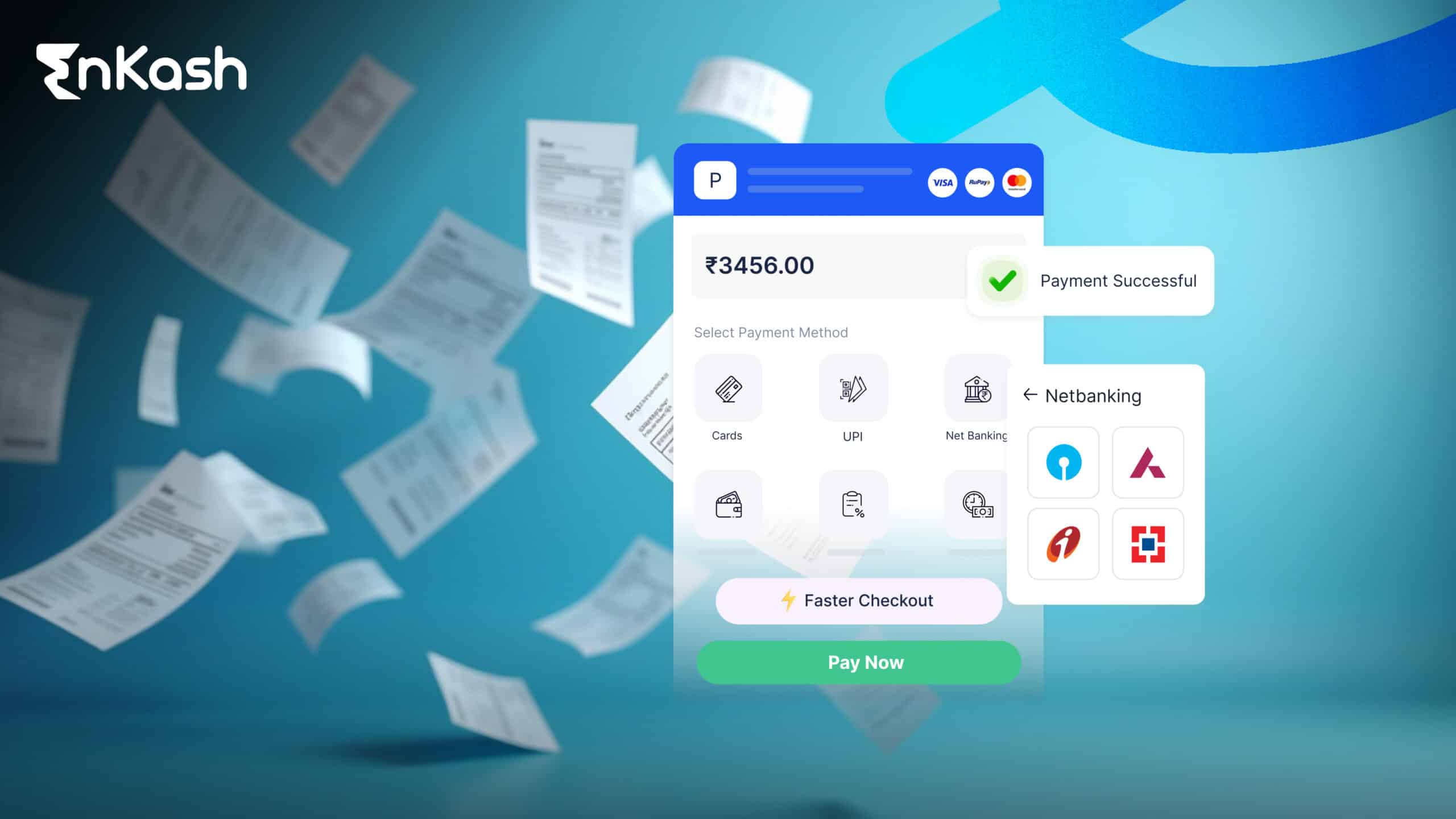

Mobile payment gateways support different types of transactions like credit/debit card payments, bank transfers, digital wallets (Apple Pay, Google Pay, Samsung Pay), and apps P2P transfers. These gateways accommodate both in-person and online payments — which is flexible and convenient for companies and consumers.

Read More: Electronic payment

What is the Function of Mobile Payment Gateways?

Mobile payment gateways are just like traditional payment gateways but for mobile devices. Here’s a simplified description of how a typical mobile payment gateway works:

- Customer Starts the Payment: This occurs when the customer makes a payment on a mobile device (phone, tablet, wearable, etc). The customer can pay using a mobile wallet (such as Google Pay or Apple Pay) or P2P payments app or type in credit card details via a mobile commerce website, depending on the transaction.

- Transmission of Payment Data: After the customer selects the payment option, the mobile phone transfers the payment information (cash-card number or bank account number) to the mobile payment server through an encrypted session.

- Authentication and Authorization: The payment gateway validates the transaction and protects the data with encryption, tokenization, etc. Some mobile payment solutions even ask for biometric authentication (fingerprints or facial recognition) to prevent fraud and unauthorized access.

- Payment Processing: Once authenticated, the mobile payment gateway connects to the customer’s bank or PSP and processes the payment. Money gets sent instantly (for cards) or is queued for approval (for ACH or bank transfer payments).

- Confirmation of Transaction: The mobile payment gateway sends the merchant and customer an acknowledgment notification after the transaction. The merchant sees the payment in their account, and the customer gets notified that the order has been fulfilled.

- Payment Successful: The payment is completed, and the merchant can send the products or provide the service or any other promised benefit. At the same time, the customer has paid using his mobile phone.

Types of Mobile Payment Solutions

Mobile payments are of various types, each for a particular type of transaction. The most common mobile payment applications are mobile wallets, NFC payments, peer-to-peer (P2P) apps, and SMS payments.

1. Mobile Wallets

Mobile wallets are virtual versions of wallets that enable the consumer to store credit cards, debit cards, loyalty points, coupons, etc, on his smartphone. Mobile wallets like Apple Pay, Google Pay, and Samsung Pay are among the most popular ones. These apps can be used with NFC-equipped devices, where customers can pay simply by tapping their phones or wearables at a POS terminal.

Mobile wallets have several advantages, such as speed, security, and convenience. They free users from carrying around physical cards or money, and they let users instantly pay in-store and online. Further, mobile wallets encrypt and tokenize sensitive payment data, which are safer than other forms of payment.

2. NFC Payments

Near Field Communication (NFC) allows two devices to connect by placing them within a few inches of one another. NFC payments let customers pay securely by simply touching their mobile devices (phones, smartwatches) at an NFC-compatible point-of-sale terminal.

NFC payments can be used alongside mobile wallets, and they are a quick and efficient means of purchase for consumers. These payments are also incredibly safe as the payment data is encrypted and tokenized during transfer.

3. Peer-to-Peer (P2P) Payment Apps

Through P2P Payment apps, users can pay people, relatives, or companies directly from their smartphones. P2P Payments: These are commonly used for small-scale payments — splitting bills, payments for services, etc.

You can send and receive money without banks’ intermediaries through these platforms. P2P payments can be tied to credit/debit cards, bank accounts, or mobile wallets for users who need payment in another format.

4. SMS Payments

With SMS payments, we conduct transactions through text messages. You can text a number and pay for products, services, or donations. SMS payments are also great for the areas where mobile banking is available, and people don’t have smartphones.

The transaction fee usually appears on the user’s phone bill, and the service provider handles the transaction for the merchant. SMS payments are quick, convenient, and widely available to most consumers, especially in emerging markets.

The Advantages of Mobile Payment Gateways

Mobile payment gateways have numerous advantages for both companies and users. These include ease of use, safety, cost efficiency, and better customer experience. Let’s look at these benefits more closely.

1. Convenience and Speed

Among the major advantages of mobile payments is convenience. Customers can make a payment without cash or paper credit cards with the help of a mobile payment gateway. Whether it’s online shopping, bill-paying, or sending cash to a friend, mobile payments are an instant and convenient way to make a purchase with a few taps on a mobile phone.

Mobile payment systems also automate company checkout, reducing the time customers wait or fill out online forms. This enhances customer experience and helps businesses close more deals, resulting in greater sales and satisfaction.

2. Enhanced Security

Mobile payment gateways have better security features to safeguard merchants and customers against fraud and hacking. Encryption, tokenization, and biometric authentication mean that mobile payments never transmit sensitive data raw, making it harder for hackers to steal payment data.

Not only that, but many mobile payment platforms use two-factor authentication (2FA), where users must prove identity using another method — such as an OTP that is sent via text message or email.

3. Cost-Effectiveness

Mobile payment gateways generally do not incur transaction charges like a traditional payment terminal. Merchants who choose mobile payment will avoid the expense of physical card readers, cash handling, and bank transaction charges. Moreover, mobile payment systems can have multiple pricing structures where enterprises can pick according to their requirement.

In terms of the consumer, mobile payments also save you from carrying cash or from having to worry about forgetting physical credit cards. Mobile wallets and P2P apps allow users to pay and receive money quickly without any extra fees.

Read More: Bills payable

4. Increased Customer Engagement

Mobile payments offer businesses a unique chance to connect with consumers in a different way. Combining mobile payments with loyalty programs allows businesses to provide rewards and discounts to consumers who make payments using their mobile devices. This creates the prospect of reordering and provides organizations with valuable insights into customer behavior and habits.

There are also features like push notifications, which you can send to notify users about offers, discounts, or transaction confirmations in mobile payment gateways.

5. Global Reach

Mobile payments don’t have geographical restrictions. Businesses can take customer payments anytime, anywhere, through mobile payment solutions. This is especially important for e-commerce companies as they can now enter international markets without expensive cross-border payment systems.

Once mobile payment becomes ubiquitous, it can help globalize business operations and provide seamless cross-border payment solutions for consumers.

Implementing Mobile Payment Gateways in Your Business

Using mobile payments in your business is no longer a choice – it’s a requirement. Mobile commerce payments make your customers feel more comfortable and keep you competitive in the digital age. So here’s how you can get started on mobile payment gateways for your company:

- Pick the Right Mobile Payment Gateway: When choosing a mobile payment gateway, remember transaction fees, supported payment options, integration, and security.

- Use the Gateway with your POS Software: If you’re a retail store owner, then it’s important to use the mobile payment gateway with your POS software. This lets you process mobile payments with NFC-enabled cards or devices at the counter. Most mobile payment gateways also provide mPOS so you can make payments from your phone and tablet.

- Mobile Payment Optimized: If you have an online store, then make sure your site or app is mobile-friendly. This includes easy checkout, mobile wallet and QR codes, and mobile-friendly site design.

- Promote Mobile Payment Methods: Once connected to your mobile payment gateway, inform your customers about available payment methods. Print signs in stores and make mobile payments available on your website and in ads.

Read More: Cost control

Solving Mobile Payment Integration Challenges

There are plenty of advantages to mobile payment gateways, but there are certain difficulties that businesses can experience when implementing them. These problems need to be acknowledged and then managed accordingly. Technical problems, security threats, customer adoption, and regulatory compliance are just a few of the common obstacles.

1. Technical Challenges

Mobile payment integration with existing systems can be tricky — especially if your company uses an older POS system or legacy application. It could have bugs, and merchants might need to update their technology to support mobile payment solutions. To overcome these technical obstacles, companies must partner with payment gateway providers who provide seamless integration options and support during the setup phase.

Read More: Account receivable process

2. Security Concerns

Security is always a worry for mobile payments, as is any other type of transaction. Customers need to believe their payment information is being transmitted correctly and that they are not selling their personal information. Mobile payment gateways use encryption, tokenization, and multi-factor authentication to avoid these risks, but enterprises also have to be aware of industry security regulations such as PCI DSS (Payment Card Industry Data Security Standard). You can prevent threats by conducting security audits and training employees on best practices.

3. Customer Adoption and Education

While mobile payments are very popular, some customers still do not want to use them because of security, privacy, or because they are not familiar with them. Hence, to break this barrier, businesses should ensure that their customers know the advantages of mobile payments and how to use them. Also, if you can offer them discounts or loyalty points for mobile payments, this can be one way to encourage people to adopt.

4. Regulatory Compliance

Mobile payment gateways must be regulated and adhere to various laws, such as data protection and consumer rights. These laws may differ from country to country, and companies need to ensure their mobile payment solutions comply with local laws and standards. Keeping up to date on regulatory changes and partnering with payment processors who care about compliance can protect organizations from legal actions and penalties.

The Future of Mobile Payment Gateways

The mobile payment system will evolve along with the technology of mobile phones. More security features, such as biometric and blockchain technology and artificial intelligence (AI) for fraud detection and customer experience, are certain to be followed in the future of mobile payment gateways.

Mobile payments are also expected to expand globally as customers and companies adopt mobile-first strategies. The emergence of smart cities, connected devices, and IoT will also bring mobile payments even further into the folds of our lives, making faster, safer, and more efficient payments.

Read More: Expense management

Conclusion

Mobile payment gateways have revolutionized our payment system with an innovative, secure, efficient, and mobile-first process of transactions. These services have changed the face of payments – from mobile wallets and NFC payments to P2P transfers and SMS payments – for the better for companies and consumers. With mobile payment, organizations can provide higher customer satisfaction, lower operating expenses, and remain relevant in a world that’s increasingly digital. It’s exciting to be in mobile payments with innovations and continuous advancement. From a small business to a global enterprise, mobile payment gateways must be embraced to make it in today’s digital economy.

FAQs

What are the fees for a mobile payment gateway?

Fees vary depending on the provider and type of transaction (physical, digital, international). There are a few usual fees like setup fees, transaction fees, monthly service charges, and chargeback fees. Before selecting a payment gateway, you need to read the fee structure.

How do mobile payment gateways deal with refunds and chargebacks?

Mobile payment terminals usually support refund features so businesses can roll back the transaction. Chargebacks are when a customer returns a payment, and the gateway company generally handles them according to their policy.

Can mobile payment gateways integrate with your business systems?

Most mobile payment gateways support integrations with existing business applications like accounting software, CRM, inventory, and eCommerce platforms.

What are the security risks of mobile payment gateways?

Despite the encryption and tokenization of mobile payment gateways, fraud, hacking, and phishing remain potential issues. It’s imperative that businesses apply further security measures such as two-factor authentication (2FA) and monitor transactions for suspicious activity.

So, what is the security of mobile payment gateways?

Encryption, tokenization, and compliance with Payment Card Industry Data Security Standards (PCI DSS) are among the technologies mobile payment gateways use to ensure customer data remains safe. Other platforms also provide biometric verification and other high-level security.

Is mobile payment gateway available on every device and platform?

Mobile payment gateways can be used across most mobile devices and operating systems (Android, iOS, web). You must, however, ensure that they are compatible with specific mobile devices and POS software.

What is the difference between a mobile payment gateway and a payment processor?

A mobile payment gateway is a service that sends transaction information between merchants, customers, and banks, while a payment processor manages the processing and authorization of payments. Both cooperate to make payments.

How do mobile payment gateways impact the customer experience?

Payments on mobile can be made faster and more efficiently for a better customer experience. This lowers checkout friction and can increase satisfaction, loyalty, and conversion rates.

Do small businesses have restrictions when using mobile payment gateways?

Some restrictions include transaction fees that might be higher for smaller organizations, integration problems, or require additional hardware (e.g., NFC-enabled devices). For small companies, you have to know how many payments they receive and pick something that works for you.

Does the mobile payment gateway support international transactions?

Yes, most mobile payment gateways accept international payments. However, companies should keep in mind that there may be currency conversion fees, cross-border transaction fees, and even regulatory guidelines that could affect international payments.