The success of a startup often depends on its ability to secure funding. While there are several funding options available, one of the most popular is the traditional VC funding rounds, starting from pre seed funding to Series A, B, and C.

As a startup founder or a venture capitalist, it’s crucial to understand the different stages of funding and what to expect.

In this guide, we’ll delve into each of the stages of funding beyond pre seed funding, starting from Series A to Series C.

What is Pre Seed Funding?

Pre seed funding, also known as seed funding, is the earliest stage of funding for a startup. This funding round is typically raised to develop a minimum viable product (MVP) and conduct initial market research. It can come from various sources, including friends and family, angel investors, or crowdfunding platforms. The amount raised during pre seed funding is usually smaller than that raised in later rounds and ranges from $10,000 to $2 million.

Acquiring Pre-Seed Funding

Acquiring pre-seed funding is often the first step in securing funding for a startup. The most common sources of pre-seed funding are friends and family, angel investors, and crowdfunding platforms.

To attract pre-seed funding, startups should have a clear business plan, a minimum viable product (MVP), and a strong founding team. It’s also important to network with potential investors, attend pitch events, and leverage online platforms to connect with potential funders.

Finally, startups should be prepared to give up equity in exchange for pre-seed funding, and should have a clear plan for using the funds to achieve their growth objectives.

Understanding the duration of pre-seed funding for startups

The duration of pre-seed funding varies depending on the needs and goals of the startup. Generally, pre-seed funding is intended to support a startup’s initial development phase, which may range from six months to two years. However, the amount of funding raised during this stage is typically smaller than that raised in later rounds, so startups may need to secure additional funding to continue their growth trajectory. Ultimately, the length of pre-seed funding depends on the startup’s business plan, market position, and funding goals, as well as the availability of follow-on funding.

How do investors participate in pre-seed rounds?

Pre-seed rounds are attractive to a wide range of investors due to their relatively small check sizes.

Angel investors: Angel investors are a popular choice for pre-seed rounds and can write checks ranging from a few thousand dollars to $500,000 or more.

Accelerators and incubators: These may also participate in pre-seed rounds, either by hosting the program or providing follow-on funding.

Dedicated VC Funds: Dedicated pre-seed funds have emerged in recent years, and larger venture capital firms are also showing interest in pre-seed rounds.

Let’s dive into each of the funding stages beyond pre seed funding and what to expect from Series A to Series C.

Exploring Series A Funding

Series A funding is the first official round of funding after pre seed funding. It is generally raised when a startup has a proven product-market fit, has generated initial revenue, and is looking to scale up. The funding round is typically led by venture capitalists and institutional investors, and the amount raised can range from $2 million to $15 million. In return, the investors receive preferred stock and a seat on the startup’s board of directors.

Scaling Up with Series B Funding

Series B funding is the second round of funding after Series A. It’s typically raised when a startup has achieved significant growth, has a solid customer base, and is looking to expand into new markets or develop new products. This round of funding can range from $15 million to $50 million, and investors may include venture capitalists, private equity firms, and corporate investors.

Reaching Market Leadership with Series C Funding

Series C funding is the third round of funding after Series B. At this stage, startups are usually mature and profitable, with a proven business model and a strong market position. The funding round is generally used to scale up operations or acquire other businesses. The amount raised can range from $50 million to over $100 million, and investors may include hedge funds, private equity firms, and sovereign wealth funds.

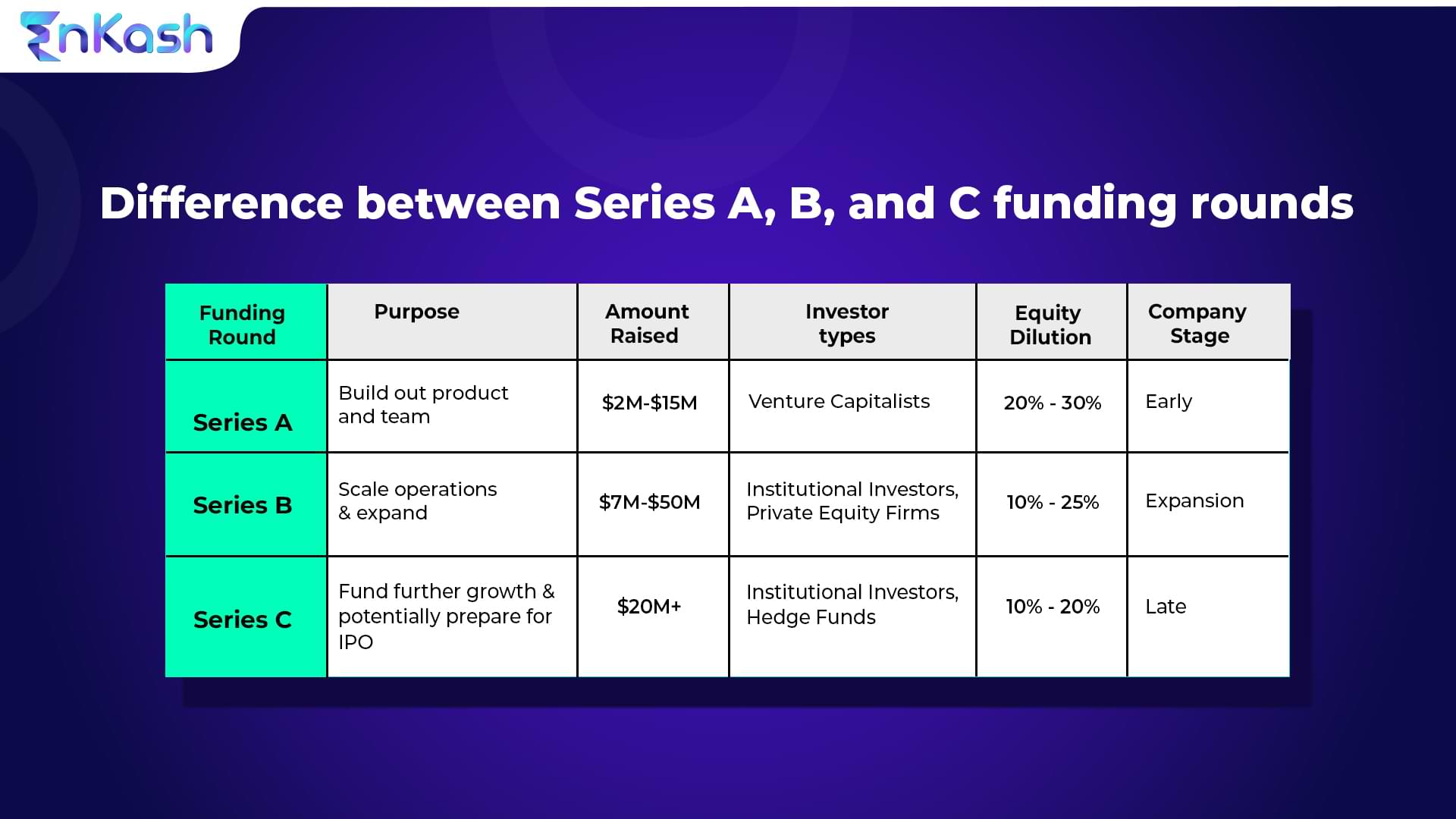

Differences Between Series A, B, and C Funding Rounds

There are several differences between Series A, B, and C funding rounds. For instance, the amount of funding raised increases with each round, as does the level of investor involvement. The terms of the investment, such as the type of stock issued and the level of control given to investors, may also differ.

Here’s a table summarizing the differences between Series A, B, and C funding rounds:

Getting your next round of venture capital

After gaining knowledge about the VC ecosystem, it’s crucial to keep in mind that VCs are professionals who negotiate deals on a full-time basis, while the entrepreneur might not have as much experience. Therefore, it’s essential to seek the help of a lawyer who can review all the documents and discuss the terms before signing or cashing any VC checks. Also, ensure that your business has the appropriate insurance coverage, and stay informed about the latest trends in the VC ecosystem.

Wrapping it up!

As an early-stage startup, understanding the different funding stages, from pre-seed funding to series B and C, is crucial for securing funding and scaling up your business. By carefully considering your business goals, market position, and financial projections, you can choose the right funding round to achieve your growth objectives and deliver significant returns to your investors.