When it comes to running a successful business, having a reliable and secure payment gateway is crucial. A payment gateway is a technology that allows businesses to accept electronic payments from their customers. It acts as a bridge between the customer, the merchant, and the financial institutions involved in the transaction. In this comprehensive guide, we will explore the different types of payment gateways available in the market and help you determine which one is right for your business.

Importance of Choosing the Right Payment Gateway for Your Business

Choosing the right payment gateway is a decision that can have a significant impact on your business. A reliable and efficient payment gateway can streamline your payment process, enhance customer experience, and boost your revenue. On the other hand, a subpar payment gateway can result in payment delays, technical glitches, and ultimately, dissatisfied customers. Therefore, it is essential to consider your business requirements, target audience, and industry-specific needs before finalizing a payment gateway.

Understanding the Different Types of Payment Gateways

Payment Gateways can be broadly categorized into three main types: traditional payment gateways, mobile payment gateways, and online payment gateways.

Traditional Payment Gateways

Traditional payment gateways are the most commonly used type of payment gateway. They enable businesses to accept credit card and debit card payments securely. These gateways usually require the customer to enter their card details on a secure payment page, which then gets processed through the gateway. Traditional payment gateways are widely accepted by customers and offer a high level of security. However, they may involve complex setup processes and transaction fees.

Mobile Payment Gateways

With the exponential growth of mobile usage, mobile payment gateways have gained popularity among businesses and customers alike. These gateways allow customers to make payments directly from their mobile devices, using apps or mobile-friendly websites. Mobile payment gateways offer convenience, speed, and a seamless user experience. They are especially beneficial for businesses that operate in mobile-driven industries, such as food delivery services or e-commerce platforms.

Online Payment Gateways

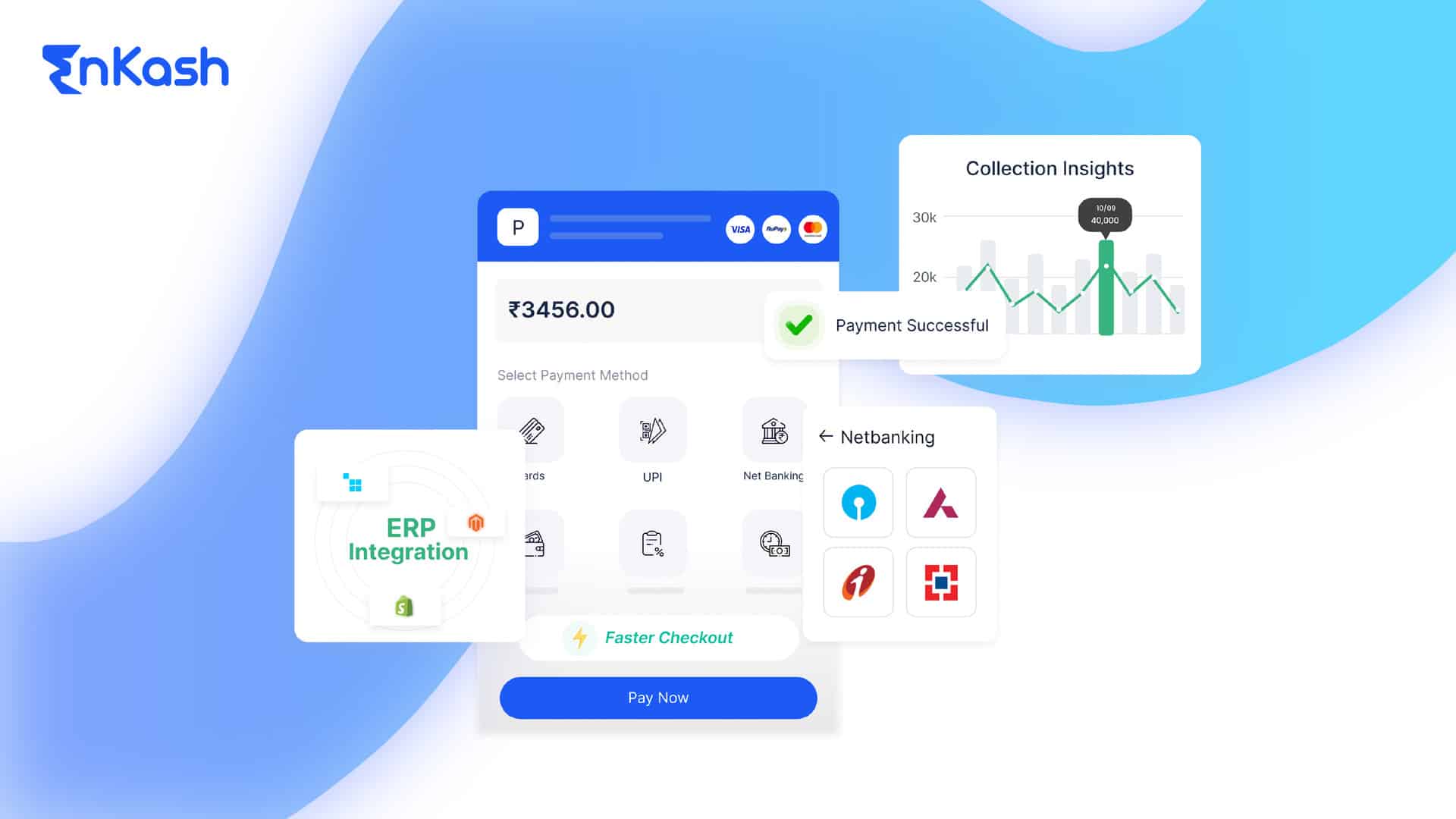

Online payment gateways are specifically designed for businesses that operate solely online. These gateways facilitate transactions made through e-commerce websites, online marketplaces, or online booking platforms. Online payment gateways provide a secure and user-friendly checkout process, enabling customers to make payments without leaving the website. They often support various payment methods, including credit cards, digital wallets, and bank transfers.

Payment Gateway Security and Fraud Prevention

Security and fraud prevention are critical aspects of any payment gateway. As a business owner, it is your responsibility to protect your customer’s sensitive information and prevent fraudulent activities. Here are some best practices to enhance payment gateway security:

- Implement robust encryption protocols, such as SSL, to secure customer data during transmission.

- Adhere to PCI DSS (Payment Card Industry Data Security Standard) compliance guidelines to ensure the secure handling of cardholder data.

- Implement multi-factor authentication and tokenization to add an extra layer of security to the payment process.

- Regularly update your payment gateway software and plugins to address any security vulnerabilities.

- Monitor transactions in real time and employ fraud detection tools to identify and prevent fraudulent activities.

- Educate your customers about safe online payment practices, such as creating strong passwords and avoiding suspicious websites.

Conclusion

Selecting the right payment gateway is a crucial decision for any business that wants to accept online payments. By understanding the different types of payment gateways available, considering the factors that matter to your business, and evaluating popular options in your region, you can make an informed choice. Remember to prioritize security, integration, customer experience, and cost-effectiveness when selecting a payment gateway.

If you are looking for a reliable and secure payment gateway platform, consider our Payment Gateway Platform, Olympus. With its features tailored to the needs of Indian businesses, get a seamless integration process, robust security measures, and excellent customer support. Choose the payment gateway that aligns with your business goals and provides a positive experience for your customers.