It is rightly said that one must have a supplier relationship of continuous improvement to create an agile process of procuring to pay process flow and in turn, boost business growth and productivity. Vendor payment automation will help streamline this process.

Automate accounts payable & receivable with EnKash

As companies expand, it creates their unique workflow with operations at each phase. With growth as a constant target, it becomes difficult for organizations to do everything in-house. Hence, the concept of outsourcing products and services played a key role for companies to strike a balance by reducing the workload on their internal teams and by effectively managing both the accounts payable and receivable workflows.

Now, it is not simple to work with third-party service providers since it involves challenges such as;

- Risk assessment: When an organization depends upon third-party vendors to run the business operation, a certain amount of security concern is inevitable. To mitigate such risk factors, certain policies should be followed in daily transactions. This can empower high-risk collaborations with a strong framework covering the financial, legal, and brand value of the company.

- Price negotiations: Vendor pricing should match with the allocated budget of the company. Hence, billing frequency, types of payment methods should be transparent and properly communicated. Both parties should review and agree to the terms of the contract.

- Visibility issue: Data and transactional clarity improves trust in a business relationship. Hence, a centralized data storage solution can improve resource allocation and the overall efficiency of the vendor.

- Cost optimization: The aim of organizations is to control the overall vendor costs while improving vendor performance.

- Long-term relationship: Most importantly, companies focus on establishing a valuable partnership with the vendor company.

- Variations in vendor selection criteria: It can cause disputes that can harm vendor relationships in the long run.

Criticalities of vendor management and vendor payment

Here, it is essential to understand the concept of vendor management and the vendor payment process. Vendor management involves structuring, sustaining, and establishing mutually-beneficial supplier relationships. While making payments to vendors is part of a company’s accounts payable workflow and it is the most crucial and final step in the purchase-to-pay cycle. The payment cycle includes the following:

- Receiving payable details

- Verifying the accuracy

- Generating the invoice

- Getting the approval

- Making the payment

Mishandling any one step of this cycle may lead to distrust and loss of brand value. Thus, prompt and systematic management of this vendor payment automation can ensure a fruitful relationship with the vendor company supplying products and services for a smooth business workflow.

In fact, vendor management being a multidisciplinary business practice involves several teams across business functions within the company. Monitoring all of that on a daily basis is not only stressful but also time-consuming and may create a hindrance to the overall growth of an enterprise. Hence, organizations are relying upon implementing strategies to handle the entire process of vendor management efficiently which also includes effective management of vendor accounts payable cycle.

As one focuses on the best practices for business it is pertinent to mention that vendor management and vendor payment automation are the two most critical aspects of any business, big or small. The tracking and timely disbursal of vendor payment invoices carve a part of the success story of the company.

Make a difference with the strategic vendor payment process

According to secondary research, one in twelve businesses do not monitor their payment processes and forty-seven percent of companies pay one in ten invoices late.

- Schedule vendor payment

- Automate the accounts payable process

- Regular updates of account for accuracy

- Electronic types of payment methods

- Optimize the finances with a real-time overview

Transition with innovative solutions

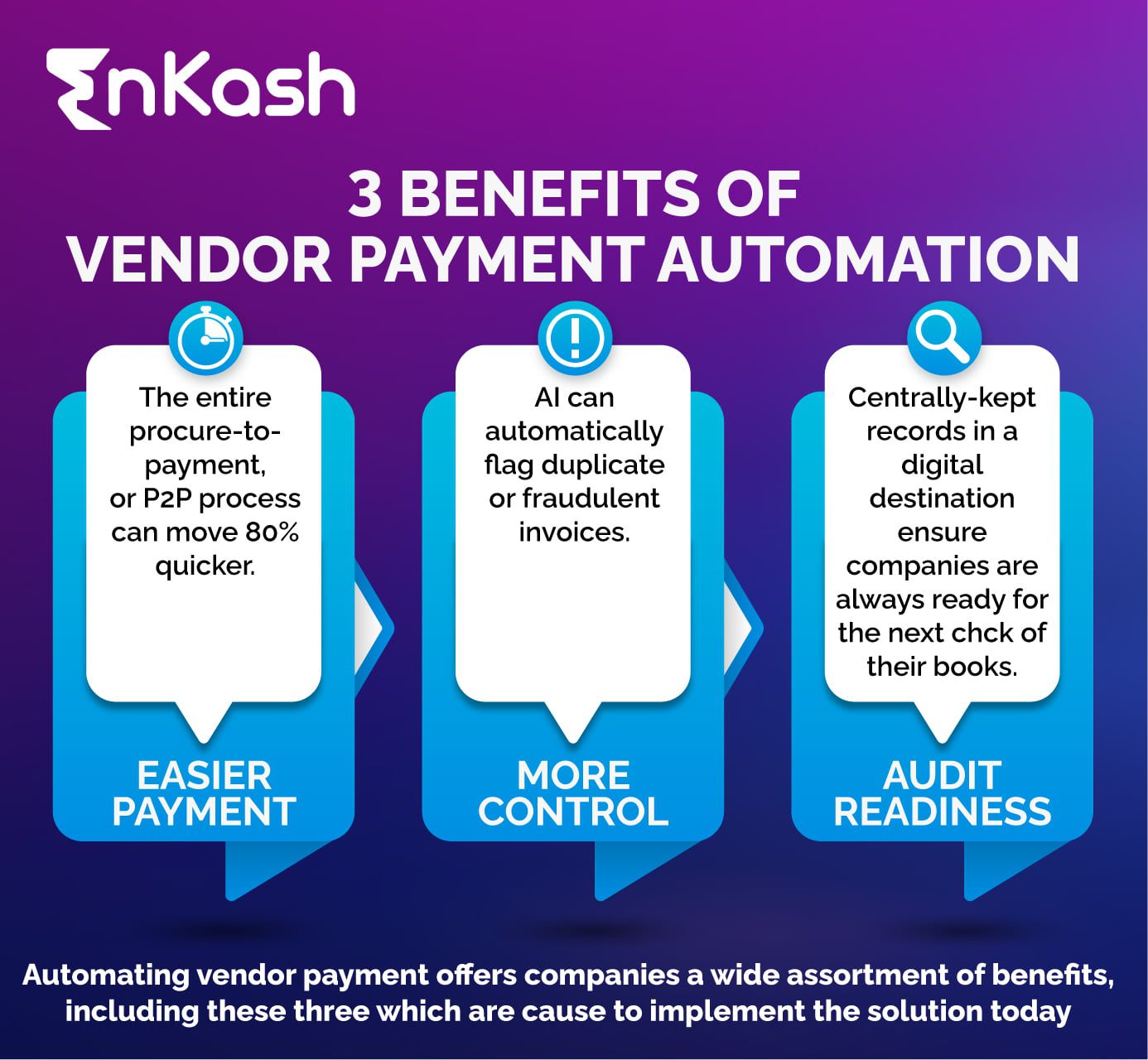

Earlier organizations use to depend upon spreadsheets for calculating vendor payment details, but currently, companies are embracing artificial intelligence (AI) considering the benefits it can bring to a business. As a solution to vendor management and vendor payment, AI-based automation solutions and data analysis are widely implemented by companies to optimize the business process of accounts payable and receivable workflow and finance operations related to types of payment methods.

A company can truly ease the complexities associated with vendor payments and enhance organizational productivity with the digital effort. Let’s understand the benefits that a company can enjoy by implementing AI-based vendor payment management solutions.

- Automation of the approval process

- Digitalization of data makes it audit-ready

- Automation of payment initiations

- Smooth tracking of transactions

- Effortless and error-free vendor management

- Enhance real-time reporting capabilities

- Create unique payment cards for each vendor

Power of innovation

A company must choose a solution with scalable features that can continue to ensure workflow automation while the company is growing. Integrated solutions are another aspect that ensures the non-duplication of invoices and payment entries in the accounts payable cycle. The focus is on simplifying complex financial operations with real-time dashboards and automation of vendor payments.

Aiming towards success!

Hence, it will not be incorrect to conclude that globalization has diminished geographical boundaries and brought companies and vendors around the world together. This has created an ecosystem of its kind nurturing best practices to ensure the deliverance of maximum value to the organization while managing vendor payments efficiently. Thus, Enkash is taking a step towards sustainability through effective management of vendor payments.

To know more, visit EnKash.com. You can also click below on Signup Now and we will reach out to you soon.