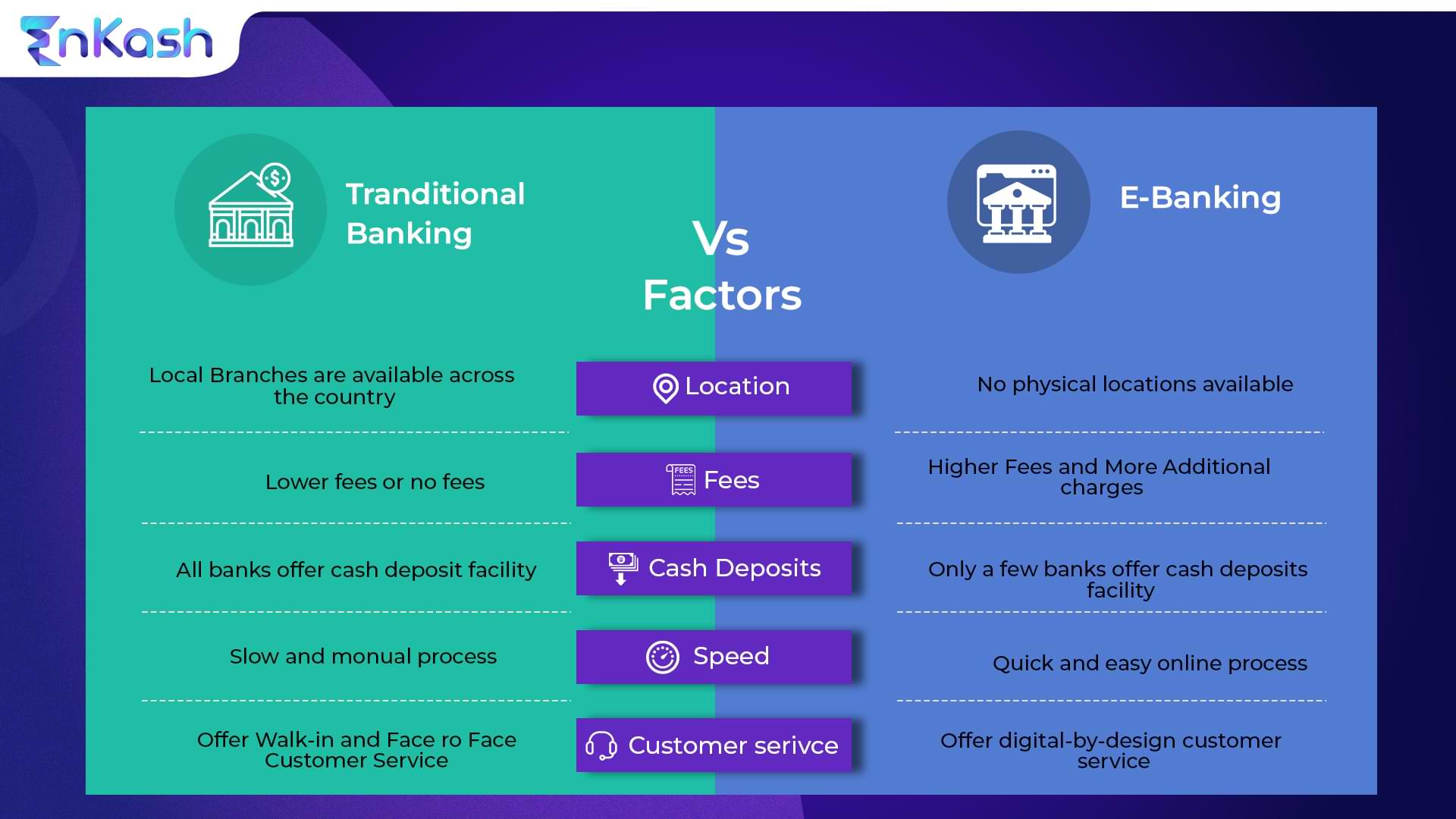

E-Banking or Electronic Banking in simple words refers to various banking transactions over the internet, which is end-to-end encrypted making it convenient, safe, and secure to use. The primary purpose of e-banking services is to promote paperless and cashless transactions in the digital world. This blog highlights the key benefits and differences between e-banking and traditional banking.

E-Banking Features

Below are the key benefits offered by e-banking in India:

- It promotes transparency since services are offered online

- The user has access to the bank services 24/7

- The user is sent notifications and alerts with updates relating to banking transactions and changes in the rules

- It lowers transaction costs for the banks

- It is convenient and easy for customers since a bank branch is not required

- It also saves time, manpower, and resources for the banks

Advantages of E-Banking

E-Banking has different benefits for customers, banks, and businesses:

For Banks:

- It enables lower transaction cost

- It increases efficiency and reduces manual errors

- Digital records reduces paperwork

- Experience higher loyalty from its customers

For Customers:

- It is convenient for the customers as they can access their account anytime, anywhere

- Lower cost per transaction as the customer is not required to visit the branch for every transaction

- There are no geographical barriers for the customers to use e-banking services

For Businesses:

- E-Banking improves productivity with the help of automation

- All the business transactions are recorded on a banking portal for future references

- It helps to reduce errors in regular banking transactions

E-Banking Services

There are two types of e-banking services i.e., financial services and non-financial services:

Financial services

Take a quick look at the financial services offered by e-banking:

- Enables the transfer of money to other private and national bank account holders instantly

- Helps to purchase goods and services and use business-to-customer payment methods such as credit cards, debit cards, net banking, mobile banking, various payment gateways, wallets, etc.

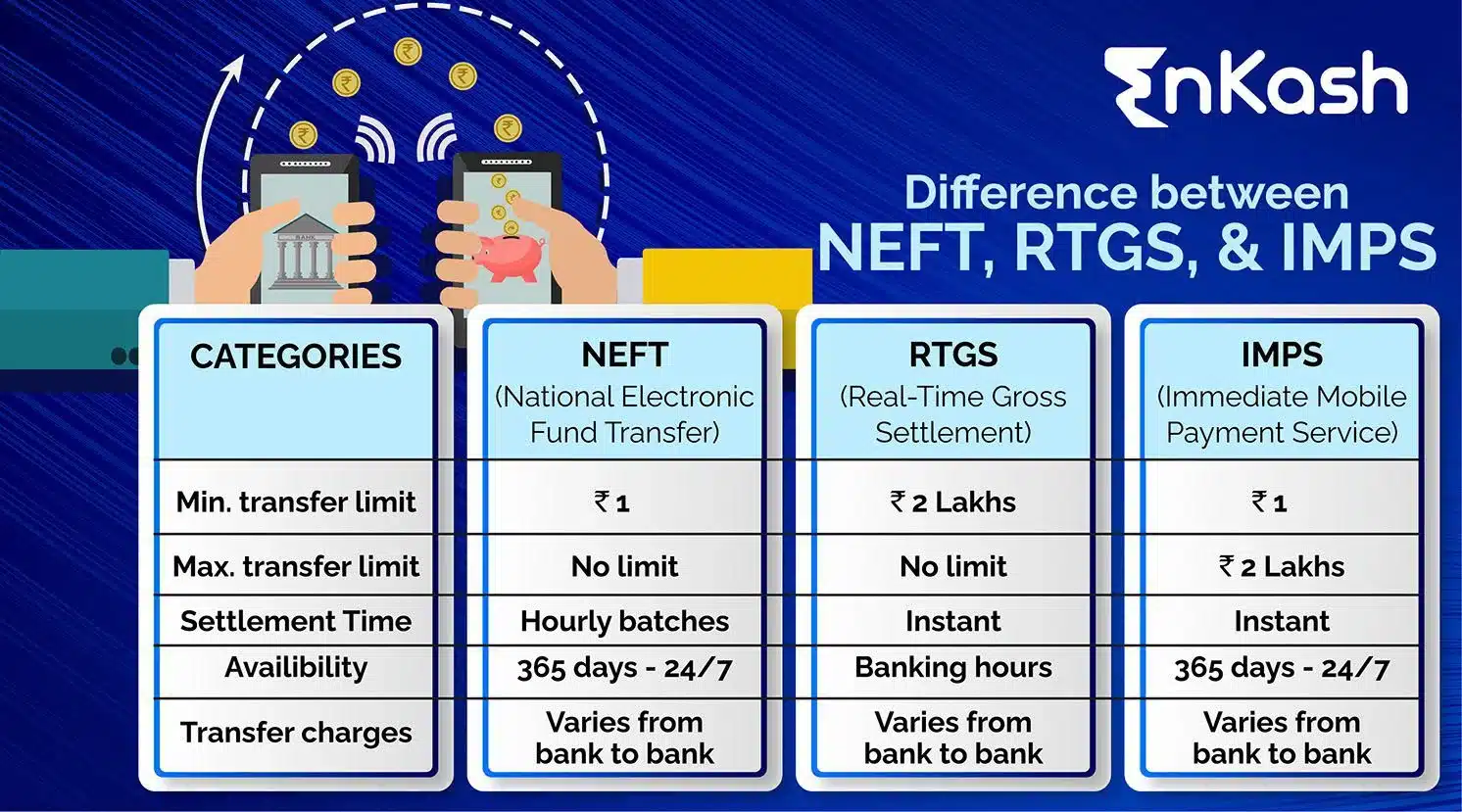

- Provides facility for making business-to-business transactions using electronic modes such as NEFT, RTGS, and IMPS options, etc. depending upon the business size and the transaction amount

Non-Financial Services

Below listed are non-financial services offered by e-banking in India;

- Allows user to view the balance sheet for both the savings and current accounts

- The customer can keep a track of the history of transactions done with huge historical archive limits

- Submitting chequebook requests

- Downloading Bank Statements as and when required

- View loan status or EMI Summary, if any

- Details relating to Mutual Funds, Demat Accounts, and insurance policy can also be monitored online

To know more, visit EnKash.com. You can also click below on Signup Now and we will reach out to you soon.