India, a country with a population of 138 crores, is growing by leaps and bounds in the digital sector. This transformation of payment modes in India has also resulted in the way we do business, and the banking sector has evolved gradually. While the conventional style of sending money to someone is still prevalent in a few villages and towns, digital banking has taken the nation by storm. From shopping on websites to paying for small mom & pop shops, from e-wallets to UPI payments, the options are varied, and many include RTGS/NEFT/UPI.

That being said, sending or transferring money is not as straightforward as it sounds. There are various limitations added to these payment modes. That is why you need to understand what is e-payment and why is it critical for today’s businesses.

While these may seem cumbersome for some, these security measures were put in for a reason. What we find an inconvenience could be a security benefit when it comes to preventing misuse. Let’s discuss what those limitations could be and what are the different modes of payment/banking available in India.

To learn more about managing digital payments and other expenses, you can watch the video below,.

Payment Methods in India

There are 4 major payment modes in India for transferring money, and depending on the regulatory body, these could be:

1. NEFT

2. RTGS

3. IMPS

4. UPI

Both NEFT and RTGS are regulated by the Reserve Bank of India, while IMPS and UPI payments are monitored by NPCI. Let us get to know more about them in detail below.

NEFT

Short for National Electronic Funds Transfer, the NEFT form is one of the oldest and most common modes of funds transfer in the country. NEFT payments are done in batches and can only be done between banks that offer NEFT services.

One of the best things about this service is that it can be done via both online and offline sources, i.e., through digital banking, and with the help of cash, cheque or demand draft in a bank branch. There is no set limit for the amount to transfer in this mode; however, a fee is levied on each transaction. The transaction fee varies according to the amount to be transacted.

How much time does NEFT take?

The time taken for NEFT transaction of money varies from bank to bank. However, the minimum transaction time via NEFT is 15 minutes, and the maximum goes to 2 hours. But it’s best to transfer the money during the working days before 7:45 p.m.

RTGS

RTGS stands for Real-Time Gross Settlements; as the name suggests, this mode of transfer is done in real-time and is optimized for high-volume transfers. The minimum amount for an RTGS transaction is 2 lacs, while the cap for per day transaction is 10 lacs. If you plan on transferring more than 2 lacs to a recipient, RTGS is the only solution.

Available in both offline and online modes, RTGS can be accessed 24*7, any time of the year. As per RBI guidelines, there is no charge associated with RTGS transfer if done online; however, for offline charges, banks may charge some fees.

IMPS

Short for Immediate Payment Services, IMPS is an online-only mode of payment that is done in real-time and is available 24/7. The minimum transfer amount for an IMPS transaction is Re. 1, while the maximum amount is currently at 5 lacs per transaction.

The charges for IMPS transactions vary from bank to bank. The best thing about IMPS is that you do not need to add beneficiaries to start transactions, and it can be done without the need to add account numbers.

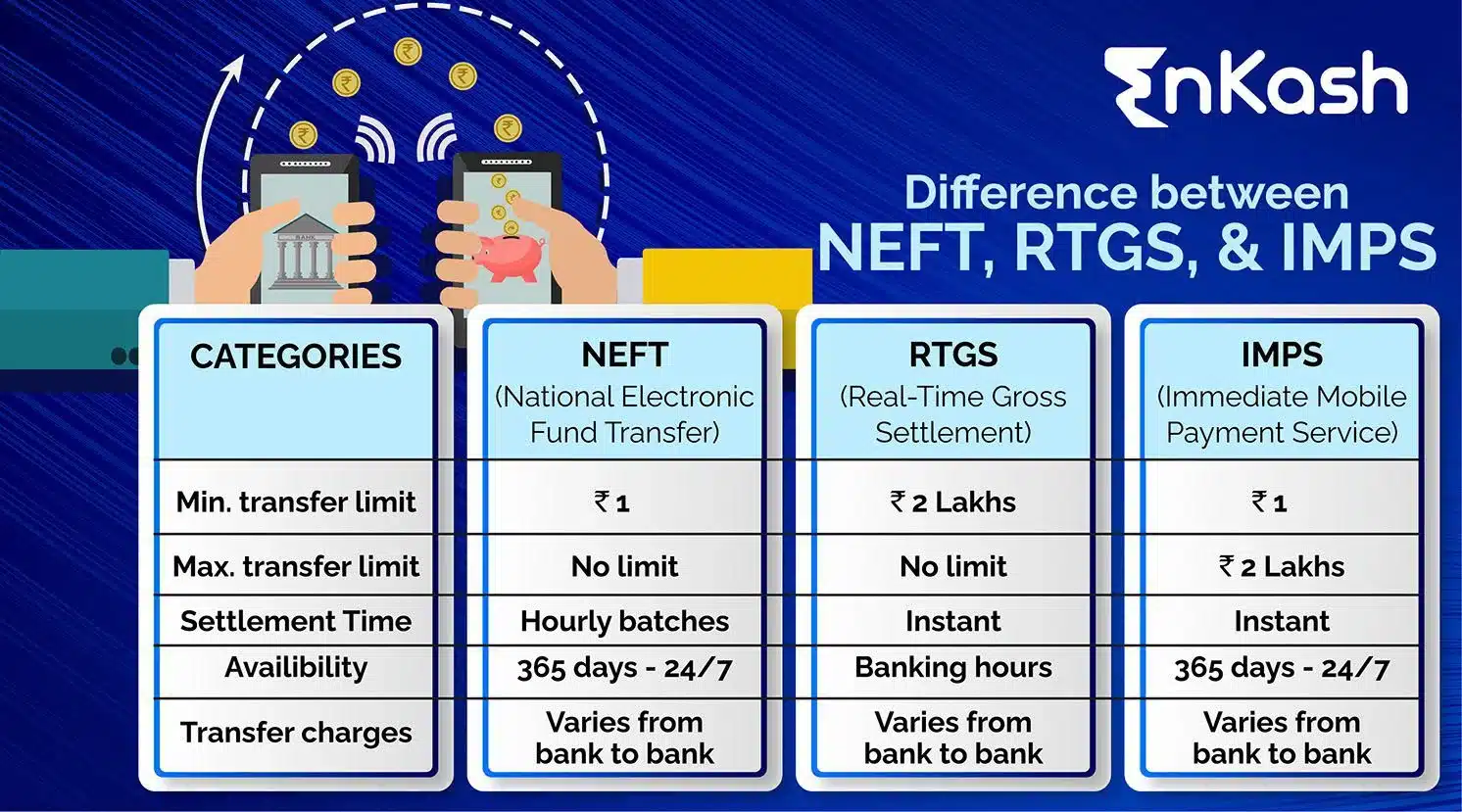

Difference between NEFT, RTGS and IMPS

The prime difference between the three modes of payment services is the amount of money transferred and the time taken during the process. In NEFT mode, there is no minimum transaction limit, but the upper cap is Rs 10 lakh, and the time consumed during the process is a maximum of 2 hours.

However, in RTGS payment mode, the minimum amount that can be transferred is Rs 2 lakh, and that can go up to Rs.10 lakh. Moreover, in the RTGS payment process, the real-time in transferring the fund is 30 minutes.

In IMPS mode, the maximum transaction limit is Rs 5 lakh, and it can be done instantly. So, these were the basic difference between the NEFT, RTGS, and IMPS.

UPI

Short for Unified Payments Interface, UPI is the fastest-growing digital payment mode currently in India. Payments/Fund transfers can be done to another recipient through phone numbers, unique QR codes, virtual payment addresses or Aadhar numbers. There is no need to enter the recipient account number to make a transaction.

UPI payments are made in real-time, can start with a minimum of Re.1 and has a cap of Rs 1 lac per day. You’ll need to link your bank account with your phone number/Aadhar number to start using the UPI mode of transaction. Currently, there are no charges or fees associated with using UPI.

Digital Payment Advantages And Disadvantages

In any mode of the financial banking system, whether it’s online or offline, there are certain sets of pros and cons, and you must become familiar with them because you are putting your hard-earned money into the bank.

Advantages of Digital Payment Services

- Fast and Simple

- Minimum Transaction Cost

- No Geographical Bar in the transaction

Disadvantages of Digital Payment Services

- High risk of forgery

- Untraceable

- Security Concerns

Bottom Line

While all 4 modes are equally helpful for transferring funds, they also have their own set of pros and cons. For quick day-to-day payments, UPI is the best service available. If your transfer amount falls between 1-5 lacs, IMPS is the quickest and best solution.

If you’re not tech-savvy and prefer the old-school method of sending money through a bank, NEFT should be your go-to mode if the amount transferred is less than 2 lacs. For anything above 2 lacs, RTGS is highly recommended. These payment modes not only make transactions and funds transfer easier but also help in bringing a change in the financial banking process of the nation.

To know more, visit EnKash.com. You can also click below on Signup Now and we will reach out to you soon.