Introduction to Cost Accounting

Cost accounting is one of the most important branches of accounting that focuses on recording, classifying, and analyzing the costs of production or services. In simple terms, cost accounting refers to tracking the expenses incurred by a business to produce a product or deliver a service. Identifying and controlling costs helps management make better decisions about pricing, budgeting, and overall operations.

The meaning of cost accounting goes beyond just numbers. Unlike financial accounting, which deals with overall profit and loss, cost accounting dives deep into the cost structure of each activity, process, or department. This makes it a vital tool for industries where controlling production costs and maximizing efficiency are essential.

What is Cost Accounting?

In simple terms, cost accounting is the process of tracking production costs—such as material costs, labor costs, and overhead costs to determine the actual cost of each product or service. Unlike financial accounting, which shows overall profitability, cost accounting dives deeper into internal cost structures to assist management in decision-making.

Cost Accounting Definitions

To understand it deeply, here are some widely accepted definitions of cost accounting by authors and institutions:

According to the Chartered Institute of Management

- Accountants (CIMA, UK): “Cost accounting is the process of classifying, recording, and appropriately allocating expenditure for the determination of costs of products or services, and for the presentation of suitably arranged data for cost control and managerial decision-making.”

- According to Wheldon: “Cost accounting is the application of accounting and costing principles, methods, and techniques in the ascertainment of costs and the analysis of savings and/or excesses as compared with previous experience or standards.”

- According to Kohler, “Cost accounting is a branch of accounting dealing with the classification, recording, allocation, summarization, and reporting of current and prospective costs.”

These definitions highlight that cost accounting is not just about cost calculation, but also about cost control, planning, and managerial efficiency.

Historical Context

The history of cost accounting began during the Industrial Revolution when large-scale manufacturing replaced manual production. Businesses needed a way to track their material, labor, and overhead costs, which led to the birth of cost accounting.

Key Stages in the Evolution

Period |

Key Development |

Significance |

18th–19th Century |

Industrial Revolution |

Introduction of basic cost tracking for materials and labor |

Early 20th Century |

Standard costing & budgetary control |

Helped compare actual vs planned costs |

Post–World War II |

Marginal costing & absorption costing |

Enhanced decision-making and pricing accuracy |

Modern Era |

Activity-Based Costing (ABC) & ERP integration |

Real-time cost analysis and strategic control |

Objectives and Functions of Cost Accounting

Cost accounting plays an important role in helping businesses to plan, control, and improve their overall financial performance. It not only measures the costs of producing goods or services but also helps management to make better decisions to maximize profits and minimize waste.

Main Objectives

Objective |

Description |

|---|---|

1. Cost Control |

Monitors and reduces unnecessary expenses by comparing actual costs with standard or budgeted costs. |

2. Cost Reduction |

Focuses on continuous improvement to lower production costs without compromising quality. |

3. Price Fixation |

Helps in deciding the selling price of products based on accurate cost data and desired profit margin. |

4. Profit Planning |

Assists management in forecasting future costs and profits through budgeting and cost analysis. |

5. Inventory Valuation |

Determines the correct value of raw materials, work-in-progress, and finished goods. |

6. Decision-Making Support |

Provides detailed cost data to help managers make informed business decisions. |

7. Cost Allocation and Comparison |

Allocates costs to various departments or products for performance comparison. |

Key Functions

- Recording Costs: Collects data on all costs related to production, such as materials, labor, and overheads.

- Classifying Costs: Categorizes expenses based on nature, function, and behavior (fixed, variable, or semi-variable).

- Analyzing and Interpreting Costs: Evaluates cost behavior to identify areas of inefficiency or high spending.

- Cost Reporting: Prepares detailed cost statements and reports for internal management use.

- Budgeting and Forecasting: Assists in creating realistic budgets and cost projections for future planning.

- Performance Evaluation: Compares actual performance with standard costs to measure efficiency and productivity.

Types of Costs in Cost Accounting

Understanding the different types of costs is essential for accurate budgeting, pricing, and decision-making. Costs can be divided in various ways based on their nature, function, and behavior, helping businesses manage expenses efficiently and improve profitability.

Type of Cost |

Meaning |

Common Examples |

|---|---|---|

Direct Cost |

Costs that are directly linked to production activities, like materials and labor. |

Raw materials, wages, production supplies |

Indirect Cost |

Expenses not directly traceable to a specific product or service. |

Rent, electricity, factory overhead |

Fixed Cost |

Remains constant regardless of the level of production. |

Factory rent, insurance |

Variable Cost |

Changes directly with production or sales volume. |

Raw materials, packaging |

Semi-Variable Cost |

Includes both fixed and variable elements. |

Utility bills, machine maintenance |

Product Cost |

Incurred during the manufacturing process and included in inventory valuation. |

Direct labor, factory overhead |

Period Cost |

Non-production costs are expensed in the period incurred. |

Office rent, administrative salaries |

Controllable Cost |

Can be influenced or managed by departmental heads or managers. |

Overtime pay, material usage |

Uncontrollable Cost |

Cannot be directly controlled by management. |

Taxes, license fees |

Opportunity Cost |

Potential benefit is lost when one alternative is chosen over another. |

Profit foregone from an unused opportunity |

Sunk Cost |

Costs already incurred that cannot be recovered. |

Past R&D expenses, old advertising costs |

Incremental Cost |

Extra cost arising from an increase in production or business activity. |

Additional raw material, overtime wages |

Marginal Cost |

Cost of producing one additional unit of output. |

Cost per extra product manufactured |

Standard Cost |

Predetermined or budgeted cost used as a benchmark for performance. |

Budgeted cost per unit |

Actual Cost |

Real cost incurred during production or operations. |

Actual wages, raw material bills |

Read More: What is a Cost Sheet?

Methods of Cost Accounting

Cost accounting methods are the techniques used to determine and record the cost of producing goods or providing services. The choice of method depends on the nature of business operations, the type of product, and the production process. Using the right method helps organizations calculate accurate costs, set proper prices, and manage profitability effectively.

Main Methods

Method |

Meaning |

Best Suited For |

Common Examples |

|---|---|---|---|

Job Costing |

Each job, contract, or order is treated as a separate unit of cost. Costs are recorded individually for every project. |

Custom-made products or services |

Construction, interior design, printing |

Batch Costing |

Cost is accumulated for a batch of identical units rather than each product. |

Industries producing goods in batches |

Pharmaceuticals, garments, bakery products |

Process Costing |

Costs are collected for each process or department and then averaged over all units produced. |

Continuous or mass production industries |

Chemicals, cement, oil refineries |

Contract Costing |

Used for large-scale, long-term projects where each contract is treated separately. |

Construction and infrastructure projects |

Road, bridge, building contracts |

Operating Costing |

Applied to services where costs are incurred to operate and maintain facilities. |

Service-based industries |

Transport, hospitals, power supply |

Unit or Output Costing |

Cost is determined per unit by dividing the total cost by the number of units produced. |

Simple, uniform production processes |

Brick-making, mining, and beverage production |

Marginal Costing |

Considers only variable costs for decision-making, ignoring fixed costs for short-term pricing. |

Decision-making and profit planning |

Pricing decisions, break-even analysis |

Standard Costing |

Predetermined costs are compared with actual costs to identify variances and improve efficiency. |

Manufacturing and large-scale production |

Automobile, machinery manufacturing |

Activity-Based Costing (ABC) |

Allocates overhead costs based on activities that drive expenses, ensuring accurate cost distribution. |

Complex, multi-product companies |

IT services, electronics, and FMCG industries |

Activity-Based-Costing (ABC)

Activity-Based Costing (ABC) is an advanced cost accounting technique used to determine the true cost of products or services by linking expenses to specific business activities. Instead of spreading overhead costs evenly, this method identifies the key activities (cost drivers) that consume resources—such as machine setups, inspections, or packaging—and assigns costs based on how much each product uses those activities.

This approach gives a more accurate picture of cost behavior, helping businesses make better decisions on pricing, budgeting, and process improvement. It’s especially useful for companies with multiple products or complex operations where traditional costing may give misleading results.

Key Features of ABC Analysis:

- It identifies and groups major activities that cause overhead costs.

- It allocates expenses to products or services based on their usage.

- Helps to detect non-value-adding activities and reduce unwanted costs.

- Supports more accurate pricing, profitability, and decision-making.

What is the Nature, Scope & Characteristics of Cost Accounting

Understanding the nature of cost accounting is essential for students, professionals, and businesses alike. Cost accounting is not just a method of calculating expenses; it is a scientific and systematic approach to identifying, analyzing, and controlling costs. It provides management with valuable data for planning, decision-making, and improving efficiency.

Nature of Cost Accounting

The nature of cost accounting can be summarized as follows:

- Analytical in nature: It focuses on analyzing costs by departments, products, or processes.

- Managerial tool: Designed for internal use to support decision-making, unlike financial accounting, which is for external reporting.

- Dynamic system: Continuously adapts to changes in production processes, technology, and business needs.

- Future-oriented: Helps in forecasting costs and budgeting, making it more forward-looking compared to traditional accounting.

Scope of Cost Accounting

The scope of cost accounting is wide and extends to multiple areas of business operations:

- Cost Ascertainment: Determining the actual cost of products or services through cost sheets and reports.

- Cost Control: Monitoring and reducing unnecessary expenses using tools like standard costing and variance analysis.

- Cost Reduction: Finding innovative ways to minimize costs without affecting quality.

- Decision Making: Providing data for pricing, make-or-buy decisions, and profitability analysis.

- Performance Evaluation: Measuring efficiency of departments, employees, and resources.

- Inventory Control: Managing raw materials, work-in-progress, and finished goods effectively.

Thus, the nature and scope of cost accounting together make it a comprehensive system for effective cost management and strategic planning.

Characteristics of Cost Accounting

The main characteristics :

- Systematic Process: Involves recording, classifying, and analyzing costs in a structured way.

- Cost Classification: Segregates costs into direct, indirect, fixed, variable, and overhead.

- Use of Techniques: Employs methods like marginal costing, budgetary control, and standard costing.

- Comparative Analysis: Helps compare actual costs with standards or budgets to identify variances.

- Continuous Process: Works throughout the production cycle, not just at year-end like financial accounting.

How is Cost Accounting Different from Financial and Management Accounting?

Understanding the difference between cost accounting and other accounting branches is crucial for students, professionals, and businesses. Cost accounting provides internal insights into costs and efficiency, while other accounting disciplines serve broader or external purposes.

1. Cost Accounting vs Financial Accounting

Feature |

Cost Accounting |

Financial Accounting |

|---|---|---|

Purpose |

Helps management control costs and improve efficiency |

Provides financial position and performance for external stakeholders |

Focus |

Detailed analysis of costs (materials, labor, overhead) |

Overall profit, loss, and financial position |

Users |

Internal management |

Investors, creditors, regulators |

Time Orientation |

Present and future-oriented (for decision-making) |

Historically oriented (records past transactions) |

Reports |

Cost sheets, variance analysis, budgets |

Balance sheet, profit & loss account, cash flow statements |

2. Cost Accounting vs Management Accounting

Feature |

Cost Accounting |

Management Accounting |

|---|---|---|

Purpose |

Determine and control the cost of products/services |

Aid overall managerial decision-making and planning |

Scope |

Limited to cost measurement and control |

Broader: budgeting, forecasting, performance evaluation, investment decisions |

Reports |

Cost reports, cost statements |

Management reports, performance reports, and financial analysis |

Time Orientation |

Present and future costs |

Present, future, and strategic planning |

Read more: Cost Accounting VS Financial Accounting.

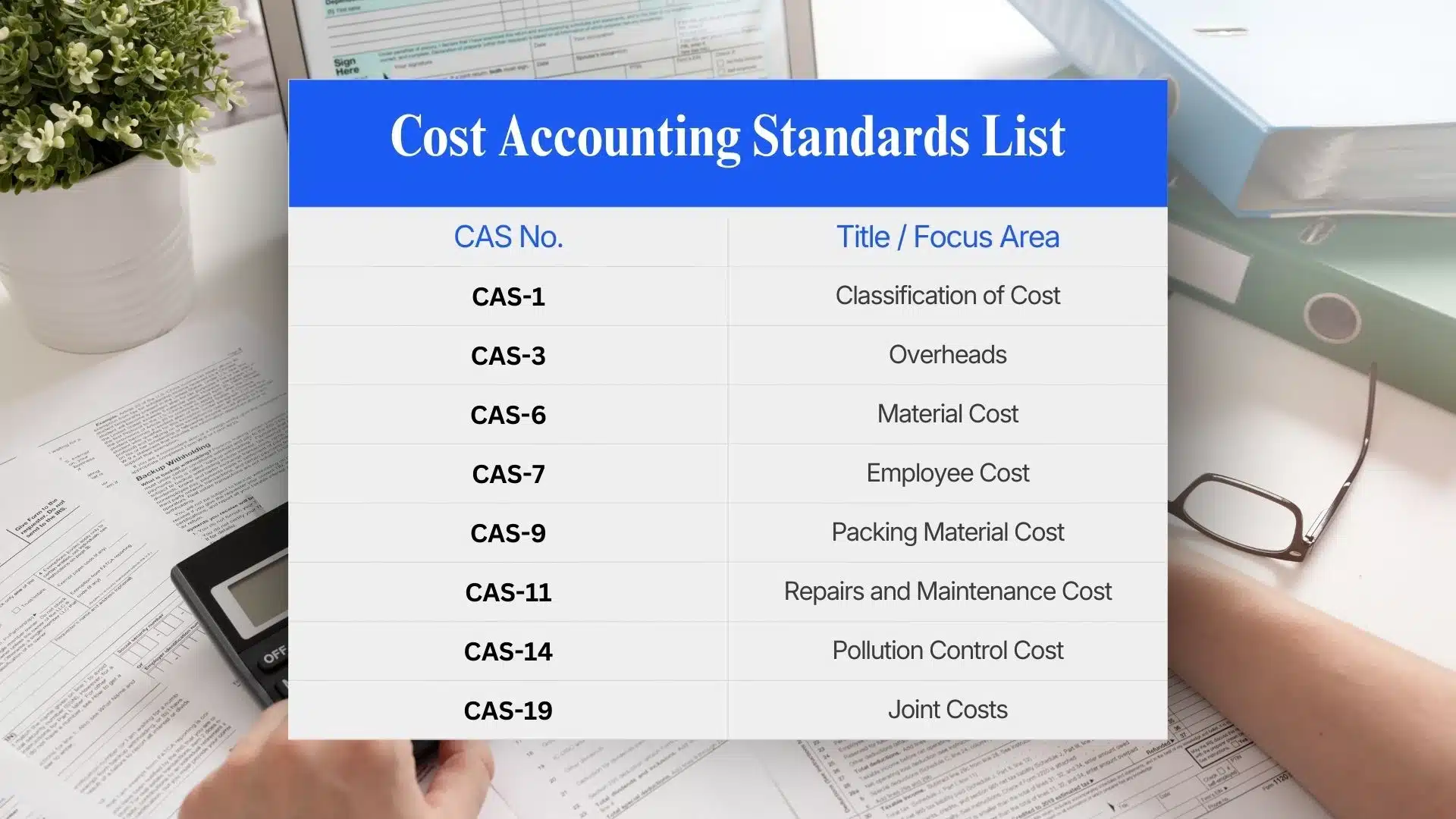

What are Cost Accounting Standards (CAS)?

Cost Accounting Standards (CAS) are a set of rules and guidelines designed to bring uniformity, accuracy, and transparency to cost accounting practices across various industries. They ensure that all organizations follow a standardized method while recording, analyzing, and reporting cost-related data. In India, these standards are issued by the Institute of Cost Accountants of India (ICAI-CMA) to promote consistency and comparability in cost statements.

CAS helps businesses maintain proper cost records, reduce discrepancies, and enhance the reliability of cost information used for decision-making. By following these standards, companies can present fair cost data for audits, government compliance, and management evaluation.

Key Objectives of Standards:

- Ensure consistency in cost recording and reporting.

- Promote transparency and reliability in cost information.

- Help in comparative analysis across products, departments, and industries.

- Assist in regulatory compliance and cost audit processes.

- Support better cost control and managerial decision-making.

Major Cost Accounting Standards of India

What is Cost Audit?

Types of Cost Audit:

1. Efficiency Audit:

Monitors how effectively resources like labor, materials, and machinery are being used. It focuses on identifying wastage and improving productivity.

2. Propriety Audit:

Ensures that expenditures are made wisely and for legitimate business purposes. It helps detect misuse of funds and promotes ethical financial practices.

3. Cost Compliance Audit:

Verifies whether cost records are maintained as per the Cost Accounting Standards (CAS) and statutory requirements issued by ICAI-CMA or the Companies Act.

4. Financial Audit of Cost Accounts:

Compares cost data with financial statements to ensure consistency and detect any discrepancies between cost and financial accounts.

5. Social Cost Audit:

Evaluates the organization’s impact on society, including environmental costs, pollution control, and corporate social responsibility expenses.

Importance of Cost Accounting

Cost accounting is vital for every business because it provides a clear understanding of how resources are used and how much it costs to produce goods or services. It goes beyond basic financial accounting by focusing on internal efficiency, cost reduction, and decision-making. By analyzing detailed cost data, management can identify areas of waste, improve productivity, and plan better for future growth.

It not only helps in controlling and reducing costs but also plays a key role in pricing, budgeting, and performance evaluation. It ensures that every rupee spent adds value and contributes to profitability. In competitive markets, accurate cost information can make the difference between profit and loss.

Key Reasons Why Cost Accounting is Important:

- Effective Cost Control: Helps track expenses, compare them with standards, and find areas for savings.

- Accurate Pricing: Enables businesses to set fair yet profitable prices based on real production costs.

- Profitability Insight: Identifies which products, services, or departments generate the most profit.

- Budgeting and Forecasting: Aids in preparing reliable budgets and long-term financial plans.

- Performance Evaluation: Measures operational efficiency and supports better managerial decisions.

Conclusion

It is a vital tool for businesses, enabling accurate cost measurement, control, and analysis. By understanding cost concepts, types of costs, methods and techniques, cost statements, and cost audits, organizations can make informed decisions, optimize resources, enhance efficiency, and improve profitability. The role of a cost accountant and adherence to cost accounting standards (CAS) ensure transparency, reliability, and compliance, making cost accounting an essential function for strategic management and long-term business growth.

FAQs

1. What is cost accounting in simple terms?

Cost accounting is the process of recording, analyzing, and managing all the costs involved in producing a product or service. In simple words, it helps businesses understand where their money is going and how to reduce unnecessary spending.

2. How is cost accounting different from financial accounting?

Financial accounting focuses on the overall financial position of a company—like profit, loss, and balance sheets—mainly for external users.

Cost accounting, on the other hand, focuses on internal cost control, efficiency, and decision-making. It helps management plan production and pricing strategies effectively.

3. What are the main methods of cost accounting?

Some common methods of cost accounting include:

- Job Costing: For customized products or projects.

Process Costing: For mass production industries like chemicals or cement. - Batch Costing: For goods produced in batches.

- Contract Costing: For long-term contracts like construction.

- Operating Costing: For service-based industries like transport or hospitals.

4. What is ABC analysis in cost accounting?

ABC (Activity-Based Costing) is a method that assigns overhead costs based on the actual activities that drive them—like machine hours or inspections. It provides a more accurate picture of product costs and helps in identifying non-value-adding activities.

5. What are the three main elements of cost?

The three main elements of cost are:

- Material Cost: The cost of raw materials used in production.

- Labour Cost: Wages and salaries paid to workers.

- Overhead Cost: Indirect expenses like rent, electricity, or maintenance.

6. What is overhead cost in cost accounting?

Overhead cost refers to all indirect expenses that cannot be directly linked to a specific product or job. Examples include factory rent, supervision, electricity, and equipment maintenance.

7. What are the limitations of cost accounting?

While it provides valuable insights, it has a few limitations:

- It can be expensive to maintain detailed cost records.

- Requires skilled staff and time for analysis.

- Estimates may not always be accurate.

- Not all costs can be easily classified or measured.

8. Is cost accounting mandatory for all companies?

No, it is not mandatory for all businesses. However, in India, under the Companies Act, 2013, certain industries like manufacturing, telecom, and power must maintain cost records as directed by the Ministry of Corporate Affairs (MCA).

9. What are the cost accounting standards in India?

Cost Accounting Standards (CAS) are issued by the Institute of Cost Accountants of India (ICAI-CMA). They provide uniform guidelines on how to record and report costs. Examples include CAS-1 (Classification of Cost) and CAS-6 (Material Cost).

10. Why is cost accounting important for decision-making?

It helps management make smart financial decisions by providing detailed insights into cost behavior, profitability, and efficiency. It supports pricing strategies, budgeting, and resource optimization—leading to better control and higher profits.