Today, organizations are constantly seeking ways to optimize their operations and maximize efficiency. One crucial aspect of business management is the collection process, where timely and effective debt recovery plays a vital role. To enhance this process, businesses are turning to collection analytics, a powerful tool that leverages data analysis techniques to assess and predict customer payment behavior. By unlocking the power of data, collection analytics enables businesses to make informed decisions, optimize cash flow, and improve overall financial management.

In this article, we will explore the concept of collection analytics in detail. We will delve into its benefits, highlight key metrics and indicators used in collection analytics software, and discuss how it can reduce bad debt and improve cash flow.

What is Collection Analytics?

Collection analytics is the application of data analysis techniques to assess and predict customer payment behavior, enabling businesses to optimize their cash inflow processes and enhance overall financial management. By analyzing historical data, collection analytics provides insights into patterns, trends, and potential risks related to business accounts receivable. This process empowers businesses to improve efficiency in debt recovery, reduce bad debt, and enhance cash flow management.

Benefits of Collection Analytics for Businesses

Implementing collection analytics offers several benefits for businesses. By leveraging the power of data, businesses can gain valuable insights that drive informed decision-making and strategic actions. Let us explore the key benefits of collection analytics:

• Improved Efficiency in Debt Recovery:

Collection analytics enables businesses to create targeted and personalized collection strategies for different customer segments. By leveraging data analytics, businesses can optimize their collection efforts, prioritize high-risk accounts, and allocate resources effectively.

• Reduced Bad Debt: By analyzing historical payment data and customer behavior, collection analytics software can predict future payment behavior. This predictive capability allows businesses to proactively manage collections and take prompt actions to reduce bad debt.

• Enhanced Cash Flow Management: Collection analytics provides businesses with a clear understanding of their payment cycle trends, average DSO, and other key metrics. This visibility allows businesses to optimize their cash flow, improve working capital management, and reduce the risk of financial instability.

• Streamlined Operations: Earlier, companies relied on manual data entry and disconnected systems, which often led to errors and inefficiencies in data management. Collection analytics automates the data collection process, pulling real-time data directly from the dashboard. This automation reduces manual errors, simplifies analysis and reporting, and streamlines overall collection operations.

Key Metrics and Indicators in Collection Analytics Software

Collection analytics software relies on various metrics and indicators to evaluate the efficiency of collection processes and identify areas for improvement. Let us explore the key metrics commonly used in collection analytics software:

• Days Sales Outstanding (DSO): DSO is a financial metric that measures the average number of days it takes for a company to collect payment after a sale has been made. DSO provides businesses with insights into their efficiency in collecting receivables and helps optimize cash flow management.

• Customer Behavior: Analyzing customer behavior data allows businesses to understand payment patterns, identify trends, and predict future payment behavior. This information helps businesses prioritize accounts, allocate resources effectively, and tailor collection strategies to individual customer segments.

• Payment Trends: Examining payment trends helps businesses identify patterns and potential risks associated with delayed or non-payment. By understanding payment trends, businesses can take proactive measures to prevent collection issues and improve overall cash flow.

• Aging of Receivables: Tracking the aging of receivables provides businesses with insights into the average time it takes to collect payments. By monitoring the aging of receivables, businesses can identify bottlenecks, streamline processes, and optimize their cash conversion cycle.

Predicting Customer Payment Behavior with Collection Analytics Software

Collection analytics software leverages historical data, customer payment patterns, and various metrics to create models that predict future payment behavior. These models consider factors such as payment history, average DSO, and customer behavior to assess the likelihood of timely payments. By utilizing predictive analytics, businesses can proactively manage collections, allocate resources efficiently, and prioritize high-risk accounts for targeted actions. This predictive capability empowers businesses to optimize their debt recovery efforts and improve cash flow management.

Days Sales Outstanding (DSO) Management: Optimizing Cash Flow

Efficient Days Sales Outstanding (DSO) management is crucial for businesses as it provides insights into the average time it takes to collect payments from customers. Effective DSO management allows businesses to optimize working capital, reduce the risk of bad debts, and enhance overall financial stability. It also helps in assessing the effectiveness of credit and collection policies, enabling businesses to make informed decisions to improve their cash conversion cycle.

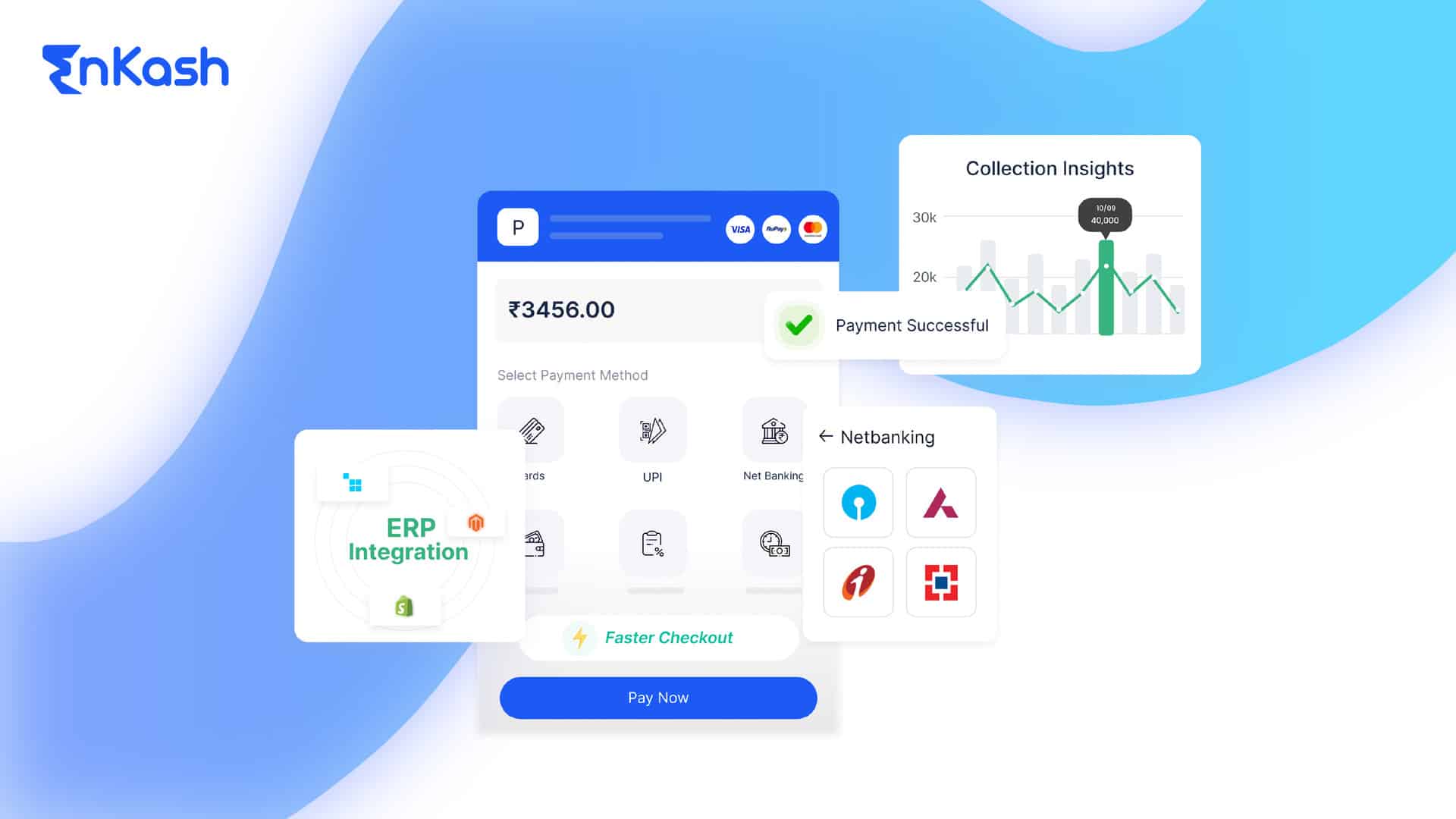

Collection Analytics with EnKash: Simplifying Data-driven Decision-Making

For the implementation of collection analytics advanced data analysis skills are not always a prerequisite for success. Many solutions, including Enkash’s offerings, are designed with user-friendliness in mind, ensuring accessibility for individuals without extensive technical expertise. Enkash’s Collection Analytics, in particular, stands out as a powerful tool to unlock the potential of data and optimize collection processes for sustainable growth. The Enkash platform automates data collection, pulling real-time information directly from the dashboard. This not only reduces manual errors but also centralizes data, simplifying the analysis and reporting process.

• Role-Based Access: EnKash allows businesses to grant role-based access to a user-friendly dashboard, facilitating easy access to relevant Accounts Receivable (AR) information for cross-functional teams like finance, sales, and operations.

• Real-Time Insights: Gain up-to-the-minute tracking of payment statuses, enabling the implementation of proactive strategies to reduce Days Sales Outstanding (DSO) and maintain a healthier cash flow position.

• Comprehensive and Customizable Dashboard: Access a comprehensive customizable dashboard providing real-time insights into AR metrics, enabling proactive collection management and quick identification of discrepancies for faster resolutions. Tailor your collection analytics dashboard to display reports based on a weekly, monthly, or custom date range, ensuring relevance and clarity.

• Visibility and Monitoring: Effortlessly track your collection process with complete visibility, monitoring invoice status, outstanding amounts, total collections, and overdue payments for prompt follow-ups.

• Automated Reporting: Receive comprehensive downloadable reports automatically, eliminating the need for manual compilation and reducing the risk of errors.

• DSO Tracking: Measure and manage Days Sales Outstanding (DSO) efficiently to gain insights into the average time it takes to collect payments. Improve receivables management with a clear understanding of payment cycle trends, optimizing cash flow further.

Conclusion

The adoption of collection analytics emerges as a strategic imperative for organizations aiming to optimize operations and bolster efficiency in debt recovery. By leveraging data analysis techniques, businesses can unlock valuable insights into customer payment behavior, paving the way for informed decision-making and targeted strategies. Enkash’s user-friendly Collection Analytics stands out as an accessible and powerful solution, automating data collection and providing real-time insights to streamline the analysis and reporting process. The benefits of collection analytics, including improved debt recovery efficiency, reduced bad debt, enhanced cash flow management, and streamlined operations, underscore its pivotal role in financial stability. The elucidation of key metrics such as Days Sales Outstanding (DSO), customer behavior, payment trends, and aging of receivables emphasizes the comprehensive nature of collection analytics software. Moreover, the article underscores the significance of DSO management in optimizing cash flow and offers a detailed exploration of EnKash’s features, reinforcing its role in simplifying data-driven decision-making without requiring advanced data analysis skills. Ultimately, the integration of collection analytics, facilitated by user-friendly platforms like Enkash, becomes a cornerstone for businesses aspiring to navigate the complexities of debt recovery and financial management with efficiency and foresight.