Understanding the Importance of a Payment Gateway

A payment gateway is an online service that enables secure financial transactions between your customers and your business. It acts as a bridge between your website or online store and the payment processor, facilitating the smooth and secure transfer of funds. Here are some key reasons why a payment gateway is essential for your e-commerce business:

Seamless Online Transactions: Traditional payment methods like cash, cheques, and direct bank transfers can be time-consuming and inconvenient for both businesses and customers. With a payment gateway, you can offer your customers a quick and easy way to make digital payments. Transactions are processed in real time, ensuring a seamless and efficient checkout experience.

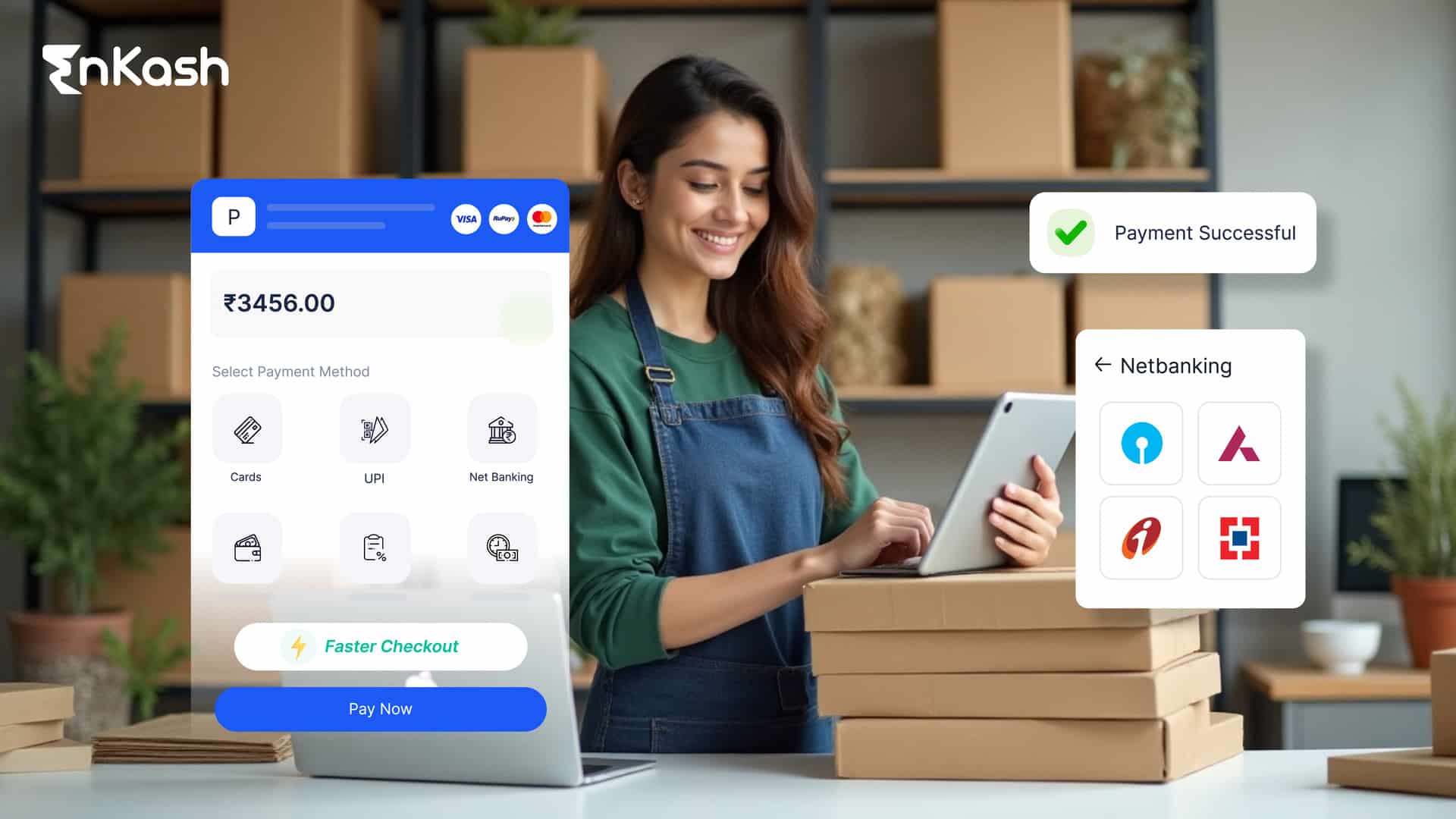

Multiple Payment Options: A payment gateway allows you to accept various payment methods, such as credit cards, debit cards, UPI, wallets, and bank transfers like NEFT, RTGS, and IMPS. It also provides convenience and flexibility to your customers, enhancing their

overall shopping experience.

Enhanced Security: Security is a top priority in online transactions. Payment gateways use advanced encryption technology to secure your customers’ payment details. This ensures that sensitive information, such as credit card numbers, is protected from unauthorized access and potential data breaches. By providing a secure payment environment, you can build trust with your customers and protect their valuable information.

Fraud Prevention: Payment gateways employ robust tools and algorithms to detect and prevent fraud. They analyze transaction patterns and use machine learning algorithms to identify suspicious activities and mitigate the risk of online fraud. By having a payment gateway with built-in fraud prevention measures, you can minimize the chances of fraudulent transactions and protect your business from financial losses.

Factors to Consider When Choosing a Payment Gateway for E-Commerce Website Payment Gateway

Selecting the best e-commerce payment gateway for your business requires careful consideration of several factors.

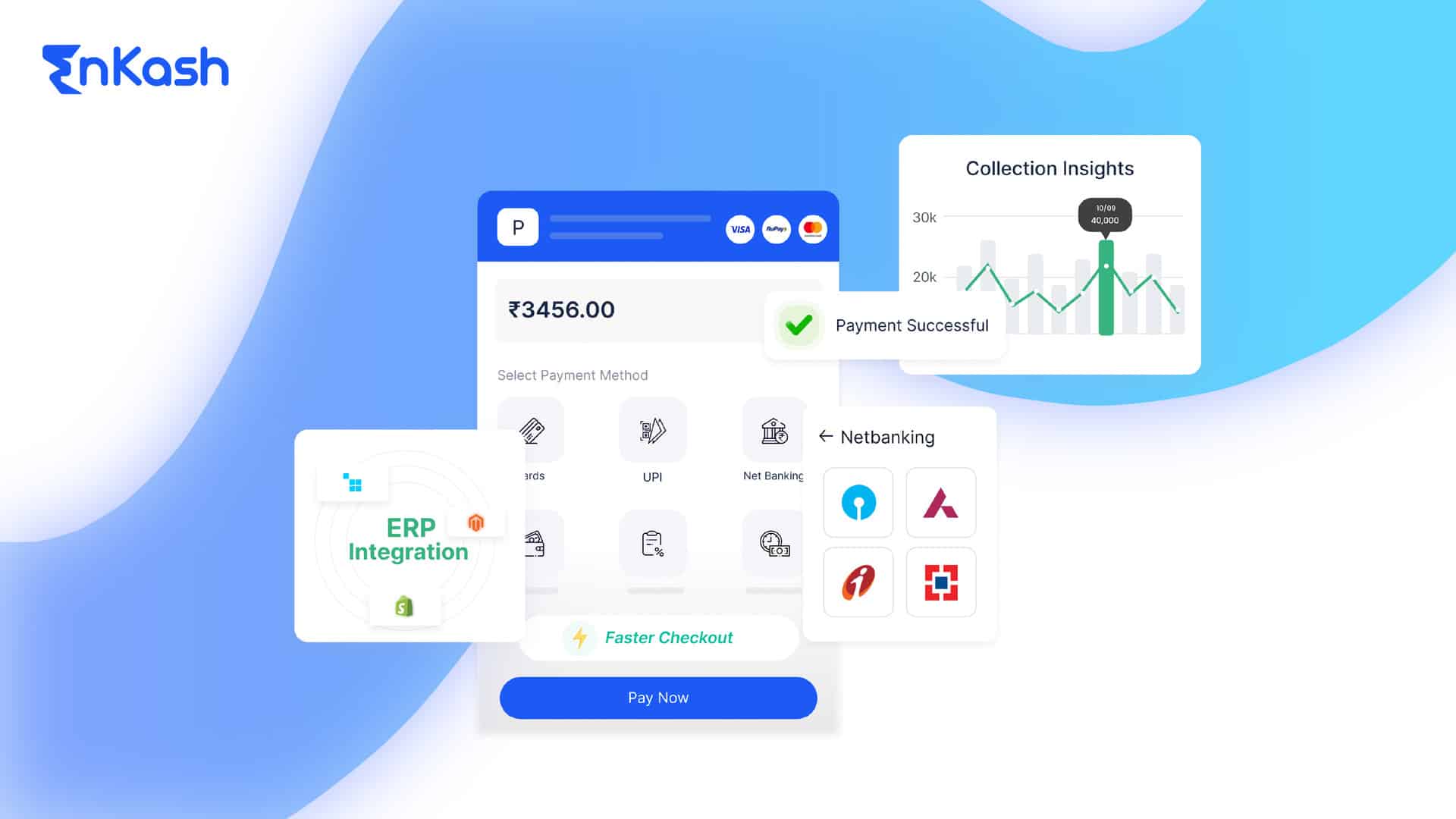

Integration Options: It should offer easy-to-use APIs, plugins, or SDKs that allow for smooth integration. Consider the compatibility with your existing system and ensure that the payment gateway can be easily integrated into your checkout process.

Payment Methods Supported: Check if the payment gateway supports the payment methods preferred by your target audience. Look for options like credit cards, debit cards, net banking, UPI, Wallets, NEFT, and RTGS payments. Offering a wide range of payment options will help you cater to diverse customer preferences and increase your potential customer base.

Transaction Fees and Pricing: Consider the transaction fees and pricing structure of the payment gateway. Evaluate the cost per transaction and any additional charges, such as setup fees, monthly fees, or hidden costs.

Security Measures: Ensure that the payment gateway prioritizes security and follows industry-standard security protocols. Look for features like data encryption, secure tokenization, and fraud detection systems. Check if the payment gateway is compliant with the Payment Card Industry Data Security Standard (PCI DSS) to ensure the highest level of security for your customer’s payment information.

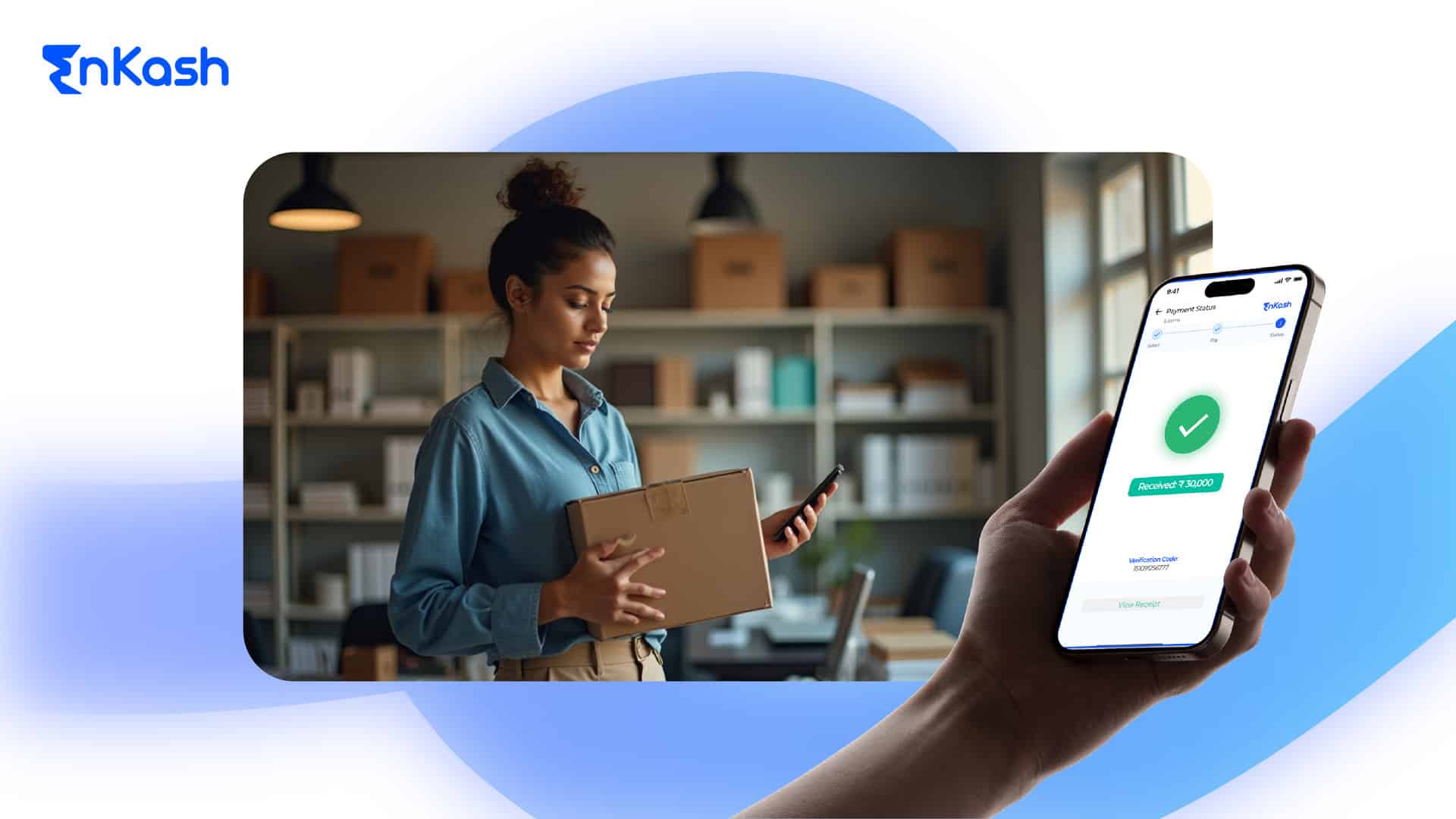

User-Friendly Interface: A user-friendly interface is essential for both you and your customers. The payment gateway should have an intuitive dashboard that allows you to manage transactions easily, generate reports, and track payment statuses. It should also provide a seamless and hassle-free checkout experience for your customers, minimizing cart abandonment.

Customer Support: When it comes to technical problems or payment gateway concerns, reliable customer support is essential. Select a payment gateway supplier that provides helpful customer service via phone, email, or live chat. You may quickly and effectively handle any payment-related concerns with the assistance of prompt and competent service.

Scalability and Growth Potential: Consider the scalability and growth potential of the payment gateway. As your business expands, you may need to process higher transaction volumes or add new features. Ensure that the payment gateway can handle your future growth requirements without compromising performance or security.

Reputation and Reviews: Research the reputation and reviews of the payment gateway provider. Look for testimonials or case studies from existing customers to gauge their satisfaction levels. Check if the provider has a solid track record of reliability, uptime, and customer support. A reputable payment gateway provider will give you confidence in their services and ensure a smooth payment experience for your customers.

The Olympus Payment Gateway Difference: A Better Way for Businesses

When it comes to choosing the best e-commerce payment gateway for your business, Olympus offers a unique and innovative solution. EnKash’s product, Olympus™, is a licensed online payment aggregator authorized by the RBI (Reserve Bank of India). Here’s why EnKash stands out from the competition:

Secure and Efficient Payment Gateway: It enables swift and secure business transactions. With advanced data encryption and fraud prevention measures, your customers can make payments with confidence, knowing that their information is protected. The real-time transaction processing ensures quick and seamless payments, enhancing the overall customer experience.

Comprehensive Integration Options: EnKash provides multiple integration options, including API integration, plugin integration, and SDK integration. Whether you have a custom website, use platforms like WordPress or Shopify, or have a mobile app, the payment gateway can be easily integrated into your existing system. This flexibility allows you to choose the integration method that best suits your business needs.

Extensive Payment Methods: EnKash supports a wide range of payment methods, including credit cards, debit cards, net banking, UPI, wallet, NEFT, and RTGS payments. By offering diverse payment options, you can cater to the preferences of your customers and maximize your sales potential. Our payment gateway ensures that you don’t miss out on any potential customers due to limited payment options.

Dedicated Customer Support: EnKash prioritizes customer satisfaction and provides dedicated customer support to address any queries or issues. Our responsive support team is available via phone, and email, ensuring prompt assistance whenever you need it. With EnKash, you can rely on support to resolve any payment-related issues and keep your business running smoothly.

Regulatory Compliance: EnKash’s product, Olympus™, is a licensed online payment aggregator authorized by the RBI. This ensures that EnKash operates within the regulatory framework and complies with the highest industry standards. By choosing EnKash, you can have peace of mind knowing that your payment gateway is backed by regulatory approval and adheres to strict compliance guidelines.

Business Growth Potential: The payment gateway is designed to support the scalability and growth of your business. As your transaction volumes increase or your business expands, EnKash can seamlessly handle the growing demands. With EnKash, you can focus on growing your business while having a reliable and efficient payment gateway to support your operations.

Conclusion

Choosing the best e-commerce payment gateway for your business is a critical decision that can significantly impact your success in the online marketplace. Consider factors like integration options, supported payment methods, security measures, pricing, and customer support when evaluating your options. Olympus payment gateway offers a secure, efficient, and comprehensive solution for businesses, with a focus on regulatory compliance and customer satisfaction. By choosing EnKash, you can streamline your payment processes, enhance customer experience, and drive the growth of your e-commerce business. Get started with EnKash today and experience the EnKash difference!