In today’s fast-paced business world, maximizing efficiency is crucial to staying competitive. One area where businesses can greatly benefit from increased efficiency is in their accounts receivable process. Accounts receivable automation is revolutionizing the way businesses manage their cash flow and streamline payment processing. By leveraging the power of automation, businesses can reduce errors, improve cash flow, and ultimately enhance their overall financial performance.

This blog will explore the numerous benefits of automating your accounts receivable process and provide valuable insights into the best available tools and software for AR automation.

Increased efficiency and reduced errors

One of the most significant benefits of automating your accounts receivable process is the increased efficiency it brings. Manual processes are often time-consuming and prone to errors, leading to delays in payment collection and potential loss of revenue. By automating tasks such as invoice processing, payment reminders, and reconciliation, businesses can streamline their accounts receivable process and significantly reduce the likelihood of errors. Automation ensures that invoices are generated accurately and promptly, payment reminders are sent on time, and payments are reconciled efficiently. This not only saves valuable time but also enhances customer satisfaction by providing a seamless and error-free payment experience.

Cost savings and improved cash flow

Another compelling benefit of automating your accounts receivable process is the cost savings it can bring to your business. Manual processes require significant manpower and resources, which can result in high operational costs. By automating tasks that were previously done manually, businesses can reduce the need for manual labor and reallocate resources to more strategic initiatives. Additionally, automation can help improve cash flow by accelerating the payment collection process. With automated payment reminders and streamlined reconciliation, businesses can ensure that payments are received promptly, minimizing the need for costly collection efforts and reducing the risk of late payments.

How automated account receivables can streamline payment processing?

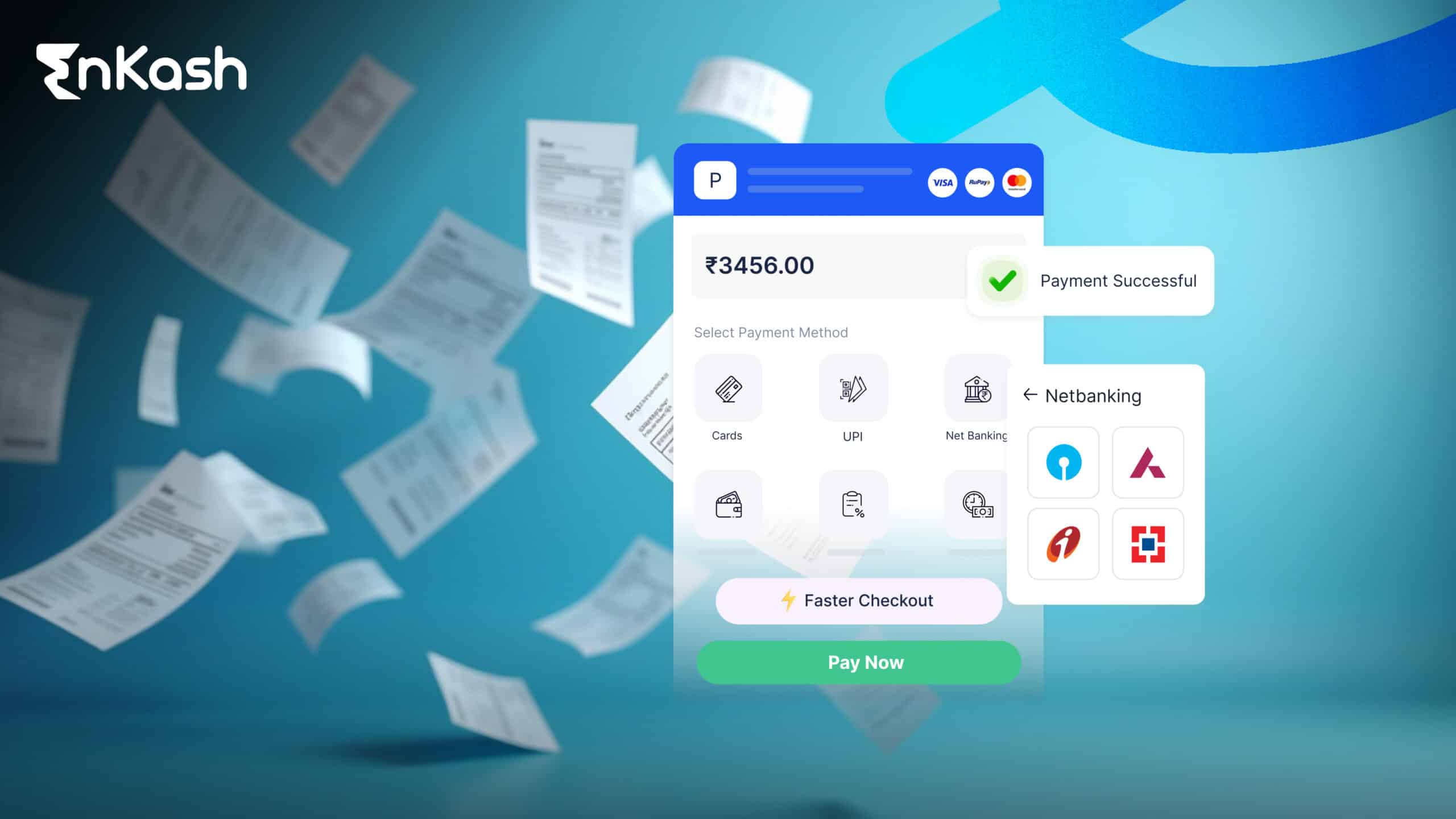

Automated account receivables can transform the payment processing landscape for businesses. Traditional payment processing methods often involve manual data entry, which is time-consuming and prone to errors. With automated account receivables, businesses can eliminate manual data entry and streamline the payment collection process. Automated solutions can capture payment information directly from invoices, reducing the need for manual intervention and ensuring accurate and timely payment processing. Additionally, automated account receivables can integrate seamlessly with payment gateways, enabling businesses to accept multiple payment methods and improving the overall customer experience. By leveraging automation, businesses can significantly reduce the time and effort required to process payments, leading to faster cash inflows and improved financial performance.

Implementing AR automation in your business

Implementing accounts receivable automation in your business requires careful planning and execution. To ensure a successful implementation, businesses should follow a systematic approach. Firstly, they need to assess their current accounts receivable process and identify areas that can benefit from automation. This could include tasks such as invoice processing, payment reminders, or reconciliation. Once the areas for automation have been identified, businesses should evaluate the available tools and software, considering factors such as functionality, ease of use, and integration capabilities. It is crucial to involve key stakeholders throughout the implementation process to ensure their buy-in and support. Lastly, businesses should provide thorough training to their employees to ensure a smooth transition to the automated accounts receivable process. By following these steps, businesses can maximize the benefits of accounts receivable automation and drive operational efficiency.

Overcoming common challenges in AR automation

While accounts receivable automation offers numerous benefits, businesses may face certain challenges during the implementation process. One common challenge is resistance to change from employees who are accustomed to manual processes. To overcome this challenge, businesses should emphasize the advantages of automation and provide comprehensive training to employees to build their confidence in the new system. Integration with existing accounting systems can also be a challenge, as businesses need to ensure seamless data flow between the automated accounts receivable solution and their accounting software. Choosing a solution that offers robust integration capabilities and provides ongoing technical support can help mitigate this challenge. By proactively addressing these challenges, businesses can successfully implement accounts receivable automation and reap its rewards.

How EnKash Olympus – Accounts Receivable Process Helps Businesses?

EnKash Olympus – Receivables is designed to empower businesses by offering a suite of features that address common challenges in the accounts receivable process. Here’s how EnKash’s solution contributes to the success of businesses:

- Efficient Invoicing Process

EnKash’s solution digitizes the invoicing process, ensuring that businesses can dispatch accurate and timely invoices. By automating invoice processing and delivery, Olympus eliminates the risk of manual errors and delays, expediting the entire accounts receivable cycle. - Automated Reminders

Olympus enables businesses to send automated payment reminders to their customers with embedded payment links. This feature not only facilitates timely payments but also improves the overall customer experience by providing convenient and user-friendly ways to settle outstanding invoices. - Real-time Payment Tracking

With real-time updates on received payments, businesses gain valuable insights into their cash flow. Olympus provides a transparent view of payment statuses, allowing businesses to track payments, identify potential delays, and make data-driven decisions to optimize their financial operations. - Streamlined Reconciliation

EnKash recommends leveraging virtual accounts to streamline the reconciliation process. By linking received payments directly to customer accounts, businesses can reduce the complexity of reconciliation, minimize manual efforts, and ensure accurate financial records. - Multiple Payment Options

Olympus supports multiple payment options, providing flexibility for customers to settle invoices using their preferred methods. This feature contributes to a positive customer experience and increases the likelihood of prompt payments, ultimately improving cash flow for businesses. - Centralized Dashboard for Management

EnKash’s solution offers a centralized dashboard that consolidates all relevant information for effective management of the accounts receivable process. Businesses can monitor payment statuses, outstanding invoices, and overall collection performance in one place, facilitating quick decision-making. - Comprehensive Training and Support

EnKash understands the importance of a smooth transition to automated accounts receivable processes. The solution includes comprehensive training and ongoing support to ensure that businesses and their employees can fully utilize the features of Olympus, overcoming any potential implementation challenges.

Conclusion: The future of automated accounts receivable

The adoption of automated accounts receivable processes presents a transformative opportunity for businesses seeking to thrive in the fast-paced and competitive business landscape. The numerous advantages outlined in this article, from heightened efficiency and error reduction to cost savings and improved cash flow, underscore the pivotal role of automation in revolutionizing financial operations. By carefully selecting tools and software tailored to their specific needs, businesses can effectively streamline payment processing and elevate the overall customer experience.

The implementation of receivables by EnKash addresses common challenges in accounts receivable automation. From digitizing the invoicing process to enhancing customer communication through automated reminders and embedded payment links, businesses can achieve a seamless and error-free accounts receivable cycle. Real-time payment tracking and streamlined reconciliation further contribute to informed decision-making and accurate financial records. By leveraging the power of automation, companies can not only meet but exceed the efficiency demands of the modern business world, fostering sustained growth and success.