If you run a small business in India, the way you collect payments can shape your entire journey. From your first sale to scaling up, a reliable payment gateway for startups is not just helpful; it is essential.

Your customers expect smooth, secure payments. You expect quick settlements and low fees. The gateway you choose affects your cash flow, your customer experience, and even your brand reputation. That is why picking the best payment gateway in India for small businesses is a decision that deserves attention.

There are plenty of options today, but many of them are built for big enterprises. As a growing brand, you need something simple, smart, and flexible. In this blog, we break down the best online payment gateway for small businesses in India. We focus on what matters most: cost, features, support, and ease of use for lean teams.

Read more: How Payment Gateway Works?

Evaluating a Payment Gateway: What Truly Matters in 2025

Picking a payment gateway is not just a matter of plugging in the right software. It has a direct influence on how your business runs each day. From managing cash flow to creating a smooth experience for your customers, this choice carries weight.

It’s worth spending time on the decision. A good payment system does more than process transactions. It allows you to focus on your work without worrying about delays or unresolved issues.

Let’s look at what matters most when choosing one.

Pricing That’s Straightforward

At first, many platforms appear cost-effective. But once you start using them, other charges show up — things like settlement fees, charges on refunds, or monthly platform costs. These details often go unnoticed until they start cutting into your margins.

Before you sign up, review everything. If the pricing isn’t clearly laid out, you’ll likely run into problems later. The best payment gateway in India for small businesses should be upfront about every rupee you’ll be charged.

How Quickly You Get Paid

There’s a difference between receiving a payment and actually getting the money in your bank account. Some providers transfer funds within a few hours, others take two or three days. If your operations depend on regular cash flow, that gap matters.

Look for a provider that fits your business rhythm. If you pay vendors daily or need to restock frequently, same-day or next-day settlement can keep things running smoothly.

Let Customers Choose How to Pay

Everyone has their own way of paying. Some stick to the Unified Payments Interface, others prefer cards or digital wallets. Limiting these options could cost you sales.

A reliable online payment solution for small businesses should support all common methods. If you offer repeat billing or subscriptions, make sure the system can handle that as well, without manual effort or extra plugins.

Security and Regulations

A payment platform must be secure, but it also needs to follow the rules. That includes two-factor authentication, proper handling of data, and full compliance with standards set by the Reserve Bank of India. This is not a feature — it’s a requirement.

The best platforms also meet Payment Card Industry Data Security Standard certification, which protects customer data during every transaction.

Setup Shouldn’t Slow You Down

Some gateways take days to activate. Others give you everything you need to go live within hours. If you’re a small team, integration should be simple and documentation should be easy to follow.

The best payment gateway for startups in India should work with your website, app, or platform without demanding weeks of setup time.

Support That Helps

Things will break. A transaction may fail, or a refund might get stuck. When that happens, you need to reach someone who can fix it.

You don’t want to wait days to hear back. Choose a provider that responds quickly and understands how to resolve real issues, not just send automated replies.

Read more: Payment Gateway Integration Guide

10 Leading Payment Gateways Supporting Small Business Growth in 2025

Selecting the right payment partner is a critical business decision. For small businesses, the ideal gateway ensures smooth customer transactions, faster access to funds, and minimal operational disruptions. In 2025, the best payment gateways offer far more than payment collection. They enable financial control, integrate with core systems, and provide the flexibility small teams need to scale confidently.

Here is a curated list of the 10 best payment gateways in India that are particularly effective for small and mid-sized businesses. Each platform has been evaluated for its ease of integration, feature set, settlement capabilities, developer support, and overall reliability.

Razorpay

Razorpay offers a comprehensive suite of products that go beyond standard payment acceptance. It supports UPI, cards, wallets, EMI, and recurring payments. The platform includes RazorpayX, which allows businesses to manage payouts, payroll, and expense tracking within the same ecosystem.

Its dashboard provides real-time insights, instant refunds, and detailed reports. The onboarding process is quick, and plugins are available for platforms such as Shopify, WooCommerce, and custom tech stacks. Razorpay is widely regarded as the best payment gateway in India for small businesses due to its versatility and startup-friendly approach.

Paytm for Business

Paytm remains a strong player in the Indian payment ecosystem. It is especially useful for businesses that operate both online and offline. With extensive support for QR code payments, UPI, wallet, and cards, Paytm gives small businesses access to a wide consumer base.

The Paytm for Business platform includes features such as transaction tracking, settlement reports, and basic invoicing. For merchants focused on retail or regional reach, Paytm is among the best payment gateways for startups in India with high mobile engagement.

Cashfree Payments

Cashfree stands out for its operational efficiency and fast settlement cycles. It supports same-day settlements, bulk payouts, and instant refunds. The platform is well-suited for D2C brands, digital marketplaces, and service platforms that rely on consistent cash flow.

Cashfree supports UPI, debit and credit cards, net banking, and payment links. Its clean API structure and developer tools make integration simple and fast. It is considered one of the best online payment gateways for small businesses in India due to its flexibility, reliability, and clear pricing.

Instamojo

Instamojo is designed for ease of use. It targets independent creators, freelancers, and home-based businesses. The platform offers ready-to-use online stores, payment links, and minimal documentation requirements, which make it an excellent starting point for businesses entering the digital space.

It also includes tools for invoicing, product listings, and order tracking. Businesses that are just getting started or have no development team can rely on Instamojo as a simple and effective online payment solution for small businesses.

PayU

PayU is a robust platform that serves startups as well as growing enterprises. It supports EMI, subscription billing, net banking, and international cards. For businesses dealing with larger ticket sizes or recurring revenue models, PayU delivers consistent performance.

Its fraud detection tools, high uptime, and well-documented APIs make it ideal for e-commerce, EdTech, and SaaS platforms. PayU is among the best payment gateways for websites in India that require scale and advanced control.

CCAvenue

CCAvenue has a long-standing presence in India’s digital payment space. It supports multiple languages and a wide range of payment options, including cards, UPI, wallets, and EMI. Its platform is highly customizable and suitable for businesses that require branded checkout experiences.

The interface includes advanced reporting, reconciliation tools, and real-time tracking. For businesses working across regions or industries like travel and education, CCAvenue remains a trusted solution with a strong backend infrastructure.

MobiKwik

MobiKwik focuses on mobile-first payments. It combines wallet integration with a pay-later option called Zip. This model works well for consumer-focused brands that target younger audiences or prepaid segments.

The platform supports standard integrations and offers reliable support. MobiKwik is a good fit for fashion, entertainment, gaming, and digital retail, where seamless mobile transactions are essential. For startups looking to diversify payment methods, it is a practical and modern option.

Zaakpay

Zaakpay provides a simple yet effective solution for startups in their early stages. It emphasizes ease of onboarding, quick approval, and a clean dashboard. The platform supports UPI, cards, and net banking, covering the essentials without overcomplicating the process.

This is ideal for businesses that need a payment gateway without advanced customizations or long-term contracts. Zaakpay is often chosen by founders who are building prototypes, running internal platforms, or launching lean commercial pilots.

Stripe

Stripe is globally recognized for its clean APIs, strong documentation, and international payment support. In India, it is used primarily by SaaS companies, export-focused platforms, and service providers that cater to clients abroad.

The platform supports multi-currency transactions, usage-based billing, and built-in dispute resolution tools. Stripe also offers invoicing, subscriptions, and advanced reporting. For businesses that serve global markets, it is among the 10 best payment gateways in India for international expansion and product-led growth.

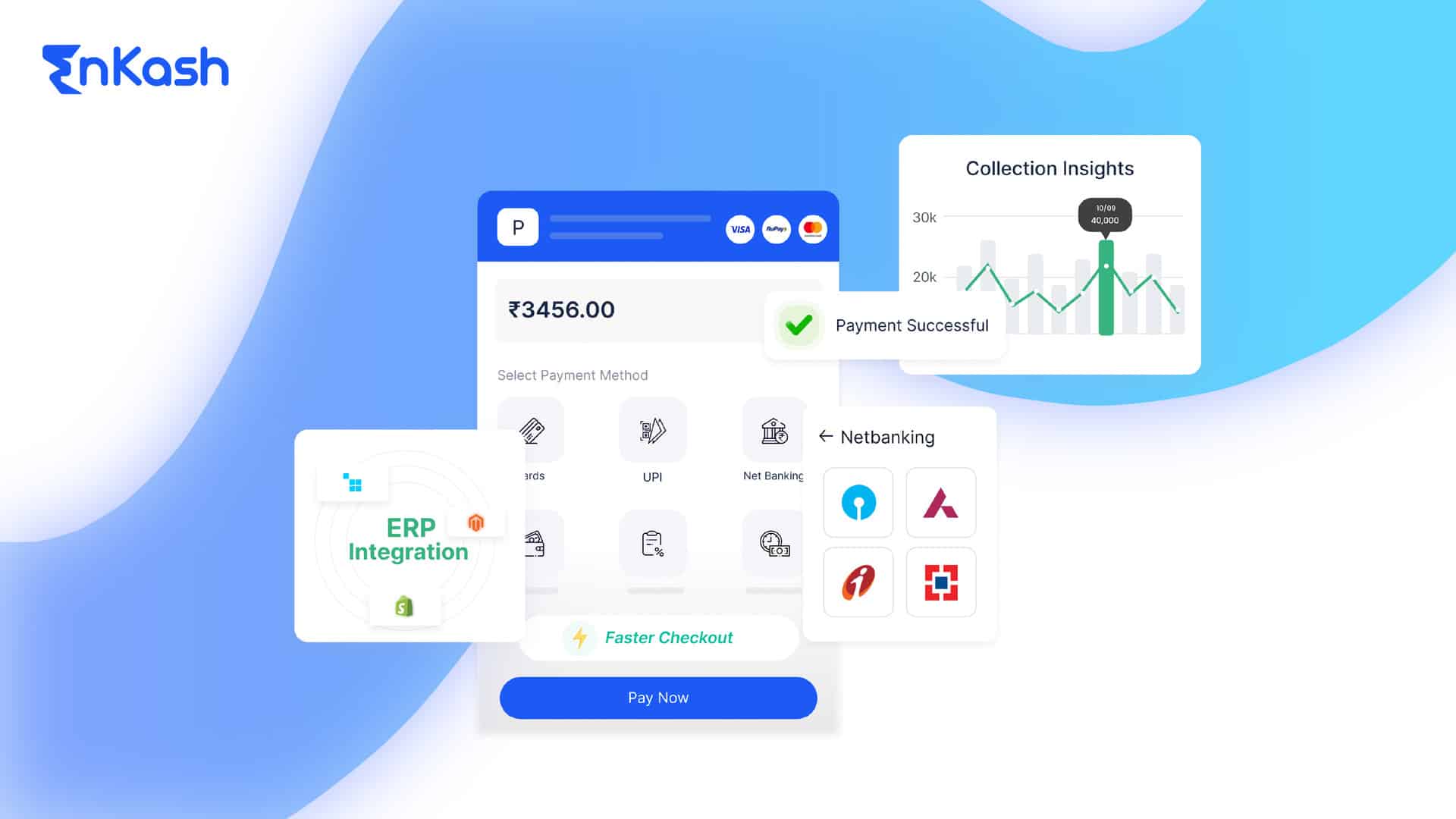

EnKash Payment Gateway

EnKash Payment Gateway is built to help businesses manage and collect payments with ease. It supports multiple payment modes like UPI, cards, net banking, and payment links through one unified system.

The platform focuses on simplifying collections, automating reconciliation, and offering better visibility into incoming payments. Businesses can generate secure links, track payment status in real time, and reduce manual work across their finance teams.

EnKash Payment Gateway is suitable for companies that want a smooth and reliable way to handle receivables without relying on multiple tools or custom setups.

Read more: The Need For Payment Gateways

What’s Next: Shifting Priorities in Payment Infrastructure for Small Businesses

Small businesses in India are becoming more selective when it comes to choosing their payment gateway. Their priorities have shifted from simple transaction processing to solutions that provide deeper financial visibility, operational control, and support for long-term growth. This evolution is redefining what qualifies as the best payment gateway in India for small businesses today.

Greater Emphasis on Real-Time Financial Insights

Business owners are no longer satisfied with basic payment summaries. They now expect detailed dashboards that show real-time data on collections, failed transactions, pending refunds, and settlement timelines. This level of visibility helps them make informed decisions related to inventory management, vendor payments, and marketing budgets.

A reliable and transparent dashboard is one of the key reasons many founders are switching to the best online payment gateway for small businesses in India that offers live transaction tracking, downloadable reports, and filters for customer or payment methods.

Recurring Billing and Automation Are Gaining Momentum

Recurring payments are no longer limited to software or subscription services. Businesses in education, wellness, and retail also offer monthly and quarterly plans. To manage this efficiently, they require features such as tokenized card billing, Unified Payments Interface Autopay, and electronic mandate creation.

The best payment gateway for startups in India now offers retry logic for failed debits, automated notifications before scheduled payments, and easy setup for recurring mandates. These tools help reduce churn, improve billing consistency, and offer a smoother experience to subscribers.

Gateways Are Expanding Beyond Collections

Many payment platforms are now evolving into full financial management solutions. Companies such as Razorpay and Enkash Olympus allow small businesses to handle vendor payments, employee reimbursements, and business expenses from within the same platform.

This shift has made the best payment gateway in India, not just a tool for revenue collection but also a key part of daily operations. Startups now prefer platforms that can help manage both collections and disbursals, reducing the need for separate systems.

Security, Regulation, and Trust Now Take Center Stage

With stricter digital payment norms in place, businesses are prioritizing security and regulatory compliance. Leading gateways must now comply with the Payment Card Industry Data Security Standard, two-factor authentication mandates, and data localization rules outlined by the Reserve Bank of India.

The best free payment gateway in India is one that can offer these protections without adding complexity or hidden costs. As regulatory scrutiny grows, business owners are seeking partners who take compliance as seriously as they do.

Different Sectors Need Different Solutions

No single platform can solve every use case. A logistics startup may require fast bulk payouts. A wellness brand may need recurring billing with easy plan upgrades. A regional e-commerce store may prioritize the Unified Payments Interface and mobile wallets.

The 10 best payment gateways in India are those that offer flexible modules, fast onboarding, and scalable infrastructure that fits the unique needs of each business type.

Read more: Global Payment Gateways

Conclusion: Investing in the Right Payment Infrastructure

Choosing the best payment gateway in India is a decision that can directly affect your business performance. For small businesses, it is not just about receiving payments. It is about choosing a platform that supports your cash flow, protects customer data, and allows you to grow with confidence.

The best online payment gateway for small businesses in India should be simple to integrate, fast to settle, and flexible across payment methods. Platforms such as Razorpay, Cashfree, and Paytm offer strong collection features. Stripe is ideal for SaaS and international billing but may lack the same level of UPI and wallet integration compared to India-first gateways like Razorpay or PayU.

Business owners must take time to compare providers, review settlement structures, understand compliance features, and match them to their specific goals. Selecting the best payment gateway for startups in India means choosing reliability, scalability, and long-term support. With the right infrastructure in place, your payment process becomes a foundation for business growth.