Running a WooCommerce store today is not just about listing products and waiting for orders. The way you accept payments can decide how well your business performs. Many store owners think any WooCommerce payment gateway will do. But the truth is, the gateway you choose affects your sales, your costs, and how your customers feel about buying from you.

Each WooCommerce payment gateway in India offers something different — from how fast you get paid to the payment options your customers can use. Picking the best payment gateway for WooCommerce means looking at more than just setup fees. It’s about finding a system that supports your business goals.

For stores in India, UPI, cards, and wallets are now basic needs. Some businesses need fast settlements, while others care more about lower fees. Some want detailed reports, while others focus on simple checkout flows.

A good payment gateway should help you grow, not just process payments. It’s part of your customer experience. This blog will help you understand what makes a gateway right for your WooCommerce store and why this choice needs a clear strategy.

Before You Choose: Questions That Will Shape the Right Gateway for You

Choosing the best payment gateway for WooCommerce is not about picking what’s most popular. It is about what works best for your store. Asking the right questions will help you decide which gateway matches your needs.

How sensitive are your margins to per-transaction costs?

If your margins are tight, even small fees can add up. Some gateways charge flat fees, others take a percentage. Look beyond the headline rate. Check for hidden charges, refund fees, or extra costs for different payment types.

Do your buyers expect UPI, EMI, or BNPL at checkout?

In India, UPI is now a must-have. EMI options or Buy Now Pay Later (BNPL) can increase conversions for higher-value items. Make sure the WooCommerce India payment gateway you pick supports the payment methods your customers use most.

Do you need same-day settlement to manage inventory and vendors?

Some businesses rely on fast cash flow. Same-day or next-day settlements can help you restock quickly or pay vendors without delay. Not all gateways offer this, so check before you commit.

Are you selling to international customers or sticking to domestic?

If you plan to sell outside India, your gateway must support international cards and currencies. A strong UPI payment gateway for WooCommerce may be enough if your market is local.

How much development support do you have?

Some gateways are easy to set up with simple plugins. Others need more technical work. If you have a developer, you can explore more advanced options. If not, stick to gateways with solid WooCommerce support.

Are you handling subscriptions, donations, or digital content?

Not all gateways support recurring payments or digital goods. If you sell memberships, donations, or content, pick a gateway that handles these flows without extra plugins.

Answering these questions will make it easier to choose the best payment gateway for WooCommerce in India that fits your business, not just today, but as you grow.

Read more: What Are the Different Types of Payment Gateways

The Payment Gateways That Work with WooCommerce in 2025

WooCommerce is a widely used platform, but not every payment gateway works equally well with it. Choosing the best payment gateway for WooCommerce means looking beyond brand names. It’s about real compatibility, ease of use, and long-term value. This guide looks at the WooCommerce payment gateways that have proven to work reliably in 2025, helping store owners manage payments smoothly.

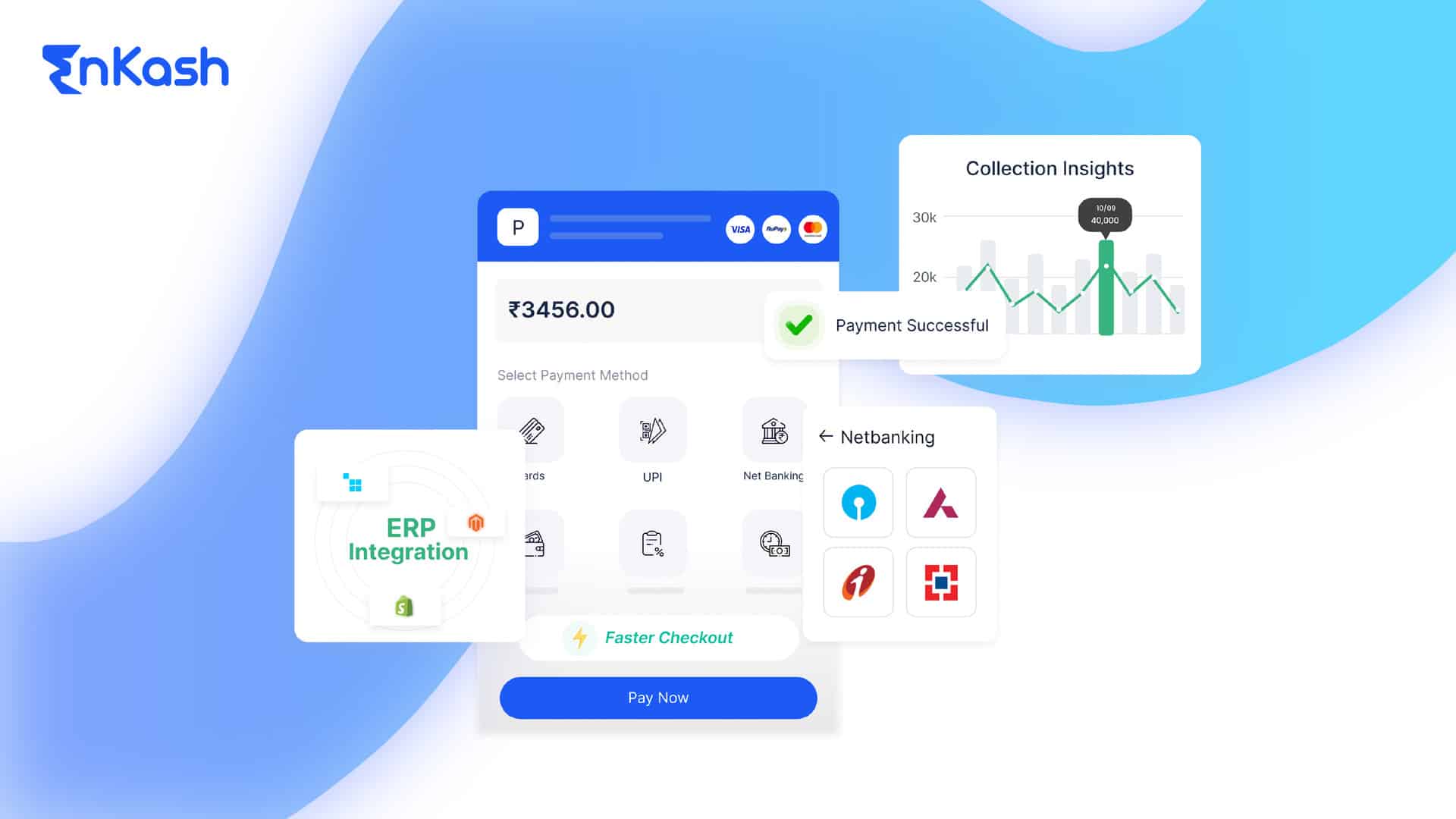

EnKash Payment Gateway

EnKash has recently extended its platform to offer a payment gateway suited for B2B collections and modern receivables.

- Supports multiple payment methods, including UPI, cards, and net banking.

- Focuses on efficient payment collection with automated reconciliation.

- Real-time tracking helps businesses stay on top of incoming payments.

- EnKash provides flexible payment links and quick integration options for WooCommerce.

- It is well-suited for businesses looking for more control over receivables without managing complex setups.

- Strong compliance with RBI guidelines adds to its reliability.

Razorpay

Razorpay is now a go-to choice for many Indian WooCommerce stores. It provides support for UPI, cards, net banking, EMI, and wallets, which makes it flexible for different customer needs.

- Razorpay offers a free WooCommerce plugin that is easy to install.

- Supports quick settlements, with options for same-day or next-day.

- UPI payments are strong, making it ideal as a UPI payment gateway for WooCommerce.

- It allows subscriptions, useful for stores with recurring billing.

- Detailed reports and analytics help monitor transactions in real-time.

- There are no setup fees, making it attractive for smaller businesses.

If you’re looking for a gateway that supports a variety of payment methods and provides modern tools, Razorpay is a strong choice.

Paytm Payment Gateway

Paytm is known for its wallet, but its payment gateway goes beyond that. It supports cards, UPI, wallets, and net banking.

- Seamless integration with WooCommerce using Paytm’s official plugin.

- Customers can pay using Paytm Wallet, which is widely used across India.

- The gateway supports QR-based payments, helpful for mobile shoppers.

- Settlements typically happen within 24-48 hours.

- Strong for stores with a large mobile user base, especially in Tier 2 and Tier 3 cities.

This WooCommerce India payment gateway is perfect for merchants who want to give buyers familiar options like UPI and wallet payments.

Cashfree Payments

Cashfree is gaining ground due to its focus on fast payments and flexibility. It’s well-suited for WooCommerce users who need reliable UPI support and quick settlements.

- Offers WooCommerce plugin support, along with REST APIs.

- Supports UPI, cards, wallets, and even international payments.

- Helps create a payment link API for easy offline and online collections.

- Their payout system is strong for businesses that also need to disburse funds.

- Real-time webhooks keep your system updated without delays.

For businesses looking for a fast and responsive payment API integration, Cashfree is a strong option.

PayU India

PayU serves both small and large WooCommerce stores with scalable solutions. It’s known for flexibility and wide payment support.

- Accepts payments through cards, wallets, EMI, and net banking.

- Provides robust fraud protection tools, giving an extra layer of safety.

- Comes with WooCommerce plugin support for quick integration.

- Useful for stores with high transaction volumes needing stability.

- Offers PayU Money for smaller merchants, with easy signup.

PayU is a great option if you are looking for a trusted name with a history of supporting Indian businesses.

Instamojo

Instamojo is ideal for small businesses and digital sellers. It’s simple, cost-effective, and doesn’t require much technical knowledge.

- Supports UPI, cards, wallets, and payment links.

- Easy integration with WooCommerce, no complex setup needed.

- No monthly fees, just transaction-based pricing.

- Perfect for selling digital downloads, tickets, or accepting donations.

- Provides a user-friendly dashboard for tracking payments.

If you’re starting small and want the best free payment gateway for WooCommerce, Instamojo offers a solid beginning.

CCAvenue

CCAvenue is one of India’s oldest gateways, known for its wide acceptance across banks and payment options.

- Supports Indian and international cards, EMI, net banking, and wallets.

- Offers multilingual checkout pages, useful for a broader reach.

- The setup is more detailed, but it gives more control.

- Strong for high-value items or stores with complex payment needs.

- Provides detailed reporting and fraud protection.

For businesses that want a more traditional WooCommerce payment gateway in India, CCAvenue brings depth and reliability.

Stripe

Stripe is perfect for WooCommerce stores that deal with international customers or run SaaS platforms.

- Supports payments in multiple currencies and countries.

- Easy to integrate with WooCommerce using the official Stripe plugin.

- Offers advanced tools like subscription billing, invoices, and reporting.

- Known for clean APIs and excellent payment API documentation.

- Charges are higher, but service quality is among the best.

Stripe works best for stores aiming for global sales and needing advanced features beyond basic checkout.

WooCommerce UPI Plugin

This plugin is for stores that want a simple, UPI-only payment setup.

- Direct UPI integration without third-party processors.

- Minimal fees and quick setup.

- Best for stores focused on Indian markets.

- No need for complex accounts or configurations.

- Works well for local businesses with low transaction volumes.

A great option if UPI is your main payment method and you want something lightweight.

Making the Right Choice

This WooCommerce payment gateways comparison shows that each gateway brings something different to the table. Some focus on speed, others on flexibility or international reach. The best payment gateway for WooCommerce depends on your store’s size, your customer base, and what you want to achieve next.

If your focus is domestic, and UPI is key, Razorpay, Paytm, or Cashfree may be right. If you’re planning to grow globally, Stripe offers tools for that. For traditional businesses, CCAvenue gives solid support for EMI and cards.

Read more: How Secure Payment Gateways Safeguard Your Business

How Payment Gateway Performance Impacts Customer Experience

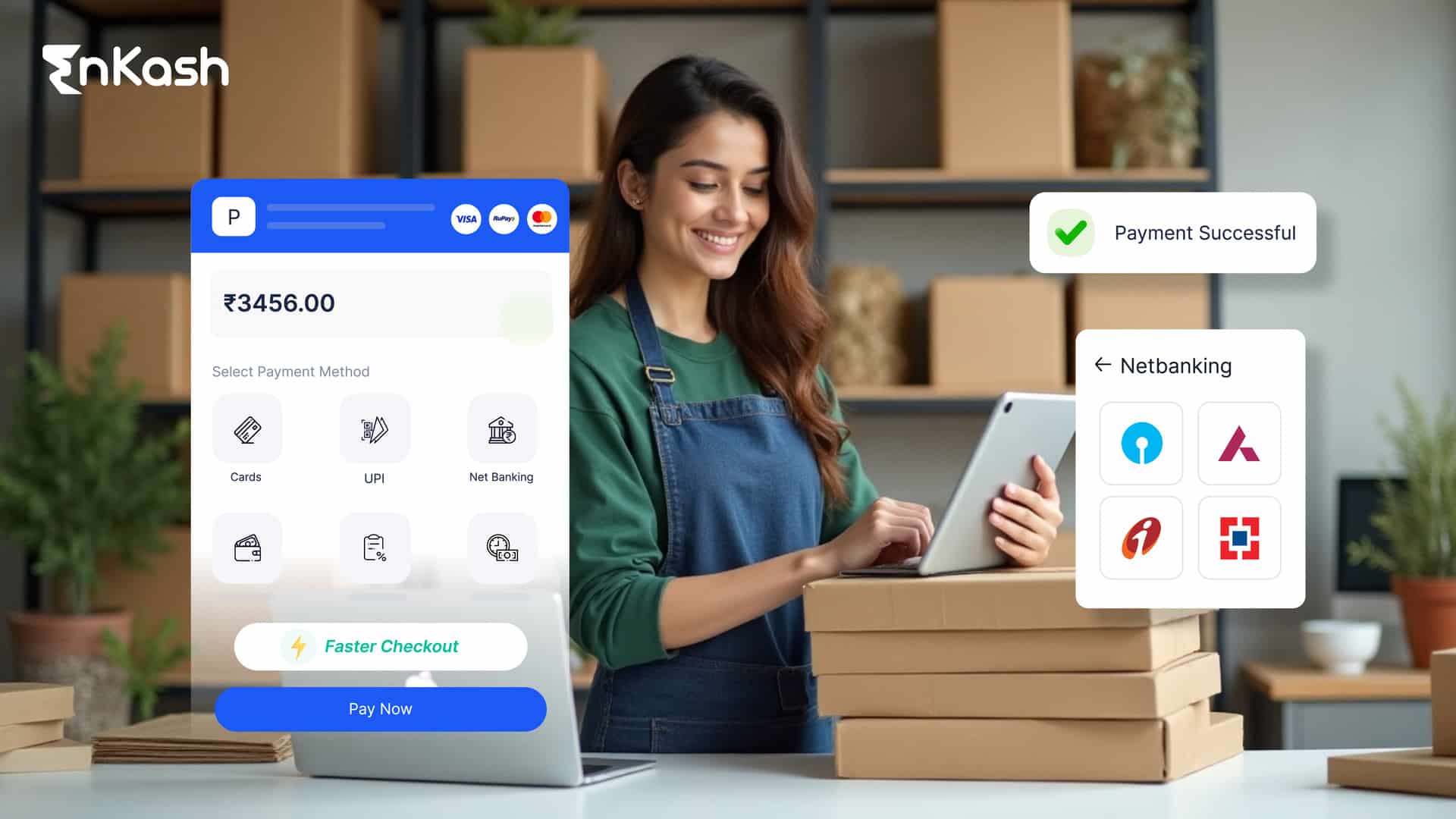

The way your payment gateway performs has a direct effect on how customers feel about shopping with you. A smooth checkout can leave a good impression, but a slow or failed payment often leads to frustration. Many buyers leave without completing their purchase if the process feels unsafe or takes too long. This is why choosing the right WooCommerce payment gateways matters.

Speed is one of the biggest factors. When customers click to pay, they expect a fast response. If the page hangs or the transaction takes too long, they may cancel the order. Quick, reliable payments help build trust and make buyers more likely to return.

Offering the right payment options also improves the experience. In India, UPI, cards, and wallets are widely used. The best payment gateway for WooCommerce will support all of these, giving customers the freedom to pay how they prefer.

Uptime is another important point. If your payment system goes down, even for a short time, it means lost sales. A stable gateway keeps your store ready to accept payments at any hour.

Refunds matter too. If a customer needs their money back, a fast refund builds goodwill. Gateways that process refunds quickly help stores keep a strong reputation.

In the end, your payment gateway does more than process transactions. It shapes how customers view your service and whether they trust your store. A reliable, flexible gateway can make every purchase feel simple and secure.

Read more: How to Choose the Right Payment Gateway for Your Business

What’s Changing in WooCommerce Payments This Year

WooCommerce payments in 2025 are not the same as they were a year ago. Buyers now expect faster, safer, and more flexible ways to pay. If your store is still using old systems, now is the time to catch up.

UPI has become the top choice for many customers in India. People prefer UPI over cards because it’s quicker and does not require them to enter long details. If your store does not support UPI yet, it should. WooCommerce payment gateways that support UPI are now seen as more reliable by buyers.

Card tokenization is now in full effect. This means real card numbers are no longer stored or passed around. Instead, secure tokens are used, making payments safer for both you and your customers. If your WooCommerce India payment gateway does not support tokenization, you may run into compliance issues.

Refunds are also expected to be faster. Customers want their money back quickly if something goes wrong. Gateways that handle fast refunds help build trust, which leads to repeat buyers.

Buy Now Pay Later (BNPL) is no longer a luxury. It’s now something many customers look for, especially for bigger purchases. Adding BNPL options can improve sales.

Security is more visible. People look for signs that their payment is safe. SSL, two-factor authentication, and trusted gateways matter more than before.

Dashboards are now more advanced. They are not just for viewing sales. You can track payments, see refund status, and manage issues all in one place.

These changes mean that WooCommerce stores must think ahead. Updating your payment system is not just about keeping up — it’s about growing with your customers.

Conclusion – Your Payment Gateway is a Growth Partner, Not a Checkbox

Choosing the best payment gateway for WooCommerce is not just another task to tick off your list. It’s a decision that can shape how your business grows. A good gateway does more than process payments. It helps you manage cash flow, build trust with customers, and give buyers the payment options they expect.

As WooCommerce stores evolve, having a payment partner that keeps up with new demands is essential. Fast settlements, strong UPI support, secure transactions, and features like BNPL are no longer extras — they are expected.

Think of your payment gateway as part of your team. It should support your goals, adapt to changes, and help make each transaction smooth for your customer. A thoughtful choice today can help you avoid problems later and open doors to more sales, better service, and steady growth.