Payments are one of the most crucial aspects of any business. With a streamlined payment structure, the business could benefit a lot. While digitization in consumer payments is more widely accepted in India, the same is not the case for commercial payments. There is plenty of opportunity for a revolution in B2B payments.

A Closer Look at Business Payments Stats

In a recent report, Credit Suisse estimated that digital payments in India would reach $1 trillion in FY23 with mobile payments accounting for $190 billion, the estimate for 2018 is $10 billion (Credit Suisse Equity Research, “The WhatsApp Moment in Payments”, February 5, 2018).

The report states that “digital payments in India are soaring on the back of global tech giants entering the market as aggregators for retail transactions”. In the same vein, another report estimates that e-commerce transactions will grow to $64 billion in 2020 from $38.5 billion in 2017 (India Brand Equity Foundation, Report on E-commerce, April 2018). Finally, McKinsey estimates that net new payment revenues in India will increase by 13% on an annual basis (McKinsey, “Global Payments Map 2017”).

While these figures show a promising picture for the future of digital payments, let’s first understand in depth what B2B payments are.

B2B Payments – At a Glance

B2B payments are transactions processed between two businesses for exchanged products or services. B2B payments tend to be for much higher sums and are often split across months or quarters. Simply put, B2B payments are payments made between companies.

B2B payments are either received at the point of sale or an invoice is sent to the buyer at a later date. Most B2B businesses send invoices monthly and require payment in 30 days. The method and terms of payment vary from business to business.

The transaction can involve anything- right from office supplies to manufacturing parts and units. Services like accounting tools, email tools, etc also come under B2B transactions.

Due to the current pandemic situation and the restrictions and reforms put in place by the government, there has been a rapid growth in B2B Payment solutions, in both consumer and commercial payments. Although, offline methods of payments are still the go-to method for most businesses.

Types of Payment Methods (Traditional) followed by Businesses

Cash

Cash is still used in some old-school businesses to settle bills, although it is gradually becoming obsolete. Paying your suppliers with a suitcase filled with notes seems odd in this age of digital transactions. Ever since demonetization, cash is not the preferred method of payment anymore.

Cheques

Cheque payments are one of the types of payment methods that are widely used by most businesses. A Cheque is a document that orders a bank to pay a particular amount of money from a person’s or company’s account to another individual’s or company’s account in whose name the cheque has been made or issued. The person who issues the cheque has a bank account for carrying out transactions.

Demand Drafts

Demand draft is a prepaid mechanism, where you pay the bank and get a demand draft for the amount you paid to the bank. The bank provides the demand draft with the details of whom the amount has to be paid.

The payee can take the demand draft, and give it to his bank and get the money deposited to their bank account. In cheques, as there is a disadvantage of bouncing, organizations stick to demand draft for business payments.

Bank Transfers

The payee includes his bank account number and IFSC code in the invoice and the payer either transfers the money from his bank with a transfer challan or just pays through online banking with NEFT or IMPS or RTGS. Online banking transactions happen in real-time which makes them faster, more efficient, and instantaneous.

Payment Gateways

An online payment gateway (PG) is a tunnel that connects your bank account to the platform where you need to transfer your money. Payment Gateway is software that authorizes you to conduct an online transaction through different payment modes like net banking, credit card, debit card, UPI, or the many online wallets that are available these days.

Payment Gateway is the finest traditional B2B payment solution that securely transfers your money from the bank account to the merchant’s payment portal.

If Traditional B2B Payment Solution Fails? What Next!

Due to the inefficiency of these existing payment methods, businesses are on the lookout for a smarter yet convenient mode of making B2B payments. There has been a massive increase in B2B payments solutions in the market to meet the increasing demands of businesses.

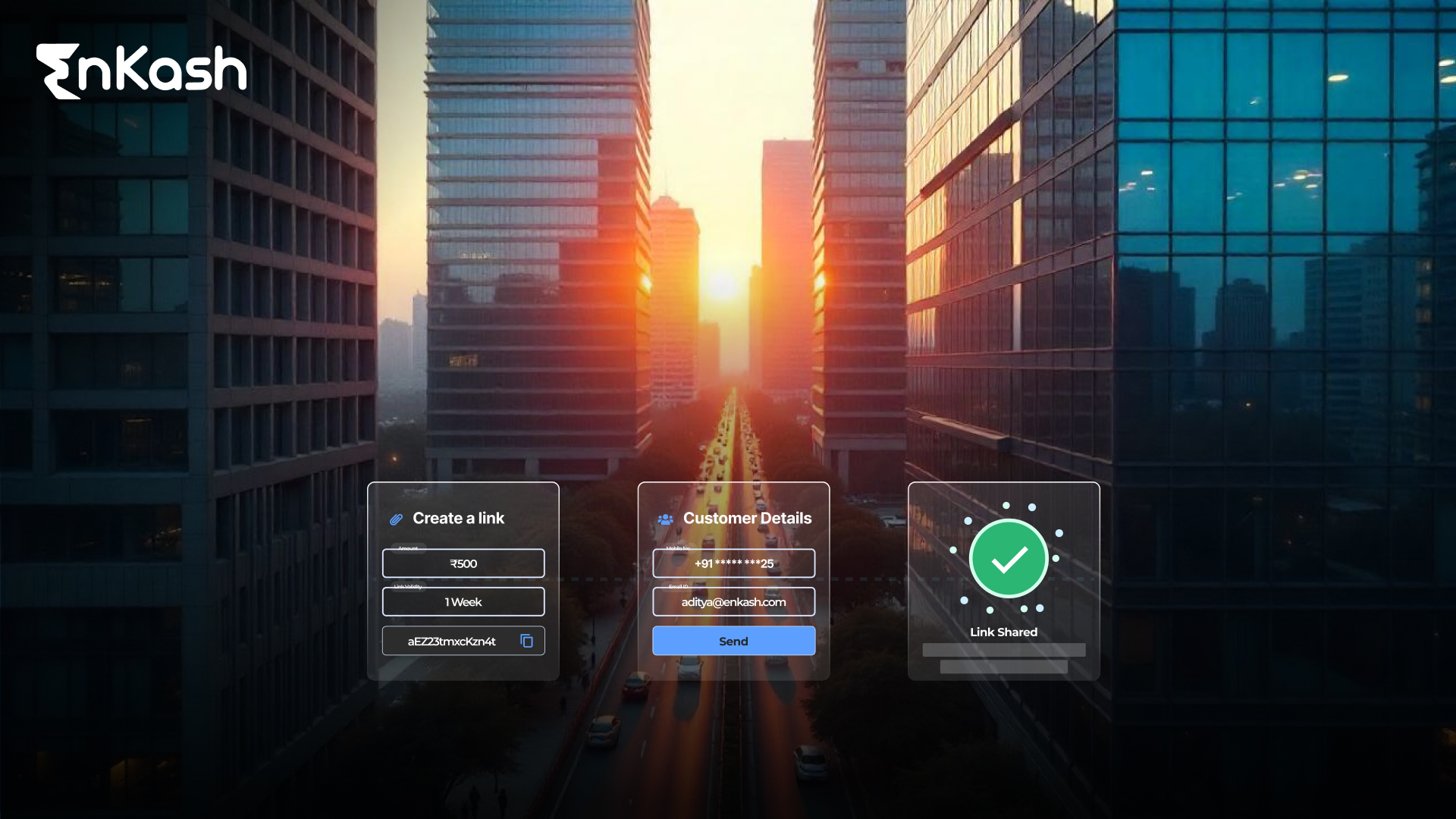

Commercial payments are made simpler and more sophisticated by these payment platforms like EnKash, which provides a one-stop solution for all your commercial expenses. From an intuitive spend management platform to a variety of commercial expense cards that ease the payments process, EnKash has all the tools you need to make your business payments quicker and more cost-effective.

Benefits of a commercial payment platform

- Speed

- Compliance

- Cost-Effective

- Paperless

- Improved Cash Flow

- More Secure

- High ROI

- Fraud Detection

- Remote Payments

- Enhanced Visibility

- Time-Saving

- Error Free

- Convenience

- Simpler Reporting

- Easy Integration

- Customizable

- Reliable Customer Service

To make B2B payments more robust, buyers and sellers must keep in mind the best practices to follow before choosing a payments platform.

For Sellers

- Send an invoice as soon as possible

- Send follow up reminders when the payment deadline is near

- Offer early payment discount and charge overdue payment penalties

- Consider card payments

For Buyers

- Do not settle your invoices before the due date

- Use commercial cards for payments if you still need time for reconciling the cost

- Inform the vendor if you miss a payment deadline

- Negotiate with your vendor for more favorable terms of B2B payments.

- Try to pay via electronic platforms instead of traditional manual payments modes

Didn’t you see the Power of EnKash so far? Let’s have a look now!

Final Thought

Business payments are not what they were a decade ago. Today, transactions are much more complicated which requires smarter solutions. Hence, it is crucial to choose a payments platform that works the best for your business. EnKash is a commercial payments platform that offers not just commercial cards but also a spend management platform, ready-to-plugin APIs, accounting tools, and the works. Upgrade your business experience with EnKash!