Multitasking is a skill that many small company entrepreneurs excel at. However, managing funds may quickly become burdensome – even the simplest financial record-keeping errors can be a headache. A professional or qualified accountant can help in the balancing of accounts and even assist you with tax preparation.

However, understanding whether you need an accountant or the insurgence of the omniscient AI can help you fare better.

Recognizing your business needs is a multi-step procedure that takes time and effort. However, before you begin your search, you must first grasp what an accountant performs and if your company genuinely needs automate business accounting.

Roles and responsibilities of an Accountant

When you own a business, you’re in charge of everything, from day-to-day operations to recruiting, drafting a business strategy, balancing cash flows and more. While the functions of an accountant are difficult, to say the least, they are extremely crucial for the proper functioning of a firm.

- An accountant is a financial expert who may help with financial planning, tax guidance, and even tax returns.

- Accountants and bookkeepers are frequently confused. While their area of action may look identical, there is a subtle difference.

- Accountants are more likely to have the monetary understanding needed for bookkeeping, they can give a more strategic review of your company.

What is Business Accounting?

To run a business, large and small, require consistent accounts receivable and accounts payable flow. If a company’s cash flows are not carefully monitored, many choices may be impacted. These will eventually cascade down to the company’s revenue statements.

Maintaining a smooth financial flow is no easy task, but if you automate business accounting, it will become easier. It necessitates a well-thought-out strategy, as well as well-planned accounts payable and collections decisions. Finally, a solid commercial costs platform that can offer transparency into the budgetary structure is essential.

What are Accounts Payable and Accounts Receivable?

You may have a better understanding of your accounts payable using the EnKash automated transaction platform. “Accounts payable” (AP) is a general ledger account that shows a company’s commitment to repay a short-term debt to creditors or suppliers. Another typical sense of “AP” is the corporate department or division in charge of making payments to vendors and other creditors on behalf of the firm. The automated transaction platform of Enkash helps consumers grasp a clearer meaning of accounts payable. Automation with EnKash also includes the ability to send payments before the deadline.

Please check out the below URL to automate or digitize the accounts payables:

As a result, you will not miss any payments and will be able to pay before the deadline, allowing you to direct more of your cash flow into revenue-generating streams. Other noteworthy facilities include:

- You can have centralized control while having decentralized spending using a virtual B2B payments platform.

- The platform provides a comprehensive view of your company’s finances, including Accounts Receivable, Accounts Payable, Working Capital, Cashflow, and a variety of other payment options.

- This aerial perspective of your company’s finances will assist you in making well-informed decisions about forthcoming purchases and payments.

For small businesses, the benefits increase when they automate business accounting. With its wide range of features, a system like EnKash can genuinely enhance your B2B payments experience. EnKash offers a broad array of business cards that allow users to make transactions on the move, allowing you to make payments without hesitation. With EnKash, you may achieve ultimate financial freedom!

Please check out the below URL to automate the business payments:

Accounting software for small businesses

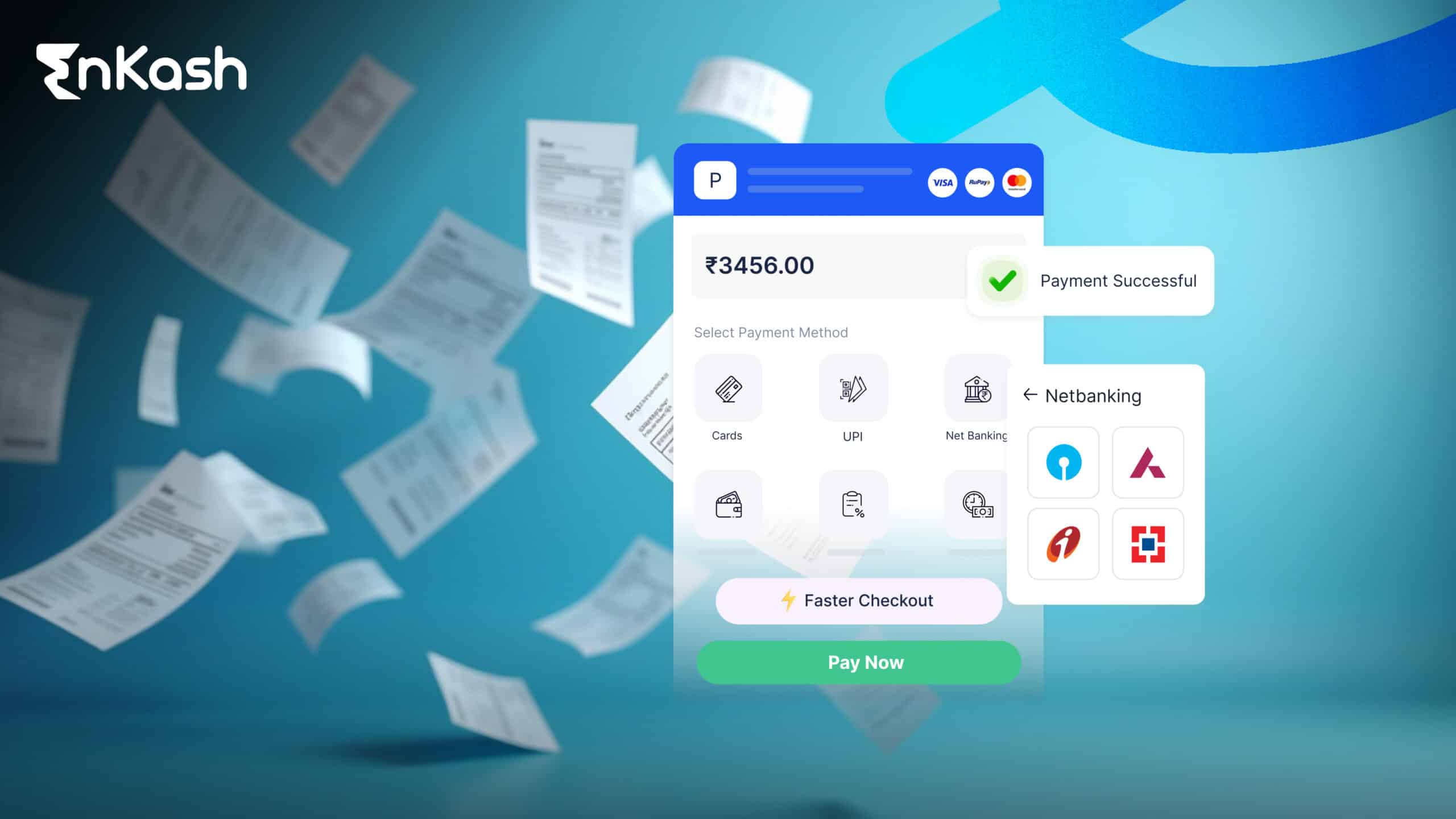

Accounting software is one essential kind of computer software that is used by accountants to manage finances and execute accounting tasks. The systematic method, effort, or process of transmitting and documenting financial data is known as accounting. One such interface is provided by EnKash.

So why switch?

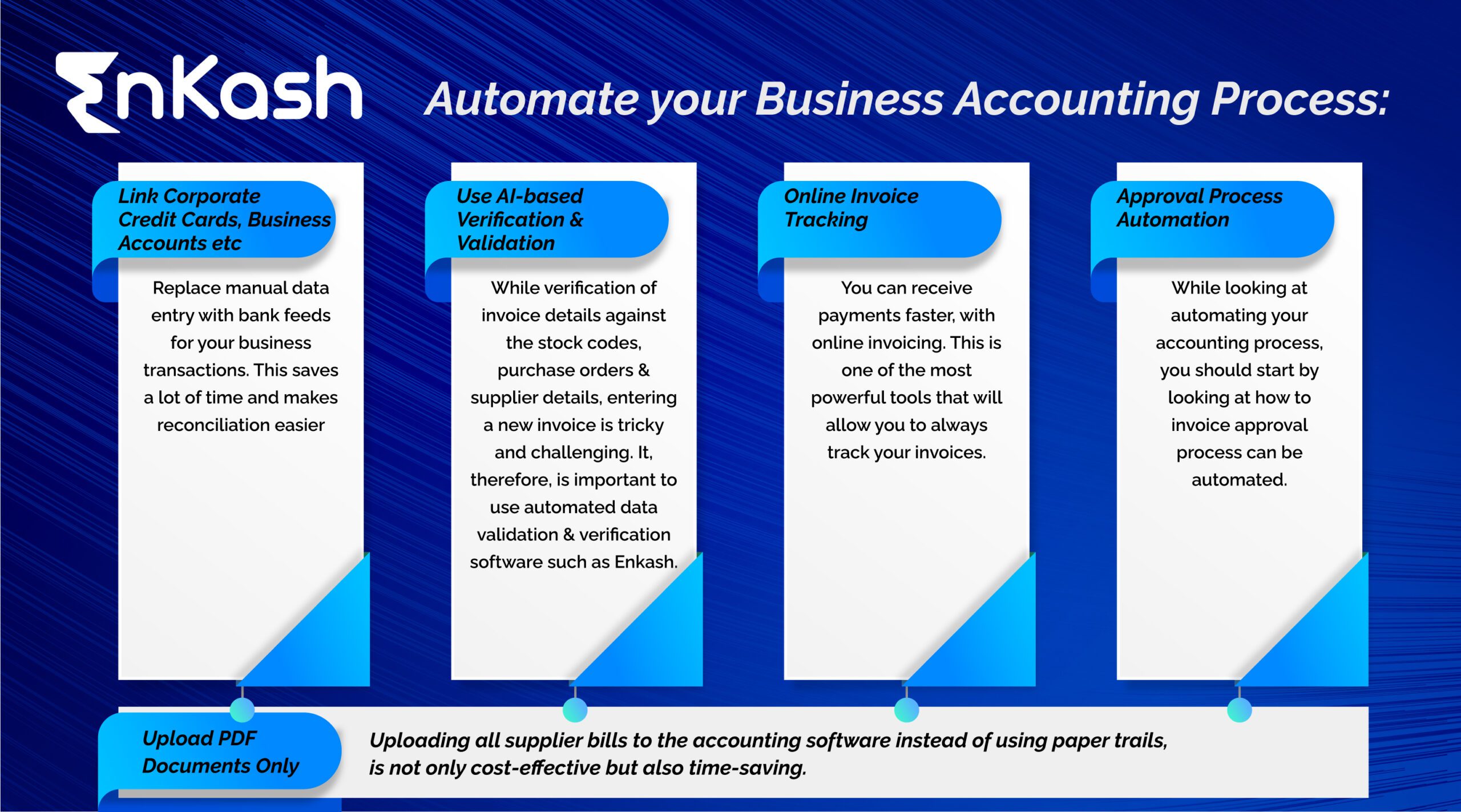

We have compiled a list of perks and benefits that come along with automating business accounting.

Benefits of business accounting automation

- Quick payments: Speed is a benefit of automation. Reviewing pricing sheets, calculating the overall amount, and then incorporating any special customer-based criteria and their cost all take a long time when creating bills. When performed manually, this is a time-consuming task that is prone to human mistakes. Automating transactions can save time by reducing the amount of time spent on repetitive tasks and reducing the likelihood of invoice errors, which can contribute to distrust in long-term business relationships with clients.

- Boosted Security: When it comes down to investing, safety should be a top priority. Traditional payment methods provide a significant level of danger, as data may fall into the wrong hands and funds can be laundered out. Multiple security measures may be implemented to access the database using a centralized automated payments system, rendering significant assaults worthless.

Benefits of Accounts Payable Automation

- Error reduction: When manually processing payments, the risk of making a mistake is great. Switching from paper to electronic documents reduces the likelihood of calculating, filing, and processing mistakes. By eliminating superfluous manual operations, AP automation increases productivity and improves employee morale by involving them in productive work.

- Spend Transparencies: Automation allows for a consolidated picture of a company’s spending patterns. Finance departments can maintain track of all incoming & outgoing cash flows from a single, real-time contact point. Senior management can keep a close eye on corporate money by confirming that they are used properly and following the firm’s policies. This provides finance teams an extra benefit of being able to map out outcomes to establish a spending limit or release funds after a certain period of time to optimize cash flow.

To know more, visit EnKash.com. You can also click below on Signup Now and we will reach out to you soon.