Efficient cash flow management is the cornerstone of financial success for any business. One crucial aspect of this process is the effective management of accounts payable. The accounts payable process encompasses all the activities related to paying the company’s debts and obligations to vendors and suppliers.

This blog will explore the fundamental principles and strategies for optimizing your accounts payable process, ensuring a smooth and sustainable cash flow for your organization.

Understanding the accounts payable process

The accounts payable workflow process involves several stages, from receiving invoices to making payments. To achieve efficiency, it is essential to comprehend each step thoroughly. The process typically starts with receiving supplier invoices for the goods or services. These invoices must be reviewed and validated for accuracy, completeness, purchase order and contract compliance.

Once verified, the invoices are recorded in the ap accounting system, and payment terms are set. The timely recording is crucial as it enables better cash flow forecasting and minimizes the risk of late payments and penalties. Afterwards, the invoices are scheduled for payment, and their due dates are tracked to ensure timely execution.

Setting up effective accounts payable systems

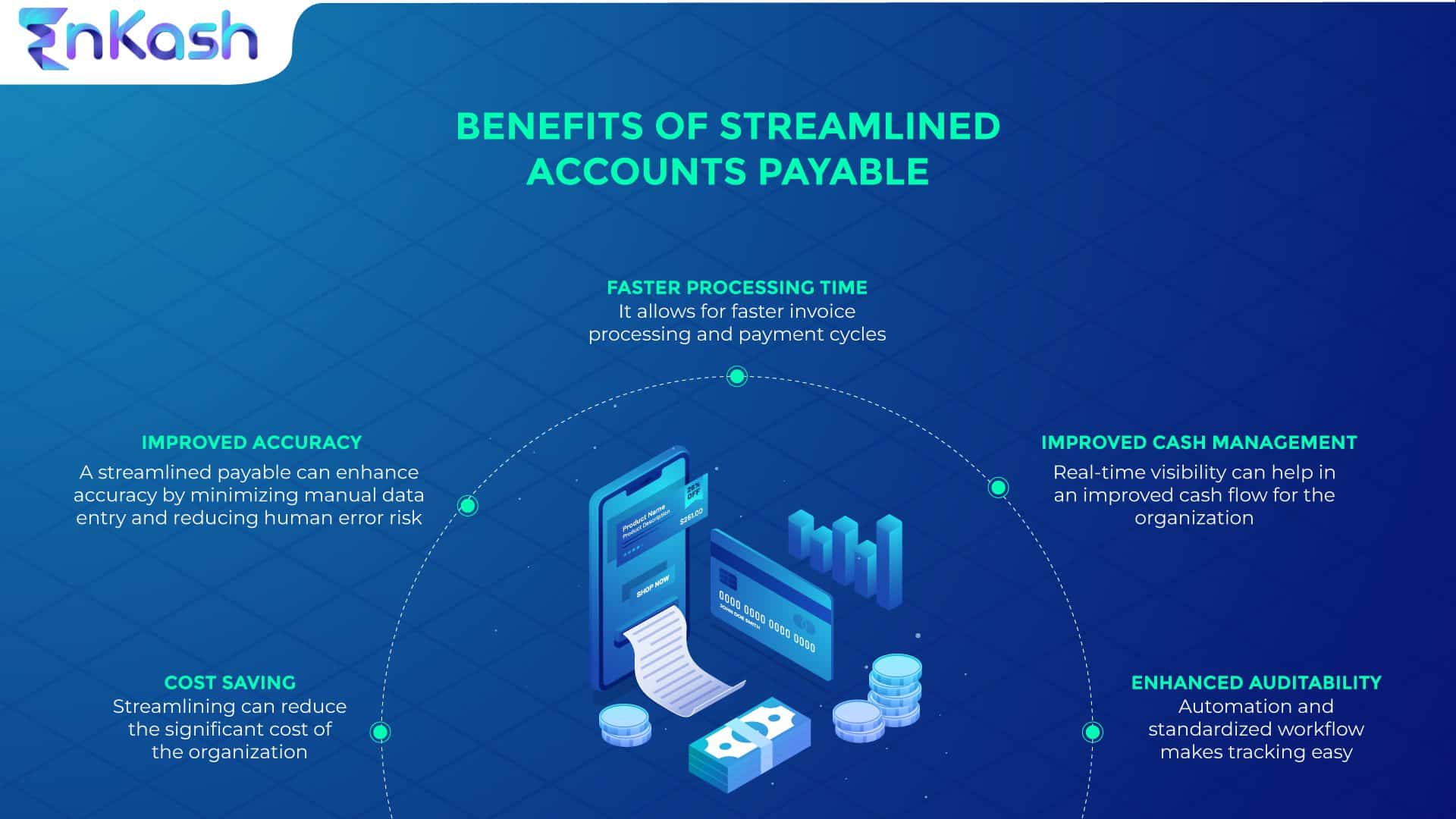

Efficient accounts payable systems lay the foundation for smooth operations. Businesses can opt for automation to streamline the process, reducing manual errors and increasing productivity. Advanced software can automate invoice processing, data entry, and payment schedules, freeing up valuable time for the finance team to focus on more strategic tasks.

Additionally, setting up a robust vendor database helps maintain accurate records and facilitates faster communication. Regularly updating contact information and payment preferences of vendors allows for seamless interaction and minimizes payment delays.

Effective invoice management

Effective invoice management is a critical aspect of optimizing the accounts payable workflow process. This involves creating a well-defined process for handling incoming invoices promptly. Encourage suppliers to submit electronic invoices to reduce paperwork and processing time. Electronic invoicing also provides better transparency, reducing the likelihood of disputes or misunderstandings.

Implementing a three-way match system can help ensure accuracy and prevent fraudulent activities. This system involves cross-referencing the purchase order, goods receipt, and invoice to verify that the received goods or services match the terms of the agreement. This process ensures you only pay for legitimate transactions, reducing the risk of overpayments or duplicate payments.

Streamlining approval workflows

The approval workflow is a crucial stage in the accounts payable process, directly affecting the payment timeline. A streamlined approval process can significantly reduce processing time and minimize the risk of delayed payments. Define clear approval hierarchies, promptly ensuring that each invoice is routed to the appropriate stakeholders.

Consider implementing electronic approval systems that enable remote approvals and real-time tracking. This not only expedites the approval process but also increases accountability and transparency.

Payment optimization and vendor management

Payment optimization involves strategically managing payment terms to maintain a healthy cash flow. Negotiate favorable payment terms with suppliers, such as extended payment windows, early payment discounts, or vendor financing options. Properly managing payment terms can help improve working capital and preserve liquidity.

Vendor management is equally important. Cultivate strong relationships with key suppliers by ensuring timely payments and open communication. Regularly review vendor performance to identify improvement opportunities and negotiate better terms for long-term partnerships.

Conclusion

Efficient cash flow management is essential for any business’s financial stability and growth. The accounts payable workflow process is crucial in maintaining smooth cash flow operations. Businesses can achieve a streamlined accounts payable process by understanding the intricacies of this process, setting up effective systems, and managing invoices. We are a spend management platform that can assist you in streamlining approval workflows and optimizing payments and vendor relationships becomes very easy.

Automation and technology continue to play a significant role in enhancing efficiency and accuracy in accounts payable. By embracing these innovations, organizations can focus on strategic financial planning and decision-making, ultimately driving success and profitability. Remember, a well-managed accounts payable process is a stepping stone towards achieving sustainable financial health for your business.

FAQs

-

What is accounts payable and its importance in cash flow management?

Accounts payable is the process of paying debts to vendors and suppliers. Efficient management of accounts payable ensures a smooth cash flow, vital for financial stability.

-

How can businesses set up effective accounts payable systems?

Businesses can set up efficient systems using automation for streamlined processes and maintaining a robust vendor database for seamless communication.

-

Why is effective invoice management crucial in accounts payable?

Effective invoice management involves handling incoming invoices promptly and implementing a three-way match system to prevent errors and fraud.

-

How can businesses streamline approval workflows in accounts payable?

Clear approval hierarchies and electronic approval systems expedite the approval process and enhance transparency.

-

How do payment optimization and vendor management contribute to cash flow management?

Strategic payment terms and strong vendor relationships improve cash flow, working capital, and overall financial health.

-

How do automation and technology enhance efficiency in accounts payable?

Embracing automation and technology enhances accuracy and efficiency, enabling businesses to focus on strategic planning and success.

UPI Payment Status Check | B2B Payments | Business Expense Reimbursement | GST Payments | Vendor Payment | Payable Management | Budget Control Management | Expense Management Software | Billing Software | Spend Analysis | Audit Trail in Tally | Expense Reporting | Employee Expense Reimbursement | Bulk Payment Processing | Credit Card to Rent Pay | Utility Bill Payment | Bulk Payment System | Best Credit Card for Utility Bill Payment | Goods and Service Tax Payment | Company Credit Card | Reimbursement of Expenses to Employees | Modes of Payment | Rent Payment | Account Type for Vendor | Spend Management Solution | Best Accounting Software in India