Introduction

In today’s mobile-first world, users expect a smooth and secure in-app experience, especially when it comes to making payments. Whether you are developing an e-commerce platform, a subscription-based service, or a donation app, integrating a robust payment gateway into your app is no longer optional – it’s essential for driving conversions and fostering user trust. In this comprehensive guide, we will equip you with the knowledge on how to seamlessly add a payment gateway for mobile apps, unlocking a world of secure and convenient transactions for your users.

What is a Mobile Payment Gateway?

Before diving into the integration process, it’s crucial to understand what a mobile payment gateway is and how it functions. A payment gateway is a technology that facilitates online transactions by connecting merchants, customers, and financial institutions. It encrypts sensitive payment information, authorizes transactions, and ensures funds are transferred securely. Imagine your app as a bustling marketplace. Customers browse your offerings, add items to their carts, and finally reach the checkout. This is where the payment gateway steps in, acting as a secure bridge between your app and the financial institutions involved.

Choosing the Right Payment Gateway

The first step in adding a payment gateway for a mobile app is selecting the right provider. With a plethora of payment gateway providers available, selecting the ideal one hinges on your specific needs. Here are some key factors to consider:

Transaction Fees: Compare pricing structures, including per-transaction fees, monthly charges, and potential hidden costs.

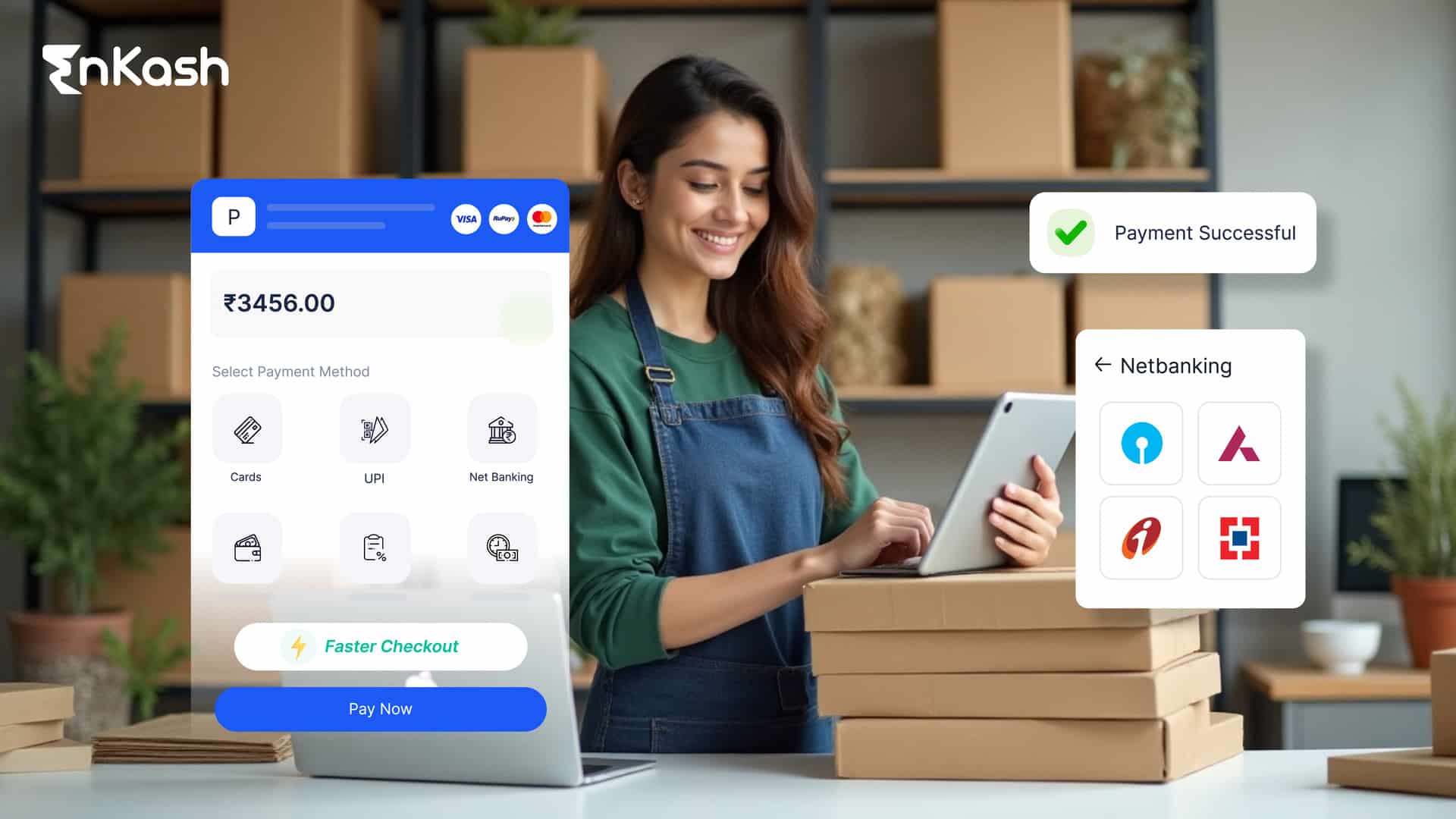

Supported Payment Methods: Cater to user preferences by offering a diverse range of payment options, including credit and debit cards, e-wallets, mobile wallets, UPI, NEFT, RTGS, and other payment modes

Security Standards: User trust is paramount. Choose a gateway that adheres to stringent security protocols like PCI DSS compliance and employs robust encryption measures to safeguard sensitive data.

Integration Ease: A smooth integration process is crucial. Look for a provider offering well-documented APIs, SDKs, and technical support to simplify implementation.

Global Reach: If you plan to cater to an international audience, ensure your chosen gateway operates in your target markets and supports multiple currencies.

Types of Integration Methods

There are several ways to integrate a mobile payment gateway into your application, depending on your development stack and requirements:

Direct API Integration:

Obtain API credentials from your chosen payment gateway provider

Use the provider’s SDKs or APIs to implement payment

functionalities

Handle payment responses, such as successful transactions, failed payments, and refunds, within your app’s backend

Hosted Payment Pages:

Redirect users to a secure payment page hosted by the payment

gateway provider

Customize the look and feel of the payment page to maintain brand

consistency

After payment completion, redirect users back to your app with the transaction status

SDK Integration:

Utilize the payment gateway provider’s SDKs for mobile platforms (Android/iOS)

Follow the SDK documentation to integrate payment features seamlessly

Handle callbacks and notifications for transaction updates and status

Custom Integration:

For advanced customization and specific requirements, opt for a custom integration approach

Develop custom APIs and backend logic to communicate with the payment gateway

Ensure robust security measures and compliance with industry standards

Step-by-Step Process for Seamless Integration

Now, let’s break down the integration process into actionable steps:

Step 1: Obtain API Credentials

Register an account with your chosen mobile payment gateway provider

Access the developer portal to generate API keys, tokens, or other required credentials

Keep these credentials secure and never expose them in client-side code or public repositories

Step 2: Implement Payment UI

Design and develop the payment user interface (UI) within your app

Include fields for card details, billing information, and payment amount

Ensure the UI is intuitive, responsive, and compliant with payment industry standards (PCI DSS)

Step 3: Backend Integration

Set up server-side endpoints to handle payment requests and responses

Use HTTPS protocol for secure data transmission between the app and your server

Implement logic for processing payments, generating invoices, and updating transaction records

Step 4: Test Transactions

Before deploying the payment gateway in a production environment, conduct thorough testing

Use test credentials provided by the payment gateway provider to simulate transactions

Test various scenarios, including successful payments, declined transactions, and refunds

Step 5: Security and Compliance

Implement security measures such as data encryption, tokenization, and secure storage of sensitive information

Ensure compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements.

Regularly update your app and backend systems to address security vulnerabilities.

Step 6: Go Live

Once testing is complete and you’ve verified the functionality and security of the payment gateway integration, go live

Replace test credentials with live credentials provided by the payment gateway provider

Monitor transactions, track payment analytics, and address any issues promptly

Best Practices for Payment Gateway Integration

To enhance user experience and ensure the success of your mobile payment gateway integration, follow these best practices:

Optimize Checkout Experience:

Keep the checkout process streamlined with minimal steps. Offer guest checkout options to reduce friction for first-time users. Provide clear instructions and error messages for payment-related issues.

Mobile-Friendly Design:

Prioritize mobile responsiveness and usability in your payment UI. Test payment flows on various devices and screen sizes to ensure compatibility.

Secure Data Handling:

Encrypt sensitive payment data both in transit and at rest. Implement tokenization to replace card details with secure tokens during transactions.

Transparent Pricing:

Clearly communicate transaction fees, currency conversion charges, and refund policies to users. Avoid hidden fees or surprises during the checkout process.

Regular Updates and Maintenance:

Stay updated with the latest security patches and compliance requirements. Monitor transaction trends, fraud patterns, and user feedback to improve payment processes.

How Does It Work?

Here’s how it works:

User Initiates Payment: When a user confirms their purchase within your app, their payment information is securely sent to the payment gateway.

Gateway Encrypts and Forwards: The gateway encrypts the user’s sensitive financial data and transmits it to the payment processor, a service that communicates with the user’s bank.

Authorization and Verification: The processor verifies the user’s card details and available funds with the issuing bank.

Funds Transfer: Upon successful verification, the authorized amount is transferred from the user’s bank account to a designated merchant account.

Confirmation and Order Fulfillment: The payment gateway communicates the transaction status back to your app, allowing you to confirm the order and initiate fulfillment.

Security Best Practices

Integrating a mobile payment gateway in India is just the first step. Here are some additional security measures to strengthen your app’s payment processing:

Tokenization: Avoid storing sensitive card data directly on your app’s servers. Instead, leverage tokenization, where the payment gateway replaces actual card details with secure tokens for future transactions.

Regular Security Audits: Proactively identify and address vulnerabilities by conducting regular security audits of your app and the payment gateway

integration.

User Authentication: Implement strong user authentication methods like multi-factor authentication to prevent unauthorized access to payment information.

Clear Communication: Educate your users about the security measures you have in place to foster trust and transparency.

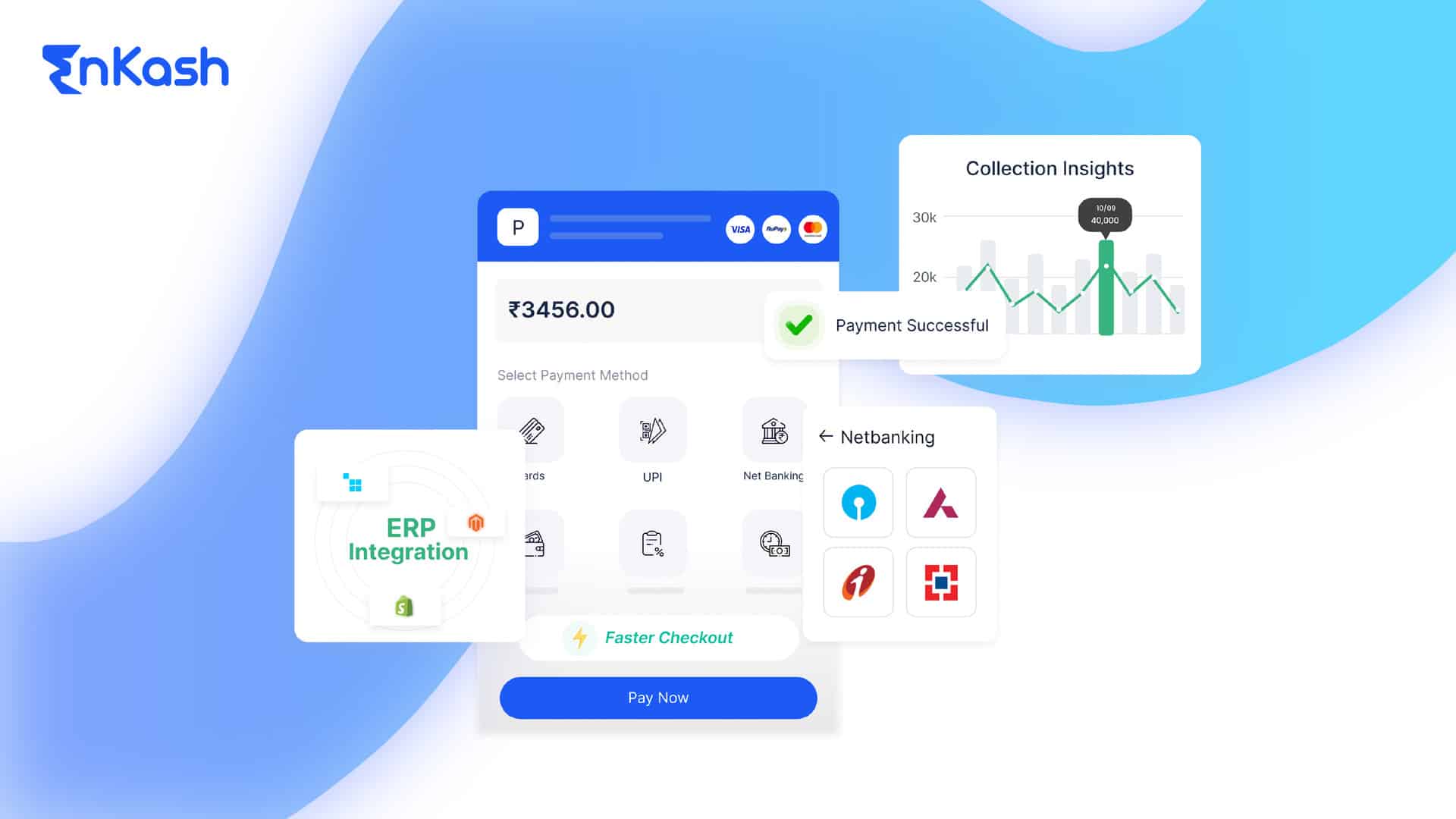

EnKash: Your Trusted Partner for Streamlined Collections

EnKash stands out as a leading mobile payment gateway India provider, offering a secure, feature-rich platform designed to elevate your app’s payment processing capabilities. Here’s why EnKash is the perfect fit for your needs:

Seamless Integration: Our intuitive APIs and SDKs make integrating the gateway into your app a breeze, minimizing development time and resources.

Flexible Modes: EnKash empowers you to reach a wider audience by supporting a vast array of payment methods, ensuring a smooth user experience worldwide.

Robust Security: We prioritize the security of your users’ financial data. EnKash adheres to the highest industry standards, including PCI DSS compliance, to safeguard transactions.

Scalability and Flexibility: Our platform scales seamlessly with your business growth, accommodating increasing transaction volumes and evolving needs.

Dedicated Support: Our team of experts is always available to assist you with any technical queries or integration challenges.

Conclusion

Integrating a payment gateway into your mobile app is a critical step in enabling secure and convenient transactions for your users. By choosing the right payment gateway provider, following integration best practices, and prioritizing security and user experience, you can build trust, drive conversions, and enhance the overall success of your app. Remember to test thoroughly, stay compliant with industry standards, and continuously optimize your payment processes for optimal results.